Shopping and consumption habits have seen unprecedented change as a result of recent restrictions on mobility and social interaction, as well as heightened consumer concerns. The impact on our diets in the short term has been marked, but in the long term, as the UK looks set to enter the sharpest recession on record, how will our attitudes and behaviours change?

We are now entering the third phase of a five-phase behavioural change in response to COVID-19. The five phases are:

- Stockpiling

- Lockdown

- Transition

- Recession

- New embedded behaviours

The current transition phase gives us an opportunity to review the impact of COVID-19 on our shopping and consumption behaviours so far, especially as they relate to diet, as well as consider the likely future effects.

During lockdown, we saw take-home food and drink purchases were in strong growth as our consumption outside of the home, in cafes and restaurants, was reduced to close to zero overnight.

According to our surveys, 1 in 3 in the UK said they were using the lockdown to eat ‘more healthily’ and exercise more (Kantar Worldpanel Plus April 2020). Another 1 in 3 disagree with these statements, showing some of us are finding it hard to stay healthy during lockdown.

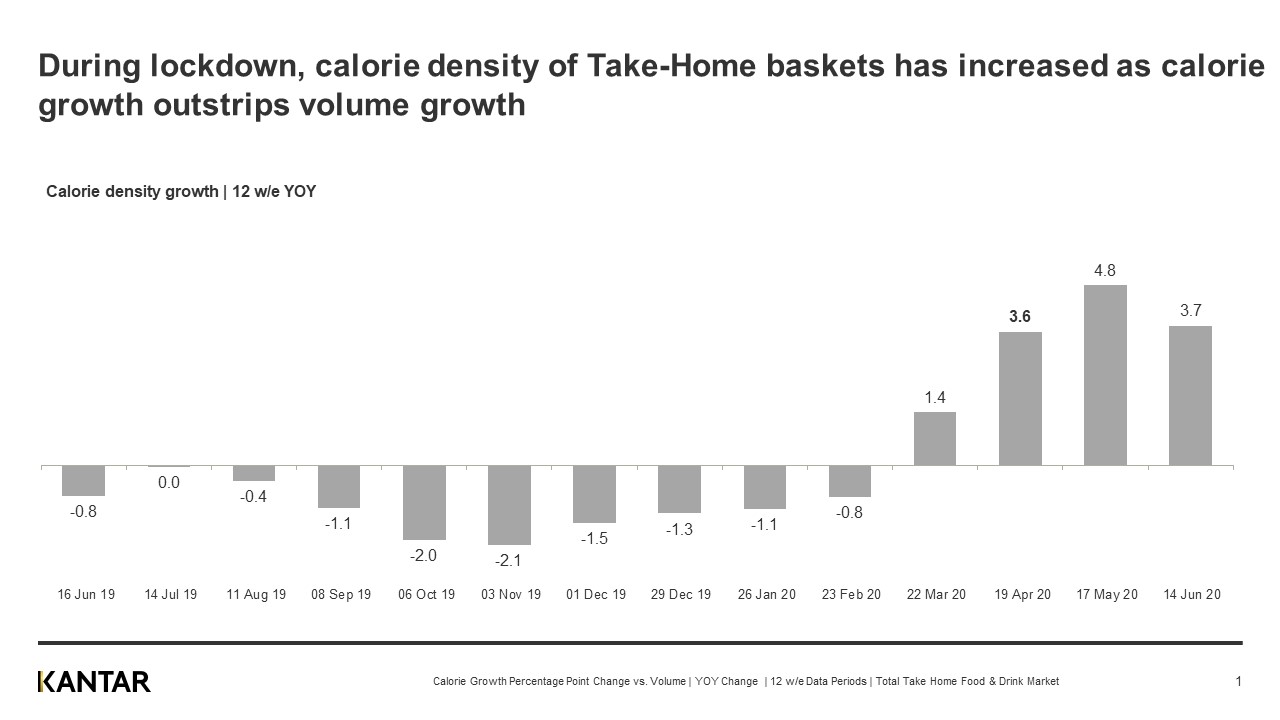

One thing confirmed by our nutrition panel data is that we are buying more calories. While take-home food and drink volume sales grew by 13% in the 12 weeks to June 2020 compared with a year ago, total calories purchased over the same time period increased by 17%. This means the calorie-density of baskets has increased by 3.7%, a significant change from the declines seen over the last few years.

