We have spent the last year discussing change in various ways and forums. The pandemic, lockdowns, and associated shocks to our way of life have changed the context in which we live, the means that we have to live with, and our priorities when spending our reserves of time and money.

Brands must consider this behaviour change, and the diversity of peoples experience, so that they can communicate with their buyers and potential buyers in a meaningful way.

Here are some examples of the shifts that are already taking place in terms of context, priorities, and means.

Altered context

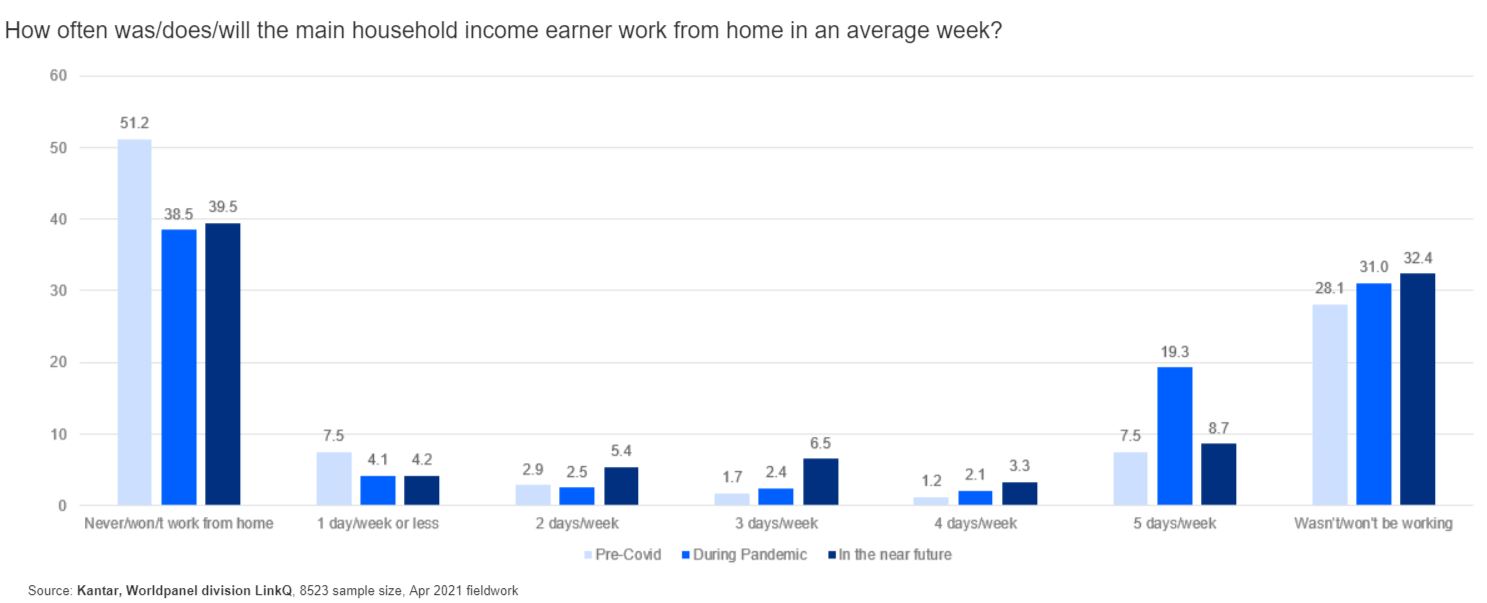

One of the biggest changes that we saw during the pandemic was working from home. Consumption outside of the home was dramatically affected by both lockdowns and the continued work from home order. We saw that reflected immediately in terms of lunches consumed out of home, which declined by half during the first year of the pandemic, resulting in 34m fewer weekday lunches out of home per week.

But decline did not just come from those who were working from home. Those still going to work spent less as well – driven both by availability (many venues were closed) and consumers’ willingness to go into shops.

So, what can we expect to happen next? When we look at our panel data, we can see that those people working from home five days a week during the pandemic are expecting to adopt a more hybrid working pattern. The result will be more diversity in how we work than anything we have seen before, meaning brands will need to cater to a broader range of behaviours.

Altered priorities

We have seen priorities shifting, which have led to behavioural changes. 2.5m adults started actively tracking their fitness over 2020, boosting the value of companies like Peloton. In the grocery market, we also saw the Vitamins, Minerals and Supplement category grow by 19%, three times faster than the total Healthcare category – this growth has continued in 2021.

Meanwhile, shoppers also sought little moments of joy from their food and drink during tough times. One way that this manifested itself was with brands like Milka and Lindt featuring in the top 10 fastest growing brands of 2020.

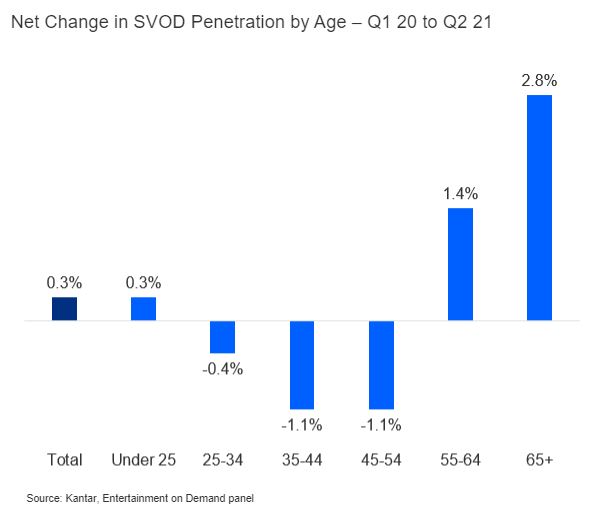

Over the course of the pandemic, we also saw a boom in streaming services. But it is the over 55s that are most likely to retain these services. This group is less inclined to return to social occasions, compared to the younger age groups, as cinema attendance amongst the oldest age group is noticeably down on pre-pandemic levels.

This is another area in which a broad range of needs are emerging, driven by varying levels of confidence amongst the different age groups, with some returning to mingle in the outside world while others remain cautious. Understanding how different groups are balancing their risk versus the rewards in the coming months is essential to strategise effectively.

Altered means

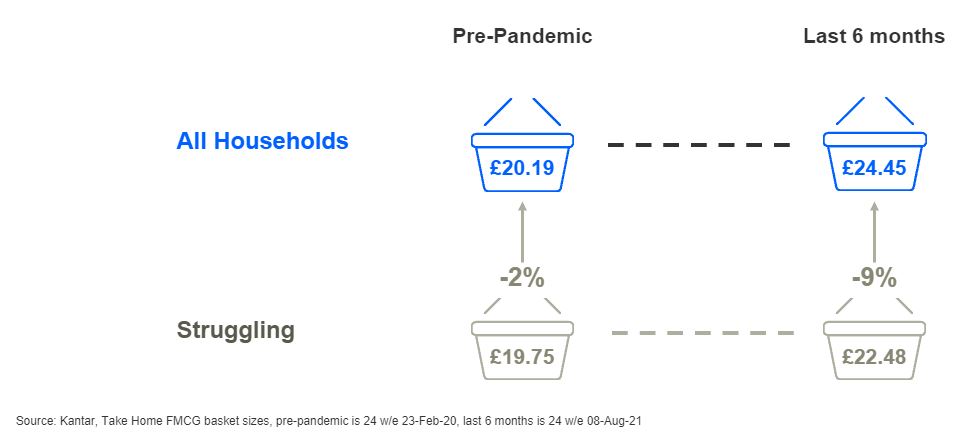

Regardless of altered priorities, consumer decisions are still going to be steered by the means they have to pursue them. Even though some households were able to accumulate record savings in 2020, our measure of shopper mindsets points to more households under pressure.

Our data shows that the gap between the pre-pandemic average basket size of a struggling household versus an average one has increased. Due to this growing contrast, retailers and brands need to understand how their consumers have been impacted to adjust their strategies.

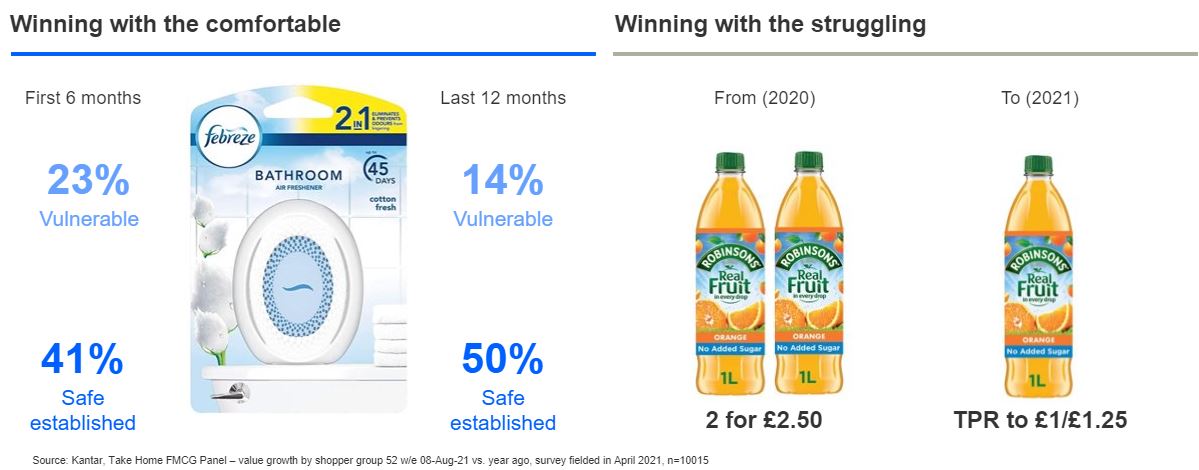

The example of the two brands in the chart, Febreze and Robinsons, highlights the difference in response of these groups to the same stimulus. Febreze has fared extremely well with the most comfortable group, experiencing YoY growth of 24%, but is struggling with the vulnerable group, seeing an 8% decline. A deeper dive helps us understand why.

Febreze had the biggest FMCG innovation of 2020, with their bathroom air freshener. In the first six months of its launch, it fared very well with both groups. But as the novelty of the product wore off and it became more of an established everyday product, the engagement of the Vulnerable group with the product tailed off dramatically, driving decline. It continues to be successful with the Safe Established cohort, and delivering growth within that group.

On the other hand, we have Robinsons, which is doing exactly the opposite by winning with the Vulnerable group but struggling with the others. Its promotional tactics made it popular with both the groups as it incentivised people to buy more, and also provided value for those with budget constraints. In 2021, the brand changed its pricing strategy towards single unit price cuts, which appealed strongly to the struggling group but failed to take advantage of those willing and able to expand their consumption within the comfortable group. Brands need to be vigilant about designing strategies that could carry the potential of winning with one group whilst cancelling out those gains with another.

Understanding these diverging shifts in shopper behaviour is essential for planning in this challenging environment. Watch our on-demand session from Kantar Talks, For better or for worse: How to grow in a divided nation, which explores the topic in more depth and offers valuable insight from experts across Kantar.

At Kantar, we are helping many manufacturers to tackle these challenges for their own brands and categories. Both through laying out the precise impact of behavioural and attitudinal changes and identifying the consumer groups most likely to deliver growth. Contact us for more information.