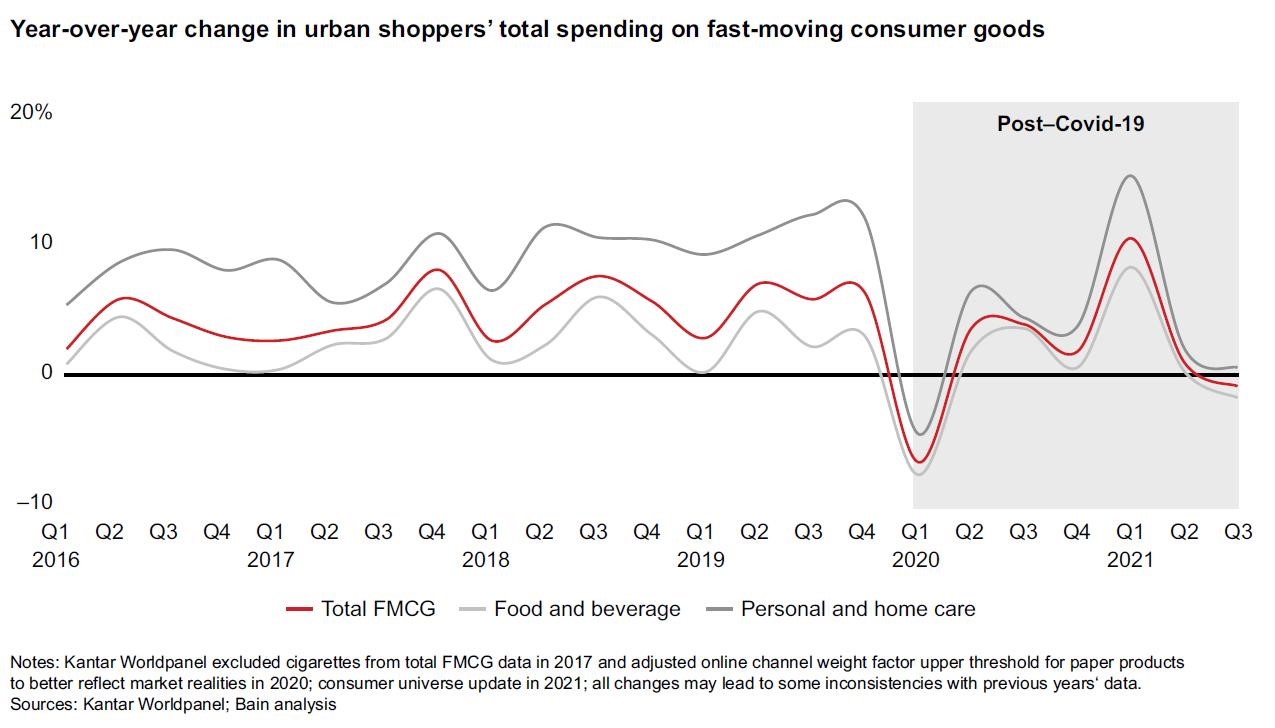

The massive decline in FMCG spending in the Chinese Mainland during the first half of 2020, brought on by the COVID-19 pandemic, ended with an equally dramatic rebound in the second half of the year. This resurgence continued unabated into the first quarter of 2021, but Q3 brought an abrupt slowdown, with overall growth dropping to -0.8% compared with the same period last year.

These are among the findings of new research released in our 10th annual China Shopper Report Vol II, created in collaboration with Bain & Company. As in previous years, we analyzed 26 key categories that span the four largest consumer goods sectors: packaged food, beverages, personal care and home care.

Despite the stalled third quarter performance, it’s clear that the foundations of consumption growth are still firmly in place. Mainland China’s middle class continues to expand, which is contributing to steady growth. Following years of 5% growth up to 2019, and flat performance in 2020, FMCG volume increased by 3.3% in the first nine months of 2021, while value rose 3.6%. This represents a modest post-COVID-19 recovery, even though average selling prices remained depressed, gaining only 0.3%.

The transition to ecommerce accelerated in the first three quarters of 2021, with penetration in online channels increasing at the expense of most offline channels. Ecommerce value grew 24%, while all offline channels except convenience stores lost value – with the grocery channel dropping furthest at 13%.

The share of growth within online channels has been steadily changing over the past three years. A game that was once mostly limited to two main players is rapidly expanding to include a host of new competitors. COVID-19 has significantly changed the way Chinese consumers shop. Live-streaming has become an important marketing and sales channel on ecommerce platforms, with top key opinion leaders contributing to sizable sales. The trend for Community Group Buying, which emerged in 2016, accelerated dramatically during COVID-19 but started to cool down and consolidate in Q3 of 2021.

