When the National Basketball Association, Major League Baseball and the National Hockey League began cancelling games, it became clear that life was no longer normal in the U.S. The impact of those decisions reflects the power and reach of sports.

Sports and sports marketing have grown because it is pretty much the only game in town in terms of delivering a massive amount of people at once—in person and especially on TV.

But sports were affected by the pandemic perhaps more than any other industry, as major league sports completely shut down for nearly four months. When Kantar Sports MONITOR—a syndicated fan insights service for brands seeking a deeper, more human connection with modern fans—surveyed Americans in May, 76% of self-identified sports fans said the absence of sports had affected them somewhat or very much.

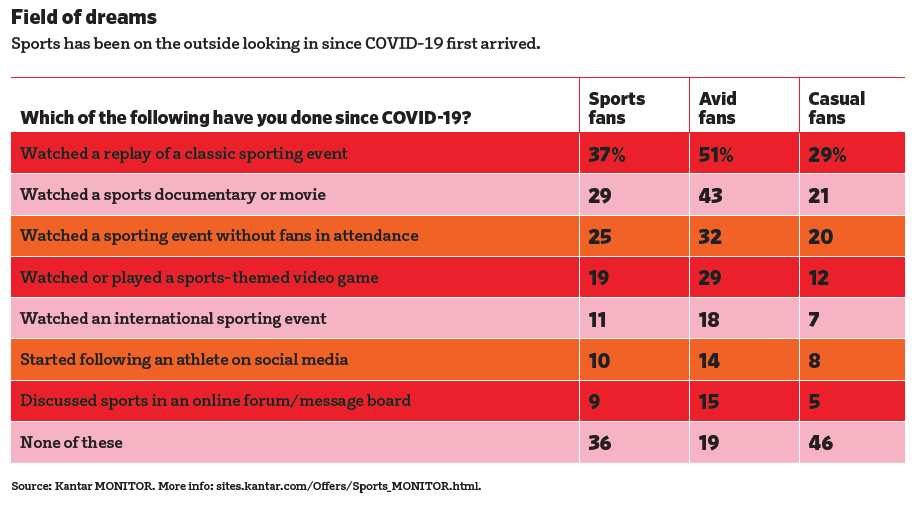

Although broadcasters tried to fill the void—and programming schedules—with game replays, documentaries and sports matches from overseas, we found that most fans didn’t engage with those second-choice options; nearly half of casual fans (46%) indicated they didn’t engage in any of seven options:

Although all four major leagues—NBA, MLB, NHL, NFL—are back playing, the break in play has left brands wondering how sports will be affected long-term.

On the positive side, the broader rise of legal sports gambling may provide even more engagement and viewership, just as fantasy sports has done. The riveting play of the U.S. national soccer team at the 2019 FIFA Women’s World Cup sparked more interest in women’s sports than the country has ever seen. And even with declining TV ratings for some individual sports post-COVID, rights fees and team valuations remain as strong as ever.

But there are points of concern for brands that have relied on sports as a key marketing channel—especially since many headwinds the sports industry was facing pre-pandemic have accelerated.

One such issue is the emotional connection that members of Gen Z, Americans born between 1997 and 2010, are developing with sports. In the decade from 2008 to 2018, the percentage of kids aged 6 to 12 who participated in baseball on a regular basis fell from 16.5% to 13.6%; basketball from 16.5% to 14.1%; soccer from 10.4% to 7.4%; and tackle football from 3.7% to 2.8%, according to The Aspen Institute. With youth sports experiencing a stark decline due to the coronavirus, and time on social media and gaming skyrocketing among youth, the long-term appeal of sports with this generation may be endangered like never before.

Another pressing issue is declining interest in the in-person fan experience, which was lagging way before anyone had heard the term “novel coronavirus.” According to a Kantar Sports MONITOR survey in 2019, 64% of Americans aged 12-plus agreed with the statement, “In most cases, I’d prefer to watch sports on television versus in person.” In October 2020, just 29% of fans said they felt either extremely or very confident that a sporting event in their local community was safe. But it goes beyond attitudes: attendance at virtually all professional and collegiate sports either is flat or has gone down over the last decade, with MLB attendance falling 14% over the past 12 years. Professional and collegiate leagues and teams across the country must provide greater assurance and a most cost-friendly experience if they expect to fill stadiums and arenas once fans are able to return.

One last major headwind facing sports and sports marketing post-pandemic is that many Americans say they have come to appreciate some aspects of the slower pace forced upon them by the pandemic. According to Kantar Sports MONITOR, the percentage of sports fans who indicate that they’re “enjoying a slower pace of life and would like to keep it even after the coronavirus is over” rose from 57% in April to 64% in September. With a majority of fans expressing dissatisfaction with sports viewing experience amidst cardboard fans and piped-in crowd noise—two-thirds (64%) said watching sports was less enjoyable compared to pre-COVID-19—it’s clear that 2021 will be a critical year for the future of sports properties, leagues and brands. The ones that do the best job of evolving their sport to align best with the trends in a post-coronavirus world will very likely be the ones that thrive well into the future.

To learn more about what the pandemic means for sports and marketers, download the full Marketing in the Time of Covid-19 report.