China’s FMCG market faced an unprecedented situation in 2020 with the impact of COVID-19 significantly changing not only what consumers purchased but how they shopped. The end of year result for the in-home market was a growth rate of just 0.3% but the Out-of-Home markets (-7.4%) and Beauty markets (-4.3%) were more heavily impacted due to the lockdown in Q1. During 2021 we expect all of these markets to recover but what does the end of year picture look like and what could be the best vs worst case scenarios? Through advanced forecasting modelling, which correlates different macro-economic factors and mobility rates with sales, Kantar Worldpanel can forecast the growth rates we might expect to see for 2021. Below we will explore what we think the future will hold for FMCG categories and what this means for retailers and manufacturers.

In-Home FMCG Market

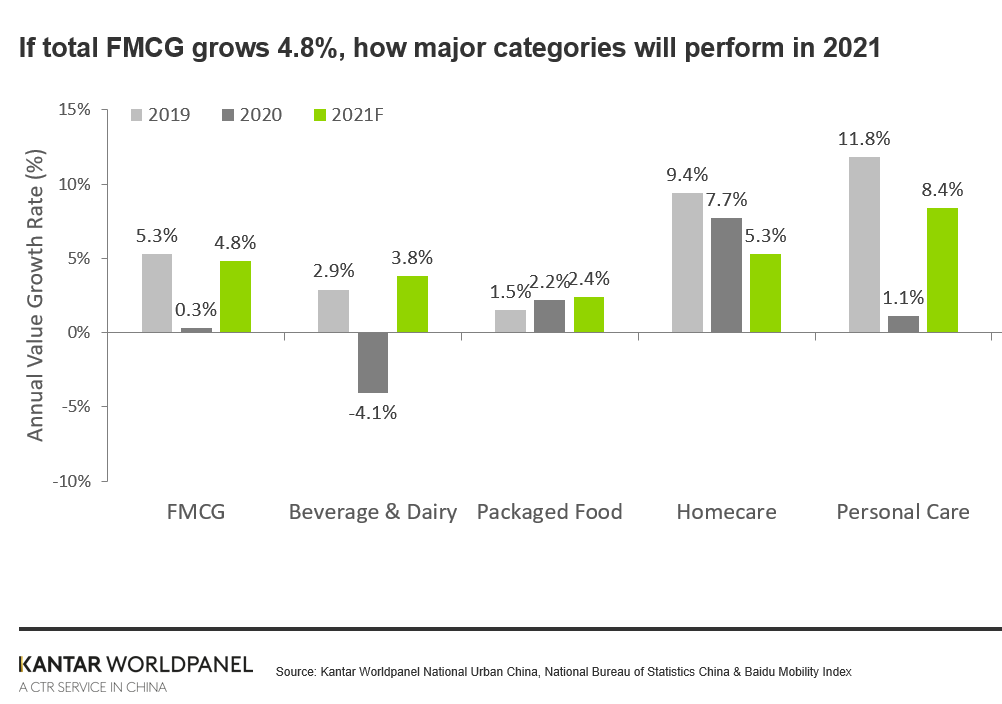

Kantar Worldpanel predicts that if the impact of COVID remains minimal and there continues to be no resurgence of the virus the in-home FMCG (note 1) market will grow by 4.8% in 2021. If existing measures on travel restrictions are removed quicker than anticipated and consumers quickly return to life as it was before COVID then the market could grow as rapidly as 7.1%. However, this is unlikely to happen in the short term as many families will still want to be cautious with their movements and spending. In the worst case scenario, where new cases of COVID emerge and more restrictions are placed on people’s movements, then the growth rate could drop to 2.7%. Regardless of what the future holds in terms of the pandemic situation we would still expect to see a higher growth rate than 2021 given that the government and citizens are now more familiar with now to handle the situation and will find ways to acquire products safely even if they are in lockdown.

Beverage and Dairy categories saw the largest decline during 2020 (-4.1%), largely driven by alcohol and yoghurt but in 2021 we expect these categories to rebound and are forecasting a growth of 3.8% which is higher than the growth rate seen in 2019. Alcohol was impacted in 2020 both due to its negative effects on immunity and less family gatherings both of which will become less of an issue in 2021.

