An article in the New York Times asks, “Is $6 too much for a bag of Ruffles?” And for many US consumers the answer would appear to be yes.

Commenting on the fact that people are buying fewer salty snacks from its Frito-Lay brands Ramon Laguarta, PepsiCo’s chief executive, said, “There is clearly a consumer that is more challenged, and a consumer that is telling us that in particular parts of our portfolio, they want more value to stay with our brands.”

That people are challenged should not have come as a surprise. In 2023, when asked about the affordability of snack brands 29% of people interviewed by Kantar BrandZ in the US* said that they could not afford them currently, and a further 35% said they could just afford snacks but were seeking to cut back.

Less inflation and more an underlying cost-of-living crisis

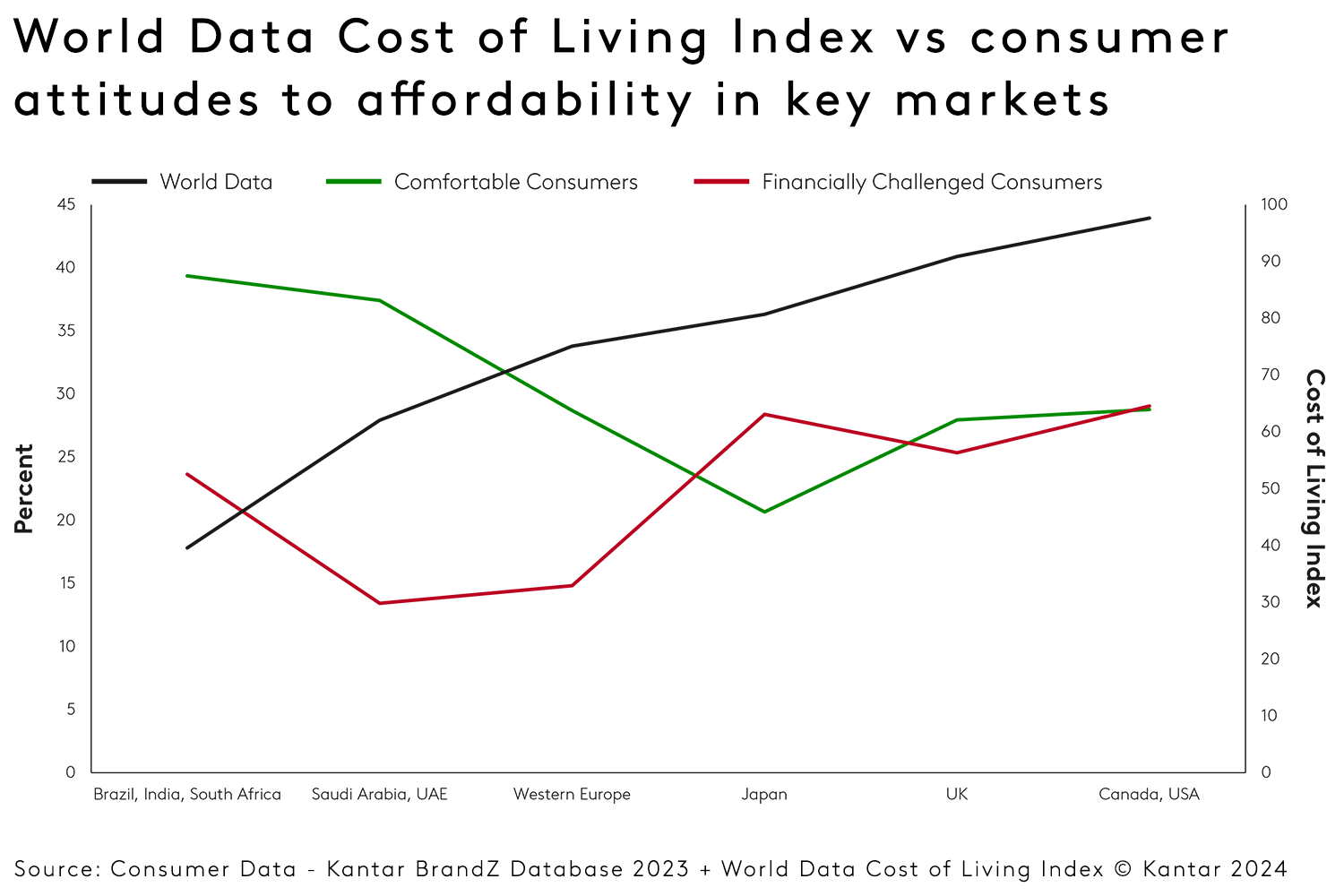

While the NYT article attributes falling sales to recent inflationary pressures, our analysis points to a more substantive, underlying cost of living crisis that impacts the most developed economies. The USA is the 18th most expensive country to live in.

While rising food prices increase the pressure on US consumers, many people were already struggling to make ends meet, and in 2023 Kantar U.S. MONITOR found 38% of people reporting high or severe economic anxiety, up from a low of 26% in 2021. Unfortunately, snack brands are not the only product that people said they could not afford, with Kantar BrandZ’s 2023 US cars survey showing over 50% of drivers in the US agreeing that they cannot currently afford a new car.

A cost of living crisis most apparent in developed economies

Shockingly, on average, more people in the US claim to be struggling to afford a range of product categories than in any other country, closely followed by those in Canada, Japan, and the UK. Countries like Brazil, India and South Africa have a much lower cost of living, and results in these countries tend to polarize between people reporting that they can comfortably afford the category asked about and people who said they were struggling.

While disentangling the many factors that influence whether people believe they are struggling or not, there are some clear patterns in the data beyond the general cost of living. Basic food and household items remain affordable to most people in developed countries, but many struggle to afford expensive, intermittent purchases like cars and home appliances.

