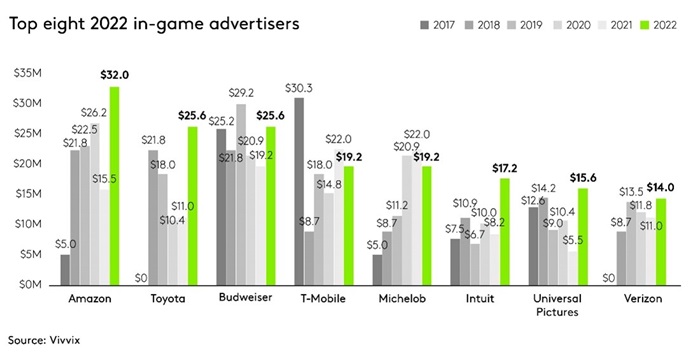

NBC generated $578 million for in-game revenue; ads remain a central part of gameday and continue to deliver strong audience connections and ROI

Super Bowl LVI, exclusively broadcasted by NBC in 2022, generated $578.36 million of in-game advertising revenue, growing $143.8 million year over year, with $32 million in revenue generated during the halftime show alone.

Total revenue, accounting for pre, post, and in-game advertising, increased by more than $100 million year over year, from $534 million in 2021 to $636 million in 2022, according to Vivvix, a Kantar company. By comparison, CBS’s Super Bowl LV in 2021 brought in the most pre-game ad revenue since 2017, $77.6 million, as compared to Super Bowl LVI, which brought in $51.1 million for pre-game advertising in 2022.

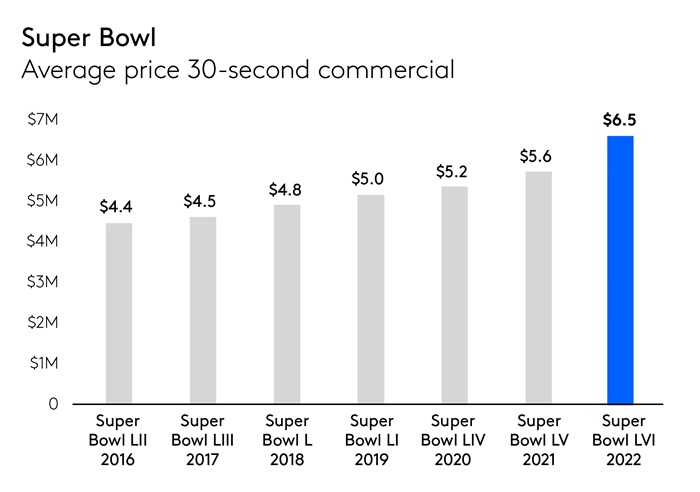

The average cost of a 2022 Super Bowl LVI 30-second commercial was $6.5 million, up more than $2 million over 2016 rates. And this year, the reported cost of a 30-second commercial is approaching $7 million.

Trends by industry

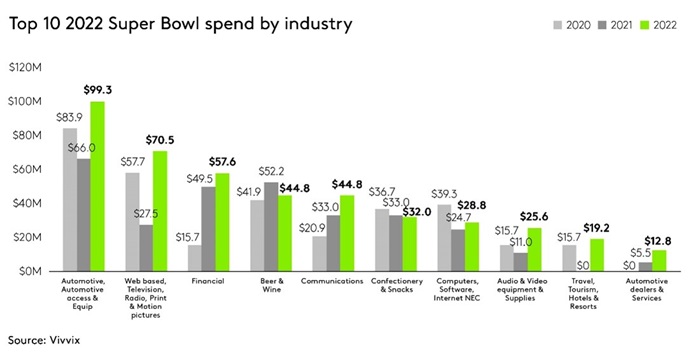

The Automotive industry, which has historically spent the most on in-game Super Bowl ad placements, led in spending again in 2022 with $99.3 million, an increase of more than $30 million from 2021. The Automotive industry also outspent the second largest-spending industry, Web Based, Television, Radio, Print & Motion Pictures, by almost $30 million. That said, Web Based, Television, Radio, Print & Motion Pictures saw the largest increase in in-game ad investment from 2021 to 2022, upping their spend as a whole by $43 million. This increase was fueled by the increased ad spend of streaming services, specifically Amazon, Disney, Netflix, HBO and AMC. Travel, Tourism, Hotels and Resorts returned to the Super Bowl in 2022, spending $19.2 million on in-game ads, after not placing a single ad in 2021.

The Financial industry, which ranked third in spend in both 2021 and 2022, was fueled by the spend of Crypto companies. In 2022, Crypto companies spent $39 million, and would have been the 5th largest spending category alone. The Financial industry has seen an increase in spend of 367% since 2020, from $15.7 million to $57.6 million in 2022.

A few industries cut their Super Bowl spending in 2022. Retail, which ranked 9th in spend in 2021, did not have any ad placements in 2022, nor did Business & Technology NEC, Household Soaps, Cleansers & Polishes, and Horticulture & Farming.

