This is the sixth consecutive year that Kantar Worldpanel and Bain & Company Inc have tracked the shopping behaviour of Chinese consumers. Our continuing research has given us a valuable long-term view across 106 fast-moving consumer goods (FMCG) categories purchased for home consumption in China. In last year’s report, we introduced readers to the phenomenon that China’s FMCG market operates at two distinct speeds: fast and slow. This year we continued to examine the two-speed pattern.

Part 1 Product categories

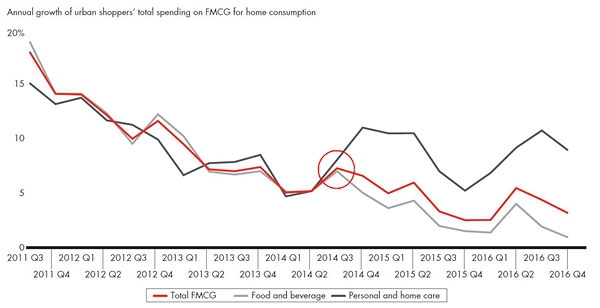

Value growth for FMCG in China continued to decelerate, reaching a five-year low of 3.0% in 2016, which represents a further slowdown of 0.6% compared with 2015. A clear trend emerged: Since Q3, 2014, consumers have significantly increased their spending on personal and home care goods, such as makeup and facial tissue, while appearing to cut back on food and beverages.

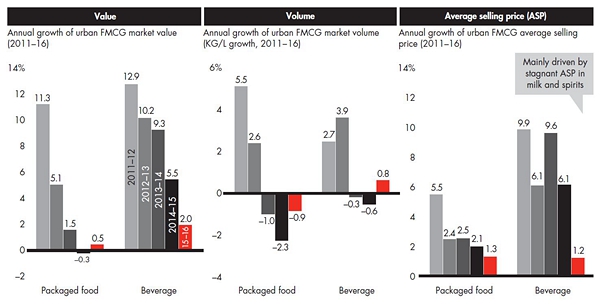

Food and beverage show stagnant growth

Let’s look first at the slow-speed categories. Packaged food remained stagnant in value growth, gaining only 0.5%. Among packaged foods, confectionary categories took the hardest hit, with value growth of candy (-6.0%), chocolate (-9.0%) and chewing gum (-15.0%) sinking. In addition to the general shift away from foods that are perceived to be less healthy, other contributing influences led to the underperformance in these categories. For example, candy and chocolate traditionally are popular as gift items. Now, as more Chinese travel during holidays, there are fewer opportunities to offer gifts to friends and family at home gatherings.

Some food and beverage categories are benefiting from innovative moves aimed at reversing the downward trend. Consider instant noodles, a category that has witnessed an average annual decline of 10% for the past two years. Leading players like Master Kong and Uni-President have introduced more premium product ranges -- noodles with better-quality ingredients in more sophisticated packaging, for example -- to address the higher demands of white-collar consumers. At the same time, these brands are benefiting by adjusting the prices on lower-end products sold to their traditional blue-collar consumer base, a move that helps them compensate for increased raw material prices and sustain value growth. The instant noodle category is an important one to watch.

Other factors come into play, too. Infant formula recovered from its negative 3% growth last year to enjoy more than 6% growth this year. Contributing to the turnaround: The government’s new second-child policy, introduced in the beginning of 2016, is starting to show remarkable results.

Personal and house care rebound

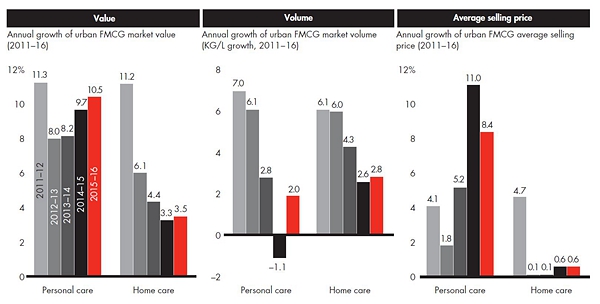

While packaged food categories may be losing ground overall, others are enjoying strong momentum. For example, the value of personal care rose 10.5% and home care grew by 3.5% in 2016, the result of a resurgence in volume and high prices. These categories benefit from critical trends among Chinese consumers, such as an increasing attention to health and wellness.

Indeed, China’s consumers are continuing to show a preference for healthy goods or for a better-quality life, a phenomenon enabled by higher average incomes.

