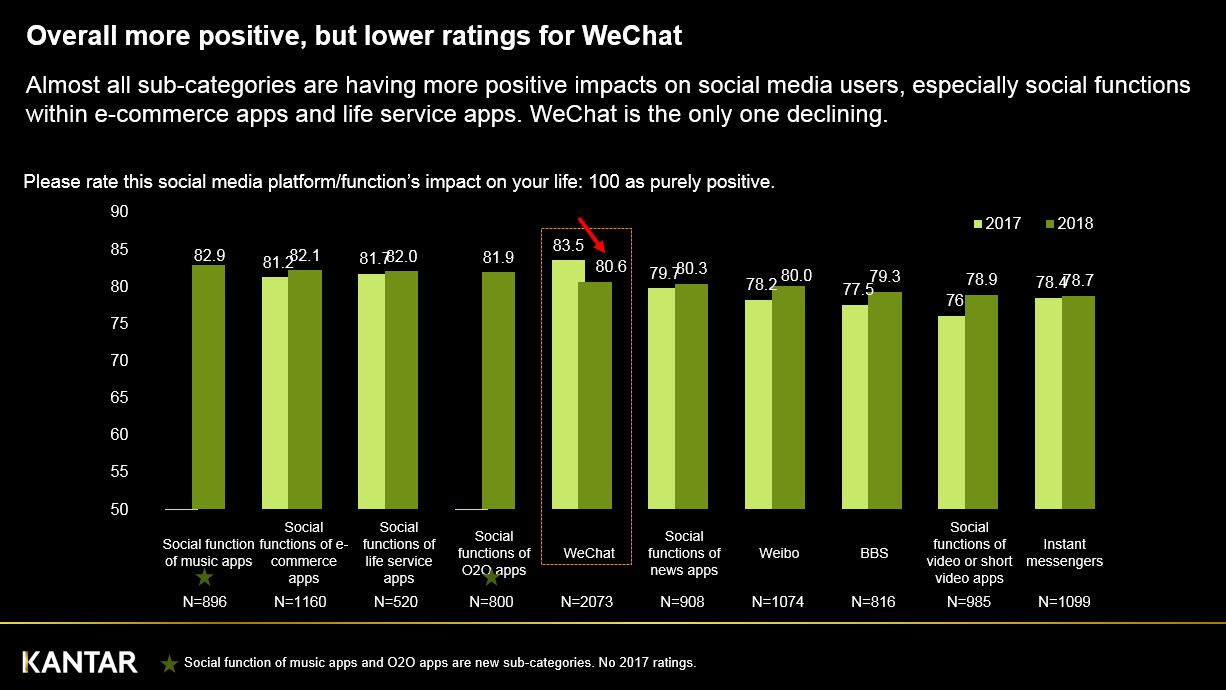

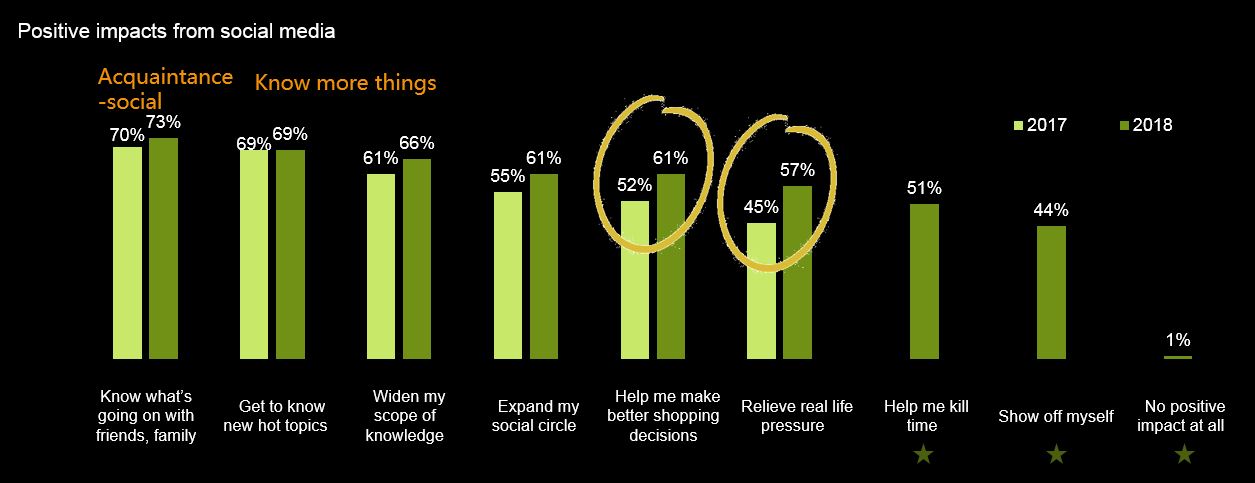

• Chinese consumers feel social media is having a more positive impact on their lives as the landscape of social media gets more diversified;

