The quick spreading of coronavirus has totally changed China’s usually busy and cheerful Lunar New Year period: people were required to stay at home, inter-city transportation has been largely reduced, international flights have been cut down to minimal, almost everyone has cancelled their travel (unless they were already overseas), visiting friends, and out-of-home activities. Schools are not opened and teachers have to teach their classes through livestreaming, even forcing sports teachers to teach kids to work out at home. Governments at all levels urged companies and stores to postpone re-opening businesses by at least one week and encouraged people to work from home whenever possible.

To understand how this is changing Chinese consumers’ behaviour and attitude during this time, and how they might resume/change their spending once the pandemic is over, Kantar launched a nationwide survey from Feb 6 till 9 through WeChat. The survey managed to collect more than 1,000 samples, including nearly 200 from the worst-hit Hubei Province. The sample is representative to mainstream consumer profile.

1. Outbreak’s impact by industry; possible level of rebound of each industry

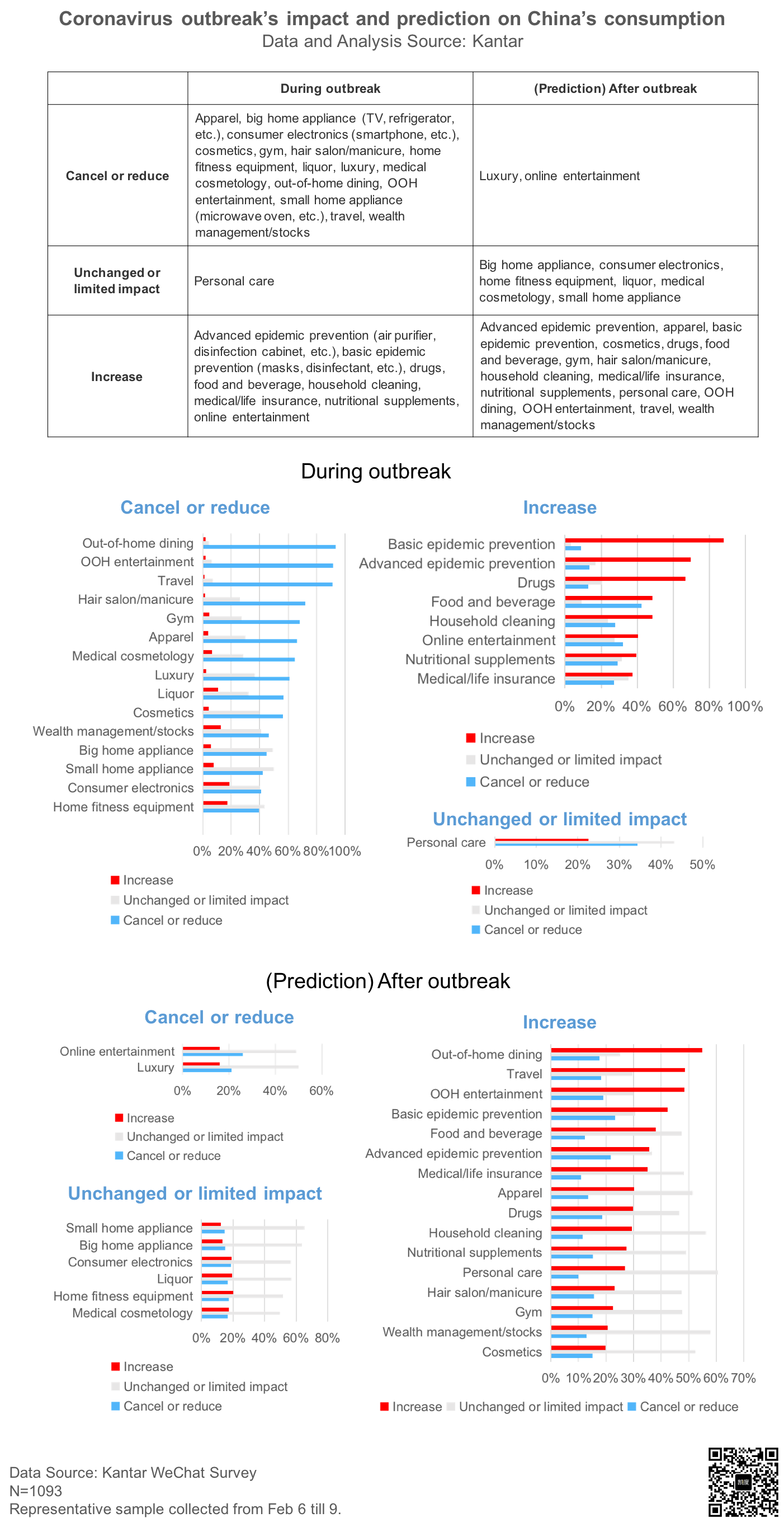

We asked consumers about the coronavirus disease’ impact on their spending on 24 industries, and how likely they would resume, or increase/reduce, their spending on these industries when the outbreak is over. We then categorised the 24 industries into different types.

