Grocery price inflation has fallen below 10% for the first time since July 2022 and now sits at 9.7% for the four weeks to 29 October 2023, according to our latest data. Take-home grocery sales over the same period rose by 7.4% compared with last year.

Grocery price inflation has finally dropped into single digits after 16 months of double digit growth, marking a big milestone for the British public and retailers. While the drop to 9.7% is positive news and something of a watershed, consumers will still be feeling the pinch. We’re only seeing year on year price falls in a limited number of major categories including butter, dried pasta and milk.

Promotions increase in every single grocer

Retailers continue to look at ways of softening the blow for shoppers and slowing the rate of price rises. This has included upping the ante on promotions – every single one of the grocers increased the proportion of sales through deals versus last year which is something that has only happened on one other occasion in nearly ten years. Consumer spending on promotions has now hit 27.2% of total grocery sales – the highest level we’ve seen since Christmas last year. This is a big gear shift from October 2022 when this figure was less than a quarter.

Shoppers have also been taking matters into their own hands to help manage their spend. It’s now been over a year and a half of pinched pockets and people are continuing to respond by trading down on the items they’re putting into their baskets. Own label lines have grown ahead of their branded counterparts every month since February 2022, with the latest four weeks showing a sales boost of 8.0% for these lines. However, the picture may well change as we go headlong into the festive period, when shoppers typically turn more to brands. The gap between own label and branded goods is at its narrowest since spring last year. Branded sales increased by 6.7% in the latest month, raising the distinct possibility that they will push ahead by Christmas.

Anyone looking to get into the festive spirit early found a welcome surprise as the average price paid for a standard bottle of sparkling wine fell from £7.46 in August to £6.86 in October, a drop of 8%. While prices for low-alcohol beer have risen more quickly, drier celebrations were still evident this month – perhaps aided by the challenge of Sober October – and volume sales of low-alcohol beer were up by 16% during the month versus a year ago.

The fight for shoppers’ Christmas spend looks set to be fierce between the retailers this year. When it comes to where people shop, Brits definitely aren’t loyal and some of the traditional shopping demographics and stereotypes have been thrown out of the window. The typical customer walking through the doors of the discounters is now representative of the country as a whole, with 54% of Aldi and Lidl’s sales coming from the more affluent ‘ABC1’ social group – close to the national average of 55%. Discounters are making their mark in frozen items and fresh groceries like meat and veg, with these categories constituting a higher proportion of their sales than the traditional retailers.

Discounters still ahead with Sainsbury's, Tesco and Ocado also winning share

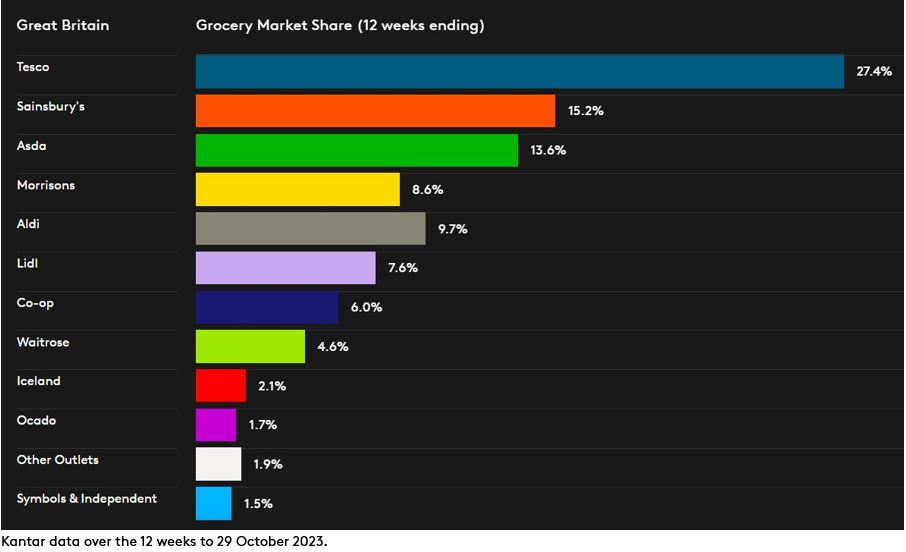

Lidl was again the fastest growing retailer this month with sales over the 12 weeks up by 14.7% and share up by 0.4 percentage points to 7.6%. Fellow discounter Aldi sat beside Waitrose as one of only two grocers to increase its number of shoppers year on year, attracting 207,000 more customers than last year. Aldi and Waitrose grew sales by 13.2% and 5.4% respectively to take 9.7% and 4.6% of the market.

Sainsbury’s was the fastest growing traditional supermarket this month, with sales up 10.1% over the 12 weeks to 29 October compared to last year. Growing ahead of the market, the retailer now holds 15.2% share, up from 14.9% last year. Britain’s largest grocery chain Tesco gained share for the fourth consecutive month to take 27.4% of the market, an increase of 0.4 percentage points versus a year ago, as year on year sales growth reached 9.5%.

Morrisons has now been back in growth for seven months, with sales in the latest period up by 3.2%. It now holds 8.6% of the market and Asda stands at 13.6%. Co-op’s sales have grown by 5.2%, the fastest rate since March 2021. Its market share stands at 6.0%, though in baskets less than £20 this figure jumps considerably to 16.9%.

Iceland now account for 2.1% of the market, as sales increased by 2.6% over the 12 weeks. Online-only grocer Ocado’s market share has risen to 1.7%, while its year-on-year sales have grown by 12.6%.