As living with squeezed budgets becomes the norm for Latin Americans, it’s increasingly important for manufacturers and retailers to understand where people are spending. Inflation has pushed FMCG prices up by 30% and the number of channels visited is up 14% versus 2021.

Shopping trips have not yet returned to pre-pandemic levels and suffered a greater drop in countries where the omnichannel remains flat. The size of carts have also shrunk.

The Omnichannel Latam report has been updated to the second quarter of the year and explains today’s retail landscape.

A new consumer redefines buying missions

Although stock-up missions continue to be the most important (39% in value), the purchase volume in Latino households is down 0.8%. Making large purchases is challenging now due to their high ticket price.

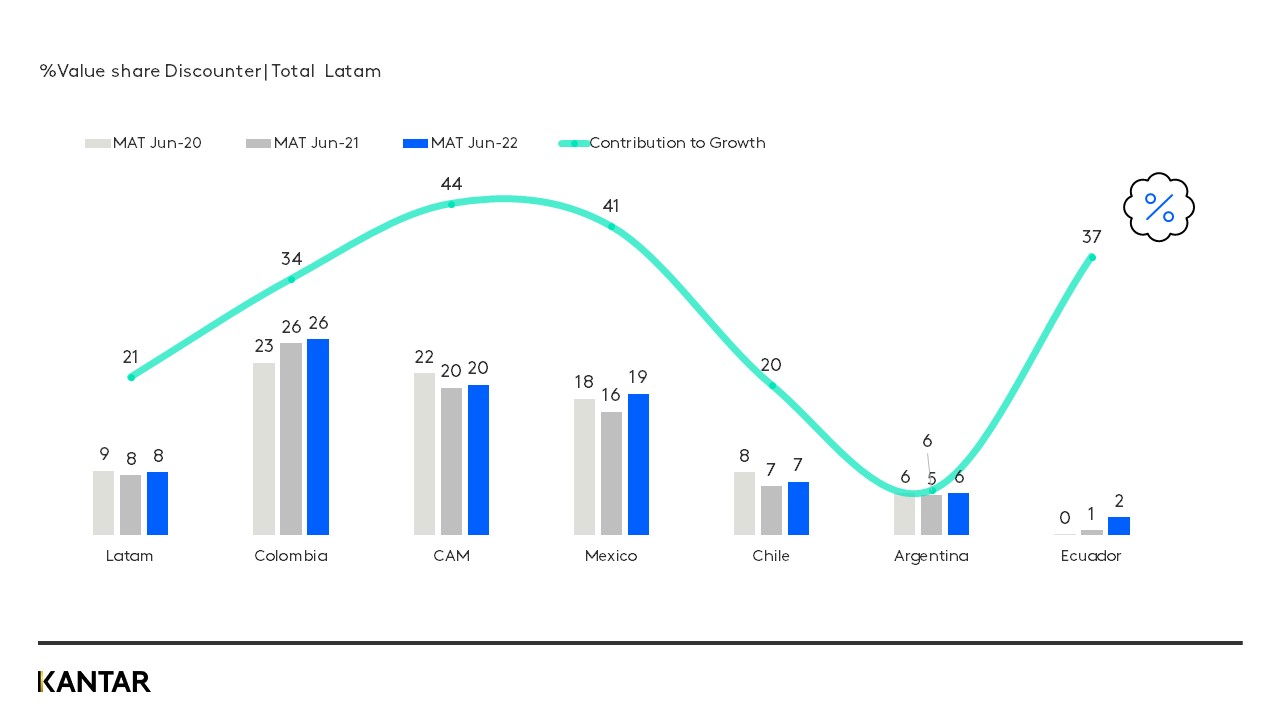

Unconventional channel missions are gaining space, with daily and fill-in are growing fastest with 14% growth. Shopping more often enables people to hold onto their money for longer and take advantage of offers.

