A record-breaking Christmas saw the latest take-home grocery sales in Ireland rise by 6% in the four weeks to 28 December 2025, according to our latest data. Sales reached a record almost €1.5 billion during December as Irish shoppers indulged over the festive period.

Despite rising prices and inflation now standing at 6.25% (up from last month’s 6.0%) shoppers spent an additional €83.5 million on groceries.

With Christmas falling on a Thursday, more people headed to supermarkets on Monday, 22 December. However, grocery sales peaked the following day, Tuesday 23 December, reaching more than €107 million in sales, a record daily spend.

In December, we saw shoppers return to store more often and on average make 23 trips in-store to pick up Christmas essentials. Irish shoppers spent on average €770 at supermarkets during the festive period, an additional €32 compared to 2024.

Raising a festive glass while low- and no-alcohol sees uplift

Irish shoppers certainly indulged this Christmas. An extra €6.6 million was spent on seasonal chocolates and biscuits, with over half of households picking up seasonal chocolate in December. On the Christmas dinner menu this year, Brussels sprouts remained a firm favourite with over 62% of households purchasing them. But we saw a slight decline in fresh turkey sales, down 2.3%, while shoppers spent an additional €3 million on chicken, possibly due to cost.

People also celebrated in style with 80% of shoppers buying alcohol this year. While sales for Champagne and sparkling wine jumped nearly 22% as consumers toasted the season of goodwill, the low- and no-alcohol category also benefitted with an additional €1.9 million spent on these ranges compared to last year. The proportion of households choosing no- and low-alcohol drinks edged up from 9% to 15.3%.

Brands benefit as shoppers turn to festive favourites

Own-label grew over the 12-week period, just shy of 4%, as shoppers spent an additional €65.7 million on these ranges, with premium own-label benefitting the most in December. A record €167.7 million was spent on these ranges with shoppers spending an additional €12 million on these ranges, up 8% versus last year, with premium own-label now holding nearly 3.5% value share.

For the first time sales of brands hit more than €2 billion as shoppers turned to their festive favourites, including an additional €9 million spent on branded cheese, antipasti, bread, home baking and savoury snacks. Brands accounted for nearly 52.4% of value sales over the 12-week period, with shoppers spending an additional €131 million versus last year.

In the latest 12 weeks, 20.3% of all value sales were bought through a promotional line, the lowest level since August 2024. At Christmas, shoppers aren’t just chasing the lowest price, they’re looking for a mix of value and quality. While promotions play a role, this season is about more than discounts. Many consumers want to indulge, despite cost-of-living pressures, and we’re seeing that reflected in their choices.

Retailer and channel performance

Online continued to grow, at a significantly faster rate compared to last month, up 9.8% year-on-year to take 6.1% value share of the market. Shoppers spent an additional €21.7 million online during the period, helped by larger and more frequent trips which contributed a combined €6.9 million to their overall performance. Nearly 19% of Irish households bought their groceries online during this time.

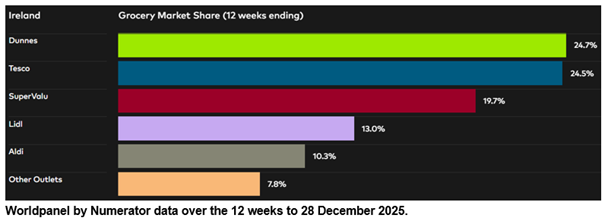

Dunnes holds 24.7% market share, up on the last 12-week period, with sales growth of 4.9% year-on-year. Larger trips contributed an additional €5.9 million to their overall performance.

Tesco holds 24.5% of the market, with value growth of 6.8% year-on-year. An influx of new shoppers contributed an additional €35.6 million to the grocer’s overall performance.

SuperValu holds 19.7% of the market with growth of 1.4%. Consumers made the most shopping trips to this grocer, averaging 22.5 trips over the latest 12 weeks. SuperValu recruited new shoppers to store over the latest 12 weeks, which contributed an additional €31.7 million to their overall performance.

Lidl holds 13% of the market with growth of 11.5%, the fastest growth among all retailers once again. Lidl welcomed new shoppers and saw existing customers buy more per trip, contributing a combined additional €25.6 million to overall performance.

Aldi holds 10.3% market share, up 2.4%. Increased store visits and new shoppers drove an additional €21 million in sales.