As more and more states legalize marijuana, companies are beginning to battle for consumers and market share in this fast-growing market. Accordingly, ad investment is starting to rise as well, with marijuana retailers spending an estimated $4.1 million in 2018, a 23% increase over 2017 spending of $3.3 million. Kantar’s Media division has done an analysis of where and how this investment is being made, including looking at ad creatives in addition to media mix and geographic location. (Our analysis focuses on marijuana retailers including clinics and dispensaries, and does not include marijuana or CBD products.)

Seattle hits the high

Washington was the first state to legalize recreational marijuana use, and it’s not surprising that ad spend was highest there, at $2.2 million in 2018. As the largest city in the state, Seattle was responsible for $1.8 million of this spend.

Meanwhile, California saw the second-highest amount of spend; the state first began issuing licenses for growing and selling marijuana in 2018, contributing to significant commercial activity in the sector. it’s not surprising that ad spend was highest in that state. Total spend in 2018 reached $915,000, with $506,000 of that focused in the Los Angeles area. It’s likely spend will increase quickly in this region; while Los Angeles had no licensed marijuana shops in January 2018, as of April 2019 over 180 dispensaries had temporary approvals.

Outdoor represents the big opportunity

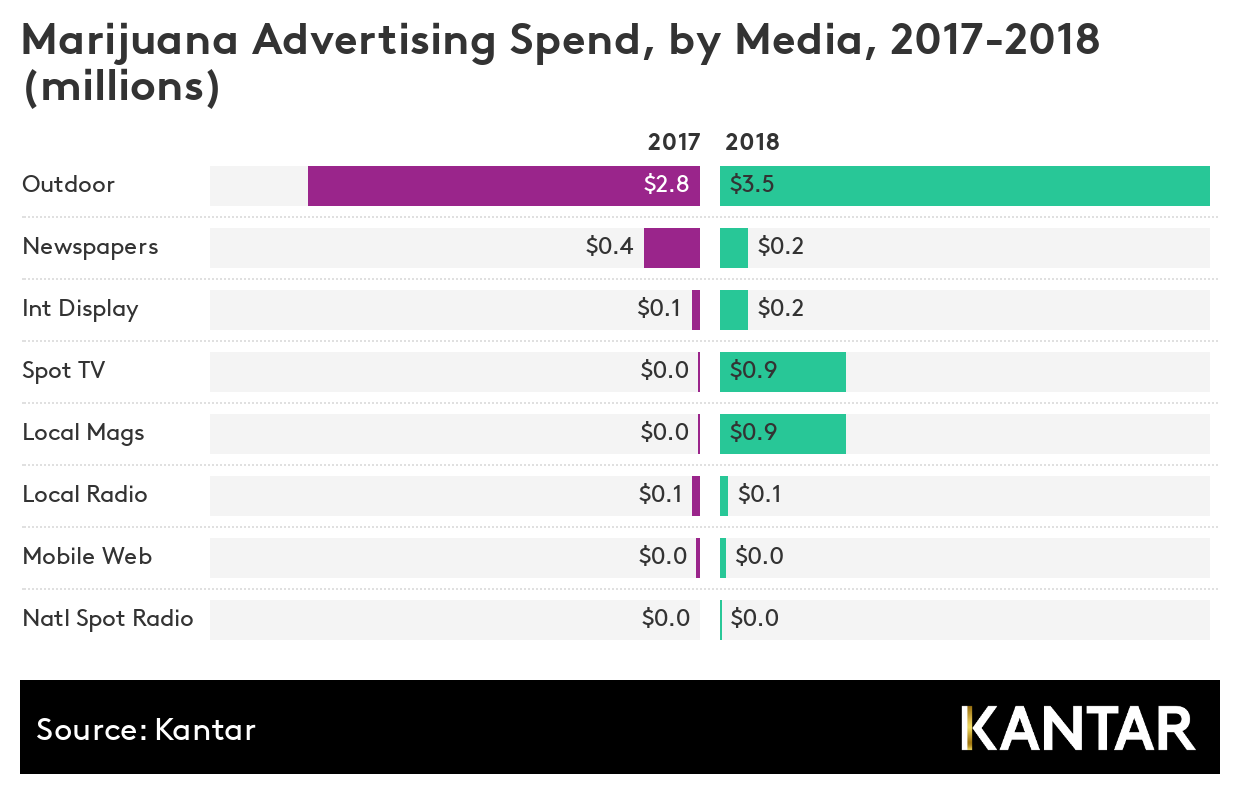

Looking at the media platforms used for marijuana retail advertising, outdoor advertising is clearly in the lead, with a huge 84% of 2018 spend, or $3.46 million. Newspapers then have the second-largest share at $212,000, or 5%, followed by online display at $168,000 or 4%. Notably, newspaper advertising spend fell by over half from 2017 to 2018, while outdoor advertising increased by 25% and online display advertising almost tripled.

Some media properties are declining to take marijuana-related advertising: In two high-profile examples, CBS refused to allow Acreage Holdings to place a Super Bowl add in 2019, while ABC turned down an ad Lowell Farms wished to air during the Oscars. TV advertising can also be too costly for small start-up businesses.

It’s clear that outdoor has been a better fit for marijuana retailers, although limits apply here as well, with many states preventing such advertising near schools, churches and parks. With media firms still developing policies around marijuana-related advertising, it may take some time for marijuana advertising to appear at scale in larger national media properties as well as on national TV.

Finding the right message

According to a survey of 1,000 US cannabis consumers by Kantar and cannabis information resource Leafly, 77% are using cannabis for both medical and recreational use. 86% highly value purchasing from a licensed vendor with known quality controls; and 41% prefer buying from a boutique retail outlet. However, more than half (57%) complete cannabis retail purchases in under 15 minutes, while 88% do so within 30 minutes, indicating an emphasis on efficiency.

With such strong usage of outdoor ads, marijuana retailers’ opportunities to deliver a complex and nuanced message are somewhat limited. Looking at ads from Eaze Marjuana Delivery, which was the largest spender in 2018 at $790,000, the initial focus appears to be on simply driving awareness. In ads like the below from San Diego, an upscale design focuses on the availability of delivery service.

Meanwhile, this partner ad from San Francisco seems aimed at more of a medical use case with its focus on the dosist dose delivery pen. Again, a modern and upscale design is used that seems targeted to upscale millenials.

As competition continues to rise in the marijuana retail space, expect to see more advertising along with diverse messaging designed to help differentiate different players. Based on Kantar’s consumer research, there are opportunities to succeed with ads that focus on safety, convenience and relaxation.