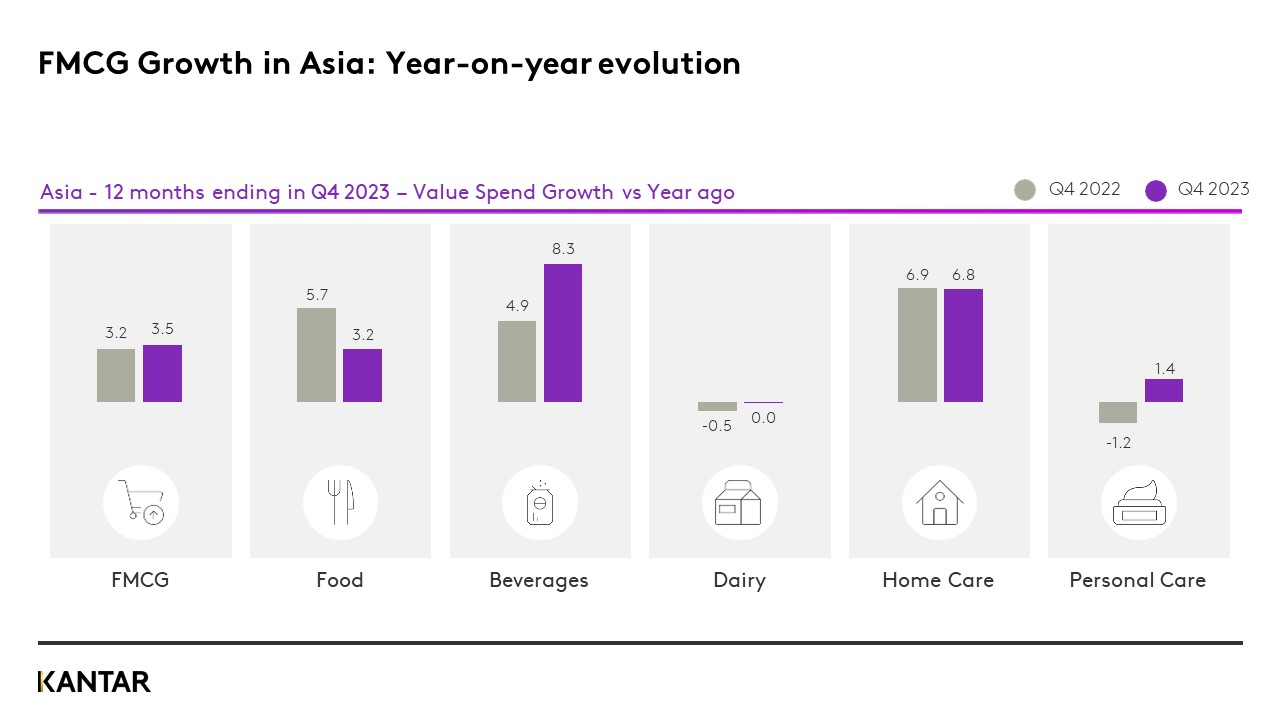

In the fourth quarter of 2023, despite economic pressures stemming from post-inflation conditions, the Asia region sustained solid FMCG growth of 3.5%. The beverages sector is currently the main driver of this growth, while personal care is recovering from its setback in 2022.

West and South Asia emerged as the primary catalysts of the region’s growth, both exhibiting double digit increases in value sales. Other territories within Asia are steadily finding their footing and contributing to the overall expansion of the FMCG market across the region.

North Asia: Lifestyle changes have a significant impact

As consumers resumed their normal lives, a proportion of them reverted to in-person shopping, leading to a nearly 3% decrease in the penetration of ecommerce. Heightened competition has prompted major platforms to intensify their efforts in the ‘price battle’.

People are spending more time outside in Taiwan, which has triggered an increased demand for beverages and led to an upturn in this category. Spend on food service has also risen, which has affected home cooking-related categories. The trend for consumers to venture out more frequently is driving growth in sales of personal care products, particularly cosmetics.

A highlight from Korea involves demographic changes due to low birth rates, and an aging population. An increase in single-person households and empty nesters represents the largest increase in FMCG spending among all life stages – with a rise in spend of 19.7% and 18.8% respectively.

SEA: Striving amid post-inflation price increases

FMCG growth in Indonesia is still driven by price rises. Recovery in volume growth was seen at the end of 2023, reflected in a slight frequency increase. However, consumers are maintaining their overall spend per trip.

The landscape is similar in Malaysia, where spending has increased across various FMCG segments, primarily driven by elevated prices. Simultaneously, consumption has declined consistently year-on-year. Higher prices have prompted Malaysians to reassess their purchasing choices, actively searching for better value alternatives, or cutting back on discretionary spending for non-essential items.

More occasions and OOH activities in Thailand have led to lower in-home consumption for cooking products and beverages, and a reduced need for home care products, while demand for personal care started to resurface. Limited budgets are steering consumers to look for more affordable choices in some categories.

In the latest quarter, FMCG spend in the Philippines increased, driven by the festive season. Filipino shoppers purchased more per trip, but maintained the same number of trips. During the holiday, Filipinos prioritised spending on food, beverage and dairy, as highlighted in the boost in sales of soft drinks, bottled water, family milk, and cooking oil.

In Vietnam, the in-home FMCG sector saw steady but cautious year-on-year growth, with urban spend primarily driven by price increases. However, rural areas indicate greater potential for volume growth. A closer look at quarterly performance shows a gradual decline in value growth, specifically in the Urban 4 area.

India: FMCG growth lags behind GDP

FMCG performed better compared with 2022. Sales value of consumer goods continued to grow at a faster rate than volume – 13% compared with 8% – driven by higher pricing. FMCG grew at a slower rate than GDP in the last two quarters of 2023, as consumers increased their spend on durables, clothing and entertainment at a faster rate.

UAE: Economic challenges lead to thrifty shopping patterns

In the United Arab Emirates, shoppers are maintaining a pattern of thrift. They are curtailing their spending by purchasing fewer packs during each trip, reducing volume per buyer, and shopping less frequently, particularly in the beverages and personal care segments.

Asia Pulse Q4 2023 is a comprehensive report curated by Kantar Asia's Worldpanel Division. This latest edition offers a deep dive into the ever-evolving Asia-Pacific markets. If you’d like to explore more, do get in touch with us. Read it by filling the form below. Experiencing some issues? Click here.