As digital banking becomes the norm, artificial intelligence is increasingly woven into the way consumers seek support, research financial products, and interact with their banks. But while AI is gaining traction, comfort levels vary widely depending on the task, and trust is far from guaranteed.

Findings from Kantar’s How U.S. Consumers Are Managing Finances study reveal a nuanced picture of how Americans perceive AI’s role in money management, highlighting both emerging opportunities and cautionary barriers for financial brands.

Let’s review some of the findings.

How AI chat fits into the modern banking experience

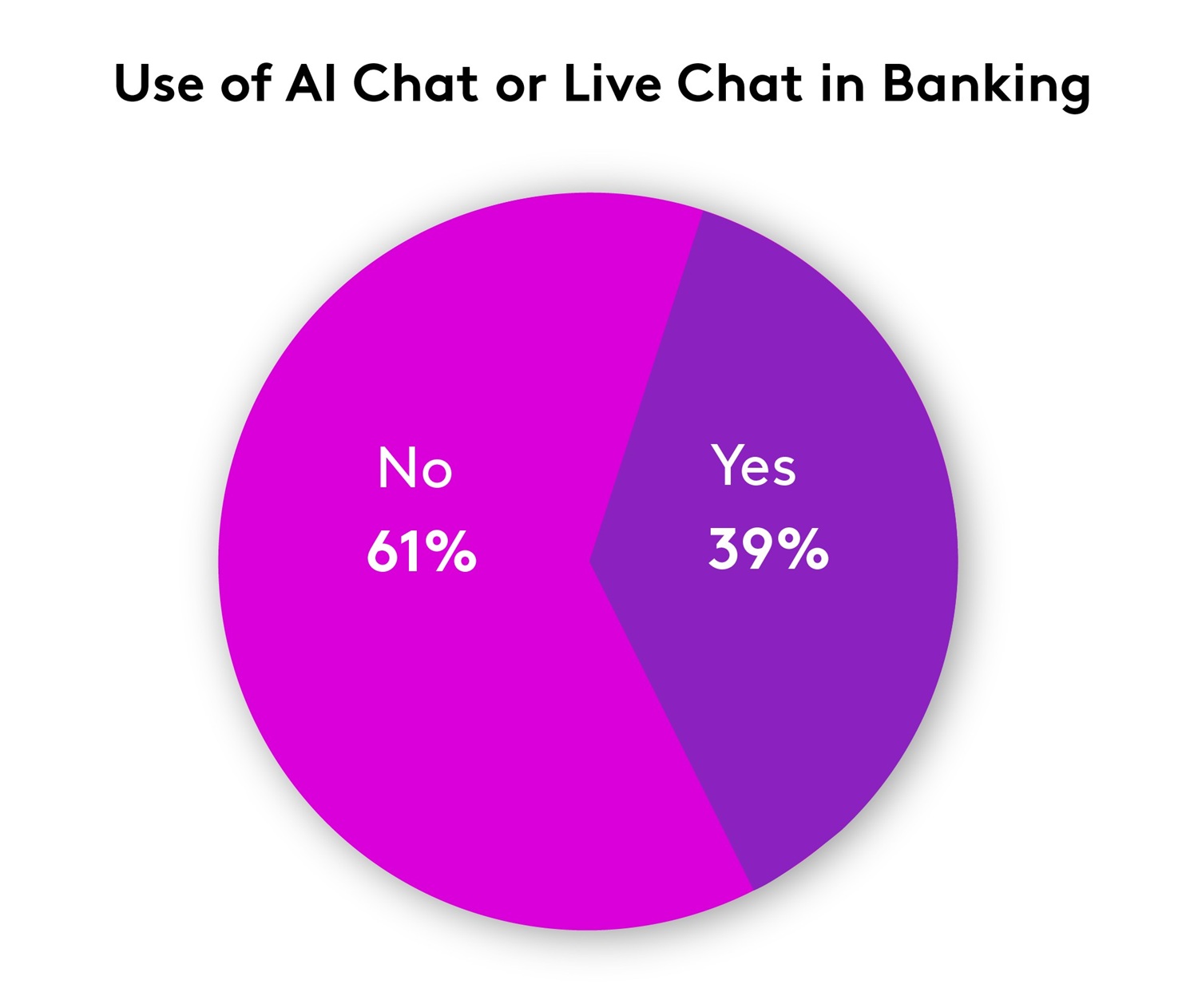

Among U.S. consumers who bank digitally via mobile or online channels, 39% have used their bank’s AI chat or live chat tools. Adoption is especially strong among younger generations, with Gen Z leading at 64% and Millennials close behind at 53%. Usage declines significantly with age, falling to 31% among Gen X and just 18% among Boomers, which reflects broader generational gaps in digital tool engagement.

These findings signal that conversational AI is quickly becoming an expected feature, particularly for younger customers accustomed to instant, on‑demand service.

