In an earlier article, we identified that “repeat purchase” and “advertising retention” are an important part of understanding the long-term effects of advertising. We showed that quantifying long-term results is tricky for several reasons, but most importantly comes down to a limited understanding of brand equity and its relationship to sales. We zoomed in on our first scenario, where sales are increasing and brand equity declining, and outlined possible reasons and solutions.

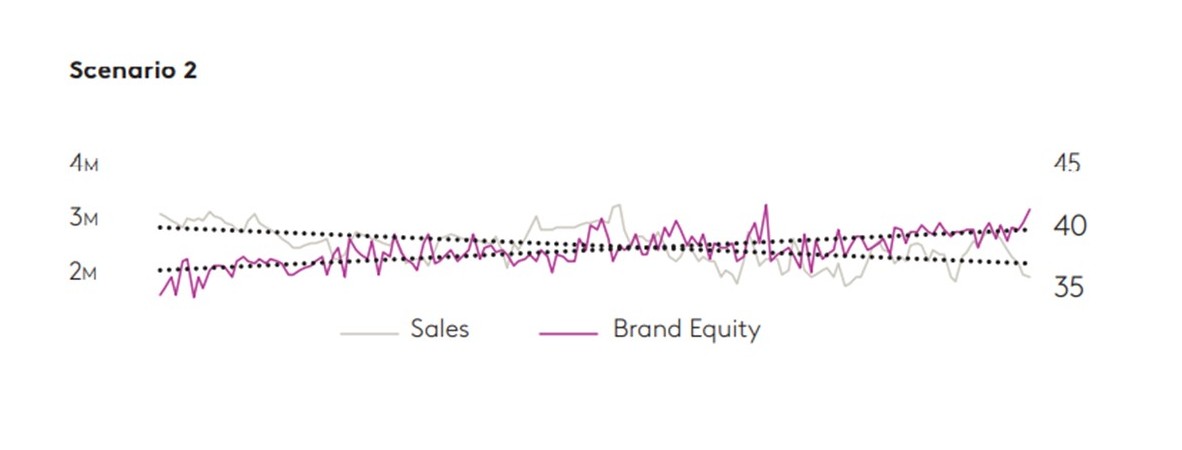

In this article, we investigate the scenario where sales are decreasing, and brand equity is increasing or flat. There are two possible reasons for this (outside of a seasonal decline in brand and category sales.)

1. A price increase

Higher prices might lead to a reduction in sales volume, but they can also build perceptions that increase brand equity. Price increases may be part of a strategic plan to become a “premium” or “higher-quality” brand or it may just be the business passing on higher costs to its customers. As a marketer, one needs to assess the potential implication a price increase could have on sales volume. The question is: would you like to attract a succession of price-sensitive, one-time consumers, or would you prefer ones who stick with your brand and continue to be “repeat purchasers”? An increased price could lead to a loss in consumers and therefore sales, but the brand still has strong equity, which in turn could lead to higher profits.

2. A reduction in media pressure

Low quality/weak creative, reduced media weight (reducing share of voice), or changes in media flighting/phasing could result in a decline in sales, but brand equity may stay the same (at least in the short-term.) To better diagnose why this might be the case, it’s important to look at sales as “base vs. incremental” when comparing to brand metrics.

As we know, incremental brand sales reflect the short-term response of the brand, whereas base brand sales reflect the long-term equity of the brand; stronger brands are usually able to sustain base sales despite a change in strategy. Signals of short-term and long-term sales impact (effectiveness drivers) typically reside in different brand KPIs, varying by category involvement, brand status, and competitive activity. This gives us a view on which brand perceptions drive short-term volume and which drive long-term brand predisposition or both.

At Kantar, our experience has led us to a set of short- and long-term metrics that are indicative of “base vs incremental” movements in sales.

Short-term metrics: Drivers of mental availability or salience e.g. communications awareness, top of mind, unaided awareness, rational brand associations.

Long-term metrics: Brand affinity, emotional brand associations, purchase intent/consideration.

Short-term vs. long-term metrics often turn out to be complementary, not contradictory.

A decline in sales is always a cause for concern

Sales could be dropping due to a decline in short-term brand metrics (while long-term metrics are holding up), as changes in the strategy may not have translated to equity changes. The good news is this can quickly be reversed by identifying the cause and addressing the problem. For example. if it’s a creative issue, it would be essential to change elements within the creative, the message, or the execution itself. It could be due to a decline in long-term brand metrics (while short-term metrics are holding up or even increasing). This is a bigger cause for concern, as it might reflect changing attitudes to the brand (despite the growing awareness) which will in time translate into (more) declining sales.