Among all industries, we can see out-of-home dining, OOH entertainment and travel have been hit worst because people cannot leave home: about 75% surveyed consumers have cancelled all planned spending related to these industries, another 17% reduced their spending. To these industries’ relief, the potential level of rebound spending is also sizeable: 82% respondents said they will resume their cancelled OOH dining spending once the outbreak is over, 78% will resume their cancelled spending on travel and 77% resume OOH entertainment.

Four industries – advanced epidemic prevention, basic epidemic prevention, drugs and nutritional supplements – sold out their stocks in some parts of China. It appears that consumers will continue to stock up these products even when the outbreak is over. We also noticed the unmet demand for supplements is significantly higher in Hubei Province than the rest of China.

Some seemingly distant industries have become collateral damage of the outbreak. For example, due to reduction in OOH dining and friend/relative visiting, 57% surveyed consumers have cancelled or reduced spending on liquor. The same is true about cosmetics (reduce + cancel=56%) and apparel (reduce + cancel = 67%). But data also showed the rebounding spending in these industries are also relatively strong.

The outbreak has also increased people’s spending in some industries, such as food and beverage (40% respondents spent more), household cleaning (48%), medical/life insurance (38%, significantly higher in Hubei than rest of China during the outbreak). Consumers’ demand for these industries will continue to be robust after the outbreak.

Overall, luxury might experience the biggest negative impact from coronavirus in both short- and middle-term: 61% surveyed respondents reduced or cancelled their spending on luxury; after the outbreak is over, 21% said they would continue to reduce – higher than any other industry. This might be related to more fundamental changes in people’s attitude towards how/why they buy (details to follow in the article).

2. Outbreak’s impact by retail channel; possible level of rebound of each channel

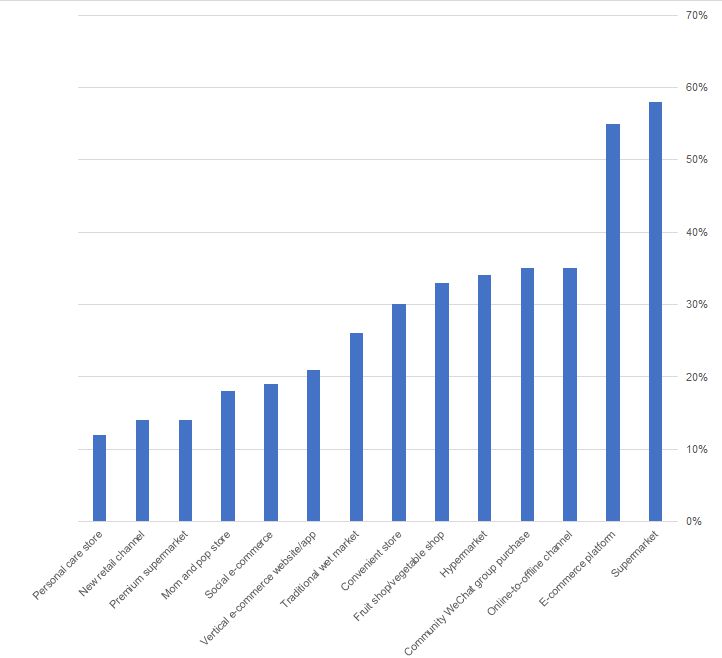

During the outbreak, many new and emerging retail channels experienced explosive growth, because 1) all consumers are required to stay home as much as possible; 2) many shops are closed for an extended period; 3) most families need fresh groceries to cook at home.

Among all surveyed consumers, 55% have bought from e-commerce platforms (Tmall, JD.com, Taobao, etc), very close to supermarket, which is the No.1 retail channel mentioned by 58% respondents. Online-to-offline channels, such as Ele.me, Meituan, Dingdong Maicai, which connect stores with consumers at home, are mentioned by 35% respondents – almost the same as hypermarkets (34%). Since so many people are staying at home, the residential complex community WeChat groups became a key information source platform. Surprisingly, it emerged as a new group purchasing channel (mentioned by 35%) as well as neighbours would join to launch group purchases.

