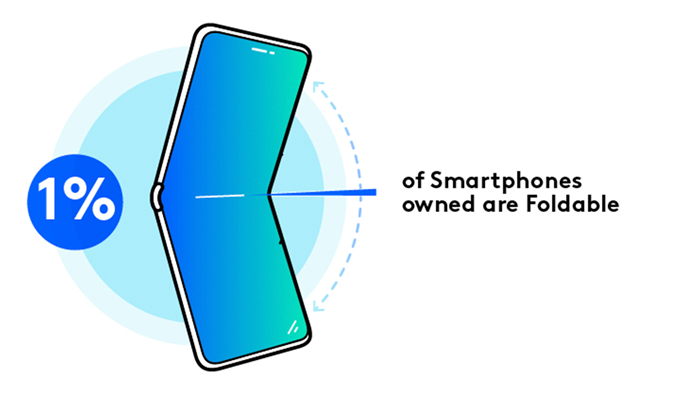

Despite a 60% year-on-year rise in adoption, Foldable Smartphones still comprise just 1% of total smartphones owned across the UK, Germany, France, Italy, Spain, the US, and Australia. This is according to the latest Worldpanel ComTech study from Kantar, the world’s leading marketing data and analytics company.

Source: ComTech, Worldpanel Division, Kantar

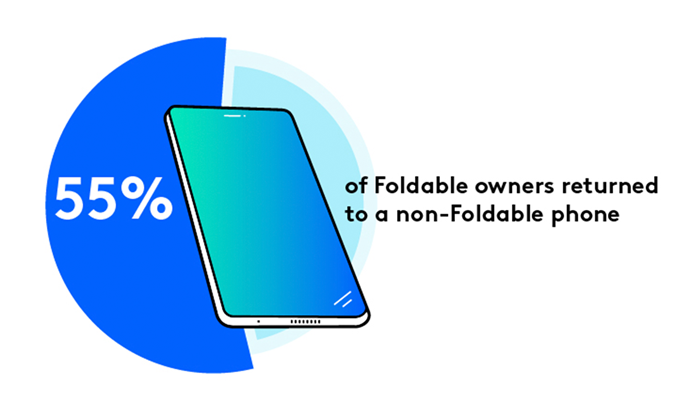

Loyalty to the product category also appears to be lacking. Of the Foldable owners who upgraded their phone in the last 12 months, 55% chose to move back to a conventional smartphone.

Source: ComTech, Worldpanel Division, Kantar

Samsung dominates the market, with a more than 90% volume share. Having launched its first Foldable Smartphone in 2019, the brand is benefiting from a ‘first mover’ advantage: its hardware is more advanced than its competitors, it has built a ‘series’ through releasing a new generation model each year, and it is able to dictate market pricing.

Flip devices – which fold in half, offering a smaller external display when closed – account for 67% of all Foldable Smartphones owned. Fold devices – featuring displays that can be folded inwards to transform a traditional sized screen into a larger tablet-sized display – account for 33%.

Barriers to adoption and loyalty

The customers that swapped their Foldable Smartphone for a non-foldable option were willing to pay a premium price for their new device, with the most popular models purchased including the Samsung Galaxy S23 Ultra and Galaxy S22 Ultra, Google Pixel 7 Pro, and iPhone 14 Pro Max. This indicates that the high price of Foldable phones is not forming a barrier to loyalty.

On the other hand, Foldable owners cite lower levels of satisfaction with frequency of software updates, after-care support, and battery life compared to owners of ‘super-premium’ non-foldable smartphones.

Jack Hamlin, Global Consumer Insights director at Worldpanel Division, Kantar, said: “The Foldable market has ample room for growth, and as more people buy, fewer will feel the first-move anxiety associated with adopting a new technology. However, it remains to be seen whether Foldables can move from a niche technology toward mass adoption. This raises questions about whether the products are addressing a consumer need – or doing so effectively enough to encourage additional buyers to purchase. Consumers are highly influenced by advocacy and word-of-mouth, and the impact that disgruntled Foldable owners and negative reviews are having on the category cannot be overstated.”

Apple – a notable omission

More original equipment manufacturers (OEM) are entering the Foldable market, with innovations that will support growth through improving build quality, creating healthy competition and reducing price (no new Foldable has yet launched under $999). Huawei, Motorola, Oppo, Vivo and Google have all entered the space with various designs. However, there remains one notable omission from the pack – Apple.

Jack Hamlin said: “With 37% of smartphone ownership shares, iPhone cannot be ignored as a competitor that has the potential to drive and sustain overall Foldable adoption, if it decides to join the market. According to Worldpanel’s data, 25% of the current 180 million iPhone owners with an intention to purchase a new phone in the next six months state that they want to purchase a Foldable phone. The majority also want to remain loyal to Apple.”

Kantar’s Worldpanel ComTech continuous monthly tracking of the Foldable Smartphone market enables accurate sales forecasting, intended versus actual behavior, manufacturer growth and more. Reach out to understand and track the Smartphone market in further detail. The analysis explores current winners, the effect that the category is having and is set to have on the wider industry, the drivers to Foldable adoption, and the intention to buy.