The latest Worldpanel ComTech Smartphone Operating System (OS) data indicates the decline in smartphone sales is levelling off, with sales global Smartphone sales volumes flat year-on-year, a marked improvement for an industry that has faced a steady and accelerated decline following the Covid pandemic (sales volumes were down -16% year-on-year Q3-22). Apple saw the strongest sales performance of all smartphone brands following the launch of its latest generation, iPhone 15, which led Apple iOS sales share to rise by 4% points.

Other insights uncovered within the global Smartphone market in the third quarter of 2023 include:

- iPhone 15 Pro Max has emerged as the top-selling iPhone 15 series variant, leading Huawei in Mainland China and boosting Apple iPhone Operating System (iOS) market share by +4% points to 30%

- Android OS fell to 64% market share. Samsung ranks as the most popular Android phone

- Samsung Galaxy Z Fold/Flip models account for greater share of sales vs predecessor

- 97% of iPhone 15 early adopters upgraded from another iPhone illustrating the unwavering loyalty of Apple’s customer base

- E-waste reduction initiatives driving sales, Samsung’s trade-in-scheme proves effective

Commenting on the latest OS data, Jack Hamlin, Global Consumer Insights Director at Kantar’s Worldpanel division, said: “It’s encouraging to see signs of market recovery as the smartphone industry stabilises in the third quarter of the year. Especially, Apple's iOS stood out with a remarkable year-on-year increase in share of sales. Apple's differentiation strategy is proving successful with the iPhone 15 series continuing its success in Europe. The latest OS data also reinforces the importance of software innovation in an industry where hardware innovation faces challenges. Manufacturers should take note of the emphasis on unique OS features by iPhone and Google Pixel, demonstrating the potential for software to enhance user engagement and satisfaction.”

Smartphone sales flat following last year’s decline

Smartphone manufacturers welcome the second half of the calendar year. The summer slump is replaced with a seasonal uplift, fuelled by flagship device launches from Samsung, Apple, and Google.