• WeChat, whose penetration rate remains nearly 100%, is the only social media app that people are less positive with compared to last year;

• Chinese consumers increasingly find social media helpful in making better shopping decisions;

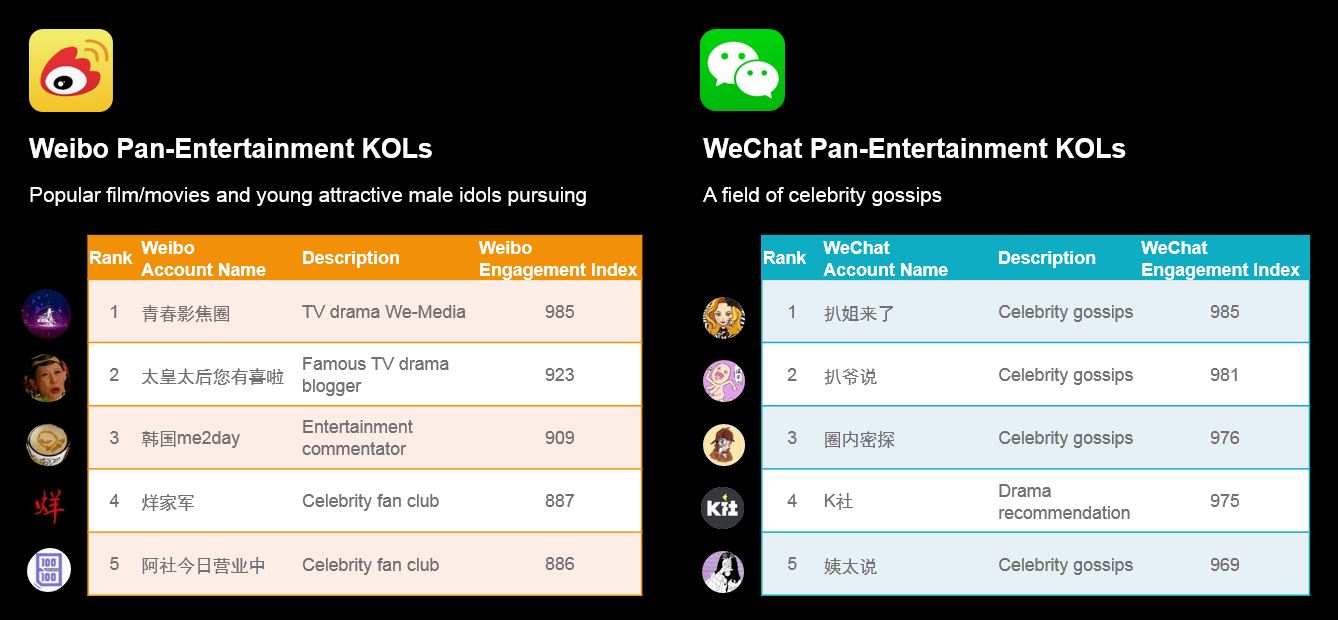

• Entertainment Key Opinion Leaders (KOLs) are the only KOL category to bridge the Weibo/WeChat divide.

Kantar’s fifth annual Social Media Impact report has found that Chinese consumers are increasingly positive about the impacts social media bring to their lives. The positivity index increased to 80.6, up from 79.8 in 2017. (note 1) WeChat was the only social media app to buck this trend, as Chinese users rated it lower compared to 2017. (note 2)

(*Music app’s social function and O2O app’s social function are two new sub-categories, so no data from 2017)

The theme of the 2018 report is “Understanding China’s Diversified Social Media Universe”, which epitomizes the latest trend of China’s social media industry: the diversification of users, the diversification of platforms, and the diversification of consumer demands.

