Kantar recently conducted new research into the sentiments of global consumers, and how they are choosing to pay for goods, services, and bills. In this research, Kantar found that consumers report paying for items using digital payments varied across demographics and regional markets.

The popularity of digital and mobile wallets is growing with 92% of consumers reporting familiarity with these payment types, and 55% having used them to make transactions, both online and in-person, in the past six months. The convenience factor of paying with your watch or phone is high for consumers when out-and-about. 23% of users leverage digital wallets specifically for the ease of paying for food or drinks at coffee shops or in fast food restaurants. The increase in availability of digitised transaction types is in line with consumers’ increasing need to prioritise speed, and flexibility when making purchases.

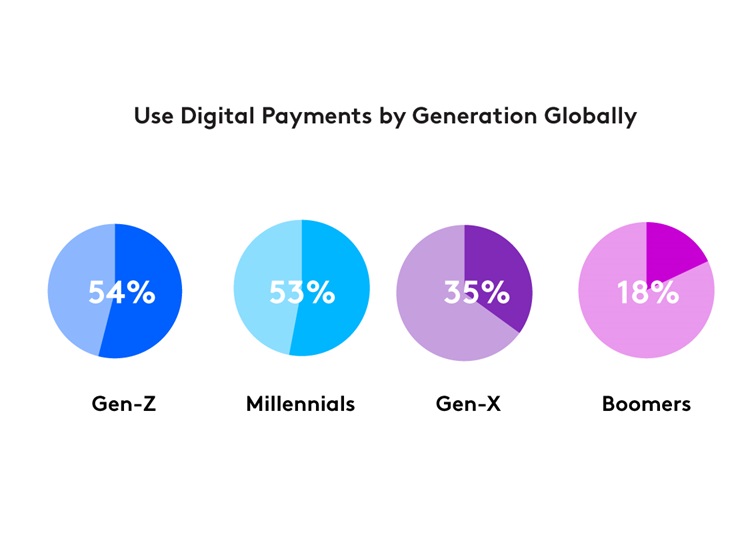

Consumers consistently cite the convenience of mobile wallets as the top reason for their adoption. The ability to make swift, secure transactions without the need for physical cards or cash aligns with the fast-paced lifestyles of today’s global consumer. Younger generations have been quicker to adopt these payment types. Over half of GenZ and Millennials have used these payment types, compared to only 18% of Boomers.

The seamless integration of digital wallets into daily routines, coupled with the added layer of security they provide, positions them as the preferred choice for those seeking an efficient and reliable payment experience – and who favour the latest tech rather than traditional methods.

The seamless integration of digital wallets into daily routines, coupled with the added layer of security they provide, positions them as the preferred choice for those seeking an efficient and reliable payment experience – and who favour the latest tech rather than traditional methods.

Digital Market Differentiation

Geographically, there are notable variations in the adoption of digital payment types. China leads the charge, with an impressive 57% of consumers relying on Apple Pay or Google Wallet. Singapore closely follows at 47%, showcasing a strong appetite for mobile payment solutions in these Asian markets. In contrast, the adoption is more modest in France (28%) and Australia (27%), suggesting varying degrees of receptiveness to digital payment methods across regions.

A Rise in Peer-to-Peer Payments

Over half - 54% - of consumers have embraced the simplicity of peer-to-peer services (like Venmo or Zelle in the US), utilising them for various everyday transactions. These services, often employed to pay for services like babysitting, dog walking, or reimbursing a friend, have become integral to the financial lives of individuals seeking quick, hassle-free ways to settle informal debts. The popularity of peer-to-peer services underscores the evolving nature of payment preferences, with consumers opting for solutions that align with their fast-paced lifestyles.

As consumers seek out banking and payment options available via digital and mobile devices more frequently, availability is anticipated to grow even further to meet market demand. From peer-to-peer services facilitating informal transactions to the widespread use of digital wallets, consumers are embracing the future of finance. As technology continues to redefine the way we transact, the possibility of a cashless society becomes more of a potential reality.

Get more answers

For more findings from this study, access the complete Connecting with the Digital Payments Community report. Find additional insights into how global consumers are paying for goods and services.

About this study

This research was conducted online among 10,001 consumers across ten global markets: Australia, Brazil, Mainland China, France, Germany, Singapore, Spain, South Africa, US and UK. Between 23 December, 2023 and 12 January, 2024. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country.

Respondents were sourced from the Kantar Profiles Audience Network.