We observed strong premiumization across personal care categories. For example, in beauty (makeup and skin care), luxury brands such as Armani and YSL have performed very well this year in China. In the toothbrush category, premiumization is the result of a rising awareness of oral hygiene and the increasing popularity of electric toothbrushes such as those manufactured by Philips. Meanwhile, facial tissue grew in volume as more Chinese consumers substituted it for toilet paper in such common household uses as wiping tables. Toilet tissue is premiumizing as more consumers trade up from two-ply to three-ply tissue.

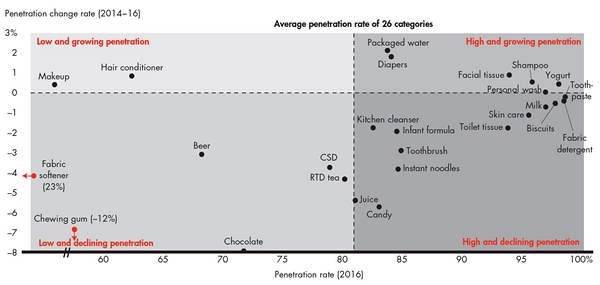

Penetration plateau

Most categories are reaching a penetration plateau and are experiencing declining penetration rates. Average penetration for the 26 categories dropped to 81% from 83% in 2015. Only seven categories grew in penetration -- yogurt, makeup, shampoo, conditioner, facial tissue, packaged water and diapers -- all of them health- and hygiene-related.

Penetration saturation reflects how most categories have reached the distribution that they need in urban China. Until now, most brands grew by opening stores or points of distribution. Now the period of mass expansion is over, and brands need to reach their growth targets by focusing on penetration, by boosting brand repeat sales and through premiumization -- pursuing average selling price increases that are higher than the rate of inflation.

As widespread distribution results in plateauing or declining penetration, many brands compensate by taking two approaches to premiumization: increasing the volume share of premium SKUs or raising prices of those SKUs. To see premiumization in action, look at the success of some juice brands commanding solid sales increases despite declining sales and volume in the overall category. Leading companies such as Weiquan and Nongfu introduced new juice ranges -- healthy “Body Management” juice and not-from-concentrate (NFC) juice, respectively. Both companies enjoyed over 20% growth in 2015 - 16.

Part 2 Area and channel

Uneven growth by geography

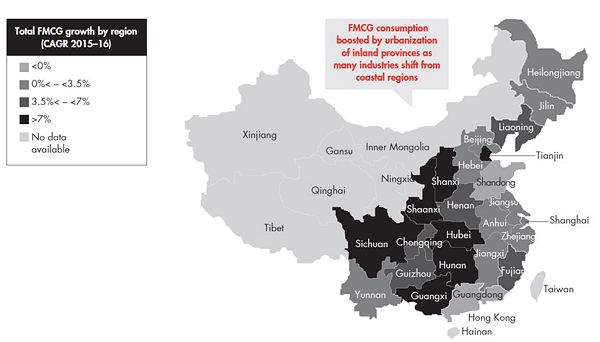

Southwestern and central provinces continue to serve as the growth engine for brands in China. Six of those provinces experienced FMCG growth in excess of 7% in 2016: Sichuan, Shaanxi, Shanxi, Guangxi, Hunan and Hubei. This resulted from an increase in number of households, fuelled in part by higher economic growth. FMCG consumption growth is boosted by the urbanization of inland provinces as many industries shift from coastal regions. Blue-collar workers continue to be a massive force in China’s FMCG market.

Online and convenience stores remain strong

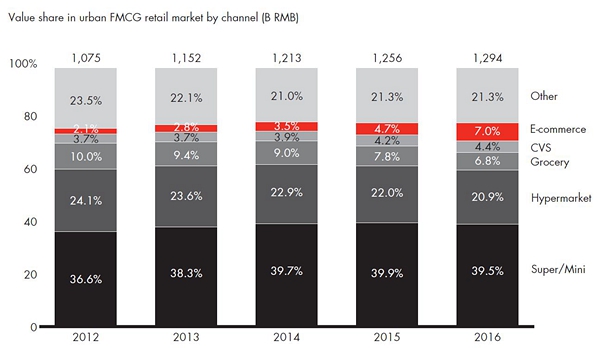

Our sixth annual study of Chinese shopper behaviour for home consumption shows the continuing shifts in retailing. Online and convenience store channels maintain strong momentum, while big-box retailers lose steam. Unsurprisingly, e-commerce led the pack, growing by more than 52.0%. Online now represents 7.0% of total FMCG sales. Convenience stores, steadily serving the needs of busy urban consumers, grew by 7.4%, adding such new incentives as in-store pickup of products bought online from other retailers. The hypermarkets that once defined robust growth declined by 2.0%, and the once-flourishing super or mini format grew by 2.0%, about the same rate as inflation. While their share is slowly shrinking, those two formats still account for more than half of the FMCG market.

