Grocery price inflation has fallen to 5.3%, marking the lowest rate since March 2022 and a decrease of 1.5 percentage points from January, according to our latest data. Take-home grocery sales grew in value by 5.1% for the four weeks to 18 February 2024.

Things are looking up for shoppers this February. Consumers have been navigating a grocery inflation rate of more than 4% for two years now, so this latest easing of price rises is especially welcome.

Though there’s been lots of discussion about the impact the Red Sea shipping crisis might have on the cost of goods, supermarkets have been pulling out all the stops to keep prices down and help people manage their budgets. This month, Morrison’s became the latest retailer to launch a price match scheme with Aldi and Lidl, after Asda made the move in January. More generally, we saw promotions accelerate this month after a post-Christmas slowdown. Consumers’ spending on offers increased by 4% in February, worth £586 million more than the same month in 2023. Sainsbury’s and Iceland’s efforts paid off in particular, and they were the only retailers to attract more shoppers through their doors. The battle between supermarkets’ own-label lines and brands also remains fierce. Own-label nipped ahead this month, growing sales by 5.5% versus branded products at 5.3%.

Shoppers fall in love with price cuts

Britons still found room within their budgets to celebrate on Valentine’s Day. In the seven days before, steak and boxed chocolate sales shot up by 12% and 16% compared with last year. However, shoppers were clearly on the hunt for value. £36 million was spent on meal deals costing £10 or more in the week leading up to 14 February. This figure is slightly down on 2023 when spend hit £43 million, but that’s because consumers chose to make more savings this year through price cuts. Sales of chilled ready meals and desserts on promotion did particularly well this year.

February saw a return to indulgence for some consumers as dry January came to a close. Total alcohol sales jumped up by 18% in volume terms versus the previous month, with consumers buying 28% more wine and 16% more beer and lager. Red wine was particularly popular, with eight million more bottles bought this month than in January.

Lidl, Sainsbury's and Tesco all win market share

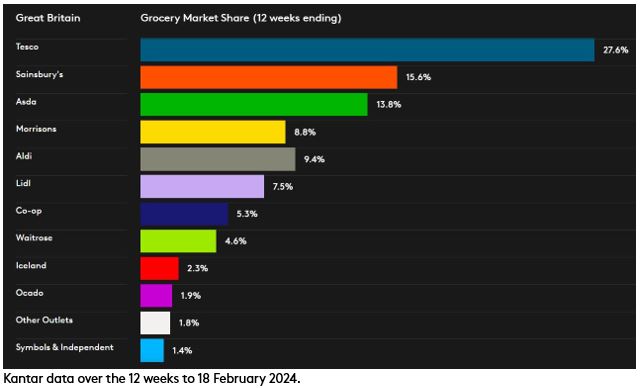

Lidl was the only retailer to achieve double-digit growth with sales up by 10.9% over the 12 weeks to 18 February 2024, making it the fastest growing grocer for the sixth month running. It now holds a 7.5% share of the market, an increase of 0.4 percentage points. Fellow discounter Aldi also grew ahead of the market, boosting sales by 5.7% and maintaining its 9.4% share.

Sainsbury’s and Tesco increased their share of the market by 0.4 and 0.3 percentage points respectively. Sainsbury’s now holds a 15.6% share, with sales up 7.6%. Tesco’s sales grew by 6.2%, pushing Britain’s largest grocer to a 27.6% share of the market.

Waitrose increased sales by 3.8%, accounting for a 4.6% share. Morrisons’ share now stands at 8.8%, with sales up by 3.1% compared to last year.

Asda, which opened its 1,000th store in February as part of its continued expansion into the convenience sector, saw sales increase by 1.9%. It now has a share of 13.8%.

Iceland accounts for 2.3% of the market and grew sales by 2.1%, while Co-op’s sales were up by 1.4%, resulting in a 5.3% share for the retailer.

Ocado now holds 1.9% share of the total market as sales rose by 4.9%, behind that of the total online market, which saw year-on-year growth of 6.8%.