Can you imagine for a moment having afternoon tea with some nuns?

How would you behave? What would you talk about? What would you reveal about yourself?

Do you think you would be telling them about your typical weekend activities or how much you like watching last nights episode of Love Island? Perhaps you would save sharing those experience for another occasion. More than likely you would be very polite and reserved, like Jake and Elwood meeting Mother Superior in the Blues Brothers (if you have had the pleasure of watching that film).

More often than researchers would like to believe, people act similarly when taking online surveys. They’ll tell us what they think we want to hear based on their perceptions of us, instead of what they really think.

Perception of market researchers, and why it matters

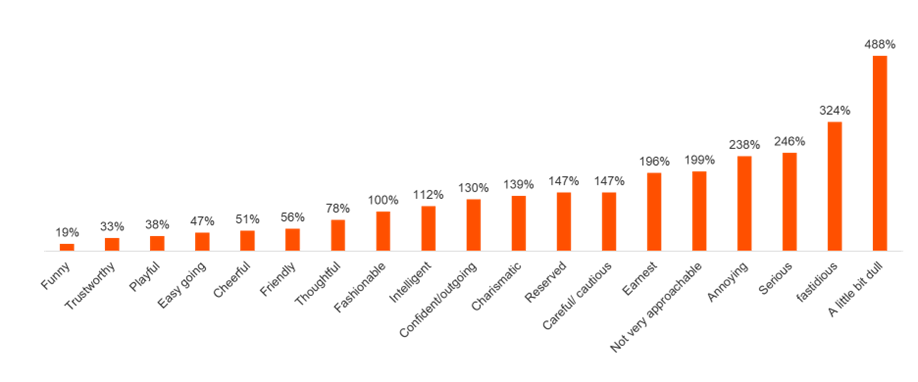

Market researchers are not nuns, but we have a bit of a pious reputation too, according to recent research of ours. We ask respondents to imagine the personality of the person who wrote the last survey they had taken and compare that to the personality of a good friend.

The general public view of market researchers was quite serious, cautious and earnest. They are seen as a little bit dull, and lacking humour. When asked what type of professionals people would want to invite to a dinner party, market researchers are one of the last on the invite list (sorry to say!).

How this impacts market research

These perceptions might help explain why researchers tend to get such high levels of acquiescence bias when asking people certain types of questions in surveys.

For example, if you ask the public whether or not they voted in the last election, 80% will say yes. Yet we know only 60% actually do. If panellist believe they’re being questioned by quite serious, earnest researchers and adopt that persona – they nearly all assume researchers voted and tell us they voted too.

Based on our data, people see researchers as intelligent and diligent. So, when we ask what level of education people attained, nearly 50% of respondents overclaim about having a degree. And when we ask what they watch on TV, they tell us they watch more news and documentary programmes like they assume researchers do – far more than real viewing figures predict.

What is potentially happening here is known as mirroring. The psychological construct that refers to the natural tendency of human beings to imitate or reflect the behavior, emotions, and expressions of others to foster empathy, rapport, and understanding between individuals.

We might adapt what we say to nuns in a way that we think reflects their perceived values, and so to respondents adapt their survey answers to reflect our perceived values.

Why are researchers considered dry and humourless?

People perceptions of market research are set by the very language we use and approach to writing surveys.

Because of the need to be balanced and unbiased, the tone of surveys does tend to be very serious, earnest and (dare we say!) dull. To make a question clear, the wording of surveys can often come across as a bit pedantic and legalese – hard work to read.

Need to be convinced? Here are a few examples of questions we’ve seen:

“On a scale of one to ten, where one means you strongly disagree, and ten means you strongly agree and five means you neither agree not disagree...”

“Below are some statements that others have used to describe shampoo brands. For each statement, please indicate whether you think it applies to the brands shown. The brands you see are a selection of some of the brands you have told us you are aware of. There is no right or wrong answer and for each statement you can select as many or as few brands as you like. You don’t even need to have tried the brands you select, as we are just interested in your overall impression. If you feel the statement does not apply to any of these brands shown, please select 'none of these'.”

