As the epicenter of the COVID-19 outbreak, China is some weeks ahead of the rest of the world in terms of the spread of the disease. We have already captured data on how the outbreak has affected the FMCG market there. Although clearly there are cultural differences across countries, some of the impacts and behaviors from China will be useful indicators of what might happen elsewhere. Here we share our findings and suggestions on how the learnings could be applied.

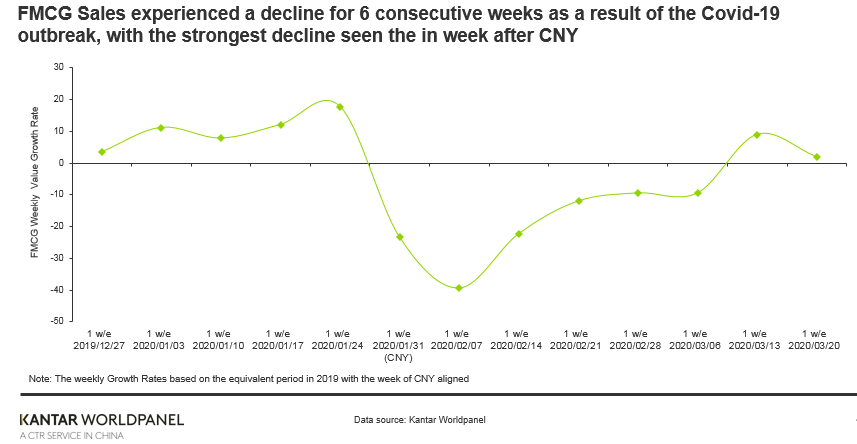

Following the outbreak of COVID-19 in January China’s FMCG market was significantly impacted as shoppers were confined to their homes. Sales starting to decline during the week of Chinese New Year (CNY) and this continued for six consecutive weeks. The fastest rate of decline was the week after Chinese New Year (w/c 3rd February) where the FMCG market fell by 39% compared to the equivalent week in 2019.

However, from the second week in March, FMCG sales returned to growth. Now that China has started returning to normal across most of the country, many FMCG manufacturers and retailers are keen to understand how long it will take for the FMCG market to fully recover and how they can help to accelerate this.

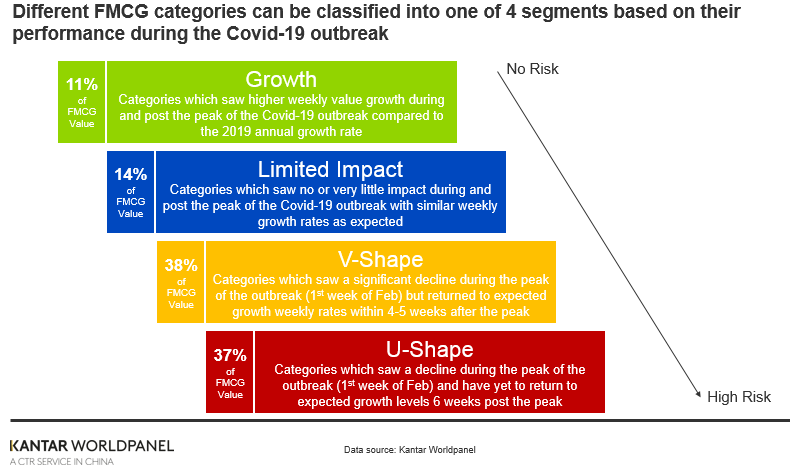

The speed of the recovery very much depends on the nature of the category and how impacted it was during the peak of the outbreak. Some categories will show a ‘V-shaped’ trajectory, where there is a quick recovery, whereas other categories will take longer and have more of a ‘U-shaped’ curve. Also, there are a handful of categories that were not negatively impacted, with some even experiencing stronger than expected growth during the epidemic.

Through analysis conducted by the Expert Solutions team at Kantar Worldpanel China, 98 FCMG categories were classified into one of four segments based on the performance they experienced both during the peak of the outbreak and whether they have experienced a fast or slow recovery during recent weeks as the COVID-19 situation improved. These are shown in the diagram above.

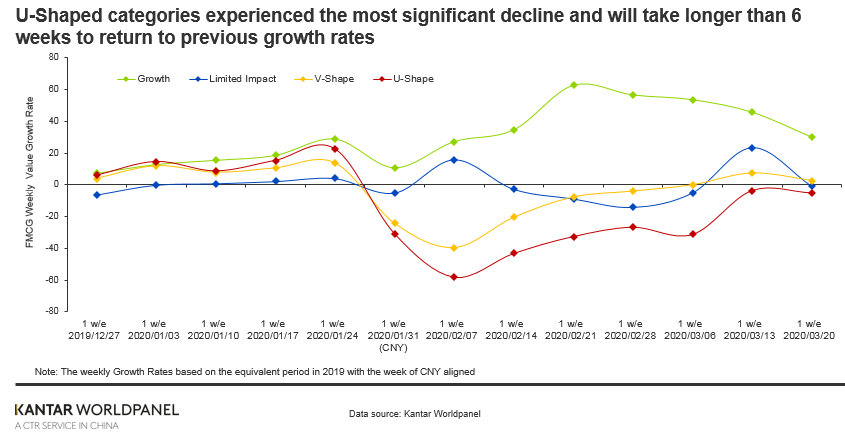

Growth categories: Increased or new demand generated as a result of COVID-19

The categories appearing here fall into two main groups. Unsurprisingly, one group consists of products which can kill germs and protect from the coronavirus such as hand wash, disinfectant and wipes. During the peak, disinfectant saw phenomenal weekly growth of over 600% and hand wash reported over 200% growth in some weeks during February.