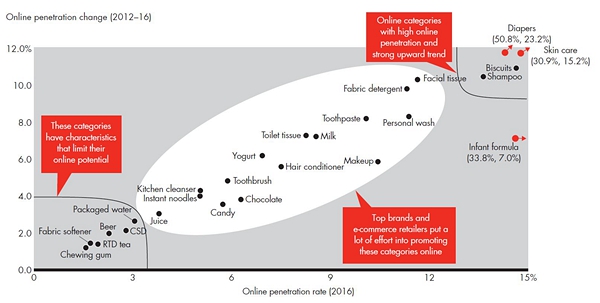

The reality is that not all categories lend themselves to online sales. As we saw last year, categories tend to form three clusters based on their digital penetration. The first cluster consists of skin care, shampoo, diapers and biscuits. These categories have a high online penetration and a strong upward momentum. On the opposite end are categories like beverages, fabric softener and chewing gum, which have a low online penetration. Among the reasons for their low online penetration: Beverages are costly to transport, chewing gum tends to be an impulse purchase and, as we reported last year, fabric softener still is not widely purchased in China. There’s significant interest in the middle cluster of categories that includes most personal care, home care and packaged foods. These categories are being aggressively promoted for online growth by top brands and e-commerce retailers.

Part 3 Local and foreign brands

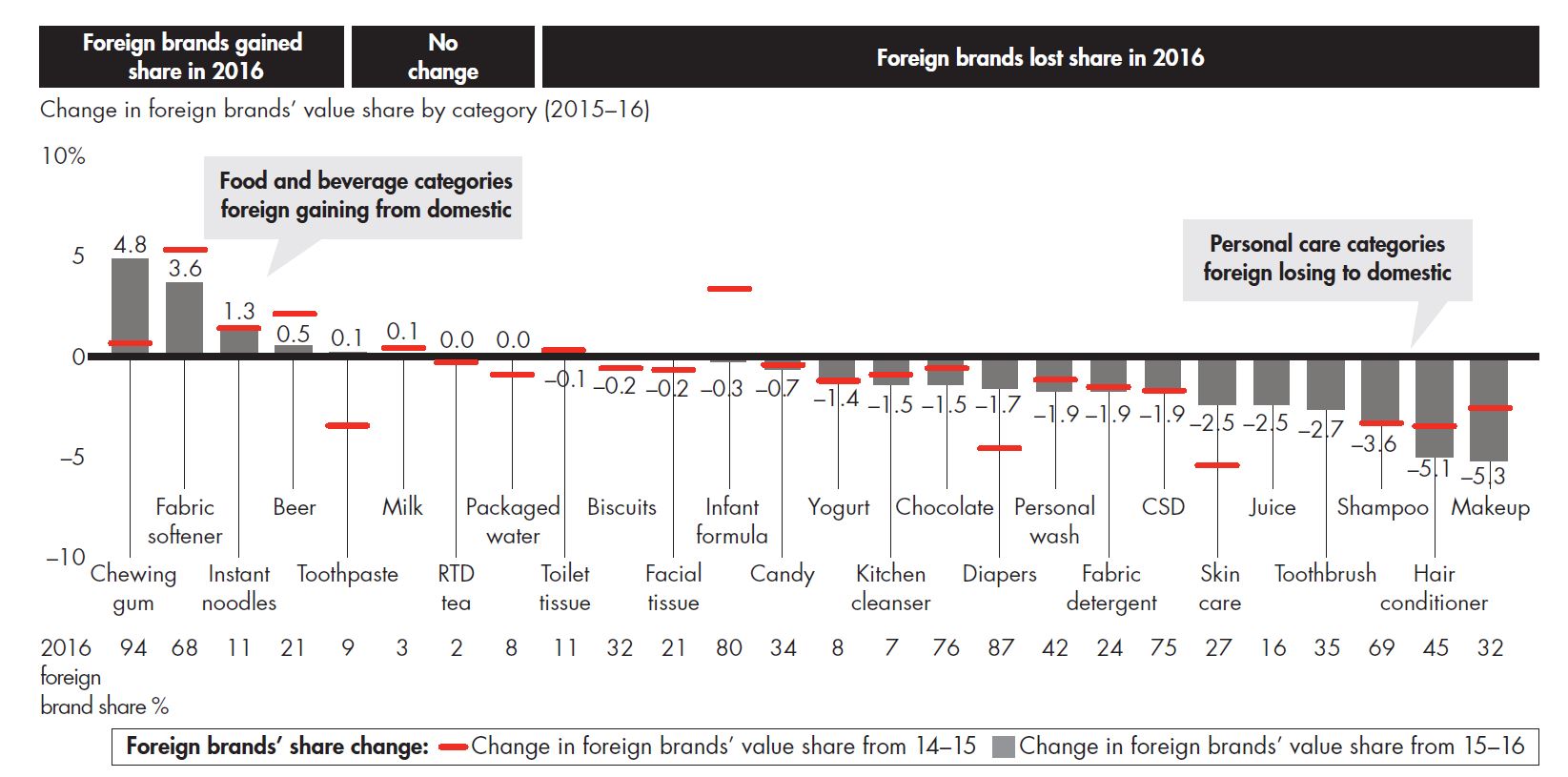

Local brands are continuing to outpace foreign brands in China. Chinese companies grew by 8.4% in 2016. It’s to the point where they account for 93% of the country’s FMCG market growth. By contrast, foreign brands grew by 1.5%. In the 26 categories we studied, foreign brands lost share to domestic brands in 18 categories and gained share in 4 categories, while share did not change or barely changed in 4 categories. The categories where domestic brands are making the most gains against foreign competitors include makeup, conditioner, shampoo and toothbrushes. Foreign companies are taking share from domestic companies in chewing gum, fabric softener, instant noodles and beer.