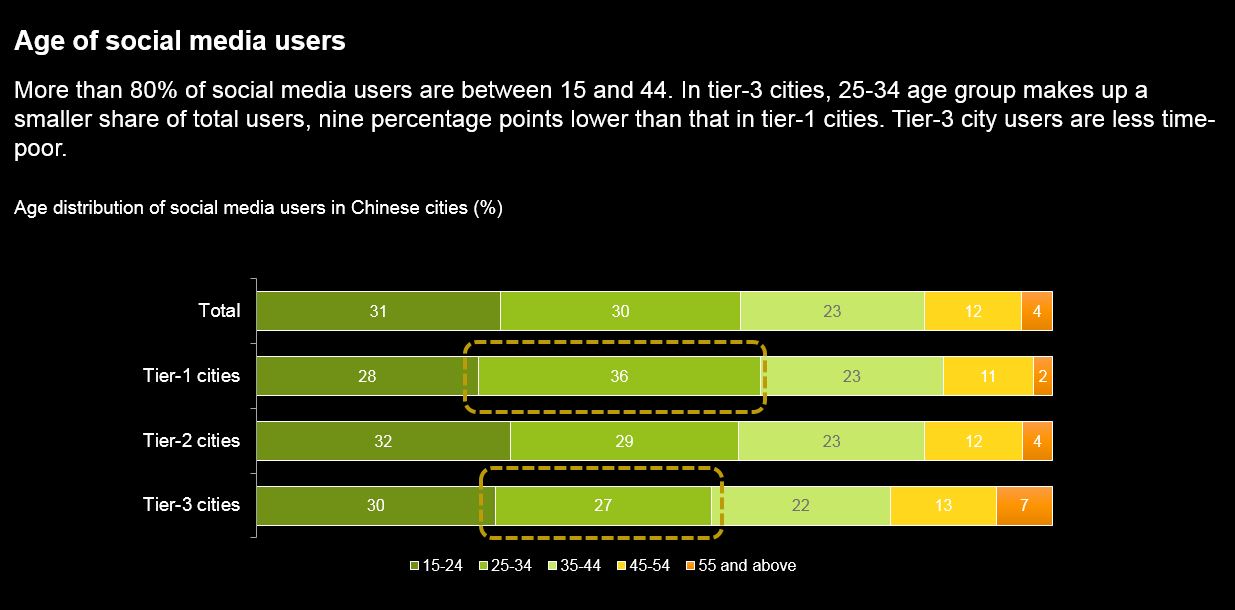

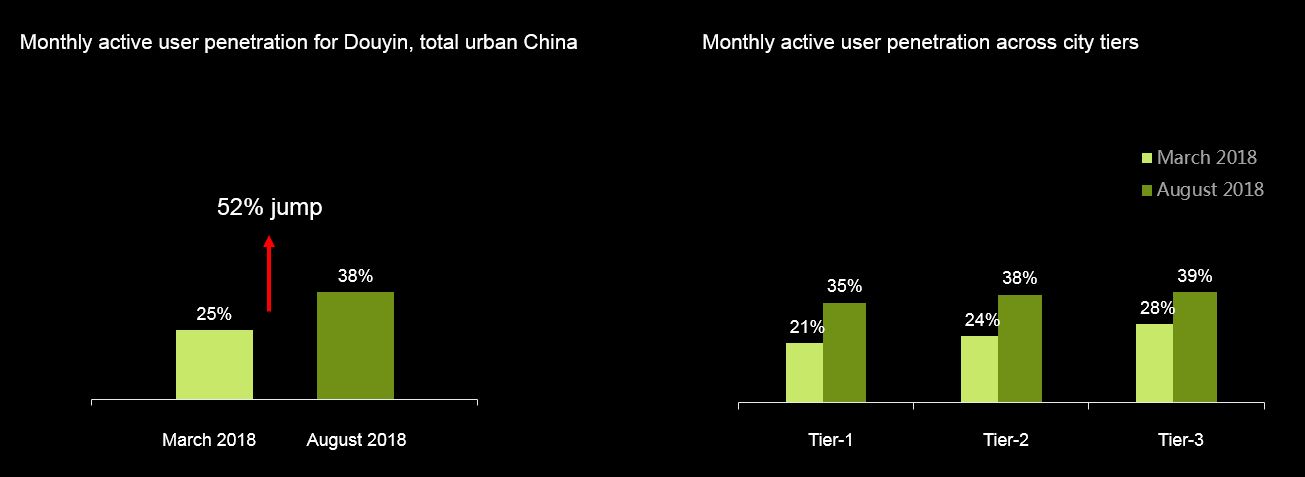

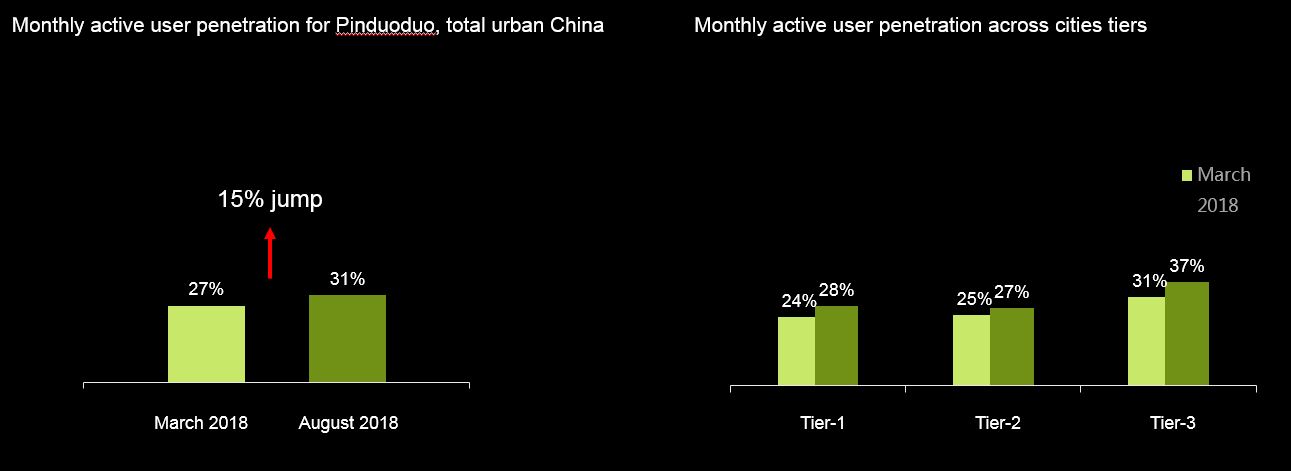

Illustrating the diversity, in tier-3 cities, there are almost 10 percentage fewer social media users in the 25-34 year age group compared to teir-1 mega cities like Shanghai and Beijing. (note 3) This trend is driven by the increased percentage of students and retired people in the smaller cities, who are more willing to try more time-consuming apps, such as short format video apps and social shopping apps. These apps typically garner momentum from smaller cities and eventually become increasingly popular in big metropolitans. Douyin and Pinduoduo are examples of this growth path. At the same time, because of their enormous penetration rates, “older” social media platforms WeChat and Weibo hardly had any meaningful growth.