“Have you consumed food and/or beverages purchased from an informal eating out place, with your children (aged 0-12), in the past two weeks? By that we mean a casual place where you can purchase a quick, inexpensive prepared meal or snack or beverage that you either eat there, take with you or eat in the car? Please select only one answer.”

So, what happens if you change the tone of survey questions and (gasp!) add the very thing researchers are perceived as lacking... a little bit of humour?

Read on for some ways to add fun and humour into online surveys.

Using humour to improve opinion poll answers

Imagine you are a political pollster trying to do more actuate voter turnout modelling while getting a reliable read from your survey on whether someone voted in the last election – a solution you probably may not think to turn to is humour.

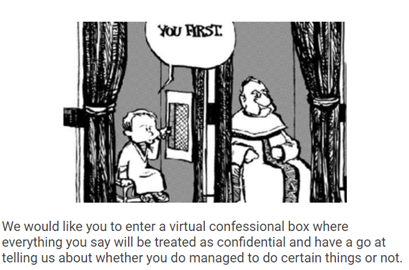

Well here is an example of how it can be applied, taken from an experiment we conducted at Kantar that aimed to get a more accurate read on whether people voted on not. To circumvent any feelings of embarrassment about admitting to not voting, we first presented respondent this cartoon and message.

We then asked them to confess whether they had actually done things like, flossing regularly, washing their hands when they last used the toilet and nobody was there, and voting in the last general election.

This touch of humour humanised the question. Respondents were now talking to someone with a sense of humour – someone who wouldn’t judge their actions (or inactions). We found that with this shift in approach the number of people feeling comfortable admitting to not voting increased from 20% to 40% - almost exactly in line with real life vote turnout levels in the UK.

We have been using humour in subtle ways like this for many years. Some of the earliest experiments undertaken into the gamification of research involved adding fun visuals to questions to see if they provoked better responses. We found well chosen visuals that gently amused respondents could sometime double the volume of feedback we would get from a simple open ended question like what foods do you dislike eating.

Using memes to encourage honesty for sustainability research

We have found humour to be a particularly valuable tool when evaluating attitudes towards sensitive topics or those where respondents refuse to budge from pious stand points.

Specifically, Kantar has found using memes in online surveys to be a particularly useful technique to encourage honesty. Memes are often shared to help people express their true feelings and actions – even when they may be negative or against social norms.

We have used popular memes to illustrate common consumer dilemmas to really help respondents open up and talk more honestly about quite serious topics. Below are examples from a very successful piece of research trying to get to the hub of the “say do gap” when it comes to sustainable behaviour.

Another example is a project we undertook to understand how the inflationary economy was impacting pet owners’ propensity to keep their pet vaccinations up to date.

When asking pet owner a question straight up about whether or they had vaccinated their pets, 95% said their pet vaccinations were up to date.

Using an honesty priming approach, we were able to determine that only 64% of pet vaccinations were up to date. We were then able to ask them why and found that respondents were much more transparent about their explanation as to why. More people readily admitted it was down to lack of money.

Watch the this Online Survey Training module to see how we did it.

Humour as an engagement tool

Humour can have other roles in online surveys, too. It can be used as a simple means of engagement – helping draw people into a task. This can be particularly helpful when transitioning topics in a survey to help reset people’s attention.

Here are four ways to use humour to increase panellist engagement.