Domestic players continue to draw on the many advantages they have over foreign brands. Many of the Chinese companies benefit from a single-country focus, family ownership and agile organizations that can quickly adapt to meet changing consumer demands. That speed has helped them make the leap from copiers to innovators. The tables were turned when multinationals were forced to play catch-up with Seeyoung’s silicone-free shampoo. Many domestic brands also are succeeding by focusing on the “good enough” segment, where consumers place relatively equal importance on price and quality, and value cost-effectiveness. That’s how Nongfu hit the sweet spot with its midrange NFC juice, filling the gap between high-end cold-pressed juice and juice made from concentrate. Chinese companies also are faster at adapting to e-commerce and social media.

We should keep in mind that these numbers compare the aggregate share of foreign brands with the aggregate share of local brands across these categories, among the top 20 brands in the category. This does not mean that all individual foreign brand are losing share; in fact, many foreign brands are gaining share.

Part 4 Food delivery and out-of-home consumption

A major change is afoot in how Chinese people prefer to consume their food and beverages. While value growth in personal care and home care maintained a healthy pace, food and beverage growth continued its steady decline. As the gap widened over the years, we decided to take a closer look at food and beverage consumption.

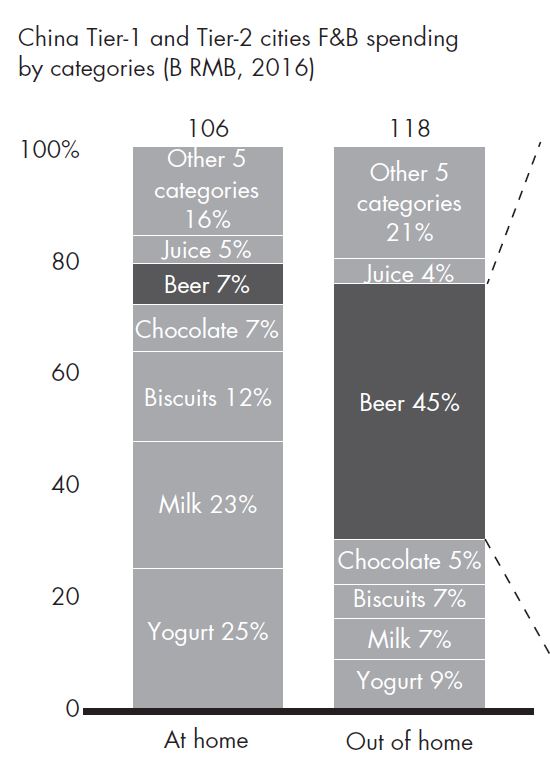

Kantar Worldpanel introduced its out-of-home (OOH) data panel last year to capture consumers’ food and beverage purchases for consumption outside their homes. The results for the first time helped us understand the dimensions of a significant trend: In several categories a very large amount of food and beverages is purchased for OOH consumption -- in restaurants, bars, cinemas, bakeries or in convenience stores to eat on the go, for instance. Instead of preparing food at home, many Chinese consumers also are preferring restaurant food delivery or dining out. This shift provides a new lens on FMCG value growth.