Where consumers draw the line on AI banking

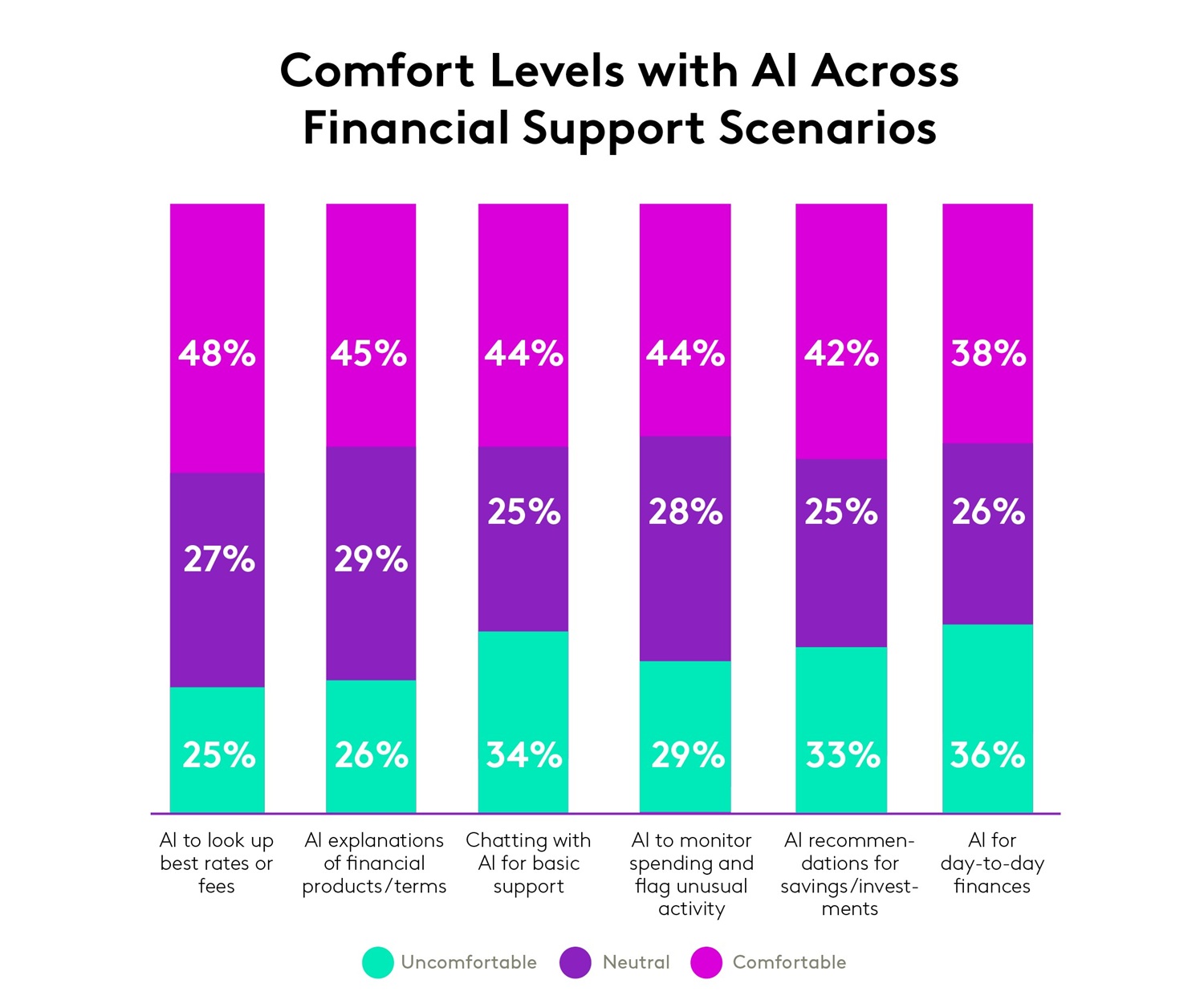

When asked where they feel comfortable relying on AI, U.S. consumers draw a clear distinction between information gathering and financial decision‑making.

Nearly half of consumers (48%) feel comfortable using AI to look up best rates and fees. This suggests an appetite for AI‑powered comparison tools, smart search, and informational support, especially for tasks that feel low‑risk and efficiency‑driven.

On the other end of the spectrum, U.S. consumers report the greatest discomfort (36%) with AI tools that handle day‑to‑day financial management. While AI can enhance research and guidance, consumers still want autonomy and human oversight in daily money matters.

Key takeaways for financial brands

1. AI should empower (not replace) human decision‑making.

U.S. consumers lean on AI for quick information but remain cautious about handing over ongoing financial tasks. Positioning AI as an assistive layer rather than a full decision‑maker will align better with current comfort levels.

2. Transparency and clarity are essential to building trust.

As consumers weigh the risks of AI‑driven support, financial institutions will need to double down on clear explanations of how AI is used, how data is protected, and where humans remain in the loop.

3. Younger generations are early adopters.

Gen Z and Millennials already embrace AI‑enabled service. Banks that invest early in conversational AI, smart search, and predictive insights will be better positioned to win loyalty from these increasingly influential segments.

Conclusion

AI’s role in financial services is growing, but consumer trust is conditional. People welcome AI as a research tool yet remain hesitant to rely on it for active money management. Financial brands that introduce AI thoughtfully, transparently, and with a human‑centered approach will be best positioned to meet evolving expectations.

Get more answers

For more findings from this study, access the full report How U.S. Consumers are Managing Finances and get actionable insights to help financial services brands adapt to the needs of today.

About the Research

This research was conducted online via Accelerated Answers, Kantar’s agile survey platform for custom research, among 1,000 U.S. respondents sourced from Kantar’s Premium Panels. All interviews were conducted as online self-completion between 14 - 20 October 2025 and includes consumers ages 18–84 who hold an account with a bank or financial institution, balanced to be nationally representative by age, gender, and region.