Kantar BrandZ™ Most Valuable Global Brands 2021 ranking report includes in-depth analysis of brand landscape and trends of 18 categories. We will publish the analysis content about a number of categories in English and Chinese. This article is based on the category focus section of automotive industry.

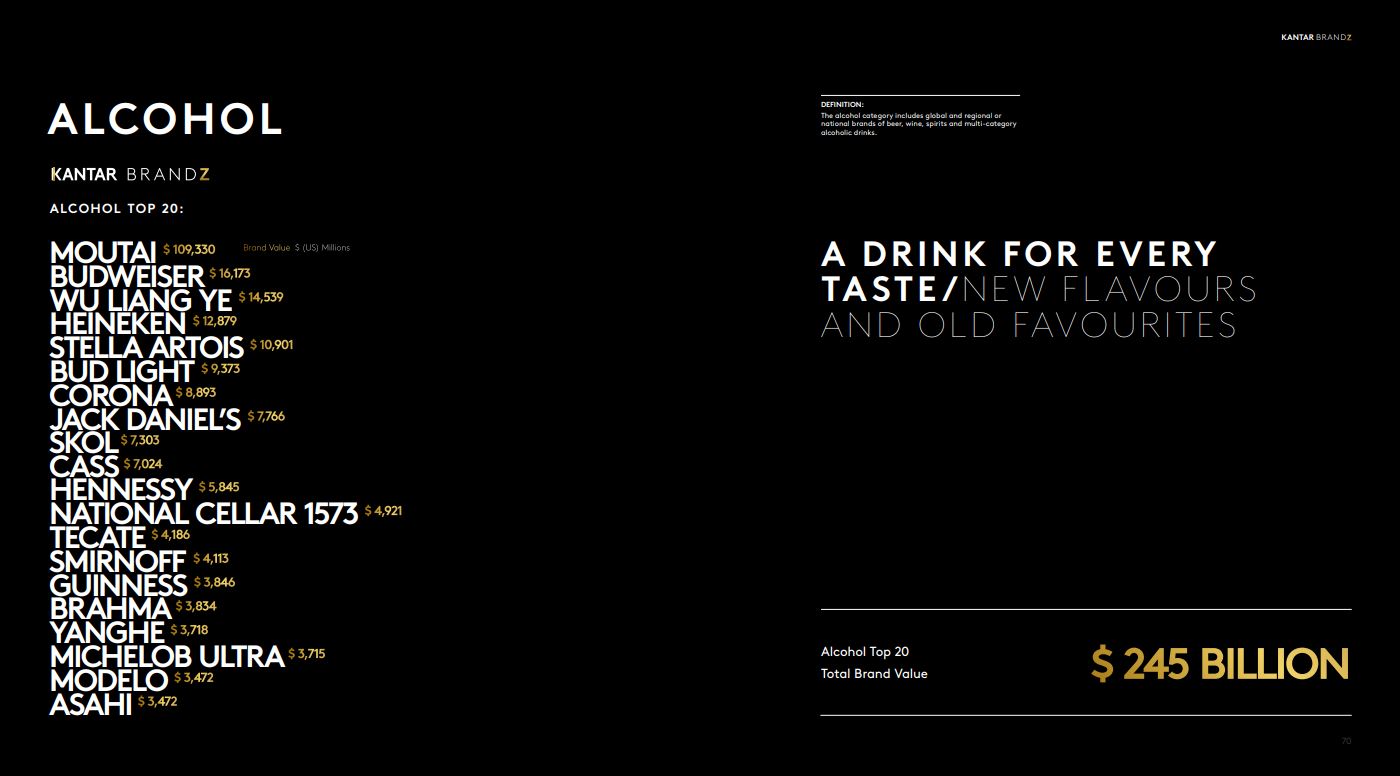

Even in normal years, alcohol is an especially dynamic corner of the BrandZ™ universe. Consumers may wait years between buying new car or mobile phone. But they are constantly sampling, evaluating, and switching between various beer and liquor brands. 2020 was a strong year for the Alcohol category overall, alcohol Top 20 total brand value achieved $ 245 billion.

