A recent report from the British Retail Consortium (BRC) revealed a spike in sales of furniture as well as other home accessories in March as people entertained more at home to save money.

Furniture is often a relatively high spend area for consumers and can prove lucrative for those in the sector who get it right – IKEA would be a great example.

Latest GB TGI data reveals that 11% of adults (six million people) claim to have spent £800 or more on furniture in the past year. Furthermore, our TGI Global Quick View survey (offering harmonised insights into consumer behaviour across 35 countries) shows that 14% of British adults have bought furniture online in last six months, although this makes them a third less likely to have done so than the global average, with the equivalent figure for India considerably higher at 31%.

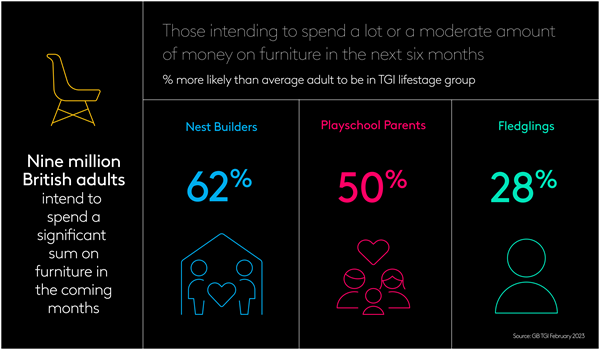

Returning to GB TGI data, 17% of adults (nine million people) plan to spend either 'a lot' or 'a moderate amount' on furniture in the next 6 months. This is higher than the proportion planning to spend a lot or a moderate amount on a new home, smart household devices or luxury clothes and accessories.

Those looking to buy furniture in the next 12 months are 62% more likely to be in the TGI lifestage group Nest Builders (aged 15-34, married/living as couple, do not live with son/daughter) and 50% more likely to be Playschool Parents (live with son/daughter and youngest child aged 5-9). This tallies with where these groups are in life, with many in the former group likely needing furniture having recently moved into their own place, whilst the latter group's furniture need would mostly stem from growing families.

A glance at the life events anticipated in the next 12 months by those who are seeking to spend significantly on furniture reveal a good fit with requirements for new furniture. TGI reveals that those intending to spend significantly on furniture are nearly twice as likely as the average adult to expect to make major home improvements soon and similarly more likely to expect to buy or sell a property.

Those seeking to spend considerable sums on furniture in the next six months are particularly likely compared to the average adult to engage with a range of media.

Cinema, outdoor media and magazines are especially popular among furniture buyers.

Attitudes reveal other opportunities for engaging these furniture purchasers.

TGI reveals that they are more than twice as likely as the average adult to engage with TV sponsorship, celebrity endorsement, paid podcast content.