GLP‑1 medications are moving rapidly from niche treatment to mainstream force, with implications that stretch far beyond weight loss alone. As adoption accelerates in the UK and around the world, these medicines are reshaping how people eat, shop, and engage with brands, creating both disruption and opportunity across food, retail, and health ecosystems. To understand where GLP‑1 is headed and what it means for manufacturers and retailers, we spoke with Leigh O’Donnell, GLP‑1 expert and sponsor of Kantar’s Global GLP‑1 study, about the drivers behind its growth, how consumer behavior is changing, and why this shift is only just beginning.

Q: What’s the trajectory of GLP-1 use in the UK and globally?

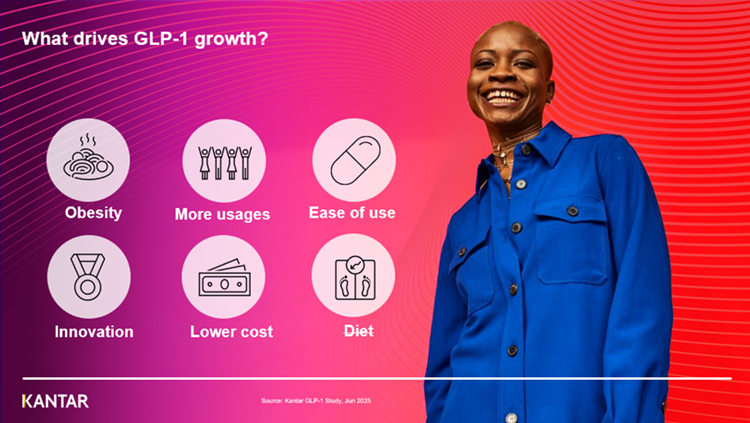

A: “GLP-1 is projected to grow in every market we are studying. There are a handful of reasons:

- Obesity: 1 in 8 is obese worldwide, doubled since 1990

- Usage: increasing into apnea, kidney and heart health, in testing for cancer & addiction

- Ease: pills will bring down costs and increase usage

- Innovation: new drugs bring greater weight loss, fewer side effects and unique action

- Cost: pills, generics, subsidies, insurance and increased competitors all drive price down”

Q: Is GLP-1 a trend that is likely to stay or is the bubble about to burst?

A: “GLP-1s aren’t going anywhere. Some 15% of British users have no plan to stop and another 9% have already been using GLP-1s for 12 months or more. In the US the number is double that (30%). Because the medication can also now be taken in pill form, which makes it easier for the user and cheaper to manufacture and transport than refrigerated jabs. The Ozempic patent is due to expire in several countries this year which will further increase accessibility and affordability.

“There is also other early research that shows that GLP-1 can be an effective treatment for drug or alcohol addiction, so we will likely see the medication be used beyond diabetes and obesity in the future.”

Q: What do GLP-1 users need from brands and from retailers?

A: “We’ve seen an increase in meal prep and decrease in restaurant meals among GLP-1 users, so supermarkets that offer meal plans and ready-to-eat food offerings can be a smart way to appeal to that audience. For example, Morrison’s “Smart and Balanced” range refers to both the portion and nutritive load, appealing to the way GLP-1 users eat. And while GLP-1 users are growing, it’s still a small part of the population, so it’s important to appeal to a more general healthy eating audience. Ranges like this do so by addressing values like portion, nutrient density, protein, fiber and freshness.”

Q: What innovation do users want?

A: “According to Kantar’s US GLP-1 study, the following food innovations that GLP-1 users would like to see are:

- High protein, low-calorie desserts (28%)

- Low-sugar, high protein baked goods (28%)

- Hydration beverages with added electrolytes and collagen (24%)

Non-food innovation GLP-1 users would most like to see are:

- Meal planning apps tailored for GLP-1 nutritional needs (33%)

- Smart portion-control platers and silverware (24%)

- Nutrition and macro-nutrient customization services (24)

- Skin care products with added hydration benefits (24%)

Q: How should brands be thinking about GLP-1 opportunities?

A: “There is a massive amount of opportunity. According to our latest data, 44% of UK users have a new go-to retailer for groceries and household essentials. This is because they want retailers that will help them find healthy items to assist them on their GLP-1 journey.

“Users also care about what they buy. Some 23% want nutritionally dense products, 21% want a wider variety of healthy items, and 21% want product offerings that will suit specific dietary needs (like high protein, vegan, low calories). Frozen meal lines in the US have also been launched, and there is a rise in ‘just for me’ GLP-1 snacks and desserts that focus on permissible indulgence – a white space that ranked highly in our survey.”

Q: What do food and drink manufacturers need to consider when developing NPD and R&D strategies in a GLP-1 age?

A: “From our research, items with high nutritional value (23%) are the top expected improvement for retailers and brands for GLP-1 users, with variety (21%) and specific dietary needs (21%) coming in close behind. These should be the main considerations for food and drinks manufacturers when it comes to developing NPD and R&D strategies in a GLP-1 age.”

For more on Kantar’s Global and US GLP-1 studies, as well as the new Life After GLP-1 study, click here.