Case study

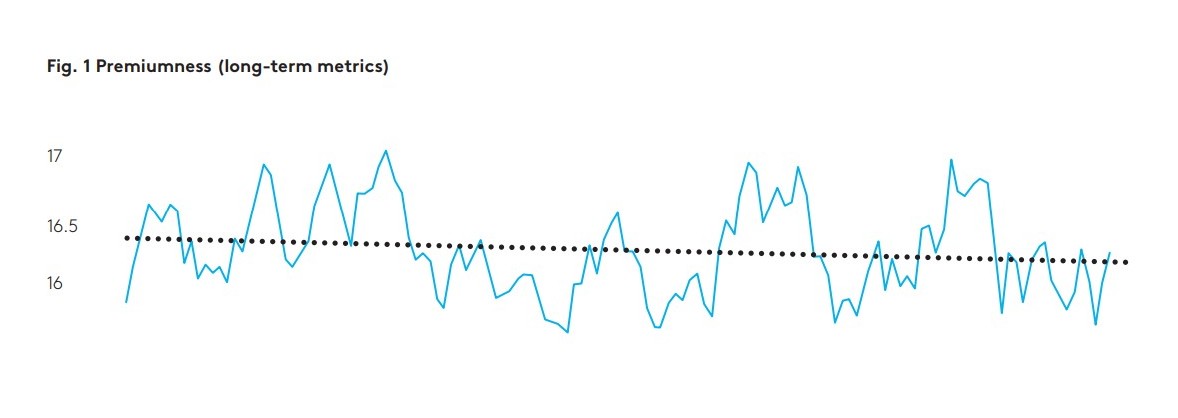

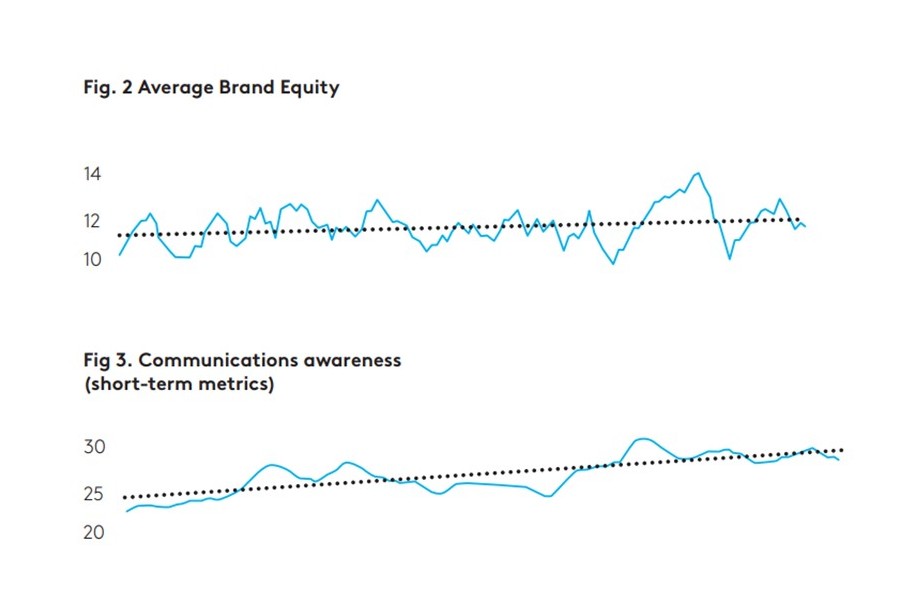

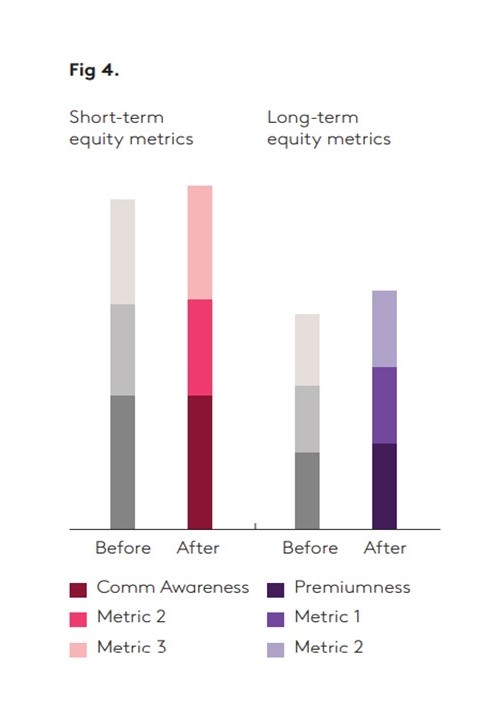

A large beverage brand faced a challenge in understanding this disconnect between brand tracking metrics and sales. Sales for this brand were declining, but brand metrics were not. As a first step we identified the core brand KPIs that best represented its “base and incremental” sales. Using short- and long-term brand KPIs as part of a broader modelling framework, we determined that the “premiumness” of the brand was getting eroded slowly over time (Figure 2), and this was not being reflected in its overall brand equity scores (Figures 3 and 4).

The decline in sales was due to a proliferation of brands within the premium segment. This was having an immediate impact on the company’s sales, but its short-term brand KPIs were either increasing or staying the same. The premium beverage segment was under a spotlight… but the brand was being perceived as less premium compared to the other competitors.

The model helped to disprove the idea that sales activation tactics were eroding quality perceptions. It also proved that “premiumness” declines were mainly coming from increased perception of “high quality” amongst a range of other beverage brands.

The brand incorporated these learnings into new messaging, which was focused around premium quality and sophistication. This resulted in an increase in average scores for those metrics (Figure 4), which in turn drove brand KPIs including consideration, “worth what it costs” scores, and claimed recent consumption. More importantly, it reversed sales decline – in fact, sales grew by 2%.

A sales decline is always cause for concern, but to better understand the severity of the problem we recommend breaking sales down into “base and Incremental” and identifying which brand metrics best relates to each. Decline in short-term KPIs (like awareness) could well be addressed with a quick fix, whereas declines in long-term KPIs might suggest bigger issues, as we saw with the beverage case study. In the next article I will focus on the scenarios when both sales and brand equity are moving in the same direction, their possible implications, and our suggestions on how best to optimize marketing strategies.