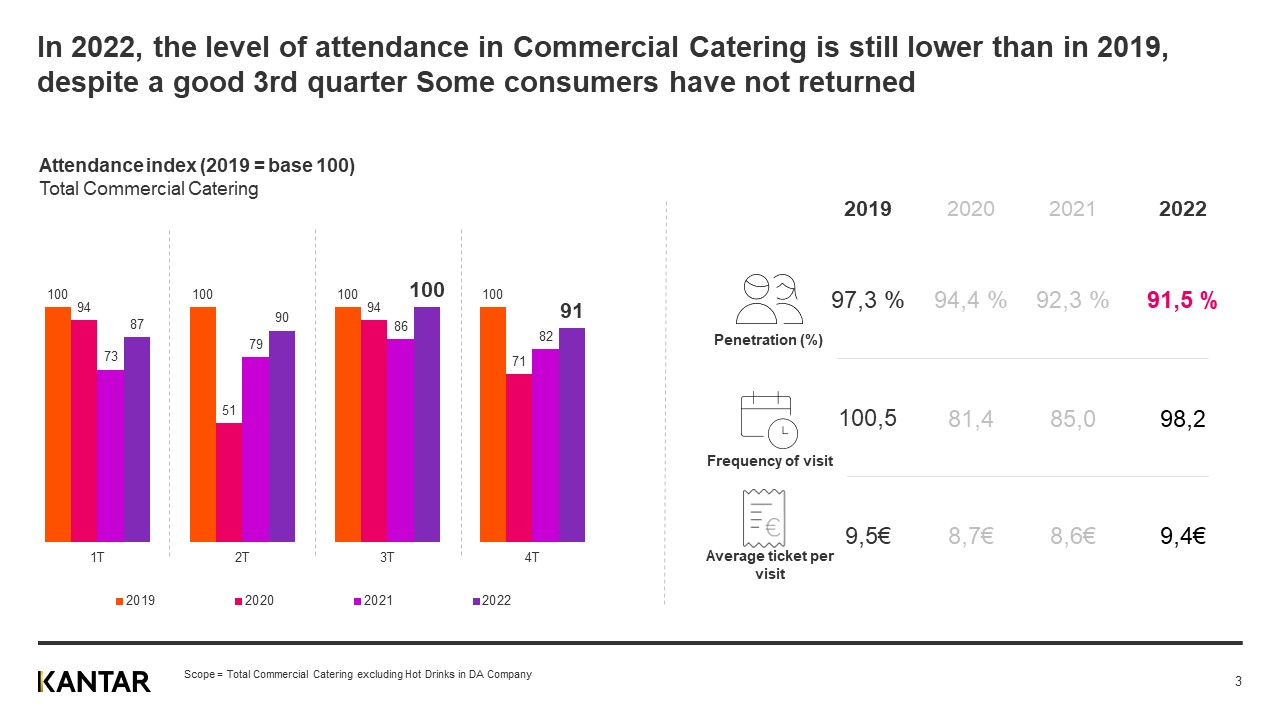

1) OOH attendance close to its 2019 attendance level

Commercial Foodservice is still seeing 7% fewer visits (vs. 2019) over the 2022 year. We had to wait until the heart of summer to see a comparable attendance; unfortunately slowed down at the end of the year. The market is still penalized by a loss of attractiveness (part of the consumers did not come back), and tends to be concentrated on the biggest frequenters (50-64 years old, urban, CSP+).