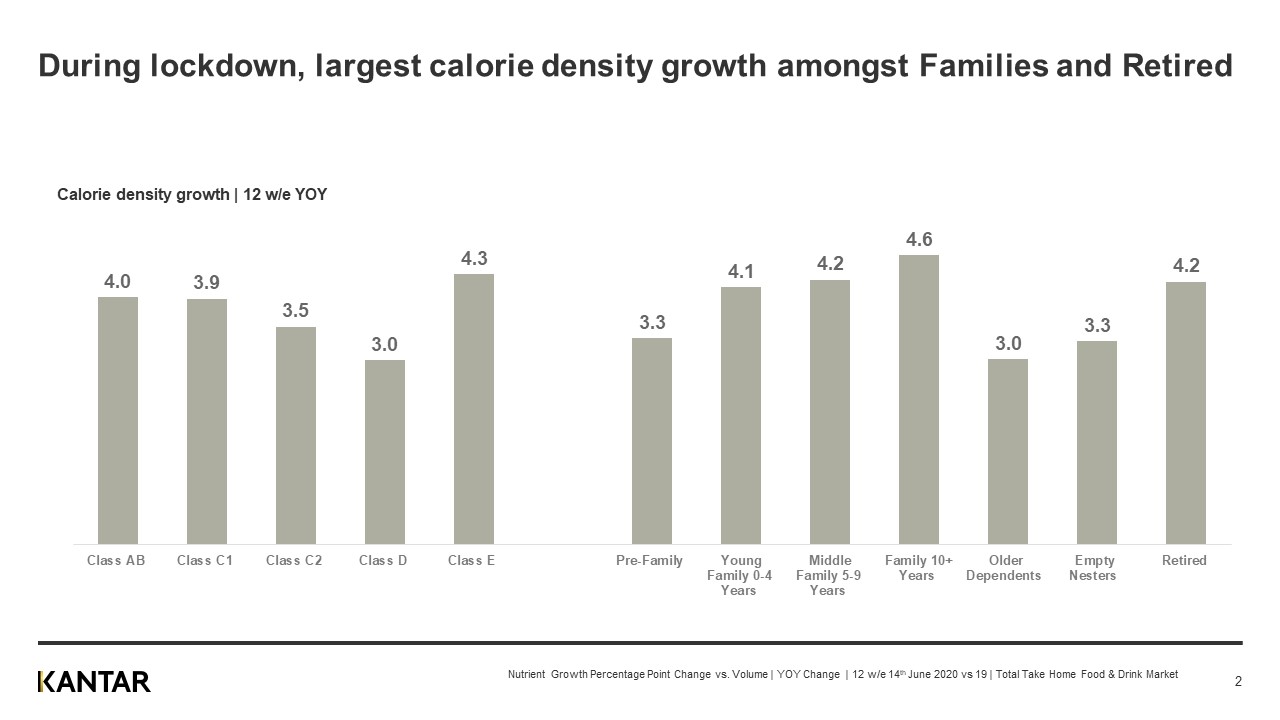

Looking at the increases in calorie density of take-home shopping baskets, by demographic group, the biggest increases are in households with children and retired households. Calorie density is growing ahead of the average in ABC1 households compared with C2D households.

