We analyse the growth opportunities for value-for-money retail models in the Asia region and particularly in Vietnam.

The effects of COVID-19 are raising concerns about household income and job security, combined with worries of increasing costs among Vietnamese consumers, according to a Kantar Worldpanel survey. Could this lead to consumers controlling their spending more in the longer term? Do value-for-money retail formats like discounters have the potential to emerge across Asia, post pandemic? In this article we analyse the value-for-money retail models we believe we’ll be seeing in the near future.

What drives growth for discounters, globally?

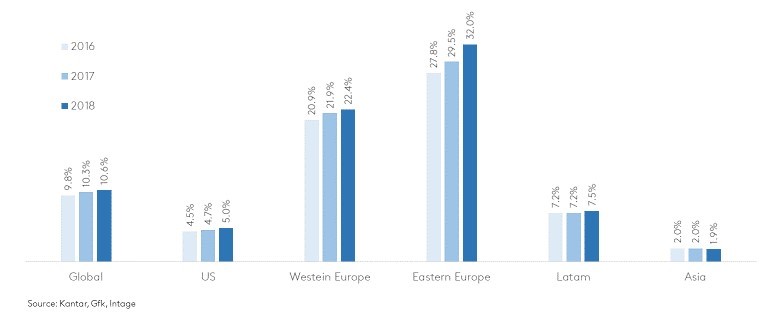

Globally, discounters have been able to grow sales by +6%, versus only +2% for total channels, and they now account for 11% of dollars spent on fast-moving consumer goods (FMCG), which is a big increase in share in a short space of time. In fact, growth is coming from everywhere except Asia.

There are two angles to this growth:

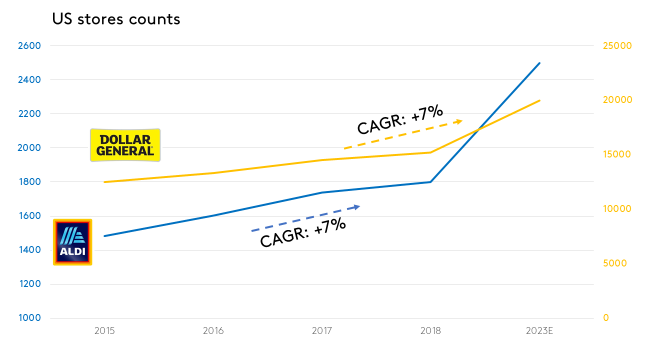

The first is the number of physical store openings across the world, which has been quite a big driver of their share gain. In the US market, Aldi has added 7% more stores to its estate, while in the UK they opened 70 new stores in 2018 alone. Finding the land for new stores can be challenging. However, with an average store size of 500-1000 square meters, which is still smaller than the average hypermarket and supermarket store, owners of discounters are not struggling.

The second key driver of their growth is more shopper driven – globally, shoppers want to have good quality at a good price and this value-for-money standing is exactly the positioning that discounters have been able to carve out.

In Europe, the positioning has developed significantly over the last few years and is not only about price. The atmosphere is very different if you visit an Aldi or Lidl. Many stores have been refreshed and enlarged to make for a very pleasant shopping experience, with a strong focus on fresh foods, bakery and frozen areas... completely different from 10 or 15 years ago.

In France, Lidl has been on a journey from a hard discounter to a top retailer. Around 2015, they changed their communication style to shoppers. They began to communicate more heavily, increasing media spend with a clear message about “the real price of good things”, which really resonated with French people.

The evolution of discounters' product assortment

There has been a movement here. At the beginning, it was very much about grocery and household products, but now discounters have expanded into all sectors such as fresh foods (fruit and vegetables), meat and bakery, and they also provide textiles and other non-food items.

However, there are two key differences between discounters and hypermarkets and supermarkets. One is that the assortment is still very different in terms of the number of SKUs and the presence of brands. Depending on location, discounters usually have 1000-1500 SKUs, while a supermarket will have 3000-4000. Private label will account for 70% of discounter products, while in supermarkets it would be the opposite: more than 70% of items are branded products.

