2020 was the year of the unpredictable, a cavalcade of the unexpected: the COVID-19 pandemic, the sudden closing of the economy, events related to the climate crisis, and ongoing political tensions that boiled over at the U.S. Capitol at the dawn of 2021. All combined to create confusion across the world, and across retail.

2021 will be a year of complexity for retail, a year in which it seeks a more predictable environment as last year’s outliers are better understood even as new challenges arise.

Kantar has identified six themes to help with your 2021 planning and your discussions with business partners in a year that will still feel the effects of 2020’s significant challenges. We invite you to watch Commerce Now: 2021 Retail Outlook to dive-deeper into the following themes with our retail and shopper experts.

The abnormal retail economy

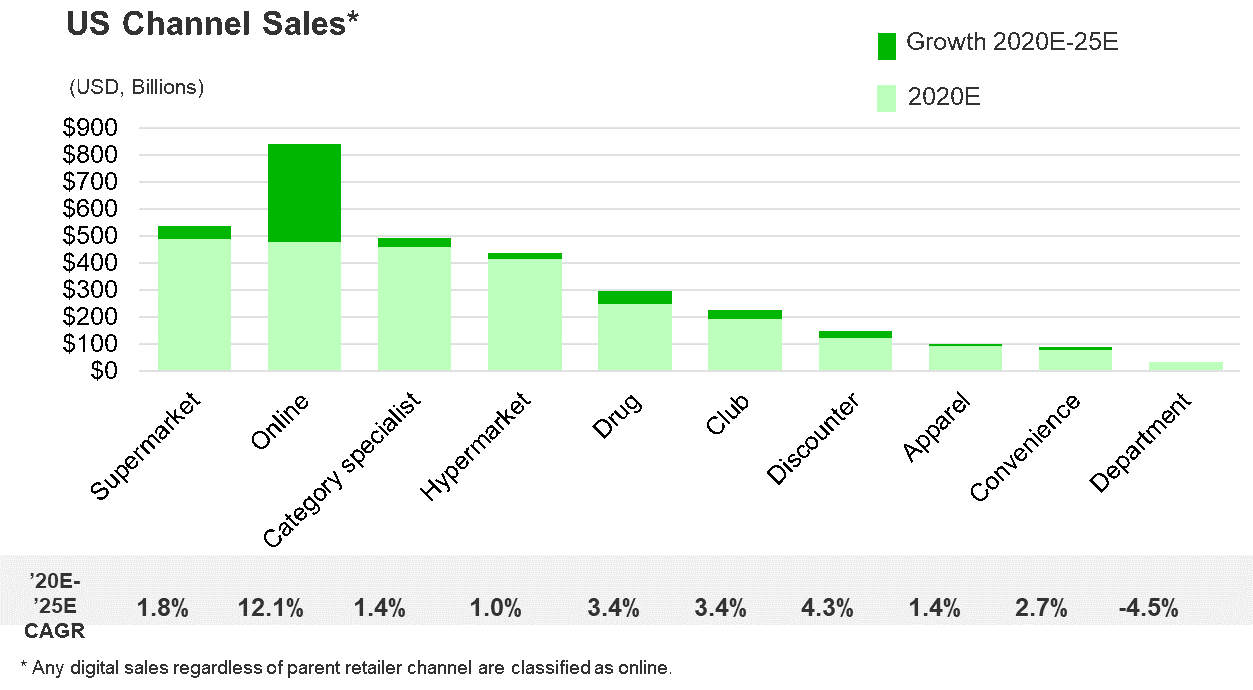

Nothing was normal in 2020, changing our view about 2021 growth. Most retailers posted major increases in sales and profits in 2020, but, save for online, they are expected to revert to far slower growth in 2021 and beyond. That distortion must be factored into any five-year plan as the outlier that it is.