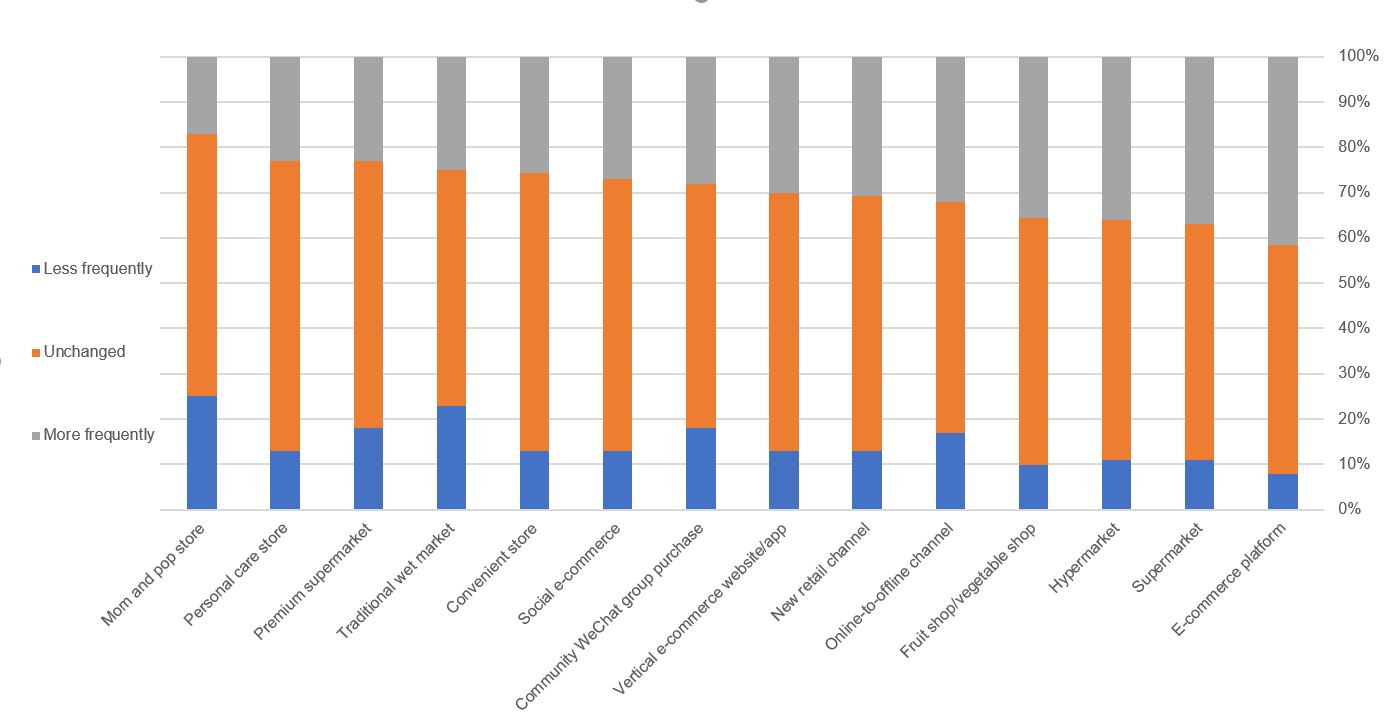

Surveyed consumers said they would resume their frequent visit to offline retail channels: 36% said they would visit hypermarkets more often, 37% said they would visit supermarkets more often. However, that doesn’t mean the online channels will stop its growth: 42% said they will buy more frequently from e-commerce platforms, only 8% said will buy less frequently. About 31% said they would buy more frequently from new retail formats, such as Hema.

It is worth noticing that though O2O enjoyed a high penetration during the outbreak and 32% surveyed consumers said after outbreak they would buy more often from O2O, still 17% said they would buy less from O2O after outbreak - higher than any other channel. O2O brands need to think how they can retain these new consumers in the post coronavirus era.

3. What are stay-at-home consumers doing?

This is probably the longest home-coming period for most of Chinese people. Except for following the development of the disease outbreak, what are Chinese consumers doing at home? Our survey captures a snapshot of people’s home activity during this special period of time.