(Age group distribution across teir-1, 2, 3 cities)

(Monthly active user penetration for short video app Douyin (known overseas as Tik Tok))

(Monthly active user penetration of social shopping app Pinduoduo)

KOLs in 2018

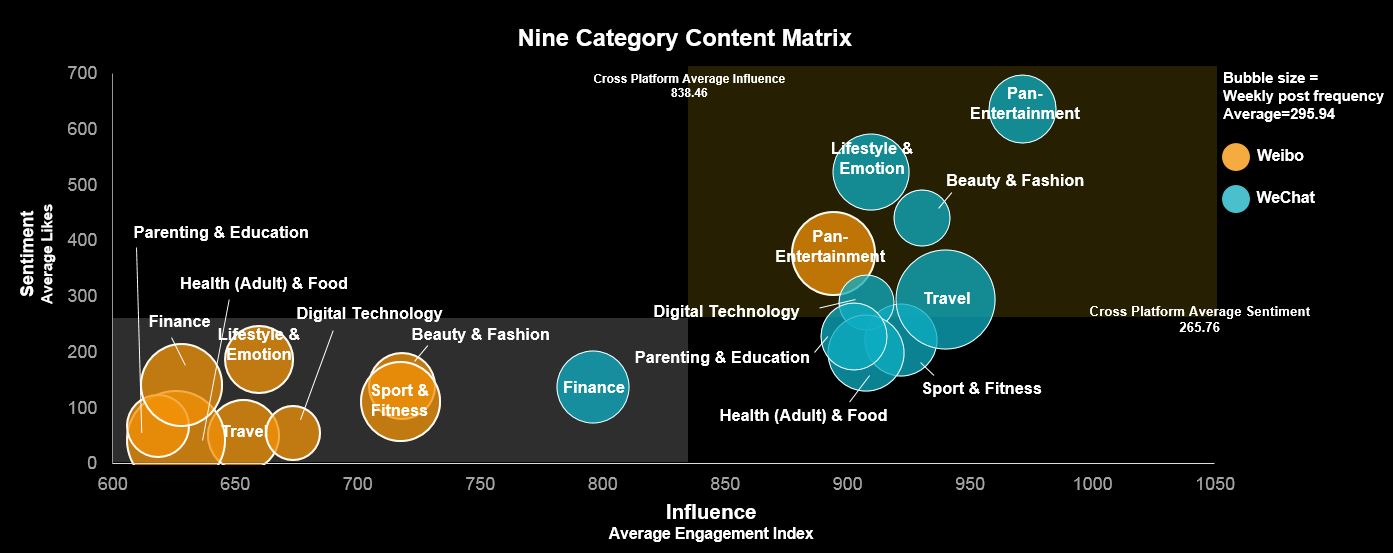

The diversification of social media platforms and their users is also reflected on the vastly different performances of KOLs (key opinion leader/influencers) on Weibo and WeChat, the two most well established social media platforms to date. Kantar Media CIC analysed nine categories to compare KOL performance. The entertainment category was identified as the only category where users actively engaged with KOLs on both Weibo and WeChat. Even in the entertainment industry, however, there was no KOL who made the top 10 ranking on both platforms.