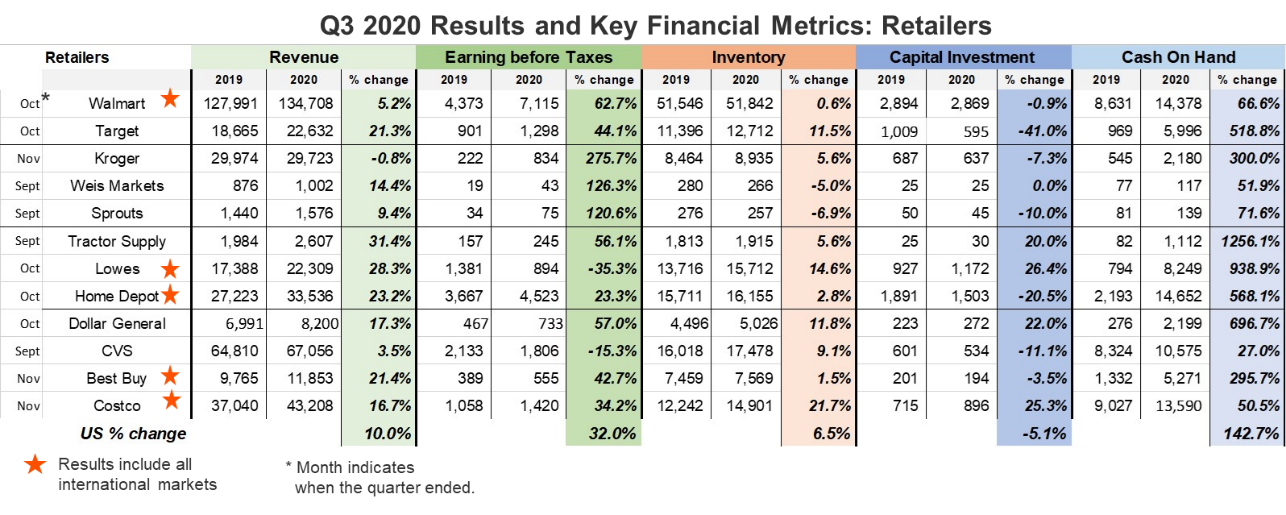

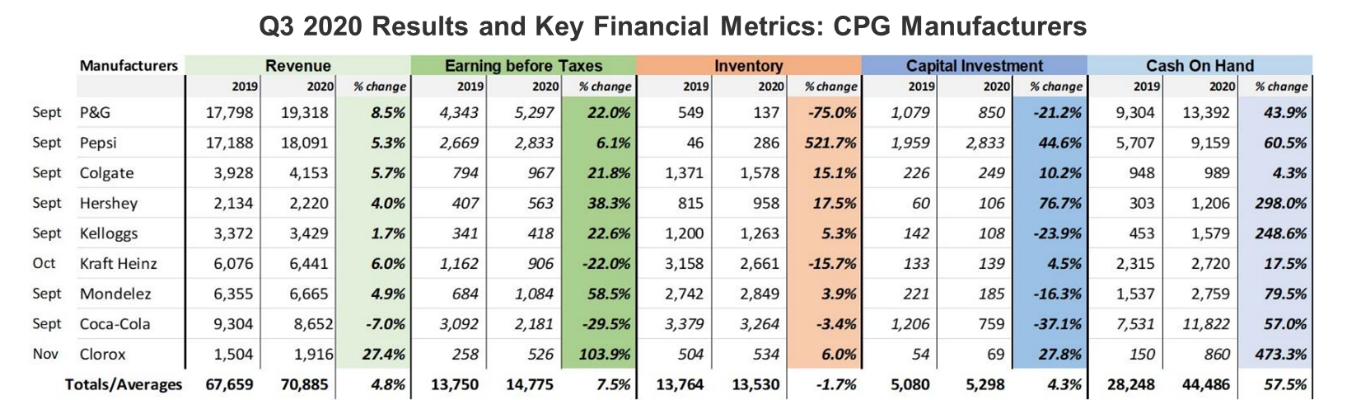

Among major retailers, operating margins before taxes also increased dramatically, in many cases to levels triple their 2019 norms. Retailers cut back inventory on hand initially due to supply chain disruptions but continued to rationalize SKUs to cut down on the number of products. Capital expenditures dropped as retailers redirected almost all funds they would have used on new stores and remodels to ecommerce. But most surprising was the increase in cash on hand, which grew to historic levels across the industry as retailers built their reserves to hedge against an unpredictable future.

In 2021, these changes will slowly shift as shoppers start spending money on restaurants, entertainment, sports events, and travel, threatening not only those sales increases but also those amazing profits. Cash on hand is by definition unproductive, so expect a major push by companies and their stakeholders to get it working. Given 2020 spending on IT infrastructure and fulfillment, expect retailers to pour some of that cash into M&As, new stores, and remodels.