In Columbia for example, we saw the average discounter carrying just 500 to 600 SKUs, with only one key brand for each of the high value categories. This helped them breed some familiarity to shoppers when they came into the store; however, once sales of private label SKUs started to outstrip the sales of the own-brand offer, they were quick to remove them.

The second difference is in logistics. Discounters focus on cost savings via low buying costs, and the way they put products on the shelf is different. With high stock rotation, products are often shelved in-box or even still in the pallet. Some manufacturers have started to package their products differently for discounters, on this basis.

Usually, you will have a different assortment versus other stores: even where brands are listed, they will be in different pack sizes, perhaps shorter shelf life, or simply short-term listings.

Do discounter retail models only attract low income shoppers?

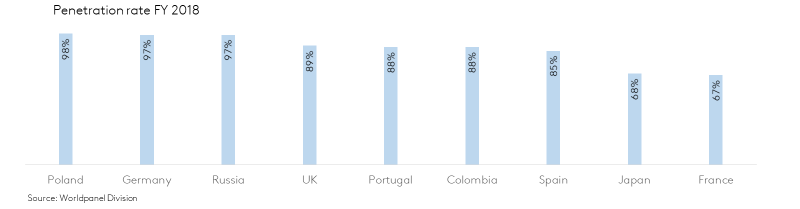

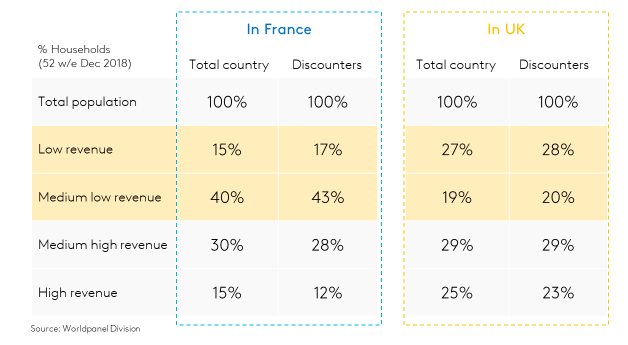

Generally, when we talk about discounters in France or the UK, penetration rate is already high, so they are quite mainstream.

That said, overall their profile is lower among high-income shoppers than average, skewing to low and medium-low-income families.

In the past, discounters would be popular for specific events like Christmas or for top-up shopping between big trips to hypermarkets and supermarkets. However, they feature much more in routine shopping missions now. The frequency of shopping is still much lower than hypermarkets and supermarkets, which means there is room for improvement.

Discounters are now attracting shoppers of all income groups, but what they need to do is to focus on building loyalty. For example, they don’t offer any strong loyalty card programmes, which would help drive more frequent trips, as well as more data for the retailer to use.

Challenges and opportunities for value-for-money retail models to succeed in Asia

In a lot of Asian markets, modern trade is still developing. In Vietnam, it accounts for just 20% of the market, with such a strong traditional trade. However, as we saw in Latam, particularly Colombia, it is still possible to succeed.

Are shoppers ready to go for an 80% private-label assortment when they are so used to buying brands? That will be a big challenge for discounters entering the Asia market. Maybe brands would need to have a bigger focus, at least at the beginning. Brands are a good way to attract shoppers, and give them some familiarity in an otherwise unfamiliar store setting.

From a logistics side, discounters will want to work with small manufactures who can commit to providing exclusively for their store, so they will need to do their homework to find them and that takes time. Some manufacturers won’t want to shift focus from being a brand owner to producing for a retailer.

Aldi launching in Shanghai will certainly be an interesting development to monitor. They’ve shown they can adapt themselves to a local context and excite shoppers with imported products. If this first step is successful, it’s highly likely they will be exploring other markets to enter and emulate.

