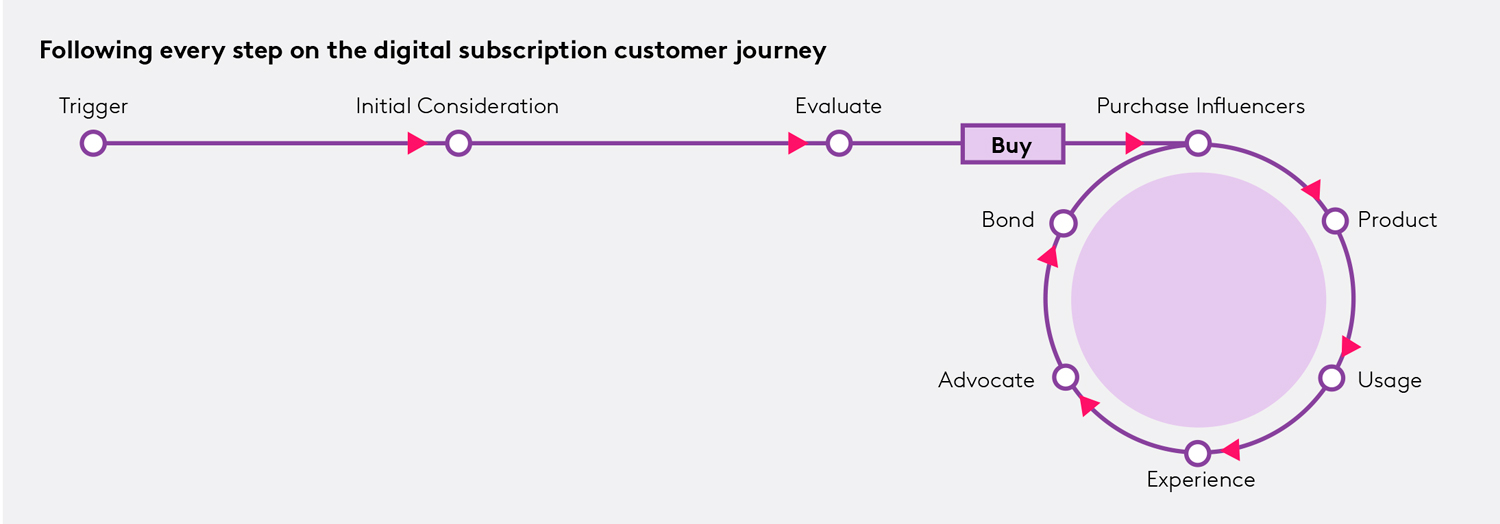

Our Entertainment on Demand service tracks the full digital subscription customer journey across music and video.

With a quarterly survey from 20,000 (US) and 12,000 (GB) longitudinal panels, plus 2,500 boost sample of new subscribers per quarter for each country, we deliver the latest insights on digital subscriptions from purchase triggers, through consideration, evaluation, intention to purchase, post-purchase usage, satisfaction/dissatisfaction, advocacy, loyalty and switching.

This offering helps the entertainment industry (service providers, cable and satellite companies, platform providers, production studios) and City analysts and investors understand the full entertainment subscription service consumer journey.