Evolving shopper needs

The pandemic, massive job losses, social distancing, working and schooling from home, and government stimulus and income support all created a radically different shopper than in the past. The major impact was the rise in retail sales as other spending options disappeared, but also the triple-digit surge in home delivery of online groceries, an increase nearly as large across all of online retailing.

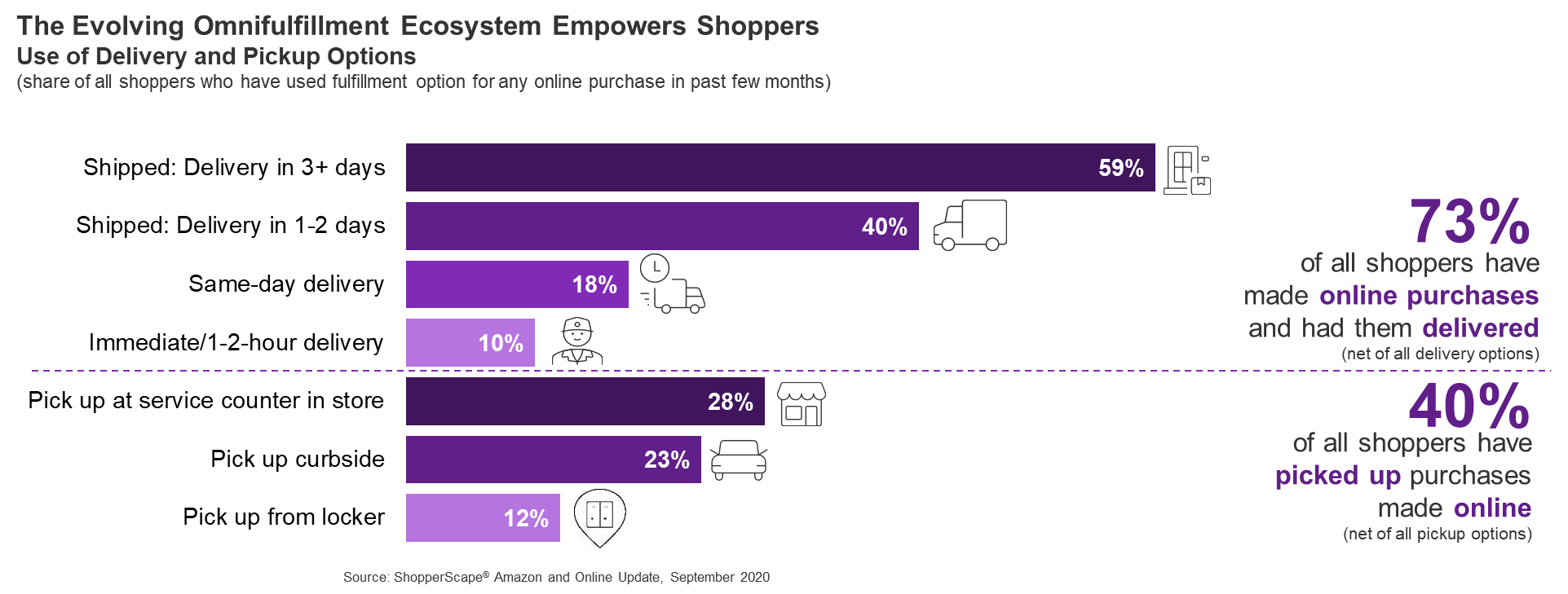

Fulfillment became the main area of concern for shoppers and retailers as stores beefed up their in-store and curbside pickup options. Retailers expanded direct shipments to homes using their own or third-party services. Stores got better at handling inventory and tracking fulfillment.

In 2021, these changes are expected to continue, though they will be less stressful for retailers. Most shoppers have become more price-aware as the recession wears on, but the stimulus bill passed in late 2020, combined with the expected increase in household payments once the Democrats take control of Congress in 2021, will support continued high levels of retail spending. The open question is how much of the increase in online shopping will continue and how much will revert to in-store spending.

Retailer portfolio and profitability

Inventory shrank due to supply chain issues that started in January and were stressed repeatedly by shopper buying surges. Logistics were impacted as well. It was no surprise that retailers reduced SKUs in light of those early difficulties, but so did manufacturers that struggled with production and raw material sourcing. The real surprise, though, was that shoppers generally did not notice or were comfortable substituting other brands. And eliminating less profitable items raised margins to record levels.

