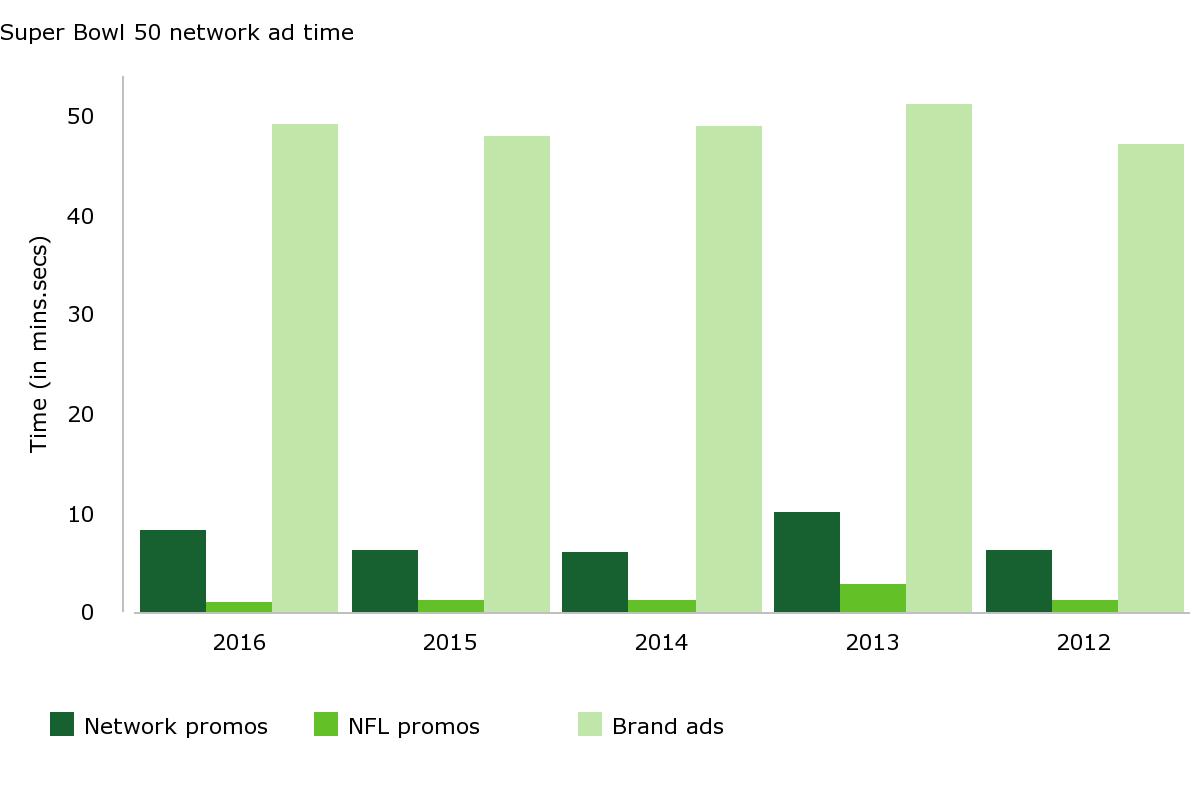

More than 49 minutes of ad time. Super Bowl 50 featured the third-largest amount of network commercial time from paying advertisers, surpassed only by the 2014 and 2015 contests. (The 2013 game had an unusually high number of ads due to delays caused by a blackout, but promos accounted for a much higher share of the volume.) Between the opening kickoff and the final whistle, CBS aired 39 minutes, 15 seconds of messages from brand advertisers.

When promotional spots from CBS and the NFL are included in the tally, the total volume of ad time swells to 49 minutes, 35 seconds, making it the second most cluttered Super Bowl in history as measured by ad time – second only to the Blackout Bowl. The game itself lasted 3 hours, 43 minutes (including halftime) which means advertising accounted for 22 percent of the total broadcast.

By comparison during the 2015 NFL regular season, ad time made up 21 percent of an average Sunday game.

Top spenders. Excluding the promotional messages aired by CBS and the NFL, there were a total of 62 in-game spots aired by 53 different advertisers from 46 unique parent company owners. The difference in counts between advertisers and parent owners is because some parents ran commercials from more than one of the advertisers they own. (Example: Pepsico featured three advertisers in the game - Doritos, Mountain Dew and Pepsi - and ran two ads for Doritos).

Anheuser-Busch InBev was the top parent company in the game with 3:30 minutes of ad time and five units. Fiat Chrysler and Pepsico were tied for second place with 2:00 of commercials apiece. Four companies had 1:30 of ad time (Deutsche Telekom, Honda Motor, Toyota Motor and Valeant Pharmaceuticals).

Rookie advertisers in the Super Bowl. An NFL team is allowed to dress 53 players for a game and that’s how many were on the Denver and Carolina sidelines. Fifteen of their combined 106 players (14%) were rookies. By coincidence, the size of the Super Bowl advertiser team also numbered 53, 17 of which were rookies (32%), indicating that buying a TV spot is the easiest way for a rookie to play in the Super Bowl.

The 2016 newbies represented 27% of paid ad time. Four were financial service providers (PayPal, Quicken Loans, Sofi Lending and Suntrust Bank), making this the most populous segment. Consumer technology products claimed three spots (Amazon, FitBit and LG).

Pharmaceuticals (Astrazeneca, Xifaxam) and consumer packaged goods (Colgate, Persil) each had a pair of members on the rookie advertiser squad.

The other freshmen were a diverse lot and included Apartments.com, Dollar Shave Club, Marmot, Pokemon20, Shock Top and Beyonce’s paid announcement of her 2016 stadium tour. Some external press reports erroneously reported that Buick was a first-time 2016 advertiser. In fact, Buick made its Super Bowl debut in 1990.

Nearly half of 2015 sponsors did not return in 2016. Of the 40 parent companies that pitched messages in the 2015 game, 18 were absent in 2016 for an attrition rate of 45%. This is on par with the 47% average attrition rate for the ten years from 2006-2015.

Longer length commercials: automakers lead the way. Of the 62 in-game commercials from brand advertisers, 17 were one minute or longer. That’s the third highest total ever but still a sharp drop from the prior two years. The surfeit of longer announcements meant that many commercial pods contained just two units from paying sponsors, which potentially gave each ad more visibility to the audience.

Auto manufacturers were again the most frequent users of long-form ads but at a lower rate than recent years. Auto accounted for five of the 17 long form ads (29%).

Top categories. As expected, auto manufacturers had the biggest presence of all ad categories in the game, accounting for 11 spots and 9:00 minutes of ad time. Financial was the second largest category with six units and 3:45 of messages. Beer advertising, all from Anheuser Busch InBev, and movies were close behind. These four categories represented 57% of the 39 minutes, 15 seconds of total ad time from paying advertisers.

For many Super Bowl viewers accustomed to seeing lots of car, movie and beer ads, the surprise category of 2016 (in perhaps more ways than sponsors intended) was Pharmaceutical. Three brands ran 2:30 of ad time to present various health conditions (constipation, diarrhea, toe fungus) that aren’t typically discussed in polite company. While Pharma is a staple of TV advertising, its participation in the Super Bowl has been rare. Before 2016, the last two Pharma category ads appeared in 2015 and 2007.

Auto ads: a slight reduction. The auto category footprint in Super Bowl 50 looked both similar and different as compared to 2015. The total number of nameplates held steady at nine, but total ad time declined by two minutes to 9:00, which is the lowest level since 2010. The BMW, Dodge, Fiat, Lexus, Mercedes Benz and Nissan nameplates did not return from their 2015 stints. Their departures were exactly offset by the addition of Acura, Audi, Buick, Honda, Hyundai and Mini. As a comparison, from 2001 through 2010 the auto category averaged six spots and 3:45 of in-game ad time per year.

The social Super Bowl. The Super Bowl generates plenty of second-screen activity during the game and marketers have accelerated their efforts to attract and engage multi-platform consumers. It’s evidenced by the number of ads containing a social media element.

According to Kantar Media’s analysis of paid commercials shown during the game, hashtags again surpassed URLs as the most popular call to action mechanism: 52% of paid ads (27 of 62) contained a hashtag as compared to 43% with a URL (23 of 62). (Some ads had both hashtags and URLs, and thus would be counted twice.) Both proportions were down slightly from 2015.