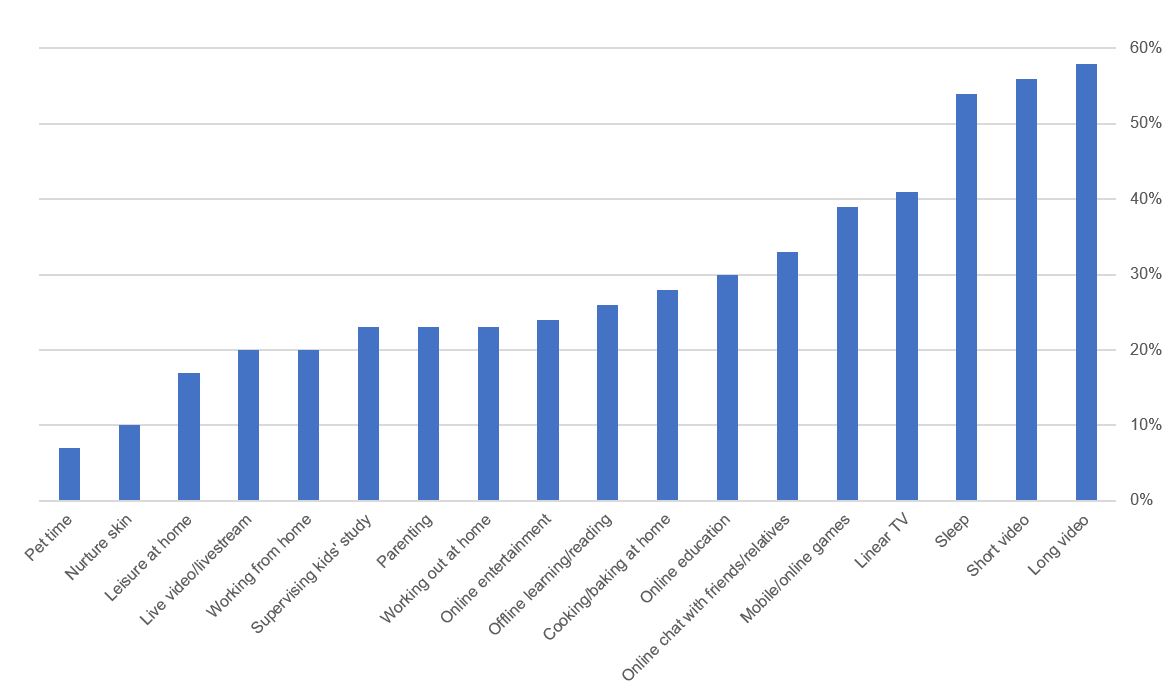

Understandably, watching video is the most mentioned time-killer. Watching long video (mentioned by 58%), short video (56%), linear TV (41%) are among the most mentioned activities. Digital entertainment is also popular, such as playing mobile/online games (39%, male significantly higher than female), online entertainment (online karaoke, etc) (24%, Hubei higher than rest of China), watching live video/livestream (20%).

It might be an exaggeration that the outbreak has turned every Chinese into a chef, but there are 28% people cooking/baking at home (female significantly higher than male). Also 23% enjoyed their parenting time. Same amount (not necessarily the same group) of people are working out at home (female significantly higher than male). Online education was mentioned by 30% of respondents, and 26% mentioned offline learning/reading. But as almost everyone won’t meet others for a long time, eventually people won’t bother to take care of their skin: only 10% would spend more time to “nurture skin”.

Interestingly, 54% said they are sleeping to kill time.