The potential of Private Label

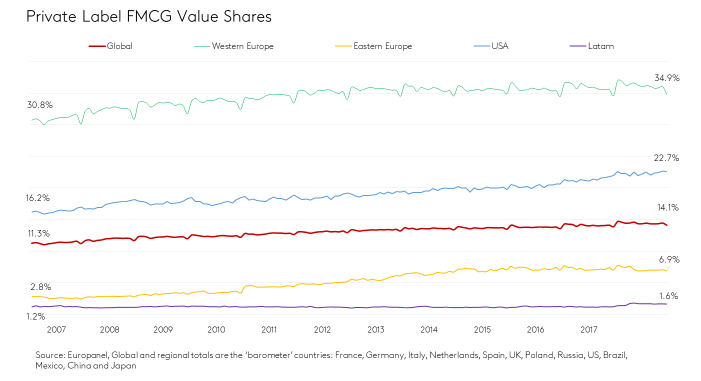

In Asia, private label is still a relatively small proposition, due in part to lower modern trade development. That is slowly changing, and we are seeing more and more private label offers in store. We can learn from European markets about the driving factors behind the success of private label products.

Private labels were first launched in the 60s and 70s, but they tended to be poor products and had really bad quality packaging.

It also started in homecare markets (what we now call low involvement categories) such as paper products and cleaning products, where people care less about the product they use. However, today, we see private label on offer in nearly all markets, and that’s because private labels offer shoppers both a good price but also good quality.

In Europe they account for around 35% of value share, over half in countries like the UK, and that’s not just one line of private label. Today you have different tiers of private label from value, to mainstream, to premium, to super premium, organic etc…and they operate like brands.

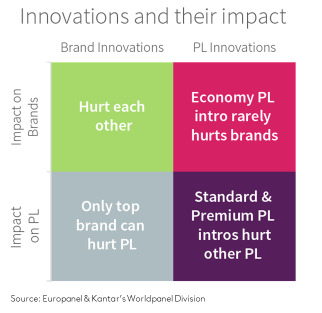

Of course, value came first, but from the late 90s and into the 2000s we started to see all the range splits, and a proper focus on quality through working with better processes to produce goods. In many cases, the branded manufacturers also work with retailers to produce their private label offer. Interestingly, research from Europanel shows that private label introductions are more likely to cannibalise other private label products, rather than branded products. Choice mechanisms can help explain why: 'Similarity' - the private label often has the same store name; and 'Compromise' - introductions at the bottom and top of the price hierarchy mean that products in the middle (brands) become more attractive compromise choices.

Today, the growth of private label is mainly thanks to discounters. In the long term, private label growth tends to impact the middle ground. Hence, the more private label develops, the more the manufacturers of such brands need to build unique characteristics or specific use benefits.

If we look at Vietnam, private label is still small, earning about 1% market share within FMCG in the four key cities (Ho Chi Minh city, Ha Noi, Da Nang, Can Tho). However, it’s on an upward trajectory, with key modern trade retailers increasingly exploring this profitable strategy.

As of now, 90% of private label spend is coming from homecare products and packaged foods – paper products, cleaning products, cooking oil and sauces, to name a few. Retailers are playing with lower price points and bigger pack sizes, but product quality can compete with that of branded offers.

Given the low awareness of private label products among Vietnamese consumers, we are seeing a stronger push for private label from key retailers, especially foreign retailers: not only in hypermarkets and supermarkets format like Emart, Aeon but also in convenience formats like FamilyMart. They offer a wider range of choices and segments, invest in branding through packaging, and focus on product display in key areas to attract consumers.

It’s not clear at the moment whether their efforts will truly help private label products to grow in popularity, but there is huge potential for success in the next few years. With the rise of convenience stores, the revitalisation of big retail formats toward “retailtainment” and the potential emergence of new retail (like discounters), it wouldn’t be a surprise to see private label products growing.

There are a few things that retailers may consider to develop private label or run discount stores in Vietnam: