In a time when choice is rife for consumers and disruption produces new opportunities regularly, understanding the factors that help or hinder your brand to be chosen by customers is vital. I was recently involved in a Kantar study that explored the reasons consumers stay loyal in their reported buying behaviours, as well as the motivations to switch brands. We interviewed 3657 people from the Kantar Profiles Network across 12 countries (US, Brazil, UK, France, Germany, Spain, The Netherlands, India, Singapore, Indonesia, Mainland China and Korea) covering 11 categories of products and services.

What did we find?

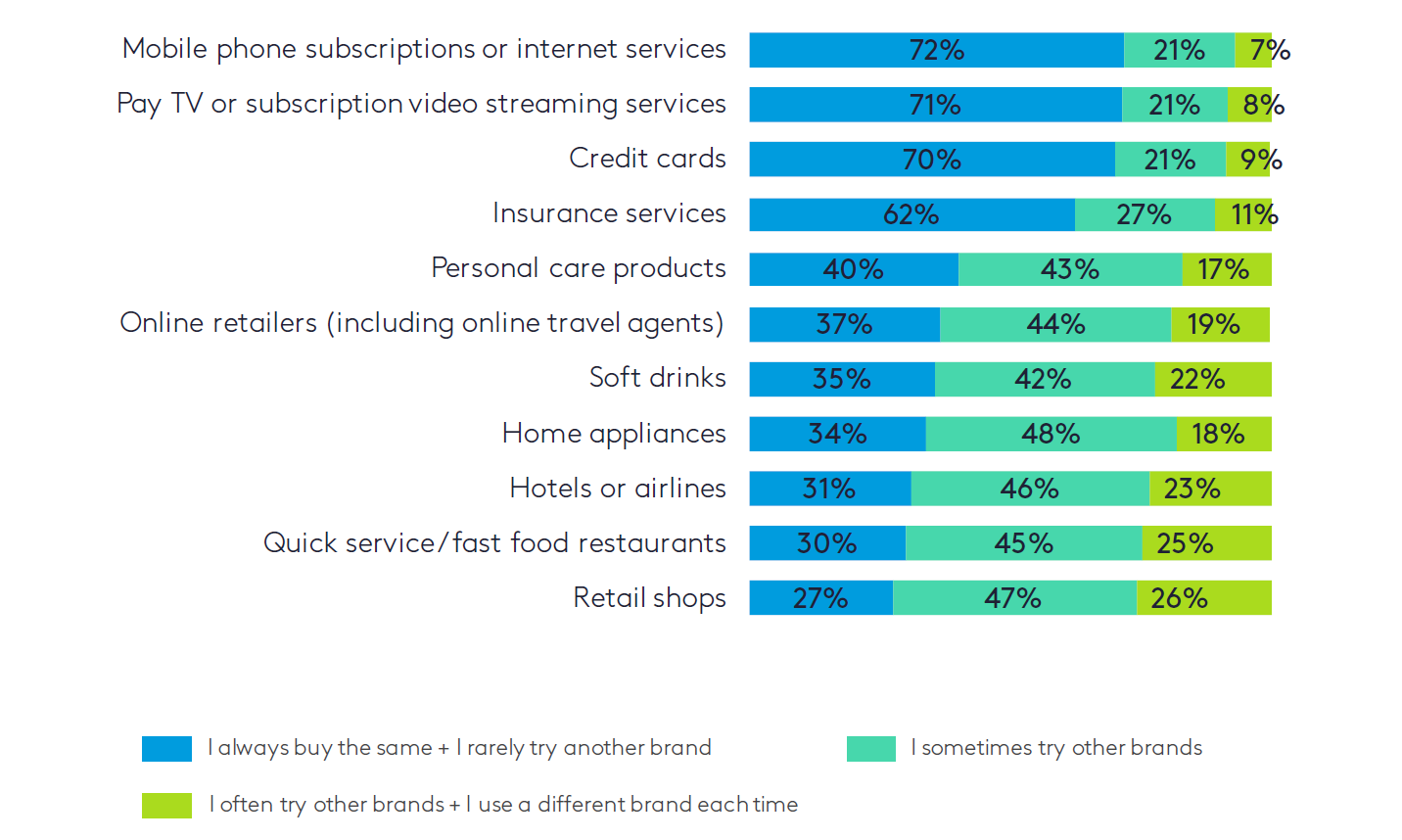

Loyalty is largely skewed towards services

The level of loyalty reported by respondents varied significantly across categories as displayed in the chart below. The top four categories, however, were all-serviced based, with Mobile phone subscriptions/ internet services, PayTV or subscription video streaming services, Credit cards and Insurance services ranking highest for global loyalty. You can see a notable drop at personal care products (40%), ranking 5th, as loyalty continues to decline in consumer product categories.

Price and quality matter most

The circumstances around choosing different categories of products and services varied greatly. If we look at the reason’s consumers choose to remain with the same brand, however, 'Cost' and 'Knowledge of quality' were reported to be the most influential for 90% of consumers. Habitual factors were the least impactful, with 'Repeat purchases' and 'Never having tried anywhere else' reported by just 35% of respondents.

Price sensitivity is a key factor for loyalty

In fact, 87% of consumers interviewed reported to shop around for the best prices and deals. This statement is reported for all the categories of product or services.

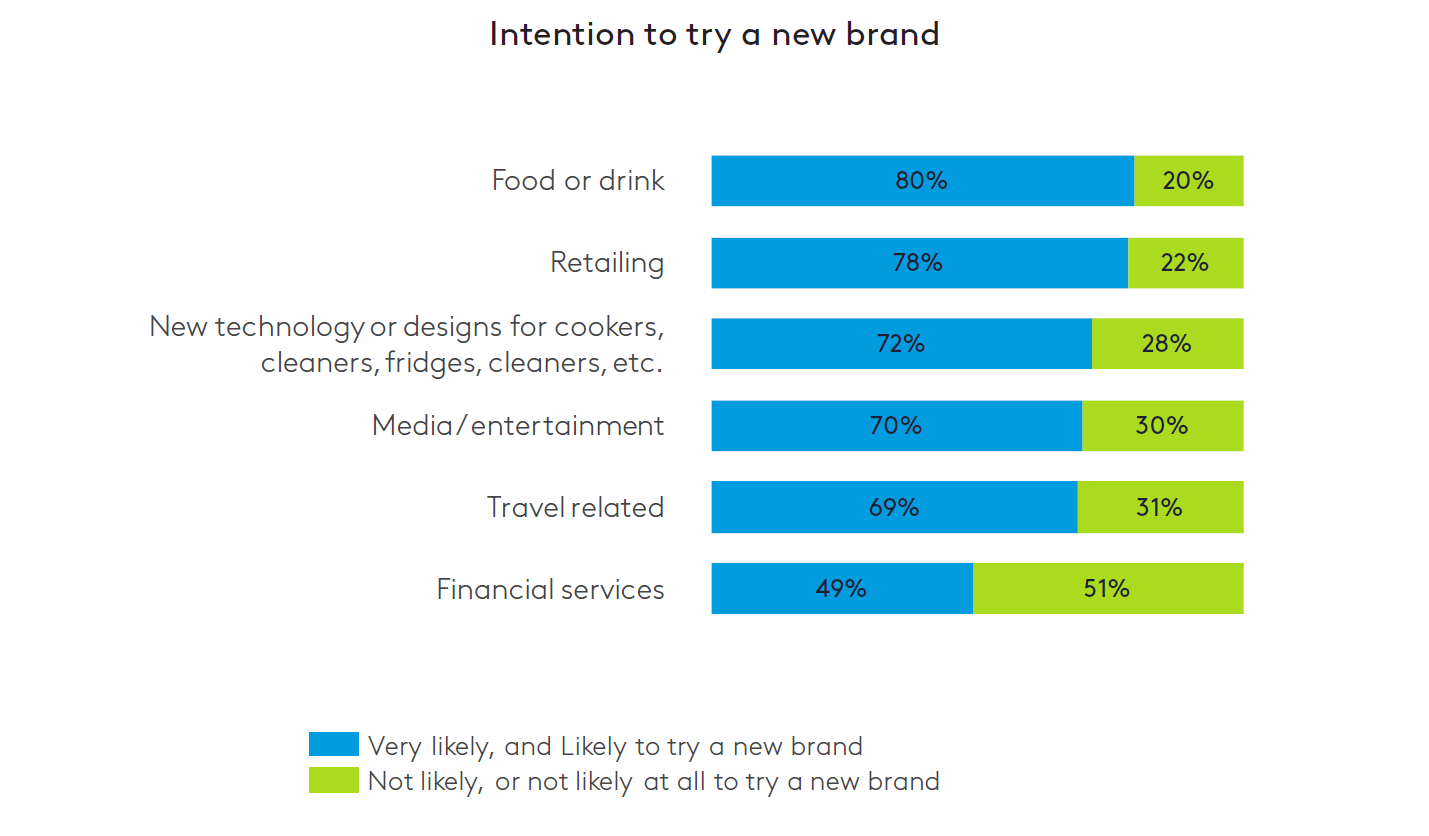

New releases impact food or drink products and retail defection the most

How likely are consumers willing to test out a new brand in the marketplace? 8 out of 10 respondents stated they are 'in with the new' when it comes to trying food and drink brands. Retail (78%) had s a similarly high propensity, whereas Financial Services had the lowest intention to try a new brand (49%). At an overall level, defection appeared to be significantly higher in Asia and Americas regions than in Europe.

Explore more of the findings, including the country level data in the full Consumer Loyalty Report.