Our latest figures show that Irish take-home grocery sales declined by 4.5% over the 12 weeks to 23 January 2022. However, sales still remain 11.2% higher than two years ago, before the pandemic took hold.

Life is returning to some normality in Ireland and grocery sales have dropped year-on-year as people take the chance to eat out in pubs, cafés, and restaurants again. We can see the impact of these busier social calendars in people’s baskets. Many consumers have turned to convenience options as they juggle new routines, with an additional €14.5 million spent on chilled convenience this period. On the back of our new-found freedoms, sales of deodorant and men’s skincare have also soared 3.8% and 6.5% respectively as we aim to look and smell our best when seeing friends and family again.

Pandemic behaviours become routine

Despite easing restrictions, it’s clear that COVID-19 has had a lasting impact on people’s lifestyles and, in turn, on the way they shop. During the different lockdowns, many shoppers used delivery services for the first time and the habit has stuck. Online grocery sales grew again this month by 3.8%, with consumers spending €5.4 million more than at the same time last year. The channel also continues to attract new shoppers.

While some familiar routines are returning, it’s not been a straightforward switch back to the old ways of doing things. Many of us are now working from home for part of the week and that means we’re less likely to go out for lunch or for a meal after work on those days. As a result, people are buying 13.3% more on each trip to the supermarket than they were in early 2020. There’s also a sense that some people still feel a bit cautious about COVID-19 and not everyone is ready to get out just yet.

Household budgets are coming under pressure as grocery price inflation reached its highest level since October 2020 this period, at 1.7%. The number of products being sold on promotion has dropped by 3% compared with last January. We’re already seeing evidence of people starting to shop around at different retailers to try and find the best price for their weekly shop.

Dry January breaks records this year

Dry January saw record-breaking engagement in Ireland, with 7.6% of households purchasing a non-alcoholic beverage, an increase of 5.8% since 2018. In contrast, the impact of Veganuary was more muted, as Irish shoppers spent €481,000 less on frozen vegetarian products than this time last year.

Non-alcoholic drinks are enjoying really strong growth, and this looks set to continue following the introduction of minimum unit pricing in Ireland. Dry January gave people the perfect opportunity to explore the different options on the supermarket shelves, and many traditional brands are diversifying their ranges to keep up with the change in demand.

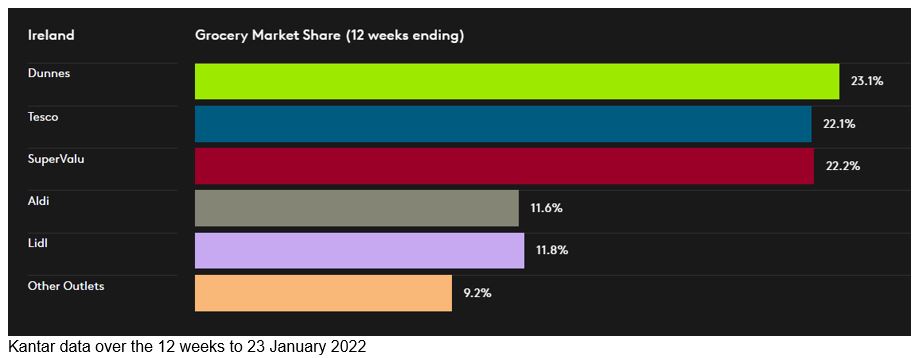

Dunnes retained its position as Ireland’s largest retailer this month, holding 23.1% of the market in the period up to 23 January 2022. The retailer benefited from the largest influx of new shoppers, who contributed an additional €42.2 million to its performance.

SuperValu follows closely with a market share of 22.2% while Tesco is just 0.1 percentage points behind this at 22.1%. Lidl now holds an 11.8% share, with Aldi at 11.6%.