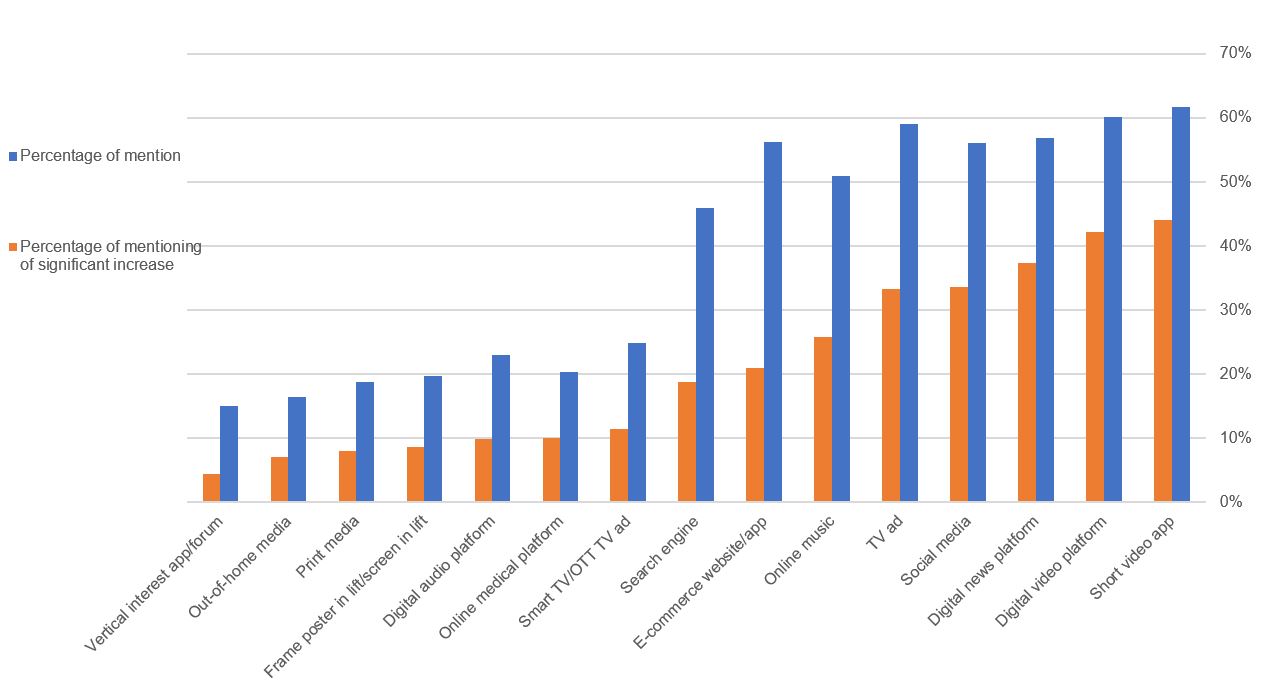

The outbreak has also changed people’s engagement with media. More than 40% respondents said they have significantly spent more time on short video apps and digital video platforms. Other media touchpoints that are being used much longer include digital news platforms (mentioned by 37%), social media (34%, although almost everyone is on WeChat for long hours in pre-outbreak days), TV ads (33%) and online music (26%).

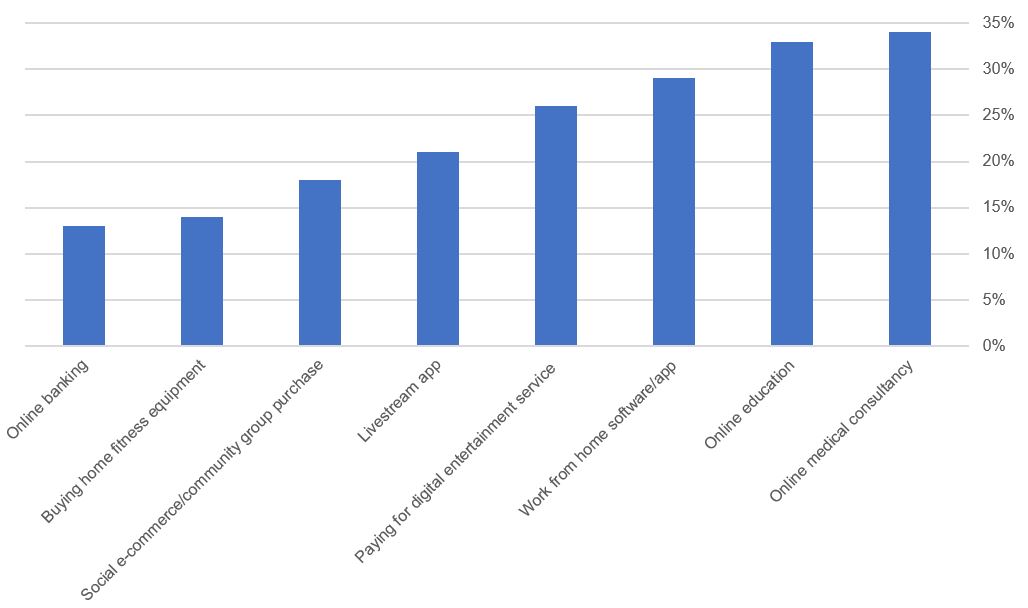

This outbreak has also nudged/forced many consumers to try something they’ve never used before, creating an opportunity for many new sectors. Among all respondents, 84% tried at least one new service for the first time, the highest being online medical consultancy (34%) and online education (33%), followed by working from home software/app (29%) and paying for digital entertainment service (26%).