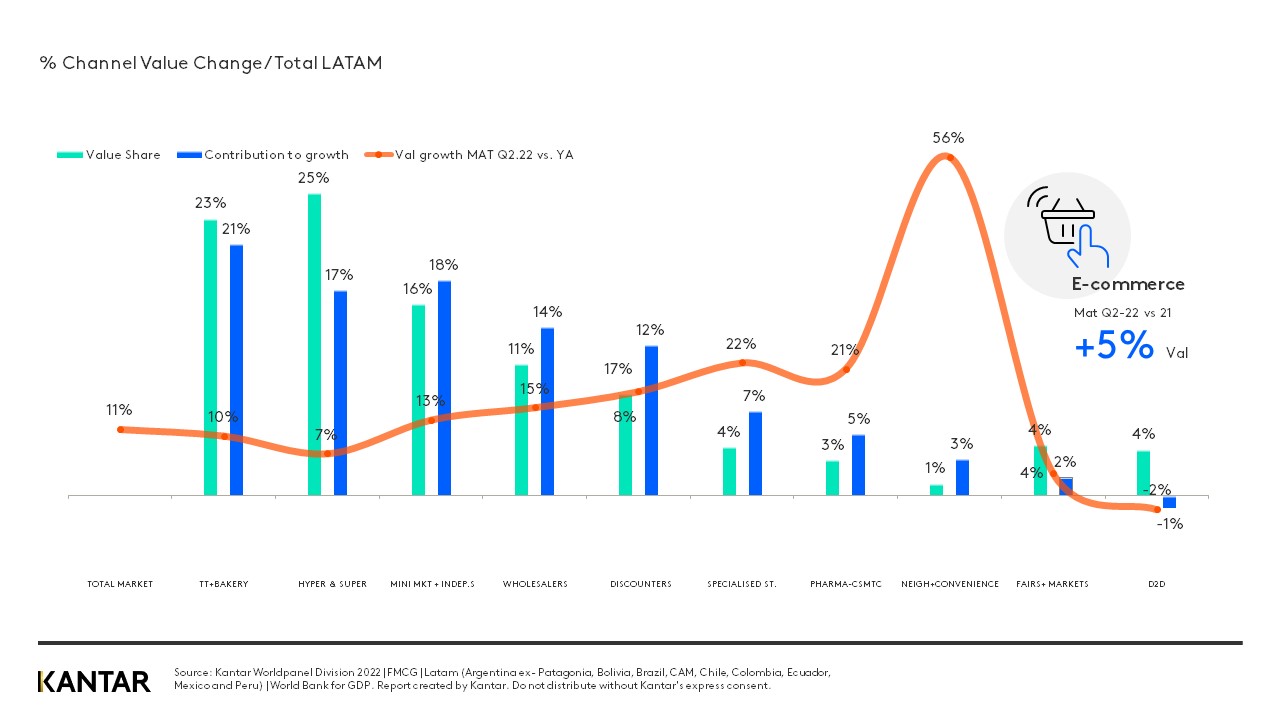

If we consider the value share of the retail channels in Latam, it is possible to project what is coming: the point of sales that benefited most during the pandemic will no longer seem so interesting to shoppers.

Hypermarkets, supermarkets, traditional and bakeries lost share and grew only 20% versus 2020. In comparison, specialized and convenience stores grew by 40%. Online has followed the global trend with growth slowing, although only slightly, for the first time since the lockdown.

Volume will also set the tone for Latin Americans day to day. In the second quarter of the year, 57% of the FMCG categories lost consumption. This is most marked in in hypermarkets and supermarkets, fairs and markets, which have slumped by 66%.

Family-size packs are becoming more popular product formats and have increased in relevance in all channels, except pharmacies. Bulk products are seen as a more accessible cost alternative, while the popularity of small formats have dropped almost everywhere, except in specialized stores.

Access to platforms has slightly changed the share across digital channels. Despite WhatsApp dropping its value share from 33 to 27% year on year, it attracts the most people with 15 million buyers. Non-pure, which includes websites or apps of supermarket and hypermarket chains, increased by 4% to reach 44% and continues to lead the way in the region.

Omnichannel will continue to allow shoppers to escape the impact of prices and offer a more rational investment of their money. Brands need to focus more on points of sale where their audience is, while retailers must adapt their strategies to meet the consumers’ needs.

Get in touch to find out how Worldpanel can help support your sales strategies and read the Omnichannel Latam report for more insights.