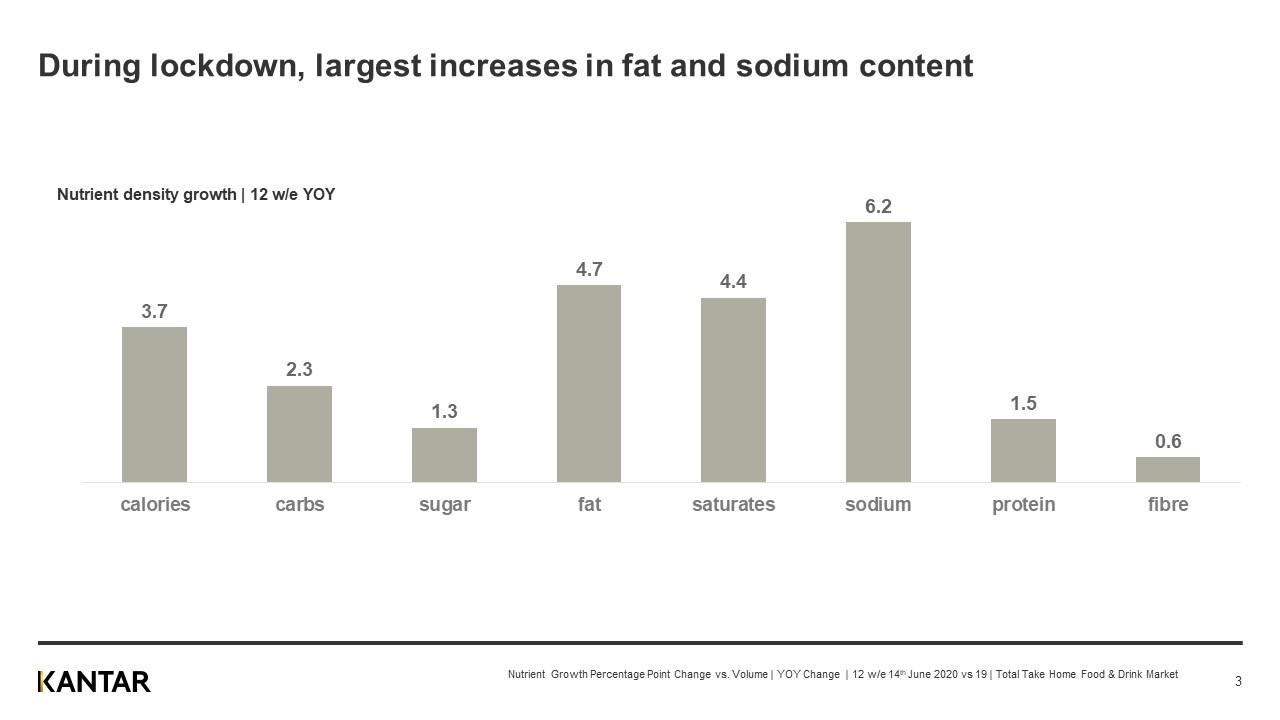

Growth in spend on saturated fats has been a key factor in this calorie increase, with the fat content of take-home baskets rising by 4.7%. This has been largely driven by the increased purchasing of dairy products over lockdown – as well as fresh meat, ice cream and confectionery.

We have also seen large increases in sodium, with the average salt content of baskets increasing by 6.2%. This is driven by increased purchasing of table salt, dairy products, fresh meat and bread.

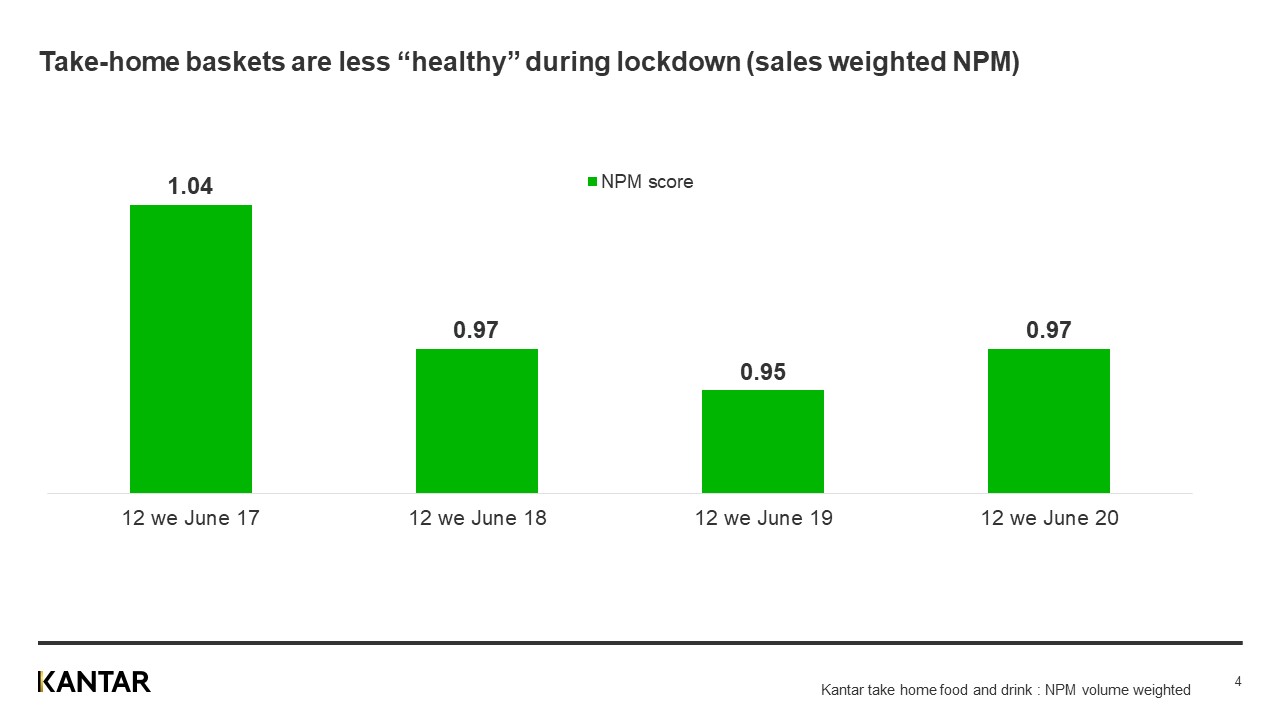

On the other hand, protein and fibre content are both increasing, but at lower rates. When we apply the Food Standards Agency’s Nutrient Profile Model scores – an objective measure of how “healthy” foods and drinks are – to the items we’re putting in our shopping baskets we can see that the overall “healthiness” of our food and drink purchasing has declined. This reverses the trend seen over the last few years and is consistent with known consumer behaviour during times of uncertainty.