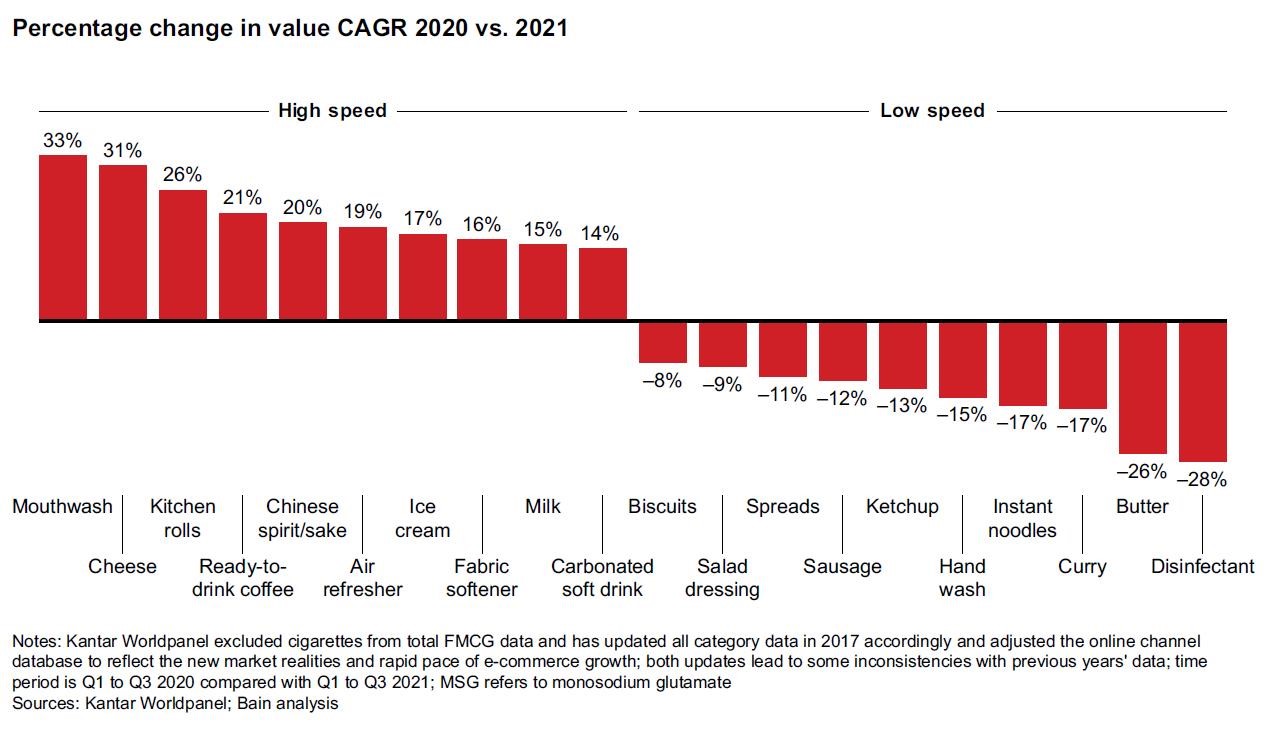

As in previous years, we identified the categories that grew very fast in 2021, as well as those that grew slowly or declined. In general, the categories that consumers associate with improved quality of life – such as cheese, air fresheners, mouthwash and ready-to-drink coffee – grew at high speed, while categories that were popular during the lockdown months, such as instant noodles, biscuits, disinfectants and hand wash, experienced negative growth.

Since 2018, we have tracked 46 fast-rising brands that were new to the Chinese market, to see what determines their success or failure. Only 17 have continued to do well, while the others have faded away or plateaued. Our analysis has revealed that in order to become a standout success, an emerging brand needs to excel across four capabilities:

- Brand Power: Earn share of mind with the target consumer group, and scale that group

- Product Ecosystem: Build superhero SKUs and extend from the core to establish a winning portfolio and a pipeline of innovations

- Channel Capability: Develop a consumer-centric, omnichannel presence and extensive geographic reach, empowered by digital tools, to go deeper and wider

- Organization Capability: Build agile iterative capabilities (empowered by data and insights) to constantly review and improve product development, channel expansion and business models

Incumbent and emerging brands will always co-exist in Mainland China’s FMCG market, and contribute in their own ways. The best companies will learn from each other and thrive together. This cross-fertilization will eventually bring more possibilities and excitement to Chinese consumers.