Even the categories’ performances on Weibo and WeChat are very different: only entertainment KOLs from Weibo had more engagement and likes than average, while most KOLs on WeChat have performed above average, except those from financial category.

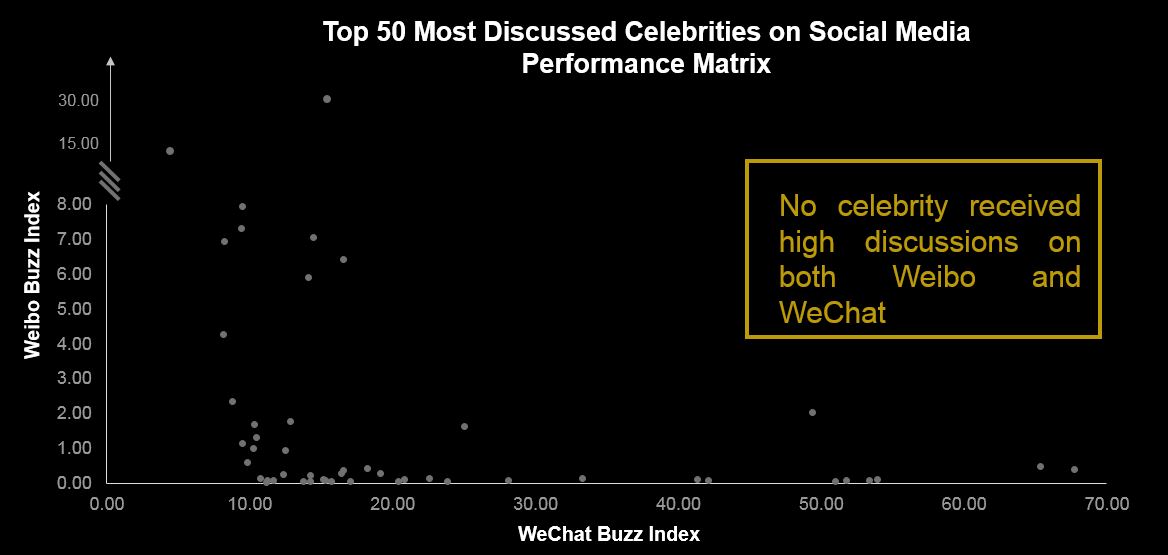

At an individual level, this trend is also true for celebrities. No celebrity achieved high-volumes of buzz on both the Weibo and WeChat platforms.

Social Media benefits and down-sides are evolving

Compared with 2017’s report, social media users are feeling differently about the benefits and harms that social media have brought to their lives.

• 57% users feel social media helps them “relieve from pressure in real life”, up 12 percentage points from last year, and the biggest increase;

• Brands really need to think more on social marketing because 61% see social media can help them “make better shopping decisions”, a 9 percentage point-increase on 2017;

• As in the previous four years, “less book reading” had remained No.1 negative impact. In 2018 two health-related concerns - “eye-sights getting worse” (49%) and “less sleep” (47%) – moved to the top of negative impact ranking.

(Items with a star are newly added options, so no 2017 data)

(Items with a star are newly added options, so no 2017 data)

Jeff Tsui, Managing Director, Greater China for Lightspeed which undertakes the survey part of the report, commented: “Ultimately, any social media platform is just a method of communication. There is no shortcut in winning the time and heart of today’s highly demanding customers. What remains highly important is brands’ understanding of their customers – to understand how this unique channel is affecting consumers’ lives. Only then can brands consistently tailor appealing offers.

“The use of social media platforms by advertisers is no longer an option, but a MUST as part of any wider communication strategy,” he said. “As an example, almost every major brands across different categories would have a WeChat public account nowadays. The setting up of one is easy, but often what has been neglected is to how to make such public accounts sustainable overtime.”