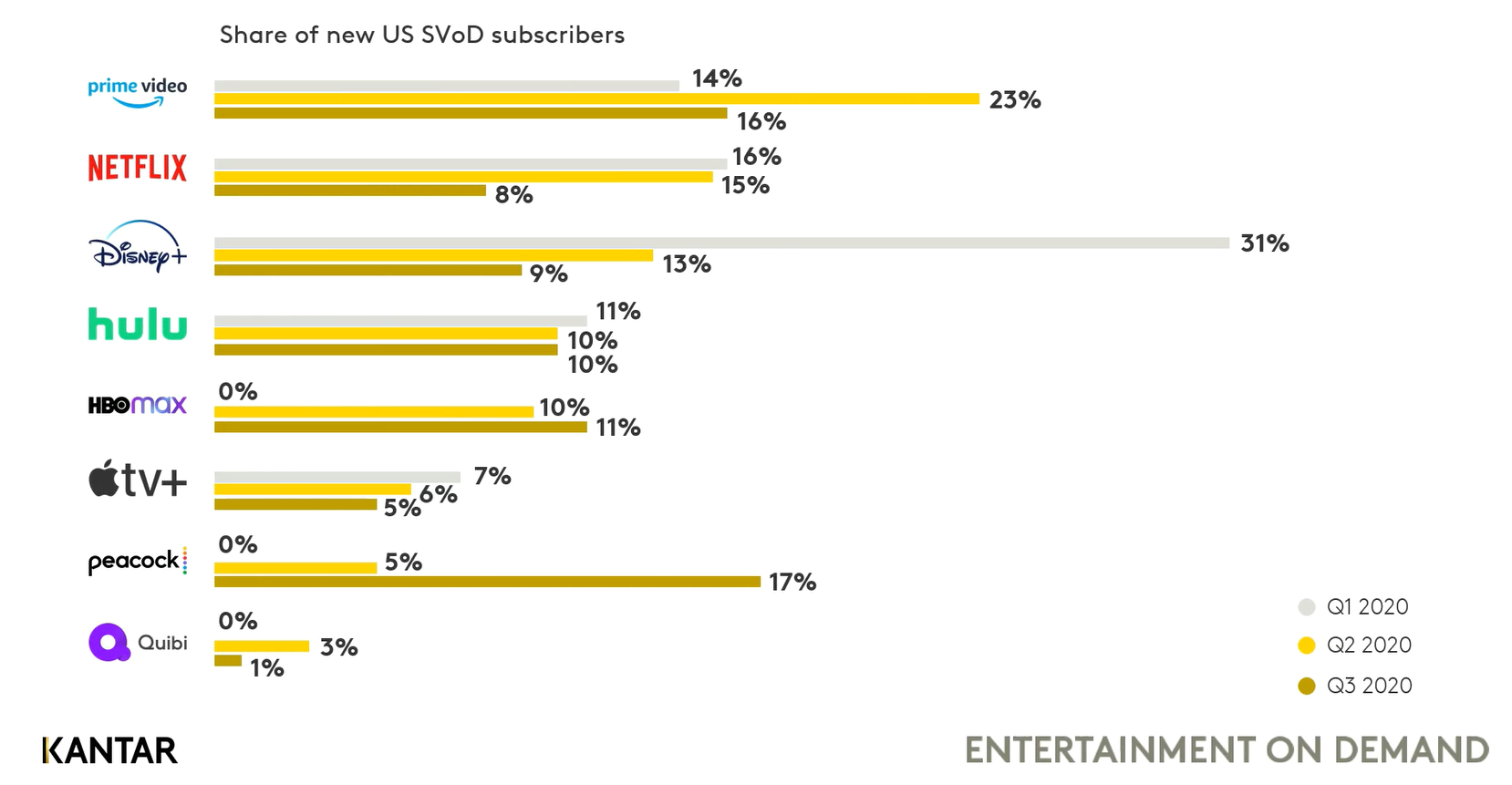

- How different brands are performing in share and subscriber numbers

- Sources of growth/decline for competitive set

- Benchmark loyalty rates

- The impact of brand switching on overall subscriber numbers

- Key triggers attracting consumers to you and competitor brands

- Product level USPs you hold vs. competitors

- Advocacy levels (Net Promoter Score – NPS) for competitive set

- Drivers of NPS performance

- Areas of strength/weakness during the critical sign-up process

- Performance across multiple pre-purchase touchpoints (paid for/ owned/ earned)

- Performance by consideration > Purchase Intention > conversión

- Opportunity amongst non-digital streaming subscribers

- Interaction between cable and digital subscriptions

- Consumers at risk of churn from your and competitor’s subscriber base

- Impact of digital on physical and other competing entertainment areas

The service is structured across three tiers:

Measure

the most important subscription service KPIs tracked longitudinally

Explain

a complete understanding of the category KPIs

Predict

using machine learning to accurately predict future consumer behaviour

Why invest in Subscription Video on Demand (SVoD)?

Book a free consultation and get a demo

Reach out to our team to learn more about how we can help your brand grow.