This will be a key issue for everyone in retail in 2021: Can they continue to generate the margins while responding to both changing shoppers and the revival of competition? Manufacturers are already reinvesting in new product development, but retailers will have a hard time walking away from these new and very high margins.

Boundless commerce

In 2021, shoppers expect to browse, select, transact, fulfill, return, and engage wherever and whenever they want. Retail must meet these new expectations profitably, not simply as a reaction to a public emergency. Retailers have already started building this foundation, mostly by spending record amounts on online retail capabilities and by expanding their stores’ omnichannel capabilities. In 2021, when retailer incomes decline as shoppers have more places to spend, the results of those efforts will become clear.

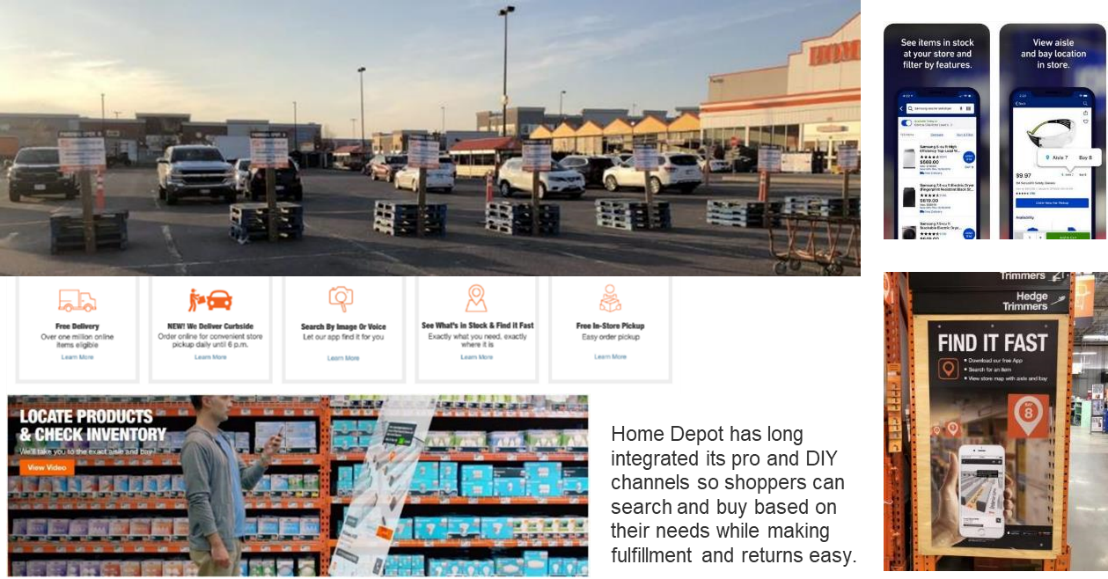

To date, most retailers have relied on handheld apps and cloud computing to create an omnichannel environment. In 2021, expect them to change over their physical spaces and create digitally aware merchandising. The home improvement channel (which, incidentally, had the largest sales increase across all retail in 2020) has made the most progress here. It has mastered mapping stores and services to online and employee apps and also rebuilt and streamlined reverse logistics or returns. How other channels rebuild the store in the new year should be measured against those standards.

