Cash may be king for many, but credit cards are frequently used by consumers across the globe. An indispensable tool for many consumers worldwide, credit cards give consumers the opportunity to extend their purchasing power, while also accessing valuable benefits like points and cash-back.

In new research, Kantar shared insights into how consumers prefer to pay for things, when they opt for cash, debit or credit, and how new payment technologies are creating more options for consumers. This research, across more than 10,000 global consumers, identified the sentiments and behaviours of consumers in the finance and payments space.

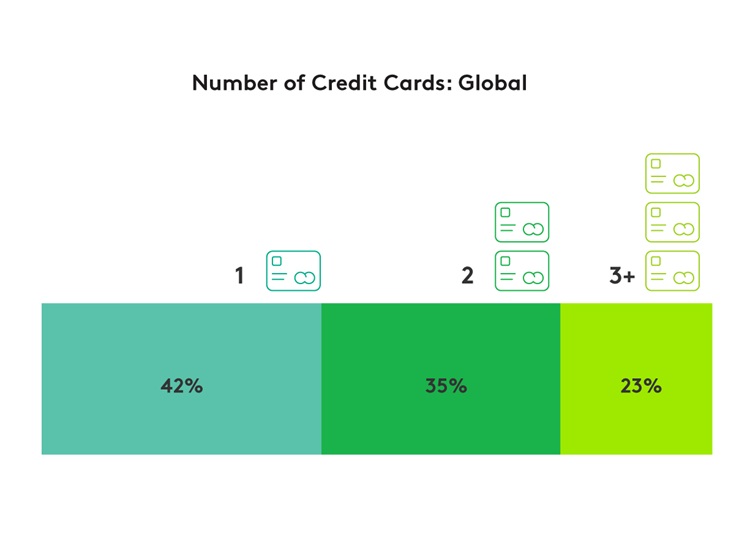

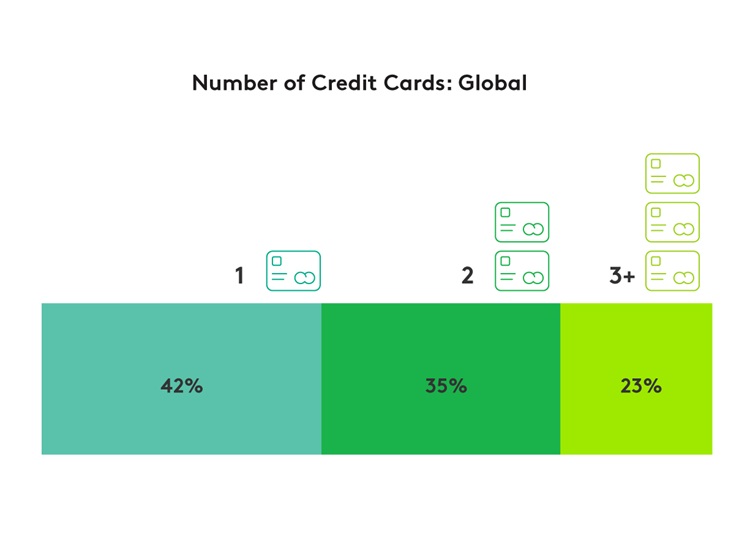

Nearly three-quarters of global consumers have used a credit card in the past six months, underlining the accessibility and availability of credit cards worldwide. 42% of credit card owners prefer to keep it simple with just one credit card. 35% are managing two cards, while 23% juggle three or more cards simultaneously. Americans are most likely to have multiple cards – 70% report having at least two credit cards – the highest of all regions.

Number of Credit Cards: Global

Spanning demographic generations, and regions, consumers frequently choose credit nearly as often as debit and cash. Global consumers shop with credit cards in a variety of situations, from eating in restaurants (38%), shopping for clothing in-stores (41%) and notably to purchasing large items (48%) for the home (like appliances or furniture).

Credit card adoption extends beyond just convenience; consumers value credit cards most for their safety and security (39%). With robust fraud protection measures in place, credit cards provide users with confidence in their financial transactions, both online and offline.

Additionally, credit cards have become important travel companions. The ease of switching between currencies and exchange rates fuelled 36% of credit card users citing their use during travel as a key motivator to use credit cards. The ability to make secure transactions, access emergency funds, and benefit from travel-related perks positions credit cards as essential tools for globetrotters.

