The Scottish government has been consulting recently on proposals to limit the advertisement of alcohol products. This has been subject to much controversy, with supporters claiming the nation’s relationship with alcohol needs to be addressed.

Meanwhile, opponents including prominent drinks manufacturers and advertising bodies say further restrictions will severely impact a key sector of the Scottish economy - one seeking to recover from Covid disruption and survive the impact of the cost of living crisis.

It is thus topical for us to explore the evolving relationship with alcohol amongst Scots, Brits as a whole and indeed western European markets more widely.

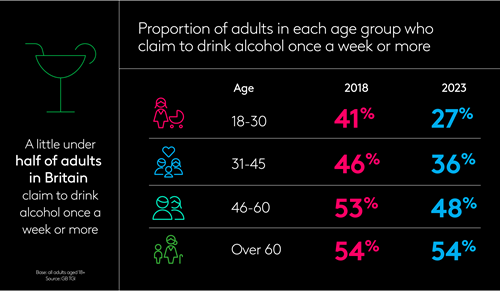

GB TGI reveals that two-thirds of adults (aged 18+) across Great Britain claim to have consumed alcohol in the past 12 months. 43% of adults claim to drink alcohol once a week or more and this is broadly consistent across England, Scotland and Wales. Those who claim to drink once a week or more are more likely found in older age groups. TGI shows that only 25% of 18-24 year olds claim to drink once a week or more, compared to 52% of those aged 50+.

The proportion of adults who claim to consume alcohol – regularly or at all – has fallen significantly in recent years, driven mostly by a decline amongst the young.

Our TGI Europa data, which explores consumer behaviour across France, Britain, Germany and Spain, reveals that claimed consumption of alcoholic drinks once a week or more is relatively consistent across all four markets.

However, different alcoholic drinks see varying levels of popularity between these markets. For example, drinking beer regularly is particularly popular in Germany, whilst when it comes to whisky or bourbon, this is significantly higher in France and Great Britain. Some markets are also more likely to be willing to pay more for good quality wine or beer, with France and Spain particularly likely to splash out on wine compared to Britain and Germany.

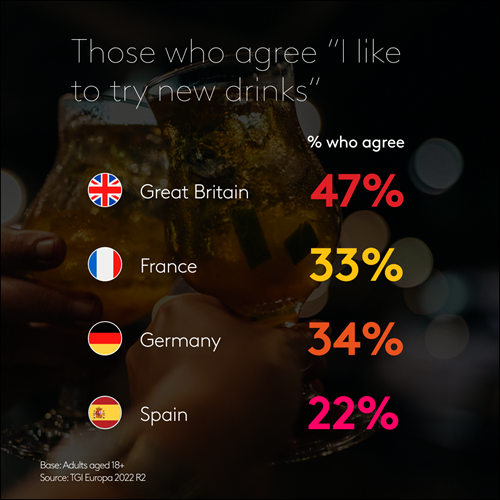

However, when it comes to willingness to try new drinks, consumers in Britain are the clear leaders with 47% of adults here in agreement with this statement – considerably more than the other three markets. This is also an attitude that has seen a sharp increase in agreement in recent years – not just in Britain, but across western Europe. In Britain those who agree they like to try new drinks are particularly likely to be young and to engage heavily with a range of media compared to the average adult, in particular cinema, social media and gaming.