As a category, Treats and Snacks have always played a crucial role in energy balance and emotional health. To Chinese people, treats and snacks are consumed not only for self-indulgence or social life, but also as a part of tradition during special occasions. In the last 3 years, January and February contributed to over 40 Billion RMB worth of sales, at least 22% of the annual value of this category, making the New Year period, especially Chinese New Year, the most important occasion to Treats and Snacks.

This year, due to the outbreak of Covid-19, the needs for hygiene, nutrition and meal replacement grew significantly. The quarantine practice – either forced by government policy or voluntarily taken for self-safety – has put limits on outdoor entertainment and social interaction and generated new occasions for in-home indulgence and consumption. Targeting these new in-home occasions will be key to growth for snacking brands during this unusual period.

17 years ago, SARS had a limited impact on the development of Treats and Snacks, as quarantine regulation was not officially implemented, and the critical time of the epidemic did not fall over Chinese New Year. Now, given the coincidence of time, the change of macro landscape and the evolution of retail, we can expect a big change in how people react towards snacking.

To help Treat and Snack players find a way through this tough time and prepare better for events in the future, Kantar Worldpanel reviewed consumer snacking behaviours during Covid-19.

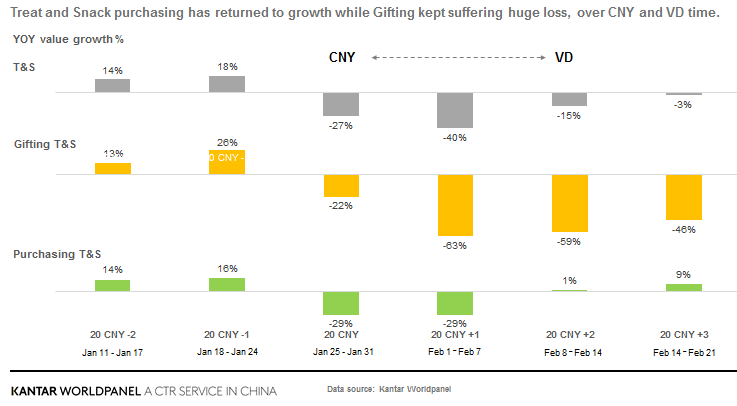

Big challenge for gifting observed

Considerably fewer Treats and Snacks were received as presents during Chinese New Year and Valentine’s Day, driven by fewer social gatherings and the change of gift choice. Fruit flavoured candy and chocolate led the decline as they are the most relevant gifting treats, followed by crispy snacks. On the other hand, personal care and hygiene categories occupied a higher share of gifting during this time. According to Meituan, the most searched gift list for Valentine's Day on its takeaway platform is masks, goggles, and alcohol disinfected cotton pads. On social media, presents made from fresh food and hygiene products (such as surgical-mask bouquets) went viral, as people became more realistic rather than romantic during this time.

There are still potential growth areas for gifting during both official holidays and personal occasions. Treat and Snack players should consider re-designing the gifting offers, with collaboration and communication focusing on health and wellbeing to win hearts and wallets of shoppers.

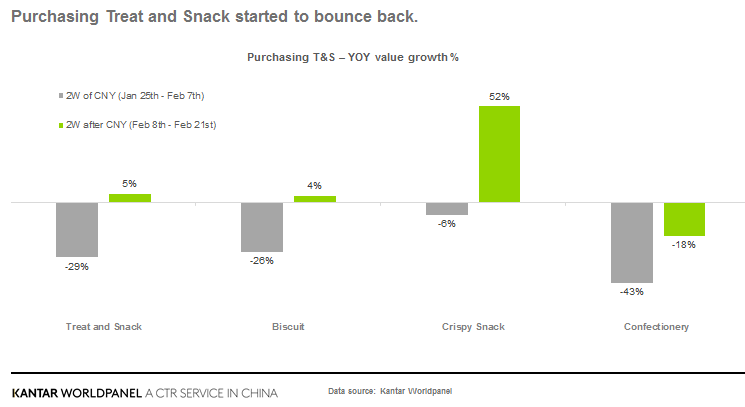

Purchasing for in-home consumption growth

Treat and Snack purchases for in-home consumption improved across channels in the two weeks of mid-February, led by young family types, especially young singles/couples who use snacking to alleviate the boredom during the quarantine period. Confectionery still experienced a decline for take-home purchases but the recovery was much clearer than in gifting. Chocolate tended to be the first one returning to growth.

