Grocery sales are expected to surpass €1.4 billion for the first time ever in December. This is according to our latest figures, which show that take-home grocery sales increased by 7.2% in the four weeks to 26 November 2023. Shoppers visited stores more often in November, making an average of 21.3 trips over the month, which is up 4.4%. However, volumes per trip continue to decline versus last year, down 4.4%.

We are on course for a record-breaking festive period, with shoppers spending an unprecedented amount at supermarkets this Christmas. It’s always a bumper time for Irish grocers with consumers buying on average 11% more items than in a typical month.

The Irish grocery landscape is as competitive as ever with retailers continuing to battle it out to offer the best value to consumers by keeping prices competitive. To give you an idea of just how fierce the competition is this year, the cost of a Christmas dinner for four has risen by 3.2%, well below the overall average growth in price per pack (+5.4%), with some festive items even falling in price. Brussels sprouts and Christmas pudding are down, 0.6% and 22% respectively, compared to last year so there’s no excuse for consumers not to enjoy them this festive season. We expect Saturday 23rd December to be the busiest day in store this year as €96m in value sales rang through the tills on Friday 23rd last year.

Declining grocery inflation and shifting consumer preferences in the lead-up to Christmas

Grocery price inflation now sits at 8.6% in the 12 weeks to 26 November 2023.

This is the seventh month in a row that there has been a drop in grocery inflation. This is good news for consumers although the rate is still incredibly high. Compared to last month’s inflation rate of 9.8%, there has been a significant drop of 1.2 percentage points, the lowest level we have seen since August 2022. We expect to see this gradual decline in inflation rates continue over the coming months.

The percentage of packs sold on promotion rose by 1.9% compared to last month. It currently stands at 26.7%, up 15.3% year-on-year, with Dunnes, SuperValu and Tesco all seeing strong growth in sales on promotion – ahead of the total market.

Own label goods continue to be popular with sales up 10.4% in the latest 12 weeks but saw a slight 0.4 percentage point decrease on last month. Irish consumers have been getting in the mood for the festivities with premium own label products which are up 10.6% with shoppers spending an additional €13.4m on these items compared to last year.

Own label value share currently stands at 46.6% with brands holding 48.5% of share, up 1.1% versus last month as shoppers turn to trusted brands in the lead up to Christmas.

Retailers are pushing own label lines and promotions to get Irish shoppers through the door. However, it seems that consumers are also reaching for branded goods as they look to indulge over the festive season, spending an additional €92m (up 6.3%) on these products, with branded seasonal biscuits and take-home confectionary proving particularly popular, up 12.9% and 12.4% respectively, and growing ahead of the overall branded market.

Irish retailer performance update

Online sales remained strong over the 12-week period, up 25.7%, with shoppers spending an additional €37.3m on the platform compared to last year. More frequent trips (+6%) and new shoppers (+1.7 percentage points) also drove online’s overall growth.

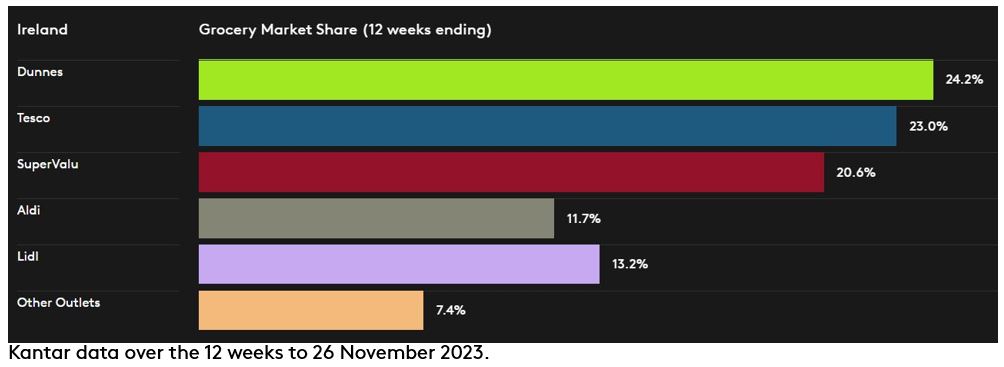

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month.

Dunnes hit a new record share of 24.2% and growth of 11.7% year-on-year. This growth was driven by a strong boost in new shoppers, up 2.2 percentage points year-on-year – the strongest growth in new shoppers of all the retailers – together with more volume per trip, which combined contributed an additional €31m to overall performance.

Tesco has 23% of the market and growth of 11.4% year-on-year. Tesco had the strongest frequency growth amongst all retailers once more, up 11.2% year-on-year, as well as recruiting new shoppers in-store, which combined contributed an additional €81.1m to overall performance.

SuperValu holds 20.6% of the market with growth of 6.2%. SuperValu shoppers made the most trips in-store compared to the other retailers – an average of 22.6 trips – alongside seeing a boost in volume per trip, which contributed an additional €47m to their overall performance.

Lidl holds 13.2% share and growth of 10.4% year on year. More frequent trips contributed an additional €39.3m to the supermarket’s overall performance. Aldi holds 11.7% with growth of 1.4% year-on-year. More frequent trips contributed an additional €17.3m to the overall performance.

Want more like this?

Read: Irish grocery price inflation hits single figures for first time this year