The latest Worldpanel ComTech Smartphone Operating System (OS) data indicates global smartphone sales volumes have increased +1% year-on-year. Apple iOS had a particularly strong performance, accounting for 37% of global smartphone sales (+10% year-on-year). The continued adoption of its iPhone 15 series is driving this.

Other insights uncovered within the global smartphone market in the fourth quarter of 2023 include:

- Android OS fell to 57% share of global smartphone sales. Samsung ranks as the most popular Android phone, despite losing share across all markets.

- Samsung Galaxy Z Flip 5 is the top selling foldable phone. However foldable adoption remains challenging.

- Huawei Harmony OS sales volumes have jumped +32% in China, driven by the popularity of Mate 60 Pro.

Commentating on the latest OS data, Jack Hamlin, Global Consumer Insights Director at Worldpanel Division, Kantar, said: “2023 was a challenging year for the technology industry, the smartphone market was no exception. Consumers, businesses and markets recalibrated to high inflation and rising interest rates which had quashed discretionary spend and dampened demand for phones. Manufacturers will welcome the second half performance, global year-on-year smartphone sales stabilised in Q3 and rose +1% in Q4. The latest OS data highlights a fantastic quarter for Apple with its iPhone 15 series driving it to a record high 37% share of global sales. Increased loyalty, gifting and trade-in are some of the contributors to its success.”