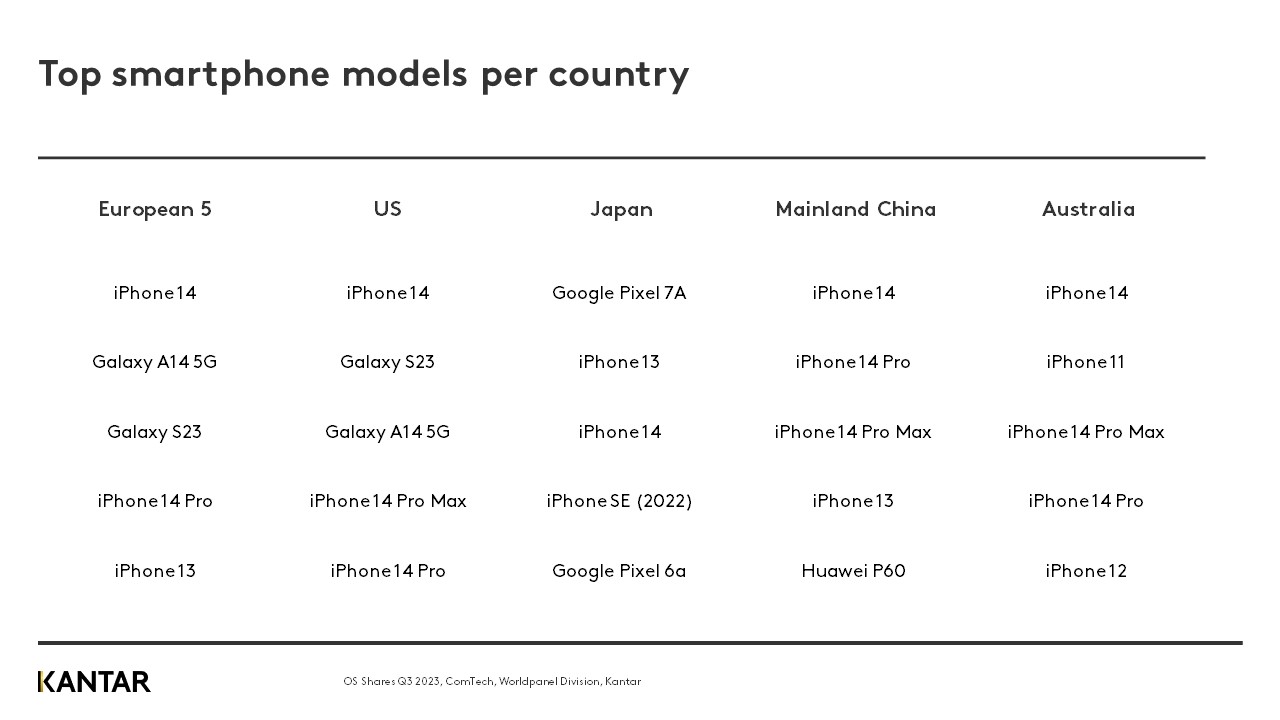

In the top 5 European markets (France, Germany, GB, Italy, and Spain), sales grew by +4% year-on-year, primarily driven by Italy and Spain and the performance of the iPhone 14 series. However, sales slightly declined in Great Britain and France, and remained flat in Germany. Android sales share is largely flat across the region. Samsung is the top Android manufacturer, followed by Xiaomi, Google, and Motorola. Google’s Pixel secured third spot in Europe; a significant achievement for the brand, gaining +3% sales share year-on-year.

The United States has seen a 12% increase in sales, fuelled by a considerable 31% year-on-year growth in Apple's iOS sales. This is especially noteworthy considering the delayed launch of the iPhone 15 compared to its predecessor. The iPhone 14 series continues to perform well, representing 20% of smartphone devices sold, while Android faces challenges, having lost -7% market share.

Across the Asia Pacific region, sales volumes vary. Australia and Mainland China saw declining sales volumes, while Apple's iOS gained year-on-year market share in both markets, thanks to the iPhone 14 series. Despite facing challenges and restrictions in Mainland China, Huawei has gained +4% share in the country, emerging as a formidable competitor to Apple with its flagship Mate 60 model. Japan saw an increase in sales volumes, primarily attributed to the success of Google Pixel, particularly the Pixel 7A, which has claimed the top spot among models.

New devices hit the market

Q3 ushered in a flurry of new smartphone announcements with notable news from Samsung, Apple, Google, Honor, Xiaomi, Motorola, and OnePlus. In August, Samsung launched the Galaxy Z Flip/Fold 5, featuring a Flex Hinge, a new Snapdragon chip, and improved software. The Flip is proving more popular than the Fold, breaking into the top 10 Samsung devices sold in Q3-23 and surpassing the Z4 series sales share by +180%. Furthermore, a compelling foldable phone from OnePlus with its ‘Open’ model has added extra competition to the market. Samsung's trade-in scheme which offers consumers money off their new foldable when they send in their old device, has driven its success, with one in three Z5 series buyers influenced by the policy.

Apple introduced the iPhone 15 series at its September 12th Wonderlust event, maintaining its predecessor's design, price, and range structure. The key change is the shift from Lightning to USB-C ports. Apple's strategy of differentiating the Base and Pro models through feature exclusivity, which began last year, continues. The Pro variants feature the new A17 Pro chips and an 'Action' button, allowing users to assign various actions to a simple tap. Early data suggests this approach is working, with the iPhone 15 Pro Max leading sales in Europe, the US, and Australia.

Both Apple and Google launched new operating systems: iOS 17 and Android 14, with iOS offering AirDrop improvements, live voicemail transcription, and FaceTime voicemails. Android 14 emphasised AI features, security enhancements, AI-generated wallpapers, and better accessibility.

As the smartphone industry experiences a stall in hardware innovation, manufacturers should recognise the impact of OS and software features on consumer choices. +7%pt more iPhone and Google Pixel owners prioritise unique OS features over Samsung. Both manufacturers have heavily focused on developing exclusive software features such as iOS FaceTime voicemails and Google Pixel call screening. These features grab consumers’ attention, presenting a fresh and innovative update to their user experience. New chips and processors garner little excitement, it is the capabilities that they enable which do.

Increased smartphone usage leads to higher satisfaction, and software features are a tool manufacturers can use to boost engagement. For instance, in September 2023, 2 in 3 iPhone owners used their device to video call (+126 over the market average). iPhone users who made video calls achieved a Net Promoter Score (NPS) of 39, +10 points higher than those who didn't, underscoring the power of a well-positioned OS feature like FaceTime in differentiating devices and enhancing user engagement and satisfaction.

Whilst it is too soon to determine if the bottom has been reached with Smartphone sales, the news bodes well for Q4-23 which will be a battleground for new devices; Samsung Galaxy Z Fold/Flip 5, Apple iPhone 15 series, Google Pixel 8 series, OnePlus Open, Xiaomi 13T Pro, Honor 90, Oppo Find N3, and Motorola G54.

Access the interactive data visualization tool with all the shares and get in touch with our experts for additional information.