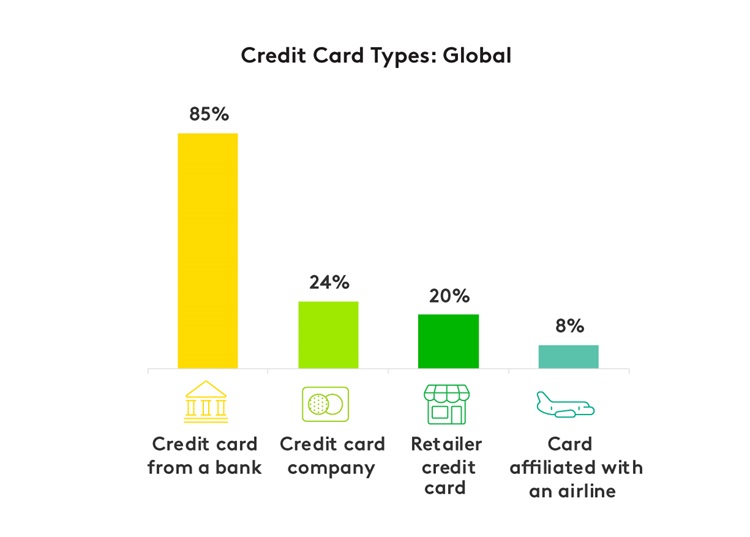

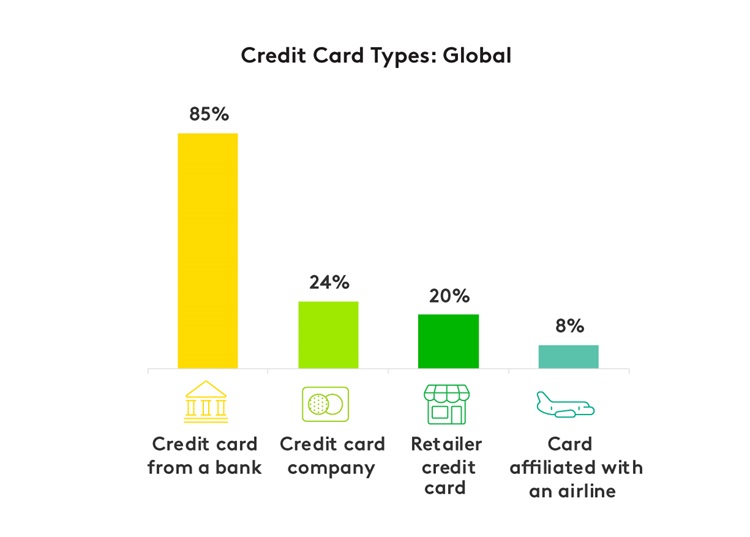

Consumers strategically choose credit cards that align with their spending habits and offer the most enticing rewards. Only 8% of credit card users have a card that is aligned with an airline, while the majority – 85% - have a card associated with a bank. Millennials are most likely to choose an airline card (14%) compared to other generations. Americans also have the highest preference for retailer cards at 32%.

Consumers continue to value being rewarded for their purchases and desire convenience and security when choosing which credit cards to own and use. Whether it's a solo credit card journey or a multi-card adventure, consumers are leveraging the power of credit cards to make their financial lives more secure, convenient, and rewarding.

Respondents were sourced from the Kantar Profiles Audience Network.

In new research, Kantar shared insights into how consumers prefer to pay for things, when they opt for cash, debit or credit, and how new payment technologies are creating more options for consumers. This research, across more than 10,000 global consumers, identified the sentiments and behaviours of consumers in the finance and payments space.

Nearly three-quarters of global consumers have used a credit card in the past six months, underlining the accessibility and availability of credit cards worldwide. 42% of credit card owners prefer to keep it simple with just one credit card. 35% are managing two cards, while 23% juggle three or more cards simultaneously. Americans are most likely to have multiple cards – 70% report having at least two credit cards – the highest of all regions.

Number of Credit Cards: Global

Spanning demographic generations, and regions, consumers frequently choose credit nearly as often as debit and cash. Global consumers shop with credit cards in a variety of situations, from eating in restaurants (38%), shopping for clothing in-stores (41%) and notably to purchasing large items (48%) for the home (like appliances or furniture).

Consumers Value Convenience & Security in Credit Card Ownership

Credit card adoption extends beyond just convenience; consumers value credit cards most for their safety and security (39%). With robust fraud protection measures in place, credit cards provide users with confidence in their financial transactions, both online and offline. Additionally, credit cards have become important travel companions. The ease of switching between currencies and exchange rates fuelled 36% of credit card users citing their use during travel as a key motivator to use credit cards. The ability to make secure transactions, access emergency funds, and benefit from travel-related perks positions credit cards as essential tools for globetrotters.

Credit Card Types Vary for Consumers

Consumers strategically choose credit cards that align with their spending habits and offer the most enticing rewards. Only 8% of credit card users have a card that is aligned with an airline, while the majority – 85% - have a card associated with a bank. Millennials are most likely to choose an airline card (14%) compared to other generations. Americans also have the highest preference for retailer cards at 32%.

Credit Card Rewards Remain Key Benefit for Cardholders

Among credit card users, 79% have cards that accumulate points, fuelling rewards-driven spending. The allure of instant cash back, and the flexibility of gift cards resonates with users, making these redemption options the go-to choices for a majority of cardholders. When redeeming their points, consumers predominantly choose cash back (35%) or gift cards (30%).Consumers continue to value being rewarded for their purchases and desire convenience and security when choosing which credit cards to own and use. Whether it's a solo credit card journey or a multi-card adventure, consumers are leveraging the power of credit cards to make their financial lives more secure, convenient, and rewarding.

Get more answers

For more findings from this study, access the complete Connecting with the Digital Payments Community. Find additional insights into how global consumers are paying for goods and services.About this study

This research was conducted online among 10,001 consumers across ten global markets: Australia, Brazil, Mainland China, France, Germany, Singapore, Spain, South Africa, US and UK, between 23 December, 2023 and 12 January, 2024. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country.Respondents were sourced from the Kantar Profiles Audience Network.