*As we approach the year’s end, Kantar China will publish a series of Thoughts Leadership articles from The Kantar BrandZ™ Top 100 Most Valuable Chinese Brands 2021 report. We sincerely hope by sharing these insightful articles, we can help clients to build stronger brands in 2022. This article is based on the 'Innovation in automation' in page 56-57 of the report with editing.

2021 Kantar BrandZ™Top 100 Most Valuable Chinese Brands report showed that the Cars category grewa mammoth 480% year on year, as returning brand BYD grew by 154% and New Energy Vehicle (NEV) brand NIO joined the China Top 100 for the first time. Looking forwards, it may not be long before a Chinese New Energy Vehicles (NEV) start-up joins the ranks of the world’s valuable and fastest-growing brands. This year, around 10% of new car sales in China are expected to be NEVs, and the market is likely to grow at 40% per annum for the next few years.

Market competition in China is already fierce. Chinese NEV startups like NIO, XPeng, and Li Auto are jostling for space with traditional automakers who are eager to electrify, such as BYD, SAIC Motors, Geely, BMW, and Mercedes-Benz. Tech giants like Xiaomi and Baidu have also joined the electric vehicle race.

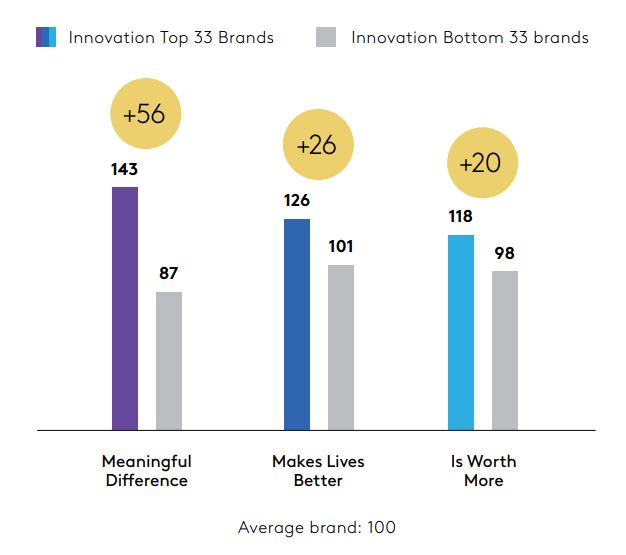

Tech led innovation is a key driver of brand value growth in the NEV electric age. Innovation is a key source of differentiation and meaningfully relevant benefits, not to mention the ‘coolfactor’ that drives distinctiveness. In the pre NEV age, consumer expectationsfor speedy innovation in the auto industry were low. If there indeed was latent consumer demand for agile innovations and upgrades, the traditional manufacturers, with their long innovation and product development cycles, were not able to respond to these consumer desires.

At first, the main task of NEV brands was to assuage consumer’s concerns on basics like range anxiety and insufficient charging facilities. Now that these fundamentals are being taken care of, NEVs are increasingly having to compete on how fast they can upgrade their hardware, and software led features and benefits. Hence, in the NEV age, cars areinnovating almost as fast as Fast Moving Consumer Goods (FMCG) or household appliancebrands.

User experience is paramount. The idea is topack in AI features that make driving easy and fun, especially for first-time drivers who might have never experienced a conventional vehicle. The interioris increasingly seen as a ’cabin’, with infotainment systems adding to the NEV’s differentiation from conventional cars.

Local players have found new ways to leverage AIand big data to provide extra value. NIO built NOMI, the world’s firstin-vehicle AI digital assistant. NOMI elevates passenger experience through understanding and adapting to consumer preferences and external information,such as passenger daily routines, travel patterns and current weather. Through this, NIO assimilates into its users’ lifestyle and builds meaningful difference with them.

Connectivity features are especially important to consumers in China, with gesture control, voice assistance, and emotion recognition tools playing an important role in defining the driving experience. These tech-led features thus offer the prospect of upending the traditional patterns of brand choice in the automotive industry.

Kantar’s recent luxury electrical vehicle (EV) study reveals that traditionalmanufacturers are seen as having high quality interior craftsmanship anddesigning break through exteriors. However, relative to NEV focused start-ups, the traditional luxury manufacturers were seen as lacking capability and experience in software development, autonomous driving technology innovation, and advanced connectivity solutions offerings. Consumers believed that most EVinnovation comes from ‘young or rising’ car companies, or big high-techplayers. This poses a dilemma for manufacturers like Mercedes-Benz, Porsche, and BMW. Going forward, they will need to highlight their innovative tech and service features without losing their distinctive luxury positioning.

Chinese NEV’s strategies, in particular, revolves around selling many car features via a subscription model. For example, the company launched a ‘battery as a service’ plan that bills customers a monthly fee for battery power recharging regularly.