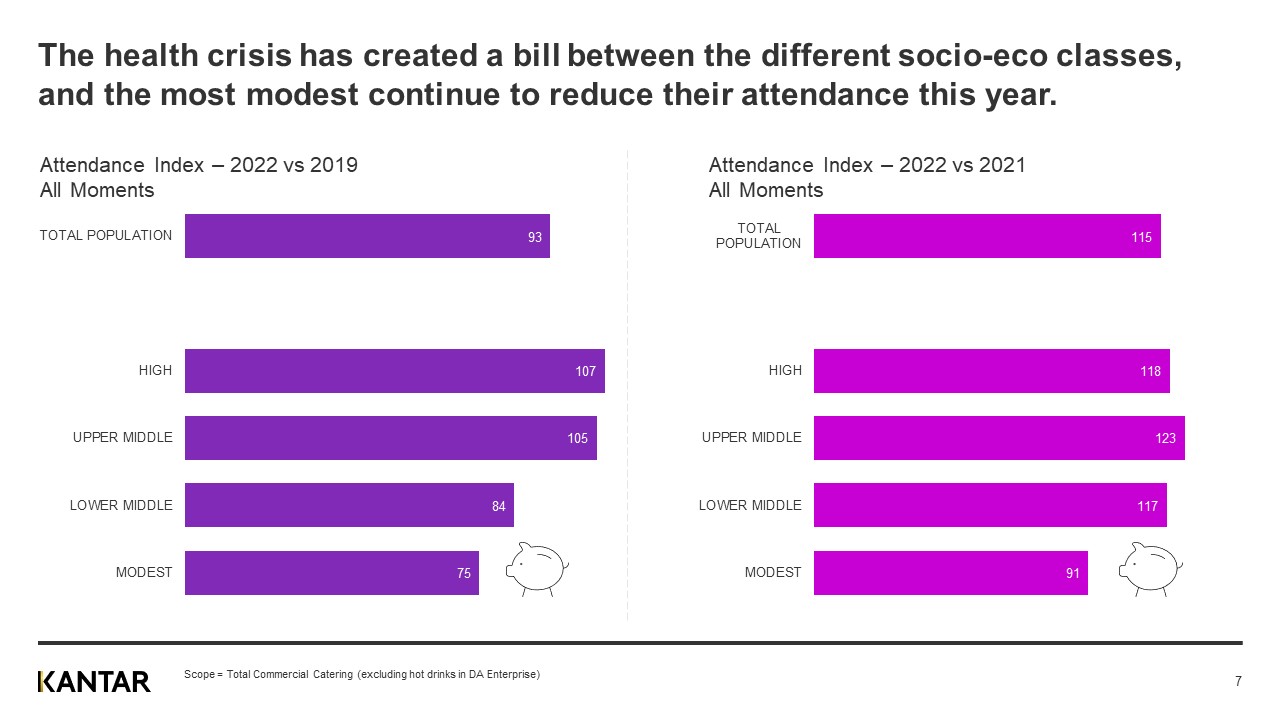

2) Inflationist context widens the divide between the different classes of the population

The most modest consumers are forced to make budgetary arbitrages on their expenses outside the home (outings, leisure activities). The divide is thus widening with the more privileged consumers who have returned to their pre-Covid level of frequentation. Faced with the increase in the average ticket (which impacts both Full-Service Restaurants and Quick-Service Restaurants), consumers tend to simplify their meals by concentrating on core meal products or tend to take their meals away from home more.

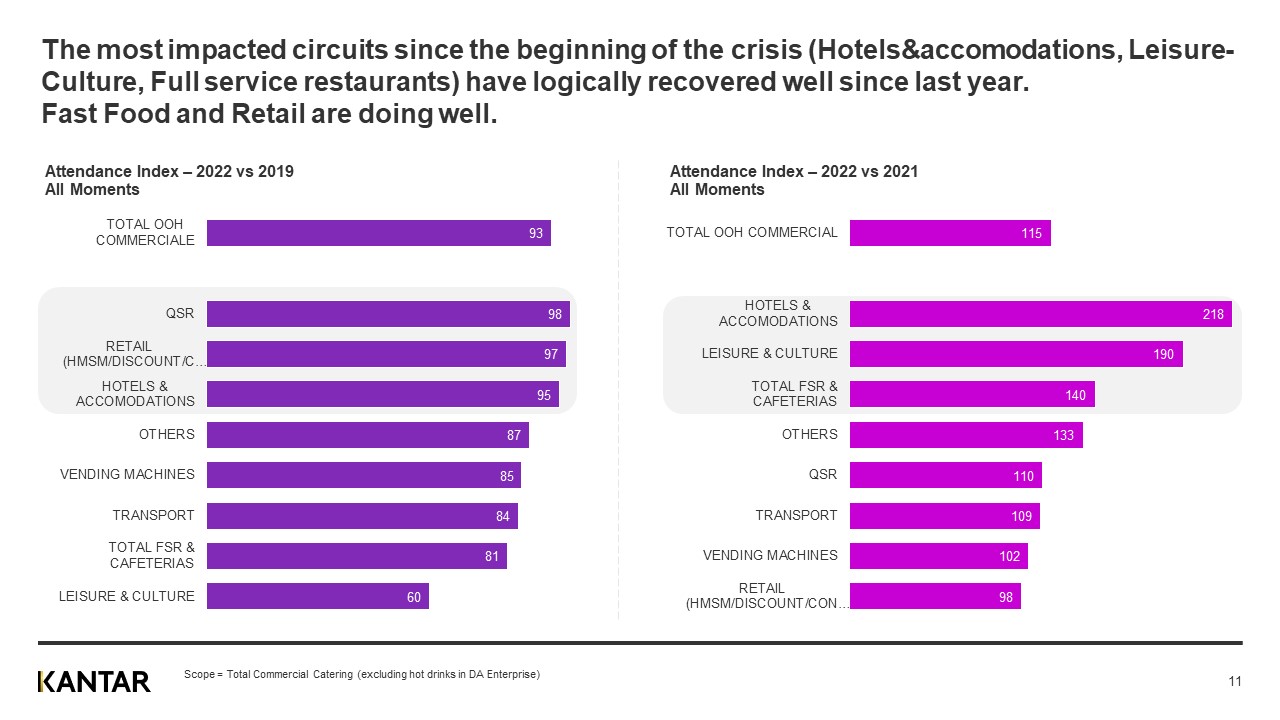

3) Omnichanneling is key

The recovery is mainly driven by the channels that have been most affected since the beginning of the crisis (Hotels, Leisure and Culture, FSR), even if QSR (especially players focused on Take-Away/Delivery) has gained market share in the long term. Restaurant operators must know how to work on omnichannel, as the French do not use only one channel for their out-of-home spending.

To know more please contact our experts: https://www.kantar.com/fr/contact/wp-france