Take-home grocery sales rose by 4.6% over the four weeks to 17 March, with an early Easter boosting sales of seasonal treats in the first three months of 2024 by £88 million compared with the same period last year, according to our latest data.

With Easter on the horizon, consumers have been stocking up on classic seasonal treats, with a quarter of people picking up four or more items when buying chocolate eggs. This rises to 29% for shoppers aged over 65, suggesting that many grandparents are planning to indulge their families this weekend. People in Wales and the north of England are among the biggest spenders, shelling out £14.18 and £13.84 on Easter eggs on average respectively in the past three months. Volume sales of hot cross buns are also up by 15% versus last year.

Inflation eases but shoppers still looking to make savings

Spring brought good news for consumers as grocery price inflation eased to 4.5% over the four weeks to 17 March, the lowest level since February 2022. Grocery inflation has come down significantly since hitting an eye-watering peak of 17% in March 2023. However, despite this continued slowdown, many British households are still feeling the squeeze. 23% identified themselves as struggling financially in our data* – the same proportion as reported in November last year.

Shoppers remain on the hunt for value and among those feeling most pressured, 78% are actively buying cheaper groceries while 68% are using promotions to help manage budgets. Retailers appear to be responding in kind, with the emphasis on discounts and price match schemes continuing this period. £605 million more was spent on deals this month than in March last year, while nearly one third of baskets across Tesco, Sainsbury’s and Asda collectively contained at least one price matched product. Premium own-label lines have been a big beneficiary of consumers trading down, growing by a whopping 16.1% this month – the quickest rate we’ve seen in nearly three years. However, sales of branded goods pushed just ahead of own label overall, increasing sales by 6.1% and 4.7% respectively in the latest four weeks.

Online channel grows faster than stores

Ocado was the fastest growing retailer this month, benefiting from a sustained voucher campaign which helped it attract customers. The retailer improved sales by 9.5% in the latest 12 weeks, ahead of the total online market which rose by 6.6%, to account for 1.9% of all take-home sales. It was the only grocer other than Waitrose to boost its number of shoppers in the latest three months.

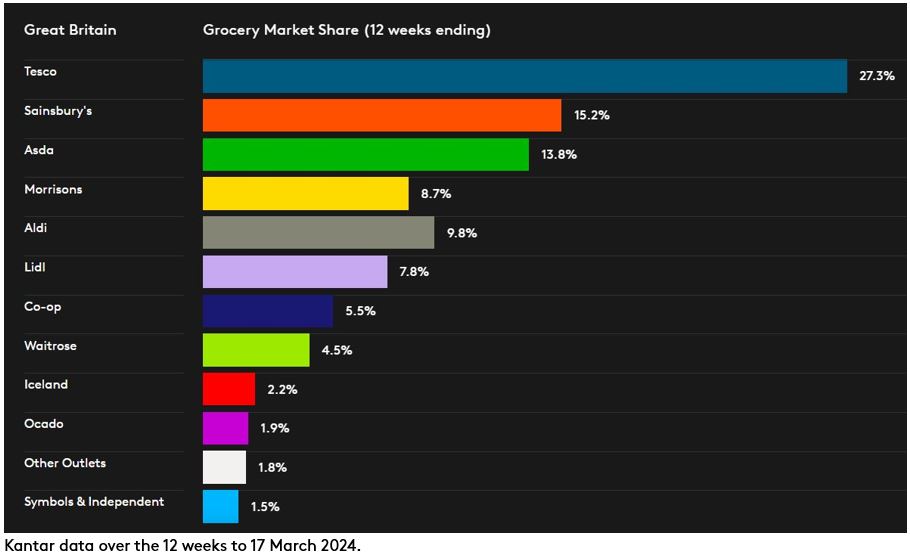

Year-on-year sales at Britain’s two largest grocers, Tesco and Sainsbury’s, climbed by 5.8% and 6.7% respectively. Their shares of the market nudged up by 0.4 percentage points each to 27.3% and 15.2%.

Morrisons saw a 3.6% increase in sales over the latest 12 weeks, marking more than one year of consistent growth for the retailer. Its share of spend stands at 8.7%. Asda, meanwhile, increased sales by 0.2% and now holds 13.8% of the market.

Aldi’s sales stepped up by 3.1%, with its market share at 9.8%. Fellow discounter Lidl grew by 8.8% to capture a 7.8% share of the market, helped by a 24% rise in sales of baked goods and a 11% jump in fruit, vegetables and salads. Iceland grew sales by 2.2%. Waitrose holds a 4.5% share, with sales up by 3.9%, while Co-op takes 5.5% of the market.

*Kantar Worldpanel LinkQ pressure groups survey, fieldwork 19 - 29 January 2024, 10,738 panellists interviewed.