During this time, creating more in-home snacking occasions could be the key to success. According to a Kantar online survey, watching video is the most common time-killing activity when people stay at home, followed by social media, mobile/online games, and cooking. A redistribution of media from offline to digital, with communication related to mood lifting and specifically targeting daily micro occasions, will help brands to win new shoppers and occasions. On the other hand, suggesting new cooking recipes with snacking ingredients on fan page/live streaming may also be a good way to improve the consumption of Treats and Snacks.

After the epidemic, food safety should be what brands should focus on, as agreed from the majority of respondents to our online survey. Additionally, more than half of surveyed consumers stated that they would spend more on personal care and household hygiene/sterilisation products (such as masks, disposable hand sanitiser, sterilising wipes, etc.) after the virus is contained. Therefore, ensuring product quality, smart cross-border offers and close co-operation with retailers for adjacent categories will help Treat and Snack players grow further after the outbreak.

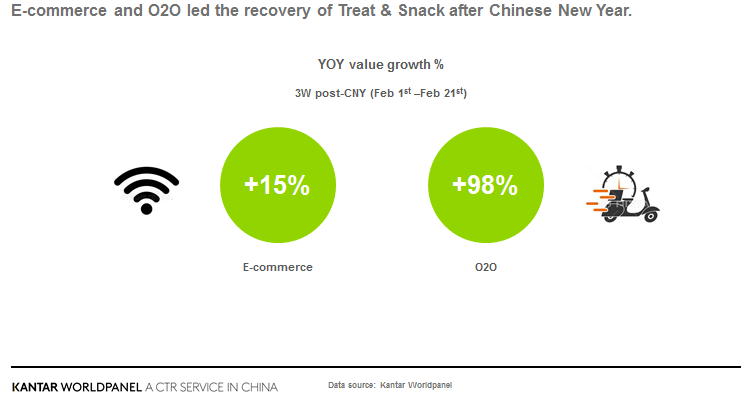

Ecommerce and O2O (offline to online) witnessed strong growth

Despite logistic constrains, ecommerce and O2O emerge as the best solutions for shopping when people are trying to reduce physical interaction. Over the 3 weeks after CNY, ecommerce enjoyed a 15% uplift, led by Crispy Snacks and Biscuit.

If 17 years ago, SARS played a big role in setting the foundation for ecommerce, then in 2020, Covid-19 boosted the growth of O2O. Over the 3 weeks after CNY, O2O doubled its size in Treat and Snack. Similar to ecommerce, Crispy Snacks led the trend with more than 200% growth, followed by Biscuits and Confectionery. As outdoor activities are not encouraged, people have a higher need for in-home cooking and consumption, leading to the growth of fresh food and ready-to-serve food delivery. Cross-category activities/promotions on key O2O platforms will help Treats and Snacks leverage the huge traffic of these staples.

The critical time of the epidemic should be long enough for Chinese people to break the psychological barriers and build up the habit of shopping via O2O. After the outbreak, an ongoing development of this channel could be expected, especially among shoppers aged 30-44. However, Treat and Snack manufacturers should have a fair expectation for O2O growth when things get back to normal. According to Kantar's online survey, offline channels still have a bright outlook, especially among those >40y/o. 36% surveyed consumers said they would visit hypermarkets more often and 37% said they would visit supermarkets more often. Therefore, gradually balancing the support towards offline would help Treat and Snack manufacturers adapt to the upcoming changes, whilst retaining buyers after the outbreak should be top priority for O2O retailers.

The unexpected virus outbreak is still going on and how brands can respond to these challenges remains to be seen. Although in-home consumption is now the priority, Treat and Snack players should be ready for the out-of-home competition, which is expected to come by end of Q2 when the virus is well contained.

***Treat and Snack includes Biscuit, Crispy Snack and Confectionery (Chocolate, Gum, Mints, Fruity Candy)

***2019 CNY week: Feb 2nd – 8th / 2020 CNY week: Jan 25th – 31st