For FMCG brands everywhere, we are in unchartered waters in the wake of COVID-19, and shifts in shopping patterns and consumer behaviour have never been more important today.

We know how important ecommerce is for FMCG retailers and brands. One of the fastest-growing channels, it has accelerated even faster during the pandemic as people shift from in-store to online.

While online has seen a huge uptick, the out-of-home (OOH) sector has suffered. Prior to lockdown it accounted for over 40% of snacking and beverage spend, but a collapse in OOH has resulted in spend in these categories falling by between 10% and 30% in major markets.

But how does a brand know if it’s currently winning online or suffering from reduced OOH consumption? Following the launch of Kantar’s global Brand Footprint report in May, we have launched two new rankings on our Marketplace platform looking at the top online and OOH brands to help companies understand how important these channels are to a brand’s true performance.

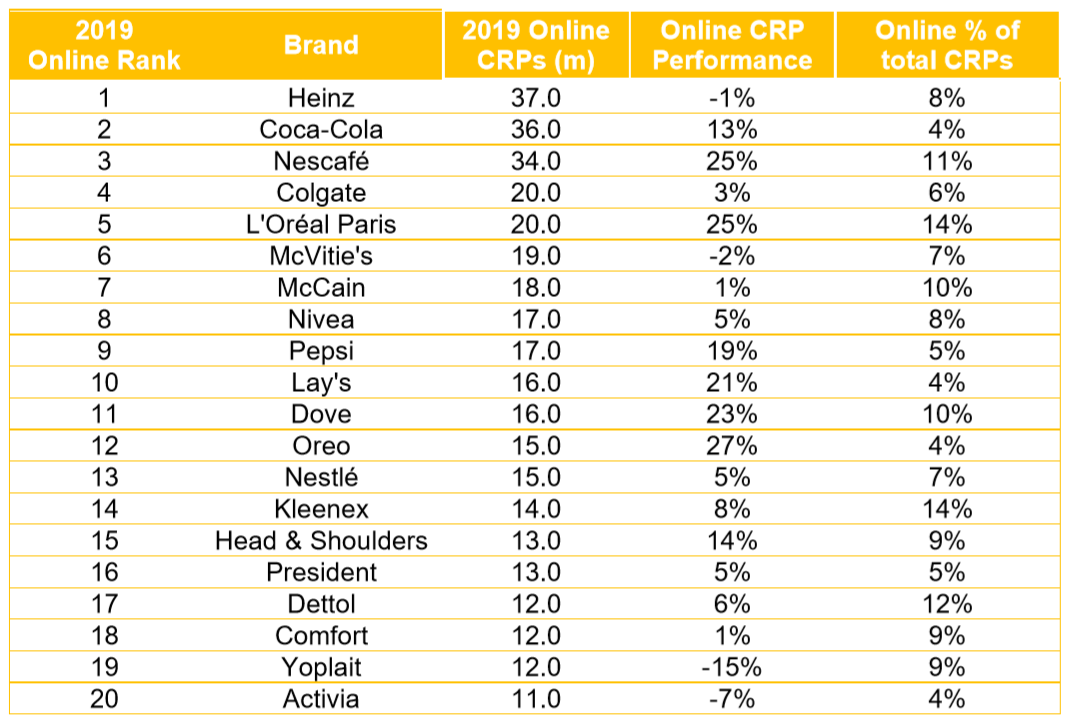

Heinz tops Online brand ranking

According to our online ranking, Heinz is the most chosen FMCG brand online, based on analysis across six key ecommerce markets: Chinese Mainland, South Korea, Taiwan, France, Spain and the UK.

It’s no surprise that Heinz takes the top spot, given the nature of its products; heavy and with a long shelf life, it’s the ideal choice for those shopping online. The brand, however, saw a slight fall in its online Consumer Reach Points (CRPs) , whilst most other brands grew with many seeing growth of +20%.

The standout brand is L’Oréal Paris with 25% growth and with the joint-highest proportion of its CRPs from the online channel (14%, the same as Kleenex).

Five of the top 10 in the online ranking – Coca-Cola, Nescafé, Colgate, Pepsi and Lay’s – are the same brands we see in our main Brand Footprint report (which combines both online and offline purchasing).

The average proportion of CRPs coming from online is 8%, with a high of 14% and a low of 4% (Coca-Cola, Lay’s, Oreo and Activia). But as online grocery shopping continues to grow during the pandemic, especially among older shoppers, it will be interesting to see how much this changes next year.

