During recent months, the Food and Beverage sectors in Latam have begun to move in very different directions. Kantar’s new report on food and beverage in the region shows how consumption within these two sectors has changed over the course of the pandemic. Will shoppers’ new habits continue?

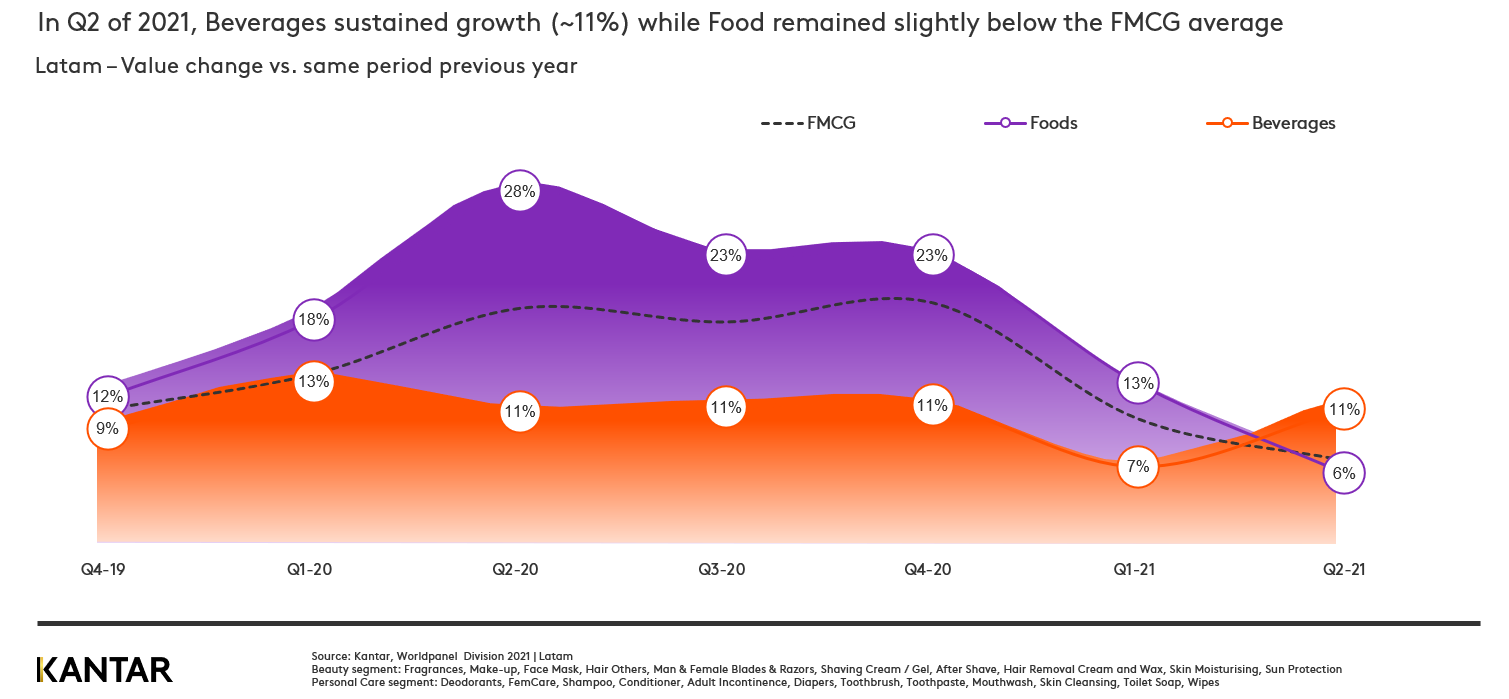

Social distancing caused in-home food consumption to reach the highest level seen this decade in mid-2020, but the impact on beverages was less positive. However, the slowdown in FMCG value growth seen in 2021 has mainly affected food, while beverage maintained its growth at 11%. Alcoholic beverages have gained 2% in share of spend due to the premiumization of the segment, with beer brands gaining the most buyers in the past 12 months.

Both food and beverage grew above overall FMCG levels during the hardest months of the pandemic, but in 2021 the deceleration has mainly hit food categories.

As reopening has been gradual across the region, spending on out-of-home meal occasions has not yet recovered. Brazil and Mexico, two important economies for Latin America, are below pre-pandemic consumption levels, especially the former.

There are fewer growing categories in 2021, although the ‘non-essentials’ are still in the spotlight – rising above pre-crisis levels and underscoring the bigger ‘indulgence’ role food and beverages play in-home. Alcoholic beverages have been scaling up their value share, reaching 62.8%. Carbonated soft drinks and juice-based drinks began to lose volume before the pandemic, and this trend continues, which we can relate to the fact that consumers’ health awareness is increasing.

Almost three quarters of the fastest-growing brands have premium tiers that are also on the rise, and more than 60% of the top 20 growing brands are expanding their premium offers. One premium snack brand in Brazil added four million new buyers between September 2020 and September 2021 – fill in the form below to download the full report and discover which one.

When it comes to channels, mini markets and independent stores contributed the most to the growth of Food and Beverage. This was driven by an increase in the share of occasions they captured, by successfully increasing their relevance to shoppers. And of course, ecommerce has soared in popularity, with 17 million consumers already using this channel to access Food and Beverage products in Latin America.

Contact us to explore this topic further, and find out more about how people buy and consume FMCG in Latam.