Even the financially challenged will buy premium brands

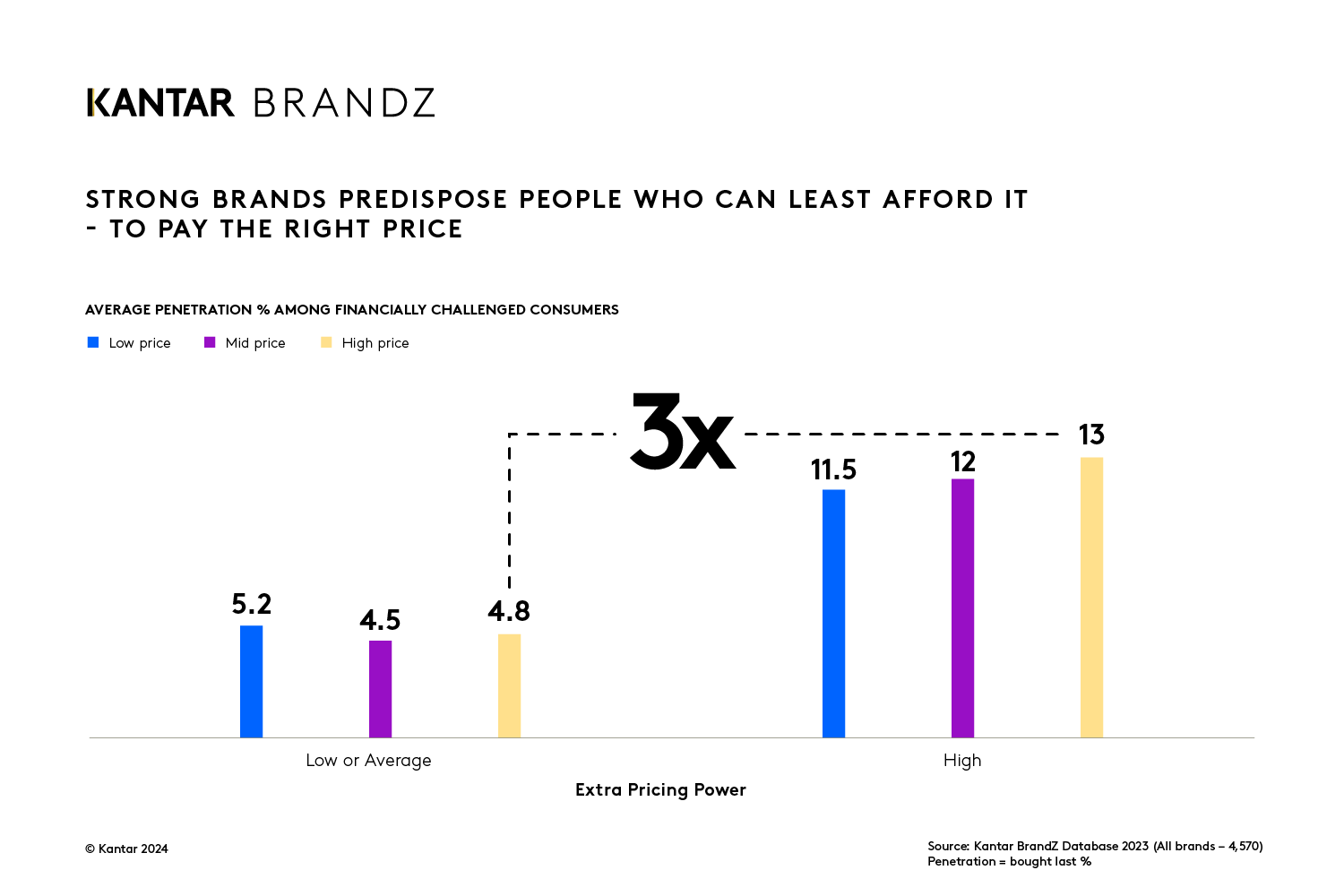

Price point, however, is not the only determinant of which brands people buy. Even those who are more financially challenged will often buy a more expensive brand if they believe it offers them better value. When money is short, people would rather pay a little more in the belief that the investment will be worthwhile. In the US, brands like Pampers, Apple iPhone, Hilton and Samsung home appliances manage to spread their appeal equally to those who believe they can comfortably afford them and those who are struggling.

How do these brands manage to achieve a strong market share irrespective of whether people are struggling or not? They possess extra Pricing Power. That is, consumer perceptions that reduce price elasticity. These brands perform better, lower the risk of disappointment, are more secure, last longer, or give an emotional boost – making these brands worth paying for, even if they cost more than the average brand.

Notably, a quarter of brands in the USA have extra Pricing Power and they capture three times the market share of the brands that do not, among both those financially challenged and those who are comfortable. When it comes to more indulgent purchases like travel, people are even more likely to choose the brands that they perceive are worth paying for.

Does your brand portfolio provide affordable options?

It is time for brands to realize that a substantial proportion of consumers in developed economies are struggling to afford their products and services. The answer is not to manipulate price through shrinkflation or temporary price deals, but by building perceptions that the brand is worth the price people are asked to pay. In doing so, it is important to recognize that not everyone is able to afford a top-of-the-line product. The answer is to offer a range: providing good value, no frills variants, without jeopardizing sales to those that can afford to pay for a better option. The answer to the affordability crisis is not more features, or better features, it is offering the right features at the right price.

Many brands have ridden the recent wave of inflation and raised prices well beyond what they were before the pandemic and reported higher earnings as a result. However, our Kantar BrandZ data finds that the combination of higher house prices and rents, healthcare, and inflation are squeezing the budgets of many in developed economies. Unless they wish to face weaker earnings in future, brands must find ways to keep their products and services affordable to those that are financially challenged, and preserve margins across value, mass and premium offerings.

*Throughout 2023, Kantar BrandZ interviewed 129,200 respondents covering 326 categories across 29 markets, measuring 4,570 brands. Within this, 36 US categories were included.

For a quick read on a brand’s strategic pricing position, Kantar’s free interactive tool, BrandSnapshot powered by BrandZ, provides intelligence on 14,000 brands. Find out more here.