The second group are products that can be used for home cooking such as bouillon, MSG, herbs and spices, and tomato ketchup. Also convenient in-home meals, such as instant noodles and quick soup, experienced growth, catering to consumers who might not be as willing or able to cook from scratch.

Categories falling into this segment have a real potential to leverage this unexpected growth momentum by ensuring consumers maintain the new habits they may have established during the epidemic. Sanitizing and keeping yourself protected from viruses will undoubtedly be a much greater concern for shoppers in the future, so brands that have these benefits or have the potential to add them should put more focus and media investment here.

Cooking at home is likely to see a resurgence with many people learning to cook and improving their skills during the self-isolation. Also many families will feel safer preparing and cooking their own meals rather than ordering take-away or going to a restaurant where there is a higher perceived risk of infection. Consumers will be keen to continue these habits once the epidemic is over so for food brands it’s important to link the brand to in-home meal occasions, food safety and spending time with the family.

Limited impact categories: Essential categories that were unaffected by the outbreak

Categories falling into this segment include dog and cat food, toilet tissues, infant milk powder, packaged water and sanitary protection. These are categories that many households simply cannot live without, but you do not necessarily need to use more of during an epidemic. The panic buying behavior of toilet paper that has recently been seen in some countries, such as Australia and the US, was not witnessed in China.

Another characteristic of the ‘limited impact’ categories is that they are more likely to be purchased online compared to the other segments. 25% of the spending on the ‘limited impact’ categories came from online versus just 19% for an average FMCG category. Online deliveries played an instrumental role in not only ensuring households received essential products during the epidemic but also meant people could safely self-isolate and not have to visit their local store.

Looking ahead to the rest of the year, a key consideration for these categories is how many consumers the online channel has won as a result of the outbreak. We know that this channel performed very well during the epidemic, winning new consumers and additional trips. Many consumers will continue this behavior for these type of categories, so working with online retailers to ensure your brand can capture this increased demand will be critical to growth.

V-shape categories: Loss of consumption but quick to recover

Categories here experienced a significant drop in sales during the last week of January and first week of February but have been relatively quick to recover, with many returning to expected weekly growth rates within six weeks from the strongest decline. These categories include cooking oil, UHT milk, yoghurt, biscuits, nutritional supplements and laundry detergent. The reason these categories are likely to have experienced a sharp decline is either due to limited availability during the peak of the outbreak in shopper’s local stores or many households deemed them unessential for a week or two during the peak. Also, many shoppers will have had excess stock already resulting from bulk purchases made in the run up to CNY which is the trend often seen for categories such as cooking oil and biscuits.

However, these categories were quick to recover once shoppers felt it was safer to shop and/or the excess stock in their home had been used. One of the main concerns for these categories is that the lost or reduced consumption is unlikely to be compensated for later in the year. CNY is an incredibly important time for many FMCG categories and as a result of many households cancelling their family gatherings during this time, it meant this period of excess consumption simply did not happen and that extra stock in shoppers’ homes was consumed in the weeks after CNY. However, the fact that many of these categories have returned to their usual weekly growth levels shows that the demand is still there. Manufacturers will need to find ways to encourage additional usage occasions in-home to help compensate for the loss experienced during the peak of the outbreak. This can be done by capitalizing on holidays later in the year, such as Golden Week in October or through multi-buy promotions, especially for those categories which are more expandable in their nature (i.e. if you encourage shoppers to buy more they will consume more, such as biscuits or soft drinks).

U-Shape Categories: Loss of consumption and yet to recover

These categories are ones that have experienced the worst impact as a result of the COVID-19 outbreak, as they suffered a significant decline during the peak (generally worse than the decline seen for V-Shape categories) and six weeks later they are yet to show signs of a full recovery. Categories here include skincare, make-up, shampoo, Chinese spirits, wine, beer, chocolate and candy.

Many personal care markets have been hit hard by the coronavirus as people had to self-isolate during the epidemic, reducing the demand for make-up and other beauty products. Many households self-isolated for almost two months and, with China only just now returning to normal, we are yet to see these markets recover. The reason for seeing alcohol and snacking products here is that people are more concerned with their health during the outbreak and want to keep their bodies fit and healthy in case they need to fight off infection. This coupled with the fact that many CNY celebrations were cancelled has meant a significant loss of consumption as well as the potential for lower future demand.

The key for brands operating in those categories is to ensure that they can capture demand by emphasizing the benefits their brands can offer in the new era. Consumers will be more concerned with health but will also be looking to enjoy family occasions and social gatherings even more than before, given that they have been unable to do this for almost two months. Therefore capturing these moments of happiness and time together can benefit both snacking and alcohol brands. The perception of beauty will become more care driven than before, and products that stabilize skin conditions and provide extra nourishment will recover faster.

Conclusion

The path to recovery will be different for every brand as it depends on how their category has been impacted by the COVID-19 outbreak but also how consumers needs will change in the future. Below are areas that manufacturers will need to understand in order to find the fastest path to recovery:

- Demand Forecasting – understanding future demand post-COVID-19 and how to compensate for lost usage occasions.

- Marketing Growth Drivers – what elements of the marketing mix will help to drive sales after the epidemic: advertising, promotions, in-store activities and distribution are likely to have different levels of importance.

- Usage occasions – identifying new usage occasions that have arisen as a result of the coronavirus will be critical in helping to capture future demand and developing new products to meet these new needs.

- Media Investment – how to optimize your media investment will be more crucial than ever, especially in the event of reduced budgets. Knowing who to reach and how to reach them in the most cost-effective way will help to improve the return on investment.

- Channel Dynamics – online and O2O will be even more important channels post epidemic so understanding how people’s behavior changes when shopping via these channels will help to identify new growth opportunities.