The strong rise of Chinese Baijiu

In the recent decade, bars/bistros have become more popular in China, and the alcohol category has diversified. Chinese consumers are becoming more sophisticated in their tastes. Chinese Baijiu has traditionally been perceived as ‘father’s favourite’; for the ‘business banquet occasion’. However, with increasing sophistication, this situation has changed.Accelerated in the post COVID-19 era, cultural confidence has made Chinese people appreciate their own country’s treasures, instead of coveting things from overseas. Consumers are shifting from western imitation to a local cultural renaissance. The fact that Chinese Baijiu is made through a complicated and delicate process is increasingly well known, and helps it compete with foreign alcohol, in terms of quality and heritage. Chinese Baijiu is now a cultural symbol, standing for the assertive confidence coming from the heart of China.

The new wave of “Hard Seltzer”

In many other countries, the alcohol market is far more unsettled. There are no longer set boundaries between “beer occasions” and “whiskey occasions” and “cocktail occasions.” Everything is up for grabs, especially after a year when most bars and pubs lay dark for months at a time. This blurring of boundaries is perhaps best exemplified by the booming, competitive seltzer segment.

“Hard Seltzer” is popular with men and women alike and appeals to both frequent and occasional drinkers of alcoholic beverages. There is no one kind of “seltzer drinker,” in other words, and no one type of seltzer occasion. It’s more that active, wellness-minded consumers have a budget for the number of calories and sugar they’re willing to consume in a given night. And they are looking for alcoholic drinks – whether it’s seltzer, or hard kombucha, or an established “sporty” beer like Michelob Ultra – that will offer them the most enjoyment, and least guilt, within those parameters. While White Claw has emerged as an early market leader in the United States, many new entrants are crowding in to chip away at its dominance: this year, even Coca-Cola will enter the fray with its line of Topo Chico hard seltzers.

Other new seltzer offerings – from established names like Bud Light, Coors, and Corona – have sought to leverage existing brand loyalty to emerge from the scrum. They should not be counted out. Conglomerates like the Heineken Group are coming off the heels of successful corporate expansions into the “0% alcohol” space. They are not resting on their laurels – and nor can they afford to. (This “low- and no-” alcohol trend, incidentally, will continue to be a major influence on the decade ahead. And here, too, there is a sense of blurring boundaries.

With so much market share up for grabs, companies are using vastly different strategies to establish their brands as Meaningfully Different competitors. Some entrants have chosen to lead with themes of flavor and discovery. Smirnoff Seltzer, for instance, offers variety 12-packs where consumers can sample varieties like Blood Orange, White Peach, Blackberry, and Pina Colada.

In the marketing realm, brands could no longer rely on tried-and-true playbookslike sponsoring music festivals and sports tournaments. Instead, they had to adapt to shifting rituals and occasions. This was a year where drinks were more likely to be paired with a home-cooked dinner for two than a night out on the town. Those brands that had built up brand equity in the mealtime space fared better than most during lockdown: for instance, French beer brand Leffe, which since 2014 has positioned itself as the perfect pre-meal “apéritif.”

Action points

1. TRACK OCCASIONSThe alcohol industry will need to monitor month-to-month shifts in drinking behaviour as markets begin to open up. The goal isn’t only to make sure supply chains are ready for a reopening – although that’s important, of course – but also to make sure that brand marketing reflects rapidly evolving drinking occasions

2. LOCALISE FLAVOURS

How can global brands respond to a growing consumer desire to “explore craft and small-batch alcohol brands.” In part, they can do so by taking advantage of the “flavours boom” to introduce locally resonant twists on their classic brand offerings: seltzer infused with Maine blueberries, say, or beer brewed with Patagonian hops. When selling drinks abroad, they can also play up ways that their offerings represent pure local expressions of their home market’s values, the better to tap into a desire for exploration and travel.

3. SHAKE UP SEGMENTATION

It no longer makes sense in many markets to think separately about “male vs. female” drinkers, and so on. Instead, brands should look to map and market to cultural clusters that may ultimately encompass a wide range of ages and backgrounds. These segments might coalesce around certain subcultures, leisure pursuits, or drinking venues – or around certain psycho-dynamic archetypes (The Adventurer, The Connoisseur, and so on)