The highest unemployment rate in 30 years, at 11%, combined with the price pressure we are seeing as a result of increased inflation around the world, is stopping the Gross Domestic Product (GDP) per capita from bouncing back to pre-COVID levels in Latin America.

Ecuador, Mexico and Central America should recover in 2022 – because their economies use the US dollar. Things are less encouraging in Argentina, Brazil, Colombia and Peru, where stabilization is likely to take two more years.

Every time another wave of COVID-19 hits, that is one more roadblock on the path to recovery, bringing further uncertainty. More restrictions could result in more price increases. This is driving consumers in Latam to cut down on their expenditure, removing items from their carts or trading down. This reflects on FMCG growth, which has dropped and stabilized to single digits, after high sustained rates in 2020 – while the average number of shopping trips per person in 2021 was 6% lower than pre-pandemic levels.

As might be expected, consumers at all socioeconomic levels (SELs) have adapted their shopping choices. It is worth noting that shoppers in lower SELs are key to growth in Latam because they represent the largest group in terms of households, and have contributed the most to the results in recent quarters. Yet, the higher purchase power they enjoyed in 2020, boosted by government aid, was only a short-term trend. This means their purchase behaviors, in particular the way they buy essential baskets such as Foods, is a strong indicator of consumers’ (new) priorities.

In Mexico, spending on Foods is the highest among all Latam countries, and cart composition has remained consistent. In Brazil, which has the lowest spend in the region, households are prioritizing staples, and downtrading to cheaper categories and brands. Facing an even more difficult situation, Colombians are having to decrease the number of categories they take home, or choose private labels, and Argentinians are increasingly choosing to buy products covered by Precios Cuidados – a special pricing program agreed between the private sector and the government.

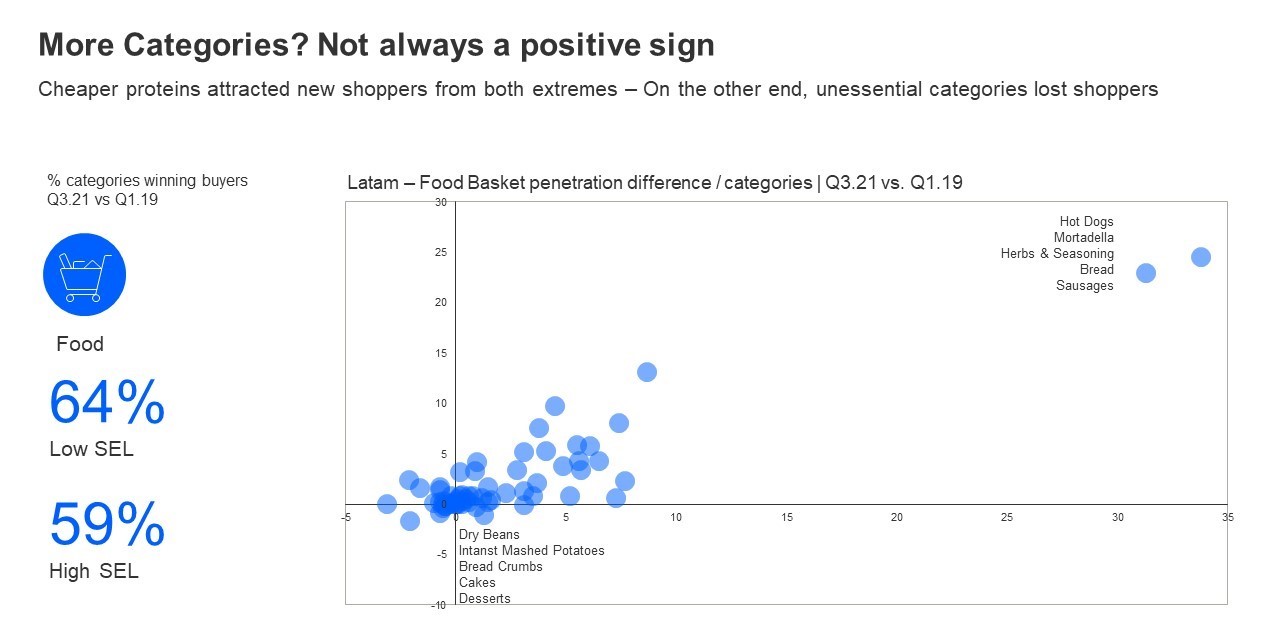

Food categories are expanding their buyer base across Latam. Looking at penetration increases by SEL, 64% of the categories have gained low-income buyers, while 59% have gained high-income buyers, an indicator that sounds positive at first. However, if we look deeper, people are choosing cheaper proteins: mortadella, hot dog and pork sausage have increased their buyers, while more superfluous categories such as desserts and cakes have lost shoppers. This is a direct impact of rationalization within households.

Food accounts for the better part of household spend across all SELs and sets the pace of spending on FMCG as a whole. It is necessary to keep tracking consumers’ preferences in each country, in order to respond quickly to the market as it changes.

Retail spend per occasion is also a good indicator of how much disposable income shoppers have, helping to inform your strategy per country and even by channel. This may be the time for manufacturers to adapt their portfolios and improve the perceived affordability of their products.

To understand future consumption trends in Latin America and the opportunities to grow, talk to us today.