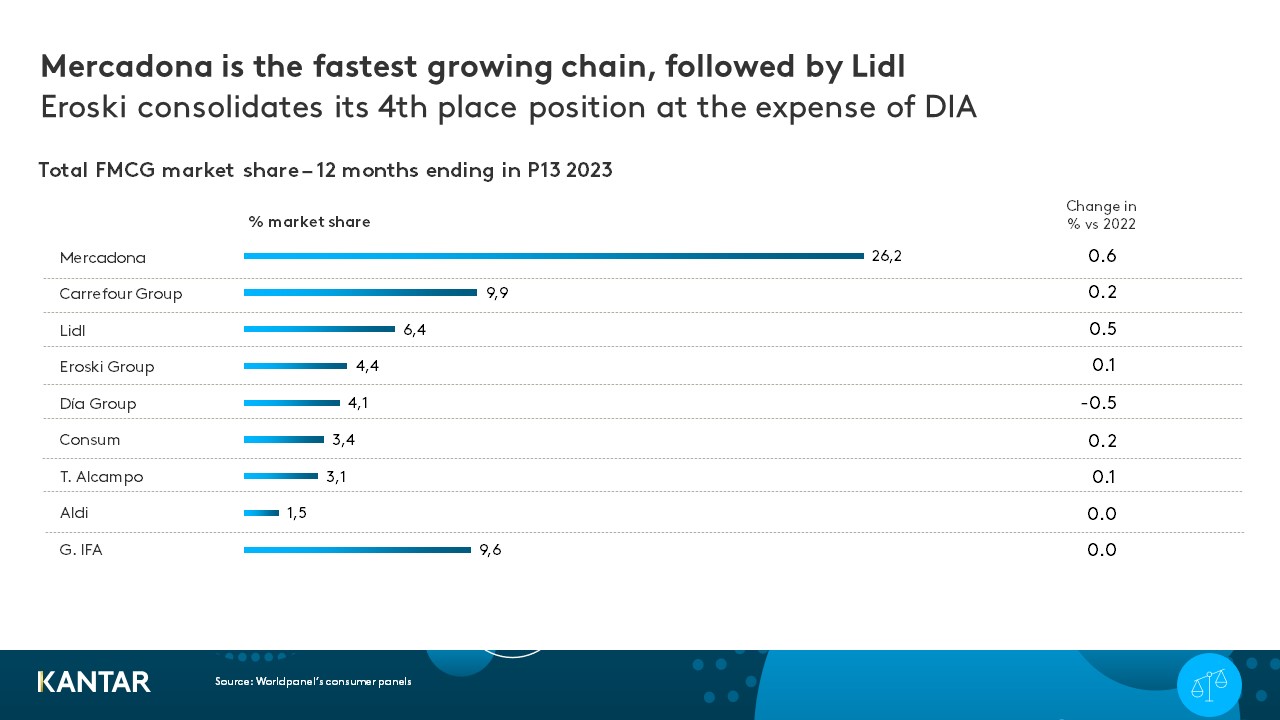

The Top 5 Spanish supermarket chains in 2023 – Mercadona, Carrefour, Lidl, Eroski Group and DIA – together now account for more than half (51%) of the total FMCG spend across all retailers. In one year, the grocery market in Spain has increased by 7.6% in value, while growth in volume has begun to show signs of stability, according to data from Worldpanel.

Modern trade in Spain is performing more strongly than traditional channels, and practically all of the main supermarket chains are gaining market share. In 2023, a year marked by rising prices, consumers sought to better control their spending and shifted from traditional stores to supermarkets. In the meantime, factors such as promotions and retailers’ own brands are rising in importance when it comes to choosing where to buy.

Mercadona is still the undisputed leader, ending the year as the chain with the highest growth in share of spend (+0.6%) to reach 26.2%. It recorded growth from April onwards, which coincided with the announcement of a price-cutting campaign on 500 products. This is a positive trend that the retailer has been able to maintain to the present day.

Carrefour maintains its second place position with a more moderate growth in share of 0.2%. Its efforts to keep prices down, through offering promotions and an attractive loyalty programme, are valued by shoppers. However, with a 9.9% share, the challenge for Carrefour is now to continue to expand its proximity formats.

Meanwhile, the German discount chains remain focused on the Spanish market. Both Aldi and Lidl are among the retailers with the highest number of new store openings, and those that are investing the most in media. Lidl, with a 6.4% value share, is in third place and achieved the second highest growth in 2023. However, this growth goes beyond opening new stores, something to take into account as the chain has already announced an ongoing expansion of its capillarity in 2024, to reach 700 stores.

As for Eroski, the group is consolidating its position as the fourth placed chain, thanks to growth in its area of influence, and its ability to withstand pressure from the Top 3 operators and the strongly performing regional chains. Regional retailers achieved a market share of 17% (+0.3%) in 2023, presenting themselves as an alternative to limited-assortment retailers with a differentiating offer.

DIA is the only one of the Top 5 chains that recorded a decrease in share (-0.5%) in 2023; a drop which is closely linked to the sale of supermarkets to Alcampo.

What does 2024 hold?

No major changes in FMCG volume are expected in 2024, while inflation is brought under control. A return to stability is expected as Spain gradually emerges from a macrocycle of crisis.

A new cycle is now starting, marked by the ongoing concentration of FMCG in organised retail. The chains that manage to capitalise on the evolution from traditional retail will be the ones that grow the most – and fresh food, a 32.5% share of which is held by specialised players, will have a determining role.

Within the current context of slowing inflation, Spain’s retail chains are aiming to position themselves as affordable options in order to ride out the new cycle. They are increasing their communication and their focus on price, which is putting more pressure on margins. Own brands have been one of the main levers retailers have pulled to act on pricing. However, in the second half of 2023, their growth recorded a slowdown.

In the likely scenario that stability increases, Spanish households will readjust their purchasing behaviour and once again seek to purchase their entire grocery shopping within a single chain. The chains will compete to attract consumers with promotions and offers, to encourage them to fill their baskets.

In fact, more and more shoppers are purchasing specific categories in a different chain from the one they usually buy in, to take advantage of promotional campaigns. Others are willing to switch to another brand if they find a good deal (+4.3% compared to 2022).

The online channel has returned to pre-pandemic growth rates, following a peak during COVID. In 2023, the e-commerce sector saw its share of spend increase in 43% of FMCG categories. This trend is here to stay – but for now, online shopping is more likely to complement and coexist with physical shopping than to supplant it.

If you would like to learn more, please get in touch with our experts or access our data visualisation tool to explore current and historical grocery market data for your region.