Kantar, the world’s leading marketing data, insights and consultancy company, carried out this year’s report through online polling, data mining, mobile behaviour data analysis and cross-analysis of purchasing data with social behaviour data. This year’s research analyses behavioural data and answers from more than 242,000 real-ID registered users/families, as well as purchasing data from 40,000 families.

Additional Findings

Other insights from the report include:

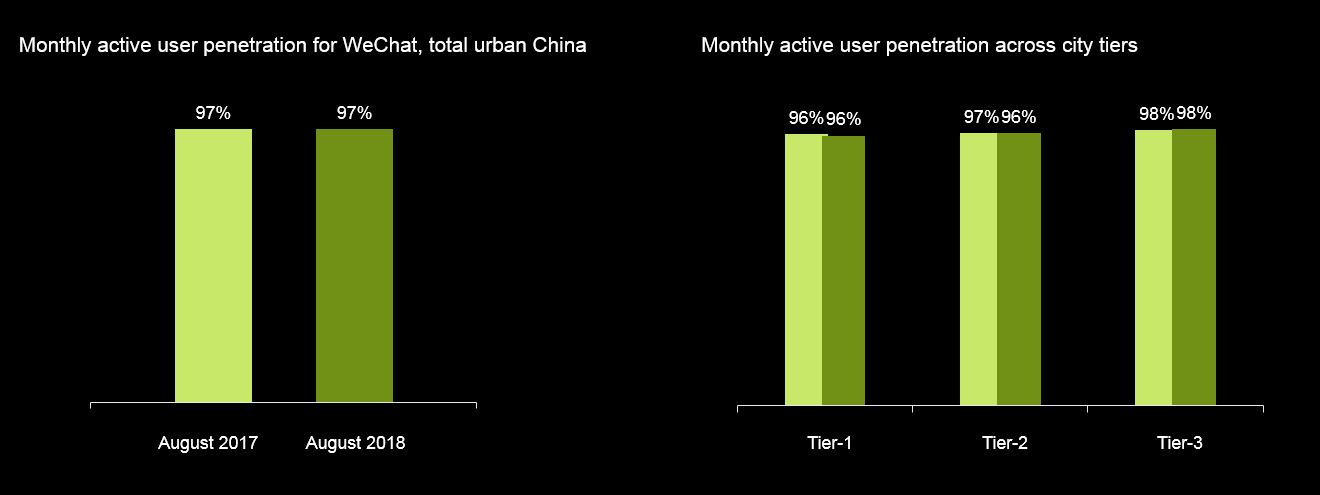

• WeChat have saturated its growth potential, with its monthly active penetration rate levelled with last year at 97% and there was almost the same across all city-tiers;

