What is happening to sales of smartphones, and the share of the market each operating system commands?

In the fourth quarter of 2020, Android grew year-on-year in Japan (+3.3 percentage points) and China (+4.7% points). A closer look at China shows local brands driving sales growth in the latest quarter; Huawei took 46.5% share (+2.3% points) and Xiaomi 11.7% share (+1.5% points).

Chinese brands continue to expand their global footprint, with Xiaomi making up almost one in five sales across Europe's top five major market (EU5); it has seen an impressive growth of 5 percentage points year on year, largely driven by Italy and Spain. Oppo, although still relatively small, also grew in all reported markets.

Global brands that track smaller sales share experienced some successes relative to their market size: Motorola was up by more than 1.5 share points year-on-year in Germany and the USA. Google grew in Japan by +2.1% points year on year.

Samsung, meanwhile, has held its fort across all reported markets in the fourth quarter, with sales share up by 2.3% points year on year across the EU5, driven by France and Germany.

iPhone 12 proving popular

While still in the early stages of launch, iPhone 12 models are tracking well. The iPhone 12 model proves popular and is already the second most sold smartphone in Q4 2020 in the USA, China and Australia. The iPhone 11 continues to attract buyers and is the number one model sold across the EU5, USA and Australia. In Japan, smaller form factors are most desired with iPhone SE (2nd generation) topping the sales list, making up almost one in five devices sold and was followed by iPhone 12 Mini in second place.

Interestingly, when comparing the specific features driving sales of each iPhone 12 model, the iPhone 12 Pro Max skews heaviest among consumers looking for “quality of the camera” across the EU5 and USA. Prior to purchasing, they attained their main source of information direct from Apple.com and, across the EU5, are more likely to have “watched new product launch event”. Other specific features to also rank in the top 3 for buyers of iPhone 12 models were “reliability and durability” (across EU5 and China), and “size of the screen” (across EU5, Japan and Australia).

The importance of 5G

With much noise around 5G, iPhone 12 certainly stands out for driving sales through this capability. In all reported markets, at least 25% of iPhone 12 models were bought for ‘5G capability’, the most being 51% of buyers in the USA. Compared to average smartphones sold, iPhone 12 models indexed by at least 117, the highest index being 367 across EU5.

In Q4 2020, the share of smartphone owners connected to a 5G network was higher year on year in Great Britain, Italy, Spain, Urban China and Australia. Across all reported markets, at least 50% of smartphone owners intending to buy in the next 6 months, intend to buy a 5G enabled smartphone; compared to intenders of last year, this is up in all markets except in France and Japan.

Where are smartphone purchases made?

Over half of smartphones were sold online in the latest quarter, across all report markets. Online smartphone sales were up in EU5 (+8.7% points), USA (+7.3% points) and Australia (+11% points) where the top source of information prior to buying was through websites. This highlights the continued need to develop and deploy digital marketing strategies to respond to the aggressive channel growth of the category.

Also not to be underestimated is the power of influence through friends and family. This touchpoint finds itself in the Top 5 purchase touchpoints across all reported markets and is number one in China, with 20% of smartphone buyers going to their friends and family as the main source of information prior to purchasing.

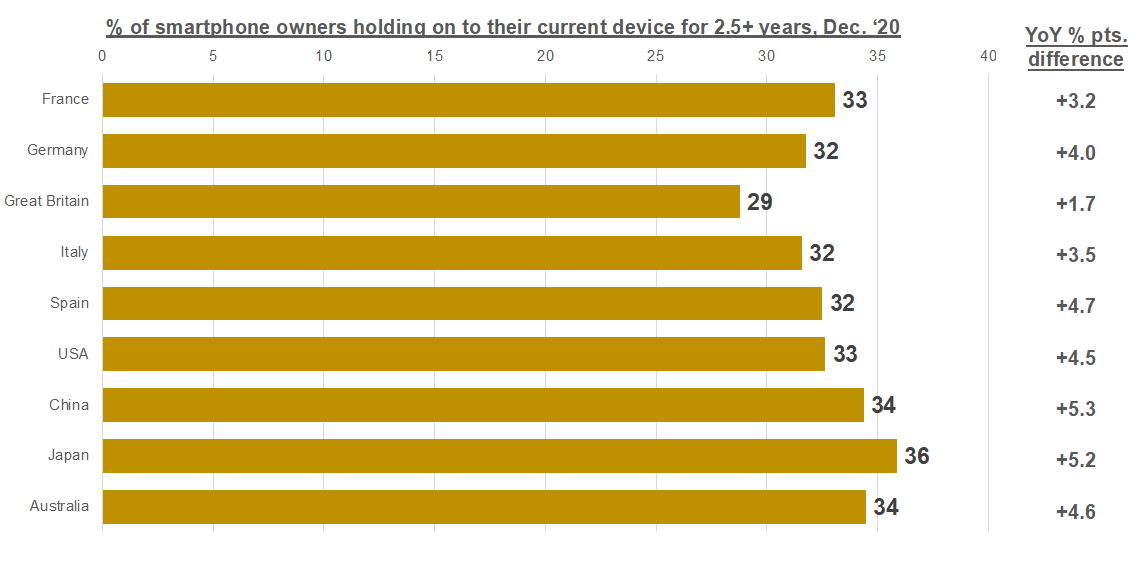

It’s not new news that smartphone sales slowed through 2020, as a result of the pandemic, with many consumers delaying their smartphone purchases and some even cancelling their plans completely; this will certainly push out replacement cycles further. Almost a third of smartphone owners have held their current device for at least 2.5 years, and these figures have increased year on year. With many consumers being repressed by current environmental and economic challenges, this year is set to be extremely interesting as we monitor and anticipate returning consumers to market.