The State of Super Bowl Commercials: Creative & Diverse

Watching commercials still plays a huge role in the Super Bowl culture for consumers. According to Sports MONITOR data, two-thirds of all Americans plan to tune into this year’s game with 25% of Super Bowl viewers say they expect to pay more attention to the ads than the game itself”

While Super Bowl ads offer a captive audience, promoting diversity, equality and inclusion (DEI) in Super Bowl creative can deeply impact a brand’s return on investment (ROI). According to Kantar's Super Bowl Creative Evolution - DEI in the Big Game 2023 Report, 29% of respondents claim they would ‘stop using brands that do not promote inclusion and diversity during the Super Bowl’. The majority also expect talent in ads to be inclusive and diverse – especially through inclusion of people of color, women, and younger generations. In 2022, Super Bowl advertisers embraced diversity with 89% of ads featuring one or more underrepresented groups. 40% of ads had three or more groups represented. While we are seeing greater racial representation, other groups including LGBTQ+ and people with disabilities are still underrepresented in lead roles, as well as inclusion of women. Ads that are both multi-racial and/or gender diverse are more enjoyable than just single gender non diverse ads, according to Kantar research.

Deepak Varma, Kantar’s Head of Neuroscience, said of themes that resonate during Super Bowl advertising, “Emotionally engaging stories have the power to resonate across demography. Humor works as it has over the years, but it may appeal to certain groups more than others. How consumers are qualifying ‘entertainment’ is expanding. Entertainment doesn't just include humor and surprise, it includes more emotional themes like empathy, compassion and togetherness that have the power to cut across all.”

“Having more diversity in Super Bowl advertising is part of a larger trend where brands are participating more in social and cultural dialogue – which is what consumers want,” says Kerry Benson, Kantar’s Creative Solutions Lead. “This new brave and purpose-oriented world requires brands to lean into an expanded sphere of social dialogue, which may require a point of view about politically polarizing subjects or pre-existing controversies.”

Return on Super Bowl Investment

Super Bowl ads consistently deliver strong return on investments. According to Kantar’s Super Bowl LVI Ad Effectiveness Report, the 2022 Super Bowl ads delivered an average ROI of $4.60 per dollar spent, with ads for T-Mobile, Verizon, AT&T, Disney+, Sam’s Club, and General Motors achieving the best results. Strong creative plays an important role in helping brands make the most of this super-sized opportunity.

“Telecom had the strongest financial return for their ads in Super Bowl LVI. All three advertisers: T-Mobile, AT&T, and Verizon saw double digit ROIs for their ads,” stated Alfredo Troncoso, Partner for Brand & Marketing ROI, Kantar, “Financial Services had a very soft performance in 2022, mainly driven by the Crypto ads that did not achieve strong ROIs across the board.”

Beers delivered a positive ROI as usual, a fact that many brands such as Heineken, Molson Coors, and Sam Adams, in addition to Budweiser and Bud Light, will try to capitalize on this year, in what will potentially be the “Beer Bowl,” similar to last year’s “Crypto Bowl.”

“While having a spot in the Super Bowl now costs about $7 million per 30 seconds, the real media value in Big Game advertising comes from how the spot is amplified across a variety of channels,” says Jed Meyer, Senior Vice President, Media Domain, at Kantar, “While having that hero anchor and TV spot still is incredibly valuable and effective, the real impact lies in how those hero campaigns utilize more experiential and creative social media tactics to resonate with what’s happening socially and culturally. Those tactics get consumers to continue engaging with that campaign for days and weeks following the Super Bowl and drive additional ROI for the campaign.”

A Global Event

More than three quarters of U.S. sports fans view the Super Bowl positively, more than any other major sporting event including the World Series and World Cup. And more importantly, these fans bring a positive attitude to the brands advertising during the big game.

“Since we started measuring consumer attitudes and sports, we’ve consistently found that the NFL is the top league and The Super Bowl is the most popular sports event of the year among virtually all segments of the U.S. population,” commented Ryan McConnell, EVP, Head of Kantar’s Sports MONITOR. “The Super Bowl is about as steady of an institution as we have in the U.S. today.”

A recent Kantar study sourced from the Profiles Audience Network found that of people who regularly watch the Super Bowl, 26% do so specifically to watch the halftime show, which this year will be sponsored by Apple Music. In 2022, the Super Bowl LVI Halftime Show had more than 120 million viewers. Interest in the halftime show has grown since 2021, when viewers said watching commercials was a bigger reason for watching the Super Bowl than the halftime show.

But the reach of the Super Bowl goes beyond the U.S. Despite only 3% of consumers in the UK claiming American Football is their most watched sport, (the most watched being Soccer/Football), 49% say they watch the Super Bowl at least occasionally, where 23% say they watch every year. In Canada, 70% of consumers say they watch the Super Bowl at least occasionally, where 38% say they watch every year.

Across these three markets, US, UK, and Canada, the majority believe that the Super Bowl is an ‘American Event,’ but that notion is changing. Younger generations are more likely to view the Super Bowl as a "Global Event” (29%).

Kantar will take a deeper look at what to expect – including how the game has become a moment of culture for Americans – and how brands can make the biggest impact in a special webinar planned for Friday, February 10. Register now.