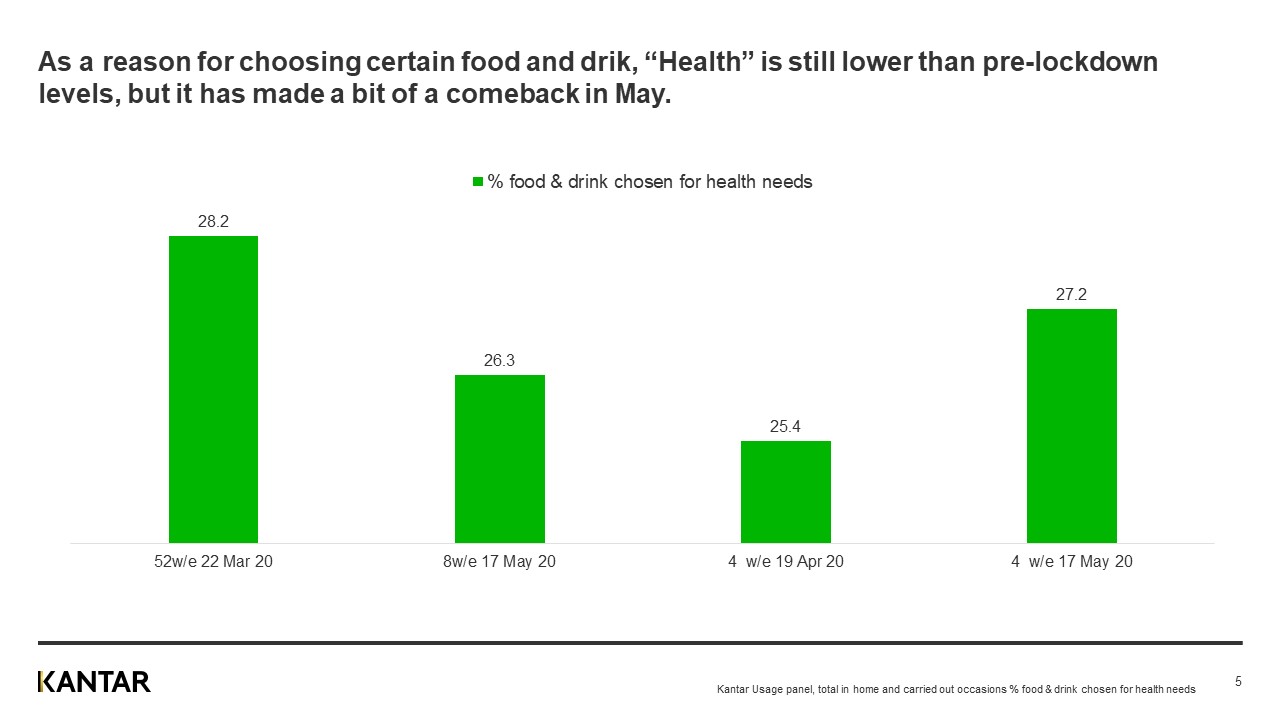

At the beginning of lockdown, we saw a drop in the percentage of occasions where “health” was cited as a reason for those in-home consumption choices. Snacking had increased, particularly: salty snacks, confectionery, biscuits and carbonated soft drinks - and families were prioritising quick and easy meals that would please their kids. However, during May there we see a general trend towards families “taking back more control” – they cut back on snacking, started cooking more and returned to options which meet health needs (especially when it comes to meals and snacks for their younger children).

However, as the economic position worsens, we expect this change to be temporarily stalled.

We anticipate that consumers will go back to making choices for “health” reasons during the transition phase, which will likely change again as we enter recession, and then come back in the second half of next year.

With the known link between obesity and COVID-19 outcomes, and the UK’s goal to reduce childhood obesity by half by 2030, it will be interesting to see how government policy changes and develops over the next few years.

We will continue to track people’s changes in behaviour as lockdown eases. Please get in touch if you want to learn more.