Global smartphone sales in growth

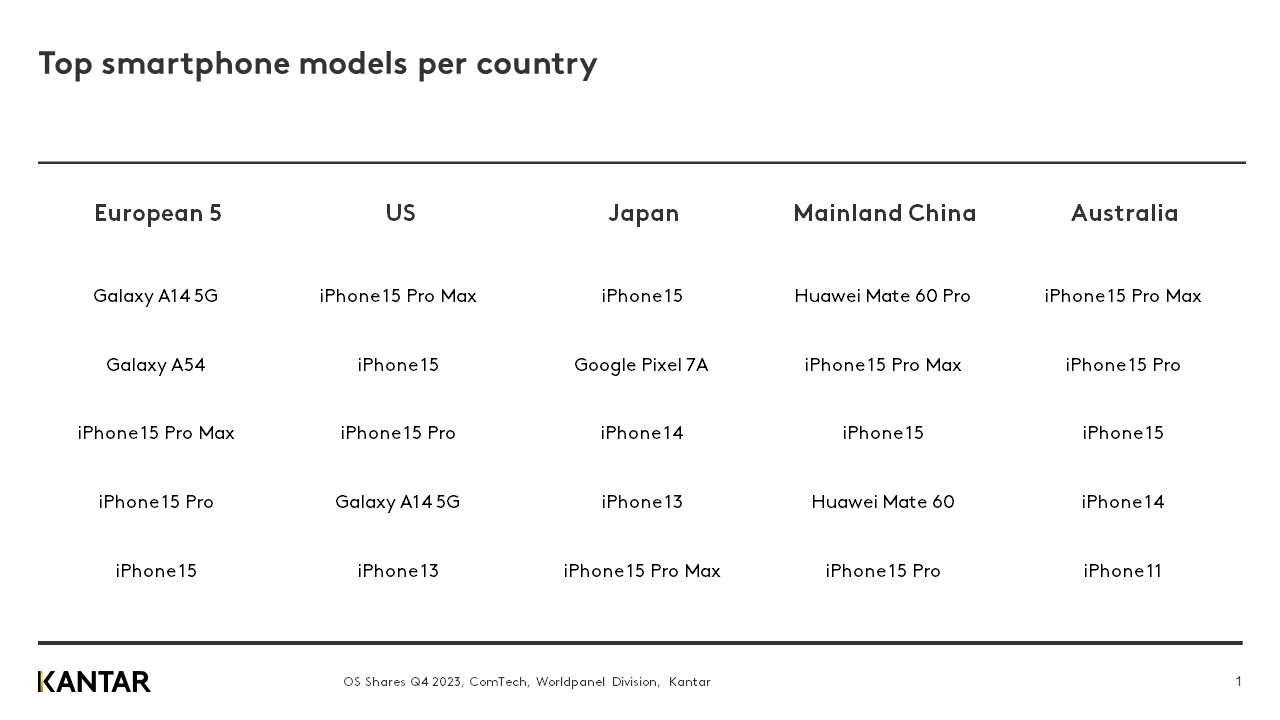

In the top 5 European markets (France, Germany, GB, Italy, and Spain), smartphone sales volumes grew by +4% year-on-year, driven by a stellar uplift in Germany, Spain and France. Apple iOS performed well, iPhone volumes increasing +19% year-on-year. The iPhone 15 series is proving incredibly popular amongst Europeans, securing the top iPhone model sold in every market other than Italy. Android OS has had a challenging quarter, sales volumes dropped -1% year-on-year. This downturn is in part driven by Samsung Galaxy performance, losing -5%pts share across the European 5. Folding smartphone adoption remains low, Galaxy Z Flip 5 ranks as the top selling foldable, accounting for 1% share of total sales. Established Android brand Motorola has had a strong quarter, ranking 4th in manufacturer sales, fuelled by its mid-tier G series.

The United States has seen a 13% increase in smartphone sales, attributed to strong growth from both Apple iOS and Android OS, +18% and +6% respectively year-on-year. The iPhone 15 series accounts for 1 in 4 smartphones sold in Q4. Consumers are opening their wallets and paying more for premium, iPhone 15 Pro Max is the top selling variant whereas the Plus falls outside of the top 10 model list. Consumers that want the larger 6.7” screen are willing to pay more for additional features including: titanium finish, faster chip, and new action button.

Across the Asia Pacific region, sales volumes vary. Mainland China and Japan saw a year-on-year decline, however in both markets the decline is less steep than the previous year. In Mainland China, consumers are moving toward domestic brand Huawei, with Harmony OS sales share jumping +32% year-on-year. The newly released Huawei Mate 60 Pro is proving most popular, yielding top spot in the models list. Japanese consumers are increasingly picking up iPhone s, sales share jumping +3%pts year-on-year. Google Pixel is also continuing its strong performance with the budget Pixel 7A proving most popular.

Australia has experienced a strong 20% uplift in sales volumes. iPhone sales have increased +29% year-on-year, the greatest increase of any market. Conversely, Samsung and Google Pixel have lost sales share.

Why is Apple performing so well?

iPhone sales have hit a three year high, accounting for 37% of global sales. There are several reasons attributing to its success, we have explored three below via our continuous, longitudinal technology panel, focusing on European 5 and United States.

-

Increased loyalty

Apple is driving a greater proportion of its sales from repeat buyers, 88% of iPhone buyers that purchased in 3 months to December 2023 upgraded from an iPhone (+3%pts higher than the previous year). Increased retention is ensuring that the new customers it won two to three years prior are purchasing another iPhone when they come to upgrade. In fact, over 1 in 3 iPhone buyers cited ‘I had a previous good brand experience’ as a top purchase influencer when they go on to purchase (+115 over-index v the previous year).

-

Gifting

Over half of iPhones purchased in 3 months to December 2023 were purchased as a gift (+114 over-index v previous year). Gen Z (24yrs and under) were the top beneficiary of these gifted devices, accounting for 45% of all gifted iPhones (+139 over-index v previous year). iPhone has always performed well amongst younger consumers, gifting allows children that don’t have the spending power an opportunity to own an iPhone. The top gifted models were iPhone 12, iPhone 11 and iPhone 13, these older models enable parents to fulfil their children’s wishes whilst minimising cost.

-

Trade-in

iPhone owners are increasingly trading-in their old devices, applying the cash-back to discount their new phone. 1 in 5 iPhone buyers stated that they were in influenced by a trade-in scheme in 3 months to December 2023 (+129 over-index v the previous year). iPhone has long held a greater residual compared to its competition, consumers are increasingly making the most of this when purchasing their new phone. For example, Apple is currently offering consumers $400 off the iPhone 15 if they trade-in an iPhone 14, 50% of the device’s original value.

Contact our expert for further information and access the interactive data visualisation tool to see the Smartphone OS shares market evolution.