Consumers in Latin America are facing greater challenges than those in many other regions of the globe, with higher than average inflation and unemployment rates, and lower economic growth. The signs are that 2022 will be even more challenging: growth in the region is expected to reach just half the forecast global rate, with twice the inflation and unemployment levels. On top of that, general price increases, with the added push the Ukrainian crisis is giving to inflation, will ultimately hit spending power even further.

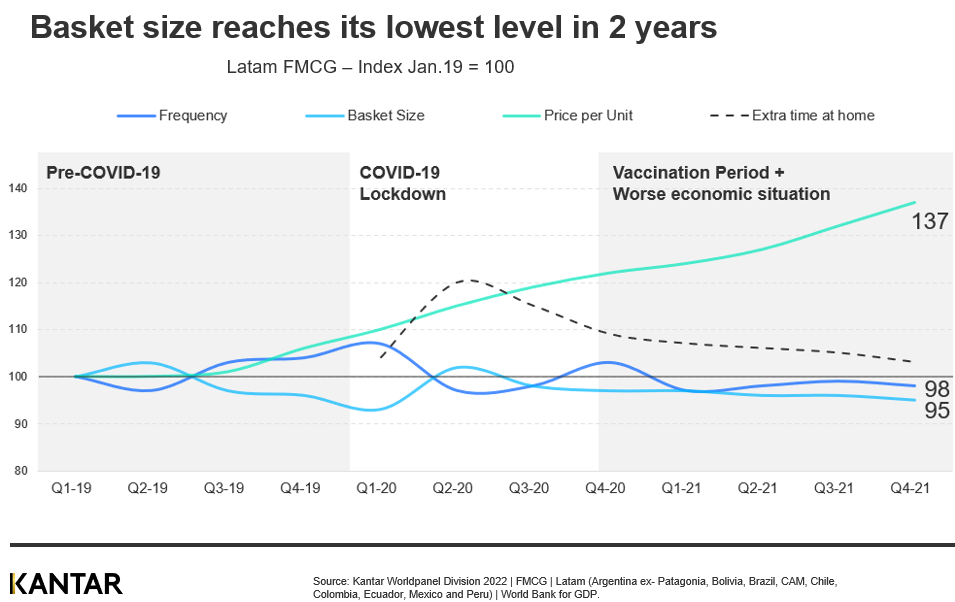

The result has been a slowdown in in-home FMCG consumption, which dropped by 1.5% in 2021, following a rise of 6.3% in 2020 when Covid-19 restrictions were at their height.

What Latam consumers buy is influenced by their environment, and how conducive it is to consumption. FMCG spend grew in countries where the economic situation was less hostile, and consumption more favorable – namely Ecuador, Bolivia and Mexico – where over half the categories are increasing volume. In Mexico, 90% of all Food categories grew value in 2021 compared to 2020. The opposite situation is found in Argentina, Colombia and Brazil, where there was more pressure on people’s finances, and less than a third of all categories managed to gain consumers.

The rational shopper

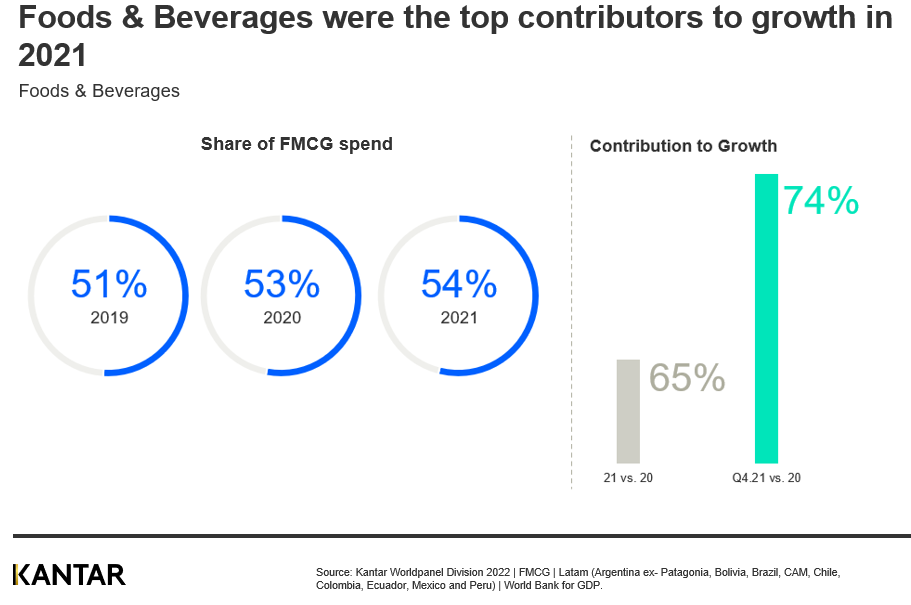

In challenging times, shoppers tend to focus on the products that are most essential to their daily lives. For that reason, mass-consumption goods continue to gain relevance in Latin America.

We can also see evidence that shoppers are turning to prioritization behaviors, with the data showing fewer trips to the point of purchase, channel fragmentation, and prioritization of food categories.

Lower frequency continues – except online

Following a decrease in the number of channels visited during lockdown, consumers made 12% more trips during the last quarter of 2021 compared to pre-pandemic levels. Despite this, the loss in frequency at total-market level means that each individual channel received fewer visits, except for online, which continued to grow despite the loosening of pandemic restrictions.

In addition, basket sizes have dropped to their lowest levels in two years. Shoppers across all socioeconomic levels are coping with price rises by transitioning to intermediate ‘fill-in’ or ‘top up’ shopping missions.

Among the online channels, the ‘non-pure’ platforms – mainly associated with retailers in modern trade – are most important to shoppers. About 75% of consumers’ online FMCG spending goes to Latin America’s large chain stores.

Focus on food

The current behavior we see in Latam is a combination of habits acquired during the pandemic, strengthened by the arrival of the Omicron variant to the region in January, and those created by economic pressure. Just like Latin Americans learned to live with lower consumption of personal care products during lockdown, it’s now the economic situation that’s forcing them to prioritize choices.

Consumers have decided to keep their spending on personal care and beauty categories low in favor of foods, which was the basket that benefited the most during lockdown and is, of course, most essential. More than 65% of the FMCG growth in 2021 came from foods and beverages – rising to 74% in Q4.

The economy in Latin America will continue to decelerate in 2022, and this is likely to further impact FMCG consumption. Our quarterly Consumer Insights reports give you a roadmap for navigating this environment, by examining the key trends in Latam consumers’ shopping behavior.

Download the paper by filling in the form below and, if you’d like to explore the latest findings or discuss how we can help you to make the right decisions for the future, please contact our experts.