Our latest take-home grocery figures in the UK show that supermarket sales fell by 3.7% over the 12 weeks to 20 February 2022. However, sales remain 8.4% higher than the same period before the pandemic in 2020. The annual decline reflects last year’s winter lockdown when the public was eating more meals and snacks at home.

The fall in spending comes despite a new high in grocery prices, as inflation stands at 4.3% in February. Apart from the start of the pandemic, when we saw grocers cut promotional deals to maintain availability, this is the fastest rate of inflation we’ve recorded since September 2013. On top of this, ongoing supply chain pressures and the potential impact of the conflict in Ukraine are set to continue pushing up prices paid by consumers.

In terms of understanding how shoppers are responding, it’s a complex picture for the market this month. Households spent on average £26 less at supermarkets in February and own-label sales did better than brands for the first time in three months. It’s important to flag that the drop in monthly spending isn’t all down to savvy budgeting. With the formal end to COVID-19 restrictions in England, more of us are now eating on the go, buying sandwiches, salads and snacks on our lunch breaks, and enjoying meals out with friends and family. That means we’re buying less food and drink to have at home.

Discounters regain shoppers as footfall increases

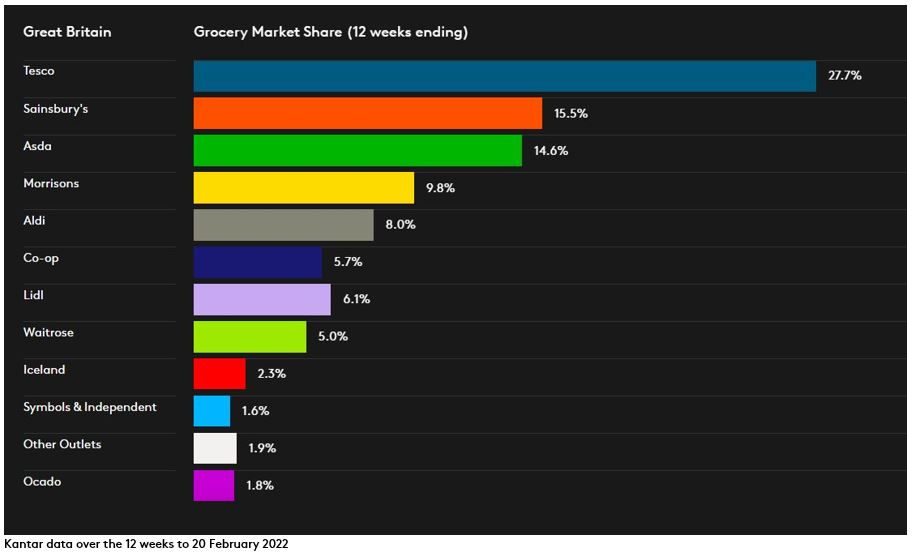

The discounters especially are benefiting from shoppers making more visits to stores. Aldi and Lidl put in strong performances this period and were the fastest growing retailers, both increasing their sales by 3.3%. Aldi attracted an additional 1.3 million customers compared with 2021, while Lidl brought in an extra million.

Further evidence that shoppers are moving beyond the pandemic can be seen in online sales, down by almost 20% year on year over the last month. It’s clear that some shoppers are shrugging off their pandemic habits. 835,000 fewer people bought groceries online over the past four weeks. That’s compared with the record 6.6 million buyers we saw last year. Digital sales now account for 13.3% of all spending, down 2.1 percentage points from last year.

This market-wide drop in online spending failed to dent Ocado’s performance. It bucked the trend to increase its sales by 0.2% over the past twelve weeks. The retailer also grew its market share from 1.7% to 1.8%.

Lovers say it with chocolate on Valentine’s Day

Shopper routines were disrupted by extreme weather in the middle of the month. Storms Dudley and Eunice had a noticeable impact on shopper footfall. We recorded nearly 7 million fewer shopping trips during the week ending 20 February compared with our expectations for this time of year. In fact, on the Friday [18 February], there was a 25% drop in footfall compared with the same day in 2021, as many schools, businesses and train links were shut across the country.

It wasn’t all bad news though and, despite the stormy forecasts, romance was in the air. Consumers braved the conditions to treat their loved ones. Sales of chilled desserts and still and sparkling wine jumped up by 15% in the week leading up to Valentine’s Day. But nothing says love like a box of chocolates, it seems, as sales leapt by 53%.

The majority of bricks and mortar retailers saw take-home grocery sales fall this period compared with last year, though all were in growth against 2020. Supermarkets with a strong food-on-the-go offer will have enjoyed an added boost that is not reflected in the numbers as people picked up sandwiches, snacks and drinks while out and about again.

Tesco extended its run of market share gains, taking another 0.3 percentage points. It now accounts for 27.7% of the market. Waitrose also grew ahead of its peers to hold its share of the market flat at 5.0%. Sainsbury’s market share is now 15.5%, Asda 14.6% and Morrisons 9.8%. Co-op holds 5.7% of the market, Iceland 2.3% and independent retailers stand at 1.6%.