A recent #BBC article caught my eye. In ‘Sausage maker Heck cuts vegan range as appetite drops’, Heck co-founder Jamie Keeble says shoppers are ‘not there yet’ when it came to buying its vegan products. Is this true? What could be behind this?

We delved into our #Kantar data to find clues which might help companies like Heck! to shape their brand strategy.

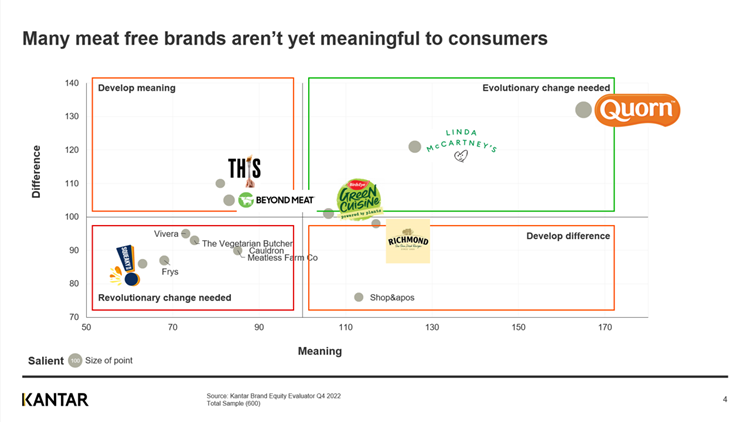

First, looking back at our foundational equity piece we can see that in the fledgling meat replacement market only a handful of brands already have strong equity. There is a long tail of brands which still need to drive value in the minds of consumers.

The biggest issue here, is that many of these brands aren’t yet meaningful to consumers, as evidenced by the chart below. We saw this in our previous piece on brand diagnosis.

Is this because meat replacement lacks relevance? Unlikely. Certainly, Kantar’s latest DX Global trends report on Food points to interest being stable. The success of Quorn, Linda McCartney, Bird’s Eye Green Cuisine and Richmond proves relevance can be created. So, what’s holding these brands back?

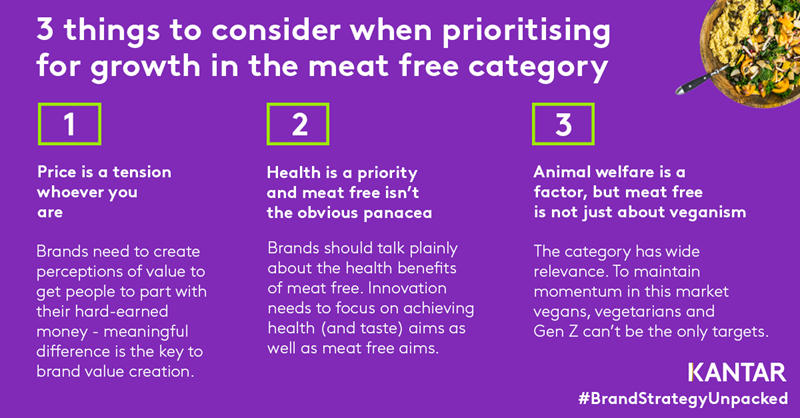

We found three clues in our #Kantar data. Brands in this category would do well to bear these in mind as they are prioritising for growth, developing their brand offers, innovating and activating.

1. Price is a tension whoever you are

In our sample of UK shoppers who’d bought a meat replacement product in the last 3 months, we can see huge price sensitivity. Three in four are looking for bargains when they buy food. 65% agree that the current inflationary, financial situation is having a significant impact on them. And 55% say they are living from pay check to pay check. People are feeling the pinch. They are looking for value.

It’s not all doom and gloom though, despite price being top of mind, six in ten would still try an exciting new product if they saw it.

Brands need to create perceptions of value to get people to part with their hard-earned cash. And our BrandZ findings show that meaningful difference is the key to value creation.

2. Health is a priority and meat free isn’t the obvious panacea

People care about what they put in their bodies. Most #meatfree shoppers say the health benefits of food are as important as the taste. This mantra is even more prevalent among older millennials, Gen X and Boomers. By observation, many meat free products are processed. This may be behind the genuine scepticism that meat alternatives are actually healthier than meat products. Very few shoppers we spoke to felt certain that meat alternatives were healthier than meat products.

Opinions are divided on whether the meat free products they want are available and whether companies are doing enough to help them to eat meat free, but 6 in 10 said they would be more likely to buy meat alternatives if they would significantly improve their health and they could more easily understand the benefits of plant-based proteins.

There is an opportunity for brands to talk more plainly about the health benefits of meat free; and to focus innovation on achieving health and taste aims as well as meat free aims.

3. Animal welfare is a factor, but meat free is not just about veganism

Next to price and health, another compelling argument to eat less meat was the assurance that this act was benefiting animal welfare. People are trying to make a difference to the world around them though the actions and choices that they make. There is a definite sustainability angle that brands could take to create relevance in this market, but to avoid green washing these claims need to be authentic, meaningful, and substantiated.

It might surprise you to know that only 7% of meat free buyers identify as vegan. 14% identify as vegetarian - they don’t eat meat, but eggs and dairy are ok. Almost a third of buyers identify as flexitarian – a new trend according to our Future of Food report – they are actively trying to reduce their animal protein and / or dairy intake. The rest of the meat free shoppers we spoke to eat a combination of meat or fish and plant-based foods.

As Tom Lees mentioned earlier in our #BrandStrategyUnpacked series in his article on maintaining momentum in this market, it’s crucial for brand teams to avoid misconceptions taking hold. For brands to grow, vegans, vegetarians and Gen Z can’t be the only targets.

Are people ‘not there yet’? I think we need to change the question. Instead, let’s ask, ‘Are enough brands really stepping up to the plate and delivering the right mix of value, health, taste and sustainability to match appetites?’ A tall order. We’re going to dive deeper into consumer needs and priority audiences in our next #BrandStrategyUnpacked installments to look for further ways to drive meaning and difference in this market. Follow the hashtag to make sure you don’t miss them.

Find and follow #BrandStrategyUnpacked on LinkedIn.