The Packaged Food sector was more resilient during 2020 reporting a growth of 2.2% (vs. 1.5% in 2019) with categories which offer convenient meal solutions, such as instant noodles and quick soup performing well, and confectionary categories seeing a strong decline due to less family gatherings. During 2021 we will expect a similar growth rate as the strong growing and declining categories returning to pre-COVID performance as people feel more comfortable to eat out of home again and have more mixing of households

The Homecare sector weathered the COVID storm better than the other sectors with a growth rate of 7.7% in 2020. People spending more time at home and the strong need for sanitizing products meant that many homecare categories saw stronger growth than in previous years. In 2021 we expect to see a lower growth rate of around 5% as although the need to protect against viruses will still be there we are unlikely to see a strong bulk buying and stock up behaviour like we witnessed during the lockdown in Q1 last year.

Personal Care was the most heavily impacted FMCG sector during 2020 seeing a drop in growth from 11.1% in 2019 to just 1.1% in 2020. During lockdown there was less of a need for people to fulfill their full personal care regime as they could not go to work or socialize with their friends and many consumers were less willing to pay for more expensive personal care products due to financial concerns. Beauty (note 2) categories (skincare & makeup) were the most heavily affected, experiencing a decline of 4% in 2020 (vs 10% growth in 2019). However, we have seen these markets recover well over the last few months and in 2021 we expect to see a growth rate of around 8% for the personal care sector, so almost returning to the pre-COVID levels. There will still be restrictions on being able to purchase overseas products which will limit the value growth as these products tend to be more premium, but overall people’s daily routines are already back to normal and if no further lockdowns are put in place the 8% growth definitely seems feasible.

Out-of-Home Beverage & Snacking

On-the-go products (note 3) were hit hard during the lockdown period and have been slow to recover as many families continued to restrict the time they spent outdoors. This resulted in a decline of 7% with on premise purchases down by 10%. However, with travel restrictions easing and the warmer weather coming we expect to see this market recover rapidly and are forecasting the market to grow by 6% in 2021.

What Does this Mean for Manufacturers and Retailers?

2021 holds a lot of opportunity for FMCG manufacturers and retails and we expect to the majority of markets to return, or even exceed, pre-COVID growth levels. But the path to growth and how to engage consumers will be different. Below are our thoughts on how to best capture growth in 2021:

• Understanding how consumers needs and preferences have changed. New needs, such as safety, health and convenience, which were formed during COVID may be permanent changes or consumers may return to their previous habits and lifestyles. Understanding this within your category and then tailoring your innovation and your messaging to meet different consumers’ needs will be essential for growth in 2021

• Channel landscape evolution. COVID-19 has accelerated the growth of channels such as O2O, livestreaming and community buying. Ensuring that you are able to leverage these channels to get your products in the hands of consumers quickly, safely and in an engaging way will help you to stay ahead of the competition.

• Anticipate demand and understand the role of marketing levers play growing penetration. Capturing new shoppers will still be essential for brand growth. By understanding the forecast for you category and the role that pricing, promotions, distribution and media play in driving penetration will help you to optimize your marketing spend throughout the year.

Kantar Worldpanel is uniquely placed to help you understand how consumers needs and the way they shop has changed. Through advanced machine learning techniques we can help you forecast demand for your categories and brands in 2021 and advise how you should invest your marketing spend to capture more new shoppers and maximize growth.

Notes from editor:

Note 1: Data source for ‘In-Home FMCG market’ is from the 40,000 household panel covering National Urban China. Category scope is 118 FMCG categories within Beverage & Dairy, Packaged Food, Homecare and Personal Care sectors (excludes Pet Food);

Note 2: Data source for Beauty categories is from the 40,000 individual panel covering National Urban China and Skincare & Makeup categories;

Note 3: Data source for ‘Out-of-Home’ categories is from the 8,000 individual panel covering Key& A Cities in China and Snacking & Beverage categories including on premise.