Source: Kantar, Worldpanel FMCG take-home purchase panels

Countries: Chinese Mainland, South Korea, Taiwan, France, Spain, UK

Time period: 12 months ending October 2019 vs year ago

Sectors: Beverages, Food, Dairy, Homecare, Health & Beauty

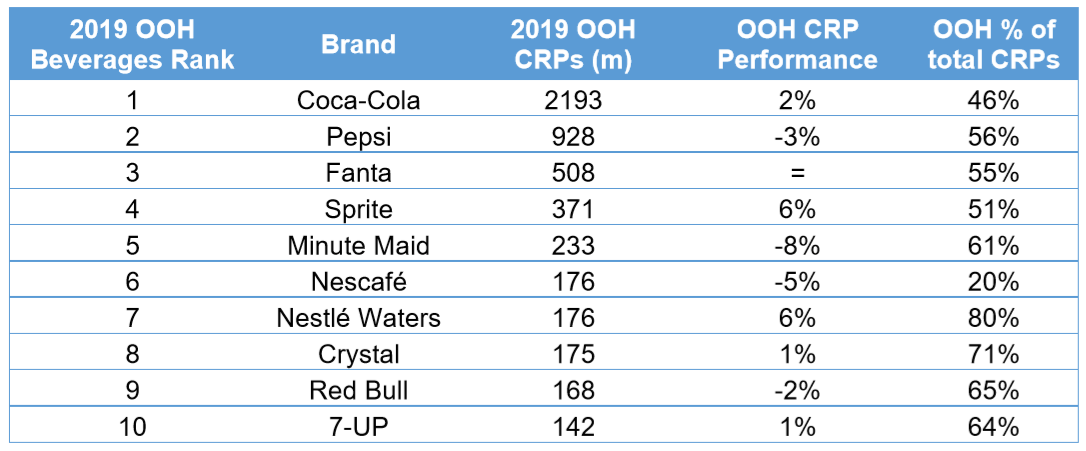

Coca-Cola and Lay’s dominate Out-of-Home brand rankings

For the two OOH rankings, looking at Non-Alcoholic Beverages and Snacking Foods, we analysed CRPs from our OOH panels in Brazil, Chinese Mainland, France, Indonesia, Mexico, Portugal, Spain, Thailand and the UK. The CRPs collected through these panels are totally incremental to the CRPs from our take-home panels and give brands in these categories a holistic view of how often they are chosen.

Coca-Cola, which also tops the main Brand Footprint report this year, is the clear winner in OOH beverages, registering a +2% growth, mirroring its in-home CRP performance where the brand saw slight growth for the first time in many years. Pepsi remains at #2 and gets over half (56%) of its CRPs from the OOH channel, whilst Coca-Cola gets 46% from OOH.

Source: Kantar, Worldpanel Out-of-Home purchase panels

Countries: Brazil, Chinese Mainland, France, Indonesia, Mexico, Portugal, Spain, Thailand, UK

Time period: 12 months ending October 2019 vs year ago

Sectors: Non-Alcoholic Beverages

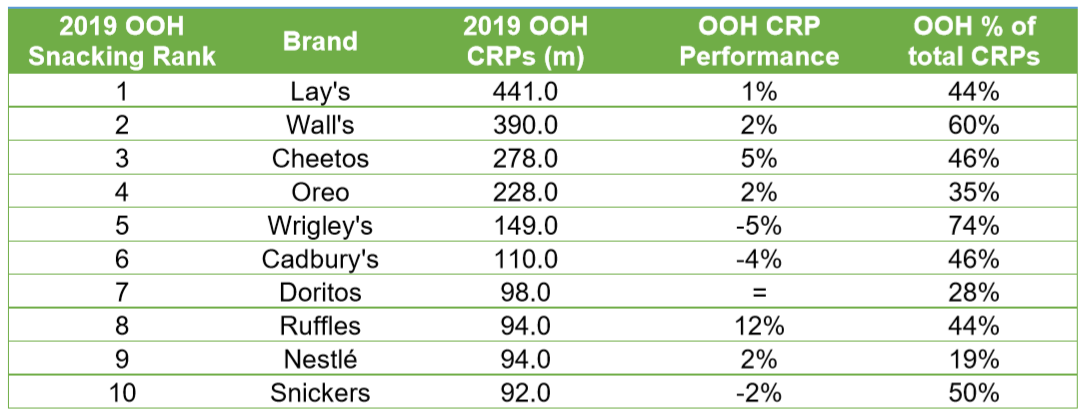

In the Snacks ranking it’s little surprise that potato chips dominate with four brands in the top 10, including Lay’s at #1 (along with Cheetos, Doritos and Ruffles). It’s worth noting that all four of these brands get less than half of their CRPs from OOH outlets, indicating that they have been less affected by the decline in OOH during the lockdown.

While many OOH outlets are opening up, this sector faces an uncertain future. The grocery sector is unlikely to replace the lost value from the OOH channel, driven in part by a large difference in price. Brands with a high proportion of sales in OOH will need to establish other routes to market to recoup losses, such as direct-to-consumer or takeaway services.

Source: Kantar, Worldpanel Out-of-Home purchase panels

Countries: Brazil, Chinese Mainland, France, Indonesia, Mexico, Portugal, Spain, Thailand, UK

Time period: 12 months ending October 2019 vs year ago

Sectors: Snacking Foods (including ice-cream)

As consumers continue to adjust to new and different ways of shopping and purchasing, brands will need to understand where this FMCG spend is going, how much of it comes from online and how much from OOH, and ultimately, how important these two channels are for the overall health of a brand.

Notes to editors: CRPs are based on take-home purchasing done online. The CRP measurement is a combination of two metrics – penetration and consumer choice.