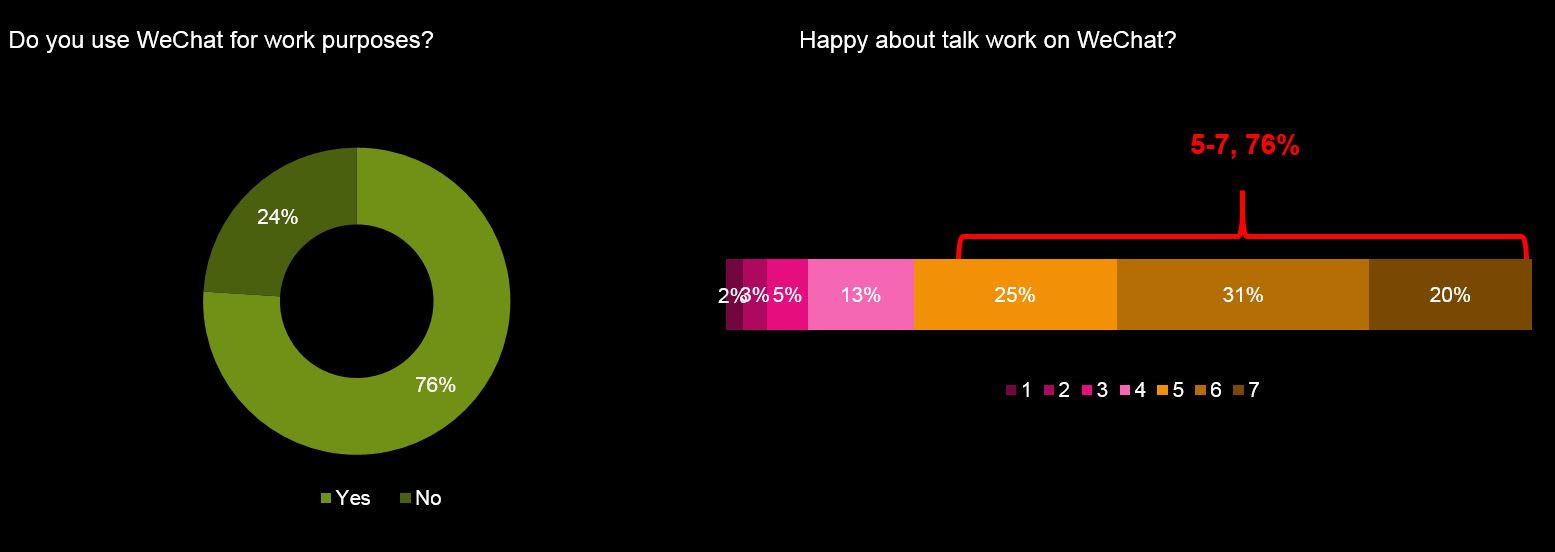

• Even though WeChat is a personal social media platform, 76% users are using it for work purpose, and 76% of them felt more or less happy with this fact;

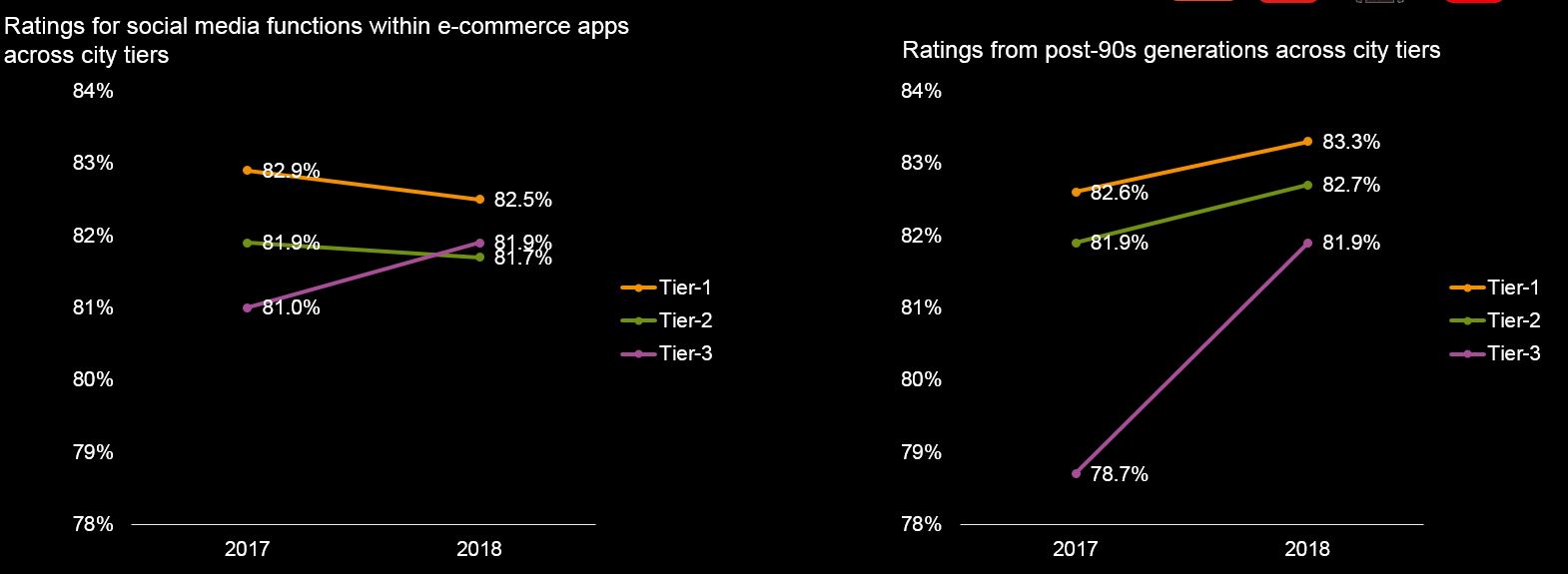

• The satisfactory rating for social functions of e-commerce apps grew a little from last year’s high base. The increase is most prominent among young people (post 90s) in tier-3 cities;