Increased social IQ

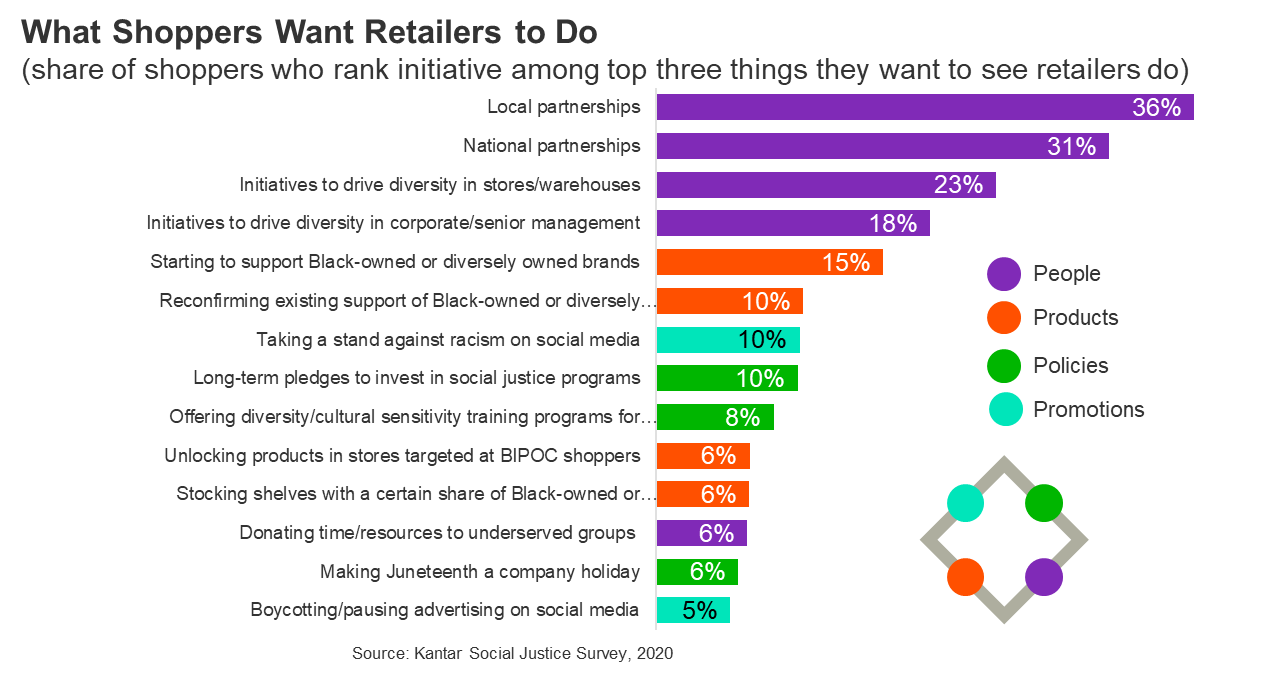

The foundation of social IQ and pervasive awareness is based on the value that retailers show to all people and their diversity. In 2019, it was a checkbox item for marketing. In 2020, it became a full-blown requirement across retail. In 2020 the Black Lives Matter movement awakened the whole US, but the social justice movement was truly global and continues to color how retail will change in 2021. The core is about people and transparency, which encompasses not just shoppers, but also employees, sourcing, manufacturers, marketing, and a host of other areas that will be a concern in 2021.

The other hurdle concerns the normal urge to define and segment populations into easily discussed groups. These core marketing activities will need to be refined to avoid communication conflicts that can result from too-broad assumptions. The key will lie in nuanced statements and being aware of the risks inherent in broad messages and product development.

Health, safety, and sustainability

Disease management in 2020 created new baselines for retailers as shoppers expected clean and safe stores. They saw stores as both risks as well as places safer than medical offices and hospitals to find health solutions. In many cases, food and health-related retail stores were the only stores open during lockdowns, combining these different drivers.

Sustainability may have far more impact in the next 10 years. The surge of climate change events, such as massive firestorms, continental dust clouds, hurricanes, and temperature extremes, undoubtedly made it a top-of-mind issue again. But so did the mass of household waste and recycling that the population witnessed firsthand throughout 2020. In 2021, expect actions by the government, rather than individual shoppers, to become more prominent in getting this crisis under control.

Key insights heading into 2021

- The great abnormal will be the result of trying to align changing complexity to planning. The biggest factors will continue to be the Fed and retailers’ massive amounts of cash on hand.

- Shoppers will continue to shift with new complexities. Plan for potential changes to price, promotion, access, and information but not certainties.

- Retail portfolios of SKUs, brands, services, and locations will shift throughout the year. Base plans on fewer opportunities to get it right.

- Boundless commerce is driving a new vision of frictionless access to products, information, options, and fulfillment. Plan against the whole for all retailers.

- Social IQ is the new baseline for discussing marketing, messaging, and product development. It’s highly important to retailers.

- Health, safety, and sustainability clearly are changing in the eyes of the shopper. But be very aware of how governments start speaking to sustainability.

Watch Commerce Now: 2021 Retail Outlook to dive-deeper into the following themes with our retail and shopper experts and fill out the form below to download the infographic for a visual guide of the retail landscape in 2021.