These trends open up dramatic new opportunities for brands and retailers. Convenience and grocery channels now hold huge potential for selling food and beverages specifically for out-of-home consumption (see Figure 18). Both brands and retailers can take advantage of this market shift. Brands can grow volume in convenience stores by introducing pack sizes for eating or drinking on the go. Convenience stores can revamp store designs to offer more products for out-of-home consumption.

For example, look at the potential for the low-growth category of beer. As one would expect, the major channel for out-of-home consumption is restaurants. However, the majority of beer sold in convenience and grocery stores is consumed out of home. This opens the door for pack-size decisions aimed at serving the out-of-home segment. By contrast, hypermarkets and supermarkets sell more beer for home consumption than for out-of-home consumption. This creates the opportunity to introduce bulk pack sizes that could boost volume and better serve consumers who drink their beer at home.

Finally, instead of cooking meals in their kitchens, more Chinese are opting to dine out or to order food delivery. Our research found that while food purchased for home cooking grew by an annual 3% from 2013 to 2016, food delivery rose by 44% and dining out grew by 10%. Forward-looking brands are already benefiting from this trend. For example, the food service divisions at Unilever and Fonterra that sell ingredients to restaurants are achieving double-digit growth. Not surprisingly, private equity investors have targeted online-to-offline (O2O) food delivery aggregator platforms such as Ele.me and Meituan -- a segment of the food delivery market that has grown by 40% to 50% annually since 2013, and will continue to advance along with Chinese consumers’ increasing appetite for convenience and for quality food and beverages.

Implications for brands and retailers

How brands can win

1. Reviewing their product portfolio to align with two-speed growth and embrace the dramatic retail changes. Companies need to review their business portfolios to examine their high-speed and low-speed mix of product categories and channels. Companies with all products falling into low-speed categories and channels have no choice but to embark on a transformation.

2. Adapting their product ranges to capture new consumer needs. In this report, we have seen the continuous strong demand for healthy, quality products, as well as the huge potential for out-of-home consumption, including dining-out and delivery. Companies can invest in research and development (R&D), supply chain (e.g., cold storage) and product design (e.g., to create packages for on-the-go consumption), and can target the right customer segment (e.g., B2B food service) to catch the wave of Chinese consumers’ new needs.

3. Continuing efforts to develop digital capabilities and more broadly design their business functions with a full channel vision. As we’ve seen in our six years of studying purchasing behaviour for China Shopper Reports, e-commerce is continuously showing strong growth momentum, with lower-tier cities starting to catch up on penetration and spending. The era of massive expansion of physical stores is over. Companies that are traditionally strong in the offline channels in lower-tier cities now face increasing pressure from competitors penetrating these cities via online. They need to focus on building their own digital capabilities and to defend their ground by activating the online channel. Companies need to design their business functions with a full-channel vision to win the future Chinese shoppers who are becoming increasingly sophisticated and multichannel.

How retailers can win

1. Adapting their customer strategy to capture the high-speed growth of the digital and O2O business. Instead of losing market share and penetration to online, traditional offline retailers need to capture the opportunity by creating a closer linkage with e-commerce. Among the approaches: collaborating with O2O delivery aggregator platforms, accepting mobile payments, digital loyalty cards and quick response (QR) code vouchers in their stores, and marketing via social media. The ultimate goal is to create a digital-friendly, frictionless multichannel shopping experience.

2. Restructuring their store portfolio. Retailers can reduce the average size of existing hypermarkets and focus their space on prepared and ready-to-eat food, while offering food for delivery and introducing new, smaller, convenience-type store formats.

3. Revamping store designs to prepare for the huge potential in out-of-home consumption. Convenience stores and traditional grocery shops can benefit from their central locations by redesigning the store format (for example, to have more shelf space for prepared food, or to have more cold storage space for beer and juice) to accommodate the larger consumer demand for food and beverages consumed on the go.

EDITOR'S NOTES

* Authors of the full report: Marcy Kou, CEO at Kantar Worldpanel Asia; Jason Yu, general manager at Kantar Worldpanel China; Bruno Lannes, a partner with Bain’s Shanghai office; Jason Ding, a partner with Bain’s Beijing office;

* To reach the author, or to know more information, data and analysis of China's FMCG market, please contact us ;