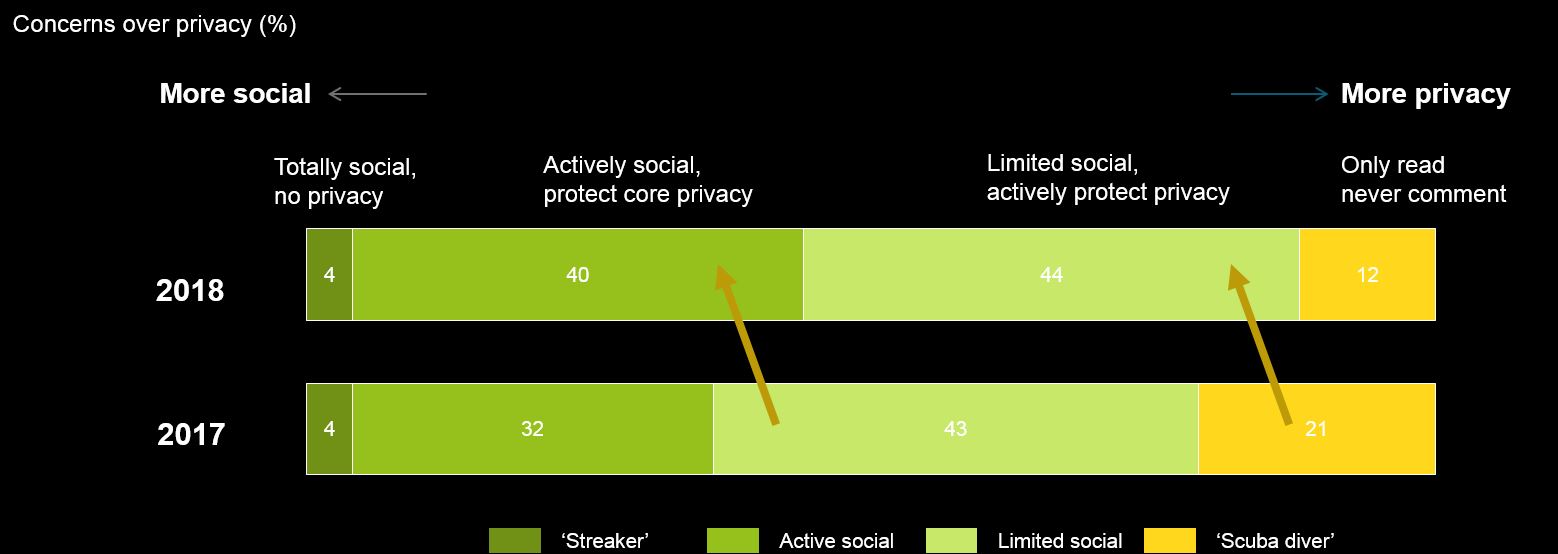

• Compared with last year, people are more comfortable to say something rather than be silent to protect privacy: only 12% social media users will remain totally silent, compared with 21% in 2017. There is an 8 percentage point increase in the proportion of “actively social and protect key privacy” user group (40% vs 32%). However, the proportion of zero-privacy protection group remains the same at 4%;

• Kantar Worldpanel data showed that social media display ads can be 4 times more effective than TV commercials, and the most optimized frequency of social media ad impression is three times.

Summary

Coolio Yang, Greater China CEO of Kantar Media CIC commented: “Most brands in China are including celebrities and social media KOLs as a very important part of their marketing campaigns. Marketers have to upper their social media capabilities to a higher level now social media landscape is so diversified. They need to understand how to manage KOL/celebrity price inflation, calculate real influence and measure outcome scientifically.

“Leveraging new technologies and methodologies for measurement is an option, but eventually brand owners and marketers need an industry-wide, third-party auditable measurement infrastructure system that all stakeholders can willingly accept,” he said. “Signing Wanghong can work in the short term, but for brands chasing long-term growth, they need to study the actual impact of their social marketing campaigns to find the most optimized solution for their sustainable growth.”

Kantar will start to offer download to the full report (about 100 slides) after November 20. You can send an email to cneditor@kantar.com to request a download link by providing your name, title and company. The email should be sent through a company email address.

EDITOR'S NOTES

Note 1: The scores from the previous three years are: 67.0 in 2016, 68.0 in 2015 and 73.4 in 2014. But as methodology was differently set up, they cannot be compared with the results since 2017.

Note 2: The 10 sub-categories are: WeChat, Weibo, social functions within e-commerce apps, instant messengers, social functions within video or short format video apps, social functions within news apps, social functions within music apps (new), BBS, social functions within online-to-offline apps (new), social functions within life service apps.

Note 3: Tier-1 cities are: Beijing, Shanghai, Guangzhou and Shenzhen; tier-2 cities are advanced provincial capitals and very advanced non-provincial capitals, such as Hangzhou, Changsha, Chengdu, Wuxi, Dalian and Wenzhou, etc; tier-3 cities are less advanced provincial capitals and advanced non-provincial capitals, such as Xining, Yinchuan, Jiangmen, Leshan, Weihai, Anshan, etc.

For more information about this research as well as more data and analysis of China market, please contact us;