1. Apply a bit of absurdity before you ask a question

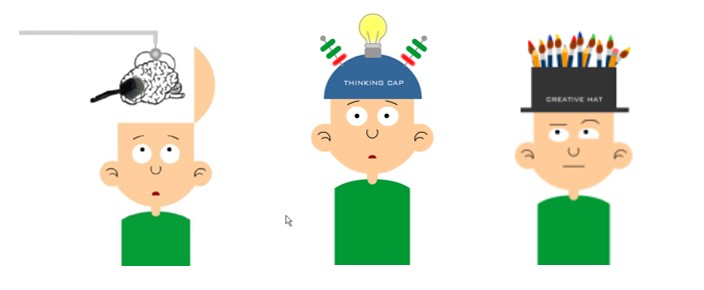

Use an element of absurdity to take people out of their conventional thinking patterns. For example, if you want panellists to “brush up on their memory”, ask them to put their thinking or creative hat on.

2. Make boring survey task more interesting

Humour generally is a weapon that can be used to make boring tasks in surveys a bit more fun. Instead of asking about brand associations outright, be imaginative with the question.

At Kantar, we did some work improving a toothpaste brand tracking study exploring what brands people associated with things like tooth whitening and fighting decay. We created an imaginary award process with different categories like “whitening tooth paste of the year awards” and ask people to be the judge.

With this approached, we reduced the amount of straight-lining from 50% to nearly zero. Framing the survey experience in this more fun way, we also found that panellists were providing more refreshing, candid feedback that is so often missing from survey research.

3. Take a serious topic down a notch or two

Researchers are often face with the challenge of conducting research about, well lets face it, some quite dull topics. We find humour is useful to draw people into talking about something that they may not want to. For example, asking about how a bank could improve their services.

Instead of asking this question outright, bring some humour into your leading question. Here, we asked in a cheeky way how perfect their bank is. This can encourage deeper thinking about specific services.

4. Unlock creativity with priming imagery

Using humourous priming imagery can have a great impact on honesty and creativity. Through our research, we’ve found that priming imagery both reduces overreporting and increases imaginative responses.

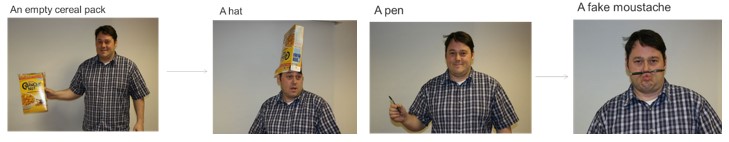

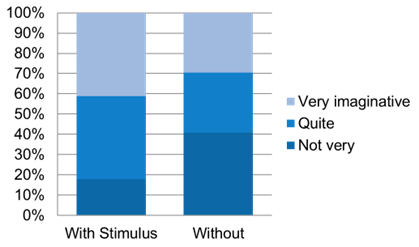

For example, we initiated a creative challenge where we asked people to come up with new ideas. We found that by presenting the images below first, responses were much more playful and creative.

When comparing the quality of ideas from a group who were asked with priming to those without, those with imaging were much more imaginative.

Does everyone respond to humour?

Kantar finds that, most people respond to humour. Get it right and humour can cross age groups and continents quite well. We have used it successfully in consumer, B2B, healthcare and global projects.

But does it always work?

We wouldn’t give a blanket assurance that humour can be added to any survey and it will improve feedback. Because it won’t. It’s a tactical weapon to deploy for certain research challenges.

Like acting, use of humour in surveys requires a degree of subtlety. And like advertising, copy writing skills are an important element of all survey design.

We advise our clients to keep humour light. It’s also a technique that we recommend be pilot tested first.

How do start applying humour in online surveys

When applied right, humour can have a deadly serious role in survey design – helping to connect more effectively with panellists and encourage more honest, thoughtful, and creative responses.

First, look at your research from a behavioural science point of view. Humour is good at normalising errant thoughts and behaviour and bring up unconscious responses to conscious levels.

Try to understand the underlying reason why people may not be telling the truth on any particular question.

Want to learn more?

Get more survey design tips by watching our Online Survey Training Modules, including "Using Humour for More Truthful Feedback."

Subscribe below to receive monthly research tips direct to your inbox.