Our latest data shows that take-home grocery sales in Ireland increased by 8.5% in the four weeks to 1 October 2023. During the month of October shoppers visited stores more often, up 5.9% and making an average of 20.5 trips. As consumers look for ways to manage household budgets, volumes per trip continued to decline compared to last year, down 7.3% with shoppers picking up on average one pack less per month.

Grocery price inflation, which stands at 10.5% in the 12 weeks to 1 October, is the main driving factor behind the rise in value sales rather than increased purchasing. Over the latest 12 weeks average prices rise by 8.7% year-on-year. It’s more welcome news for shoppers that inflation has fallen for the fifth month in a row – from last month’s 11.3%. Although there is promise in the current trajectory and this marks the lowest level of inflation we have seen since September 2022, the fact is that inflation still remains high. There is currently a drop in the level of sales sold on promotion. Back in 2020, 27.7% of sales were on promotion versus 24.4% this year. This is down 3.3 percentage points when compared to 2020.

With current levels of grocery inflation in the market, unless consumers make changes to their shopping habits, the average annual grocery bill is set to rise by €176 from €1,677 to €1,853. Own label goods remained popular in the latest 12 weeks, with sales up 11.5% compared to brands which have grown by 5.1%. Value own label ranges continue to see the strongest growth at 13% with Irish shoppers spending an additional €7.7m year-on-year in a bid to save money and control how much they are spending. Own label holds 47.9% share with branded value share at 46.8% which is the highest share seen for branded products since June 2022.

Winter sales stall as shoppers prolong summer spending

Warmer than usual weather meant purchases of winter staples were put on hold for another month. Barbecues stayed out longer than usual and, as a result, Irish shoppers spent an additional €860k on chilled burgers and grills, €538k on chilled prepared salads, and €2.4m on ice cream. But with Halloween fast approaching, shoppers were unable to avoid supermarkets filled with seasonal treats and spent an additional €3.9m on take-home confectionery.

Online sales remained strong over the 12-week period, up 25.2% year-on-year with shoppers spending an additional €36.1m online year-on-year. The period saw more frequent trips up 5.6% and a boost of new shoppers venturing to the online platform, which is a 1.83 percentage points increase with now 18% of Irish household’s purchasing their groceries online.

Irish retailer performance update

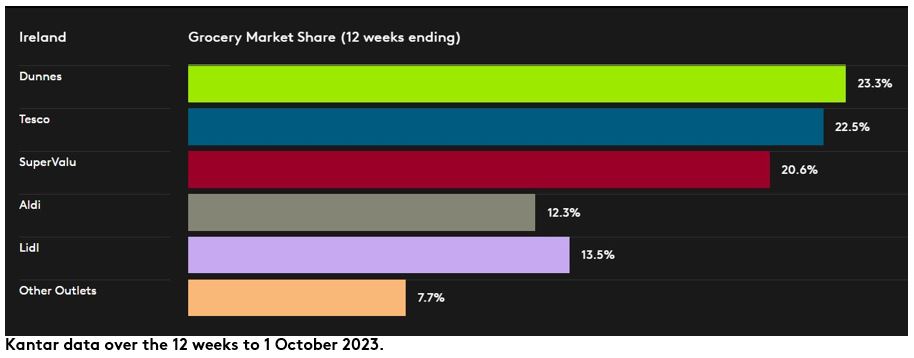

Dunnes holds 23.3% with growth of 10.5% year-on-year driven by a strong boost in new shoppers, up 3.24 percentage points year-on-year, which is the biggest increase in new shoppers amongst all the retailers.

Tesco holds 22.5% of the market with growth of 11.3% year-on-year. Tesco saw the strongest frequency growth amongst all retailers again, up 15.8% year-on-year, which contributed an additional €94.1m to overall performance.

SuperValu holds 20.6% of the market with growth of 4.5% which is a 0.5 percentage point increase versus last month. SuperValu shoppers make the most trips in store compared to other retailers, an average of 21.7 trips, and pick up more volume per trip, contributing an additional €5.9m to their overall performance.

Lidl holds 13.5% share and growth of 11% year on year. More frequent trips contributed to an additional €43.2m to overall performance. Aldi holds 12.3% with growth of 4% year-on-year. A strong boost in new shoppers and more frequent trips contributed an additional €27m to overall performance.

Want more like this?

Read: Grocery price inflation in Ireland falls for fourth month in a row

Read: Irish grocery inflation drops to lowest rate since November 2022