4. Consumers’ attitude change

One of the most popular jokes during this outbreak is: “Now human being can understand why dogs need to be walked every day!” When the outbreak is eventually over, will, or how will, Chinese consumers change?

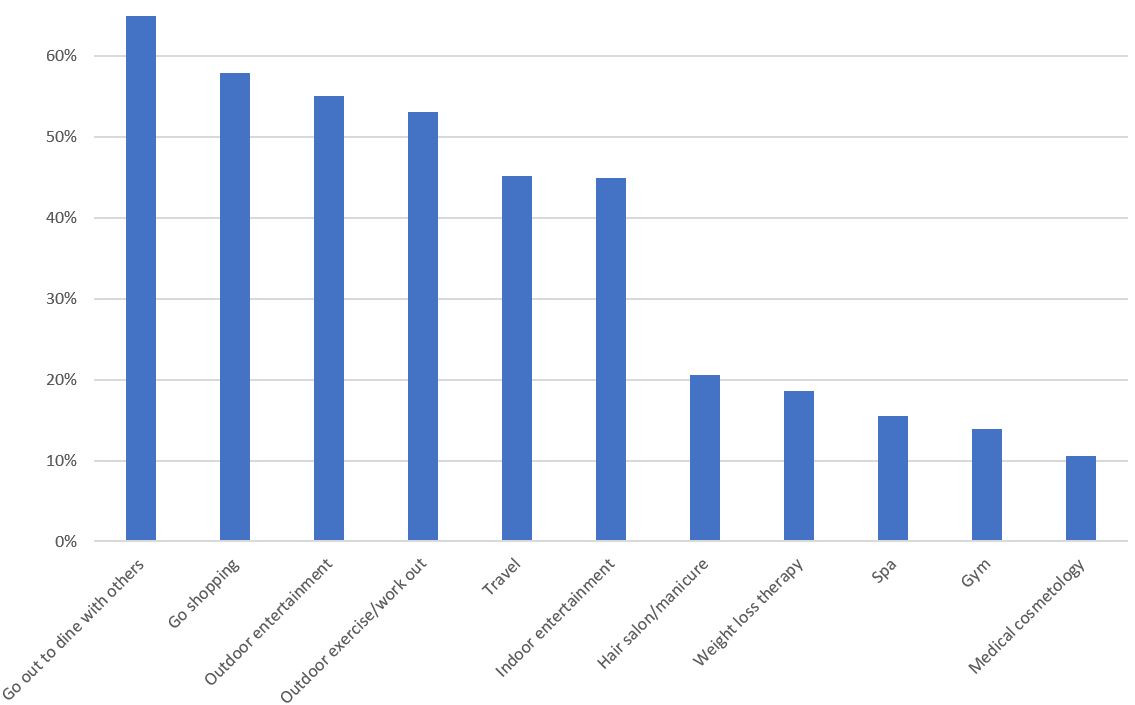

First of all, everyone wants to go out! The most mentioned activity for “what do you want to do most when the outbreak is over” is “go out to dine with others” (65%), followed by “go shopping” (58%), and “outdoor entertainment” (55%) and “outdoor exercise/work out” (53%). “Travel” was mentioned by 45% respondents.

Though everyone has tried their best to stock up epidemic prevention products, 83% surveyed consumers will still stock up masks and disinfectant. Wearing a mask will become a daily behaviour for 65% people; 76% will pay attention to the bacteria killing feature of personal care and household cleaning products; 63% will consider buy home appliances for disinfecting purposes.

In our snapshot survey, under this circumstance, Chinese people’s consumption attitude will become more conservative. There are more people agreeing to “save up for rainy days”, “reduce unnecessary spending” than agreeing to “enjoy instant pleasure”. People will treasure things that money cannot buy, such as “spending more time with family and friends”, “richer spiritual world”, “becoming a better self”.

In their attitude towards brand, people will “pay more to buy from socially responsible brands”, “pay more for cleaner environment and services”, “pay more attention to environmental protection and sustainability”.

Towards the end of the survey, we asked participating consumers to nominate brands that they liked more during the outbreak period (at most three) and explain why. From the 375 brands nominated, we can find that while some won consumers’ hearts because of their donation for the fight against the coronavirus, some are nominated for continuing to offer same high level of service/product under this extremely challenging circumstance. We believe a friendly brand in need is a great brand in deed. Brand love won within this special period can support a brand’s sustainable growth.