Grocery inflation continued to rise, increasing from 5.43% in the previous 12-week period to 5.86% now.

August kicked off with a bang with the All Together Now Festival, Galway Races and the upcoming Oasis comeback and Robbie Williams filling Croke Park.

Irish social calendars have been overflowing with consumers enjoying the last of the summer sun, spending a whopping €7.2 million extra on alcohol and an additional €1.3 million on suncare. Shoppers also indulged in other ways, spending an additional €8.9 million on take-home soft drinks and chocolate. With such busy calendars, it’s clear that shoppers needed a bit of an energy boost with nearly €1 million more spent on sports and energy drinks compared to the same time last year.

Shoppers spent €735 million on promotional lines during the latest 12-week period, an 8.9% increase compared to the previous year. Key growth categories included Alcohol, Frozen and Household all growing ahead of the total market for promotional lines.

Brand boost

Over the latest 12-week period, brands have grown behind the total market, up 5.7%, with growth slowing to 3.7%. Despite this, shoppers still spent an additional €58.7 million on branded products, significantly up on last 12-week period. Own label saw stronger growth over the 12 weeks at 6.3% with premium own label the standout performer, up 14.5%. Shoppers spent nearly €17.7 million extra on these ranges.Brands currently hold 47% value share of the total market with own label at 47.1% value share.

Retailer and channel performance

Total online currently holds 5.6% value share of the market, with sales rising by 6.8% year-on-year, and shoppers spending an additional €12.5 million through this channel. Over the latest 12-week period, shoppers purchased their groceries more often online, up 7.6%, contributing €13.8 million to its overall performance, down on last month’s €15.7 million.

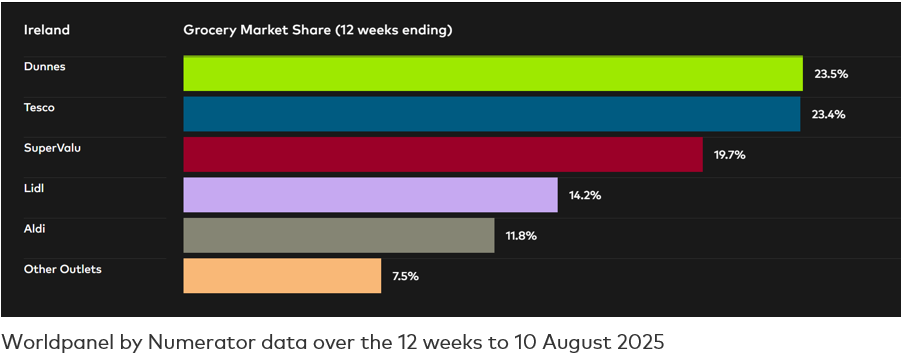

Over the latest 12 weeks, Dunnes holds 23.5% market share, with sales growth of 6.3% year-on-year. Dunnes shoppers returned to store more often, up 2.2%, which contributed €16.7 million to their overall performance.

Tesco holds 23.4% of the market, with value growth of 5.6% year-on-year. Shoppers increased their trips to store by 2.9%, which contributed €22.3 million to overall performance.

SuperValu holds 19.7% of the market with growth of 4.2%. Consumers made the most shopping trips to this grocer, averaging 25.6 trips over the latest 12 weeks up 9.6% year-on-year. This increase in the number of shopping trips contributed an additional €61.6 million to its performance.

Lidl holds 14.2% of the market with growth of 9.5%. Lidl also saw shoppers pick up more volume in store, up 3.1%, contributing an additional €13.8 million to overall performance. Aldi holds 11.8% market share, up 4.4%. Increased